U.S. News

- FOMC Interest Rate Decision

- The Federal Reserve on Wednesday kept its benchmark short-term borrowing rate in a targeted range between 5.25% – 5.50%

- With its decision to hold the line on rates, the committee in its post-meeting statement noted a lack of further progress in getting inflation back down to its 2% target

- The Federal Open Market Committee did vote to ease the pace at which it is reducing bond holdings on the central bank’s balance sheet

- Consumer Confidence

- Consumer confidence fell in April for the third straight month to 97.0 and touched a 21-month low due to the high cost of food and gas and fresh worries about the jobs market

- Confidence has retreated since the start of the year and sits well below the pre-pandemic high

- Historically, readings below 80 in the expectations index signal a forthcoming recession

- Construction Spending

- Spending on construction projects fell 0.2% in March to $2.08 trillion as U.S. companies and the government scaled back projects across the nation

- Private residential construction fell 0.7% in March, with single-family construction falling 0.2% and multifamily construction falling 0.6%. Spending on public residential construction rose by 0.5%

- Over the past year construction spending is up 9.6%

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., flat to 208,000 in the week ended April 26, compared from the prior week

- The four-week moving average was 210,000, down 3500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – flat by 0,000 to 1.774 million in the week ended April 19. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.362 trillion in the week ended May 3, down $40.0 billion from the prior week

- Treasury holdings totaled $4.534 trillion, down $5.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.37 trillion in the week, down $16.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.56 trillion as of May 3, an increase of 9.9% from the previous year

- Debt held by the public was $24.64 trillion, and intragovernmental holdings were $7.08 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index rose 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $2,725.45 per 40ft

- Drewry’s composite World Container Index has increased by 54.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

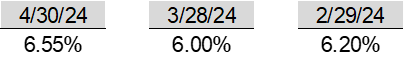

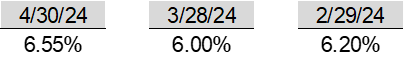

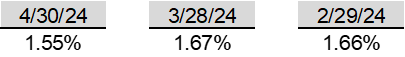

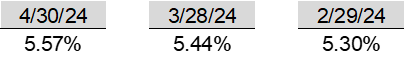

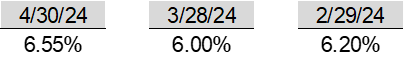

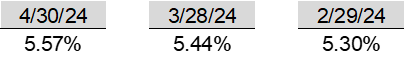

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- The fate of a deal that would free Israeli hostages and stop the war in Gaza is now in the hands of two leaders whose future is at stake in the war: Israeli Prime Minister Benjamin Netanyahu and Hamas’s top leader in Gaza, Yahya Sinwar

- The calculations of both men, whose strategies have left them little room to reach a compromise, pose a challenge for the Biden administration which has been working to free the hostages and secure a cease-fire

- Negotiations over a cease-fire deal are at a critical point. The Israeli government has said it plans to send forces into Rafah, a city at the southern edge of the Gaza Strip where more than a million Palestinian civilians are sheltering. Rafah’s border crossing with Egypt is also a lifeline bringing humanitarian aid to the people of Gaza, many of whom are on the edge of starvation. Netanyahu says the operation is necessary to destroy Hamas’s remaining military forces in the area

-

China

- This past week China’s government hinted at lowering borrowing costs further and extending new help for the property market while announcing plans to convene a long-deferred policy meeting, whose delay had fueled unease about Beijing’s economic management

- The promise of further action comes as data continue to suggest growth is softening with surveys pointing to weakening activity in manufacturing and services, and figures showing a recent plunge in industrial profits

- Thornier challenges around trade, foreign investment and an aging and shrinking workforce are clouding the longer-term outlook. Above all, China’s drawn-out real estate bust remains a major drag despite a number of small measures last year aimed at soothing the sector

-

Russia

- The United States on Wednesday accused Russia of violating the international chemical weapons ban by deploying the choking agent chloropicrin against Ukrainian troops and using riot control agents “as a method of warfare” in Ukraine. The Russian embassy in Washington did not immediately respond to a request for comment

- Earlier this month, the Ukrainian military reported that Russia had stepped up its illegal use of riot control agents as it presses its biggest advances in eastern Ukraine in more than two years

- In addition to chloropicrin, Russian forces have used grenades loaded with CS and CN gases, the Ukrainian military says. It says at least 500 Ukrainian soldiers have been treated for exposure to toxic substances and one was killed by suffocating on tear gas

-

France

- French President Emmanuel Macron is rekindling debate over whether France’s nuclear arsenal should play a role in deterring attacks against European allies, igniting criticism across the political spectrum from lawmakers who say any move to extend the country’s nuclear umbrella risks compromising a linchpin of national sovereignty

-

Germany

- German inflation held steady this month, adding to signs that price pressures have cooled sustainably in the eurozone’s most important economy. Consumer prices were on average 2.2% higher than in April of last year, the same rate booked in March, according to national-standard figures set out Monday by German statistics authority Destatis

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

Finland

- Finland, sharing NATO’s longest border with Russia at 830 miles, has escalated its security measures, including constructing new fences and enhancing surveillance, in response to increased Russian aggression and hybrid warfare tactics

-

South Korea

- SK Hynix plans to invest an additional $14.6 billion to expand its semiconductor production capacity in South Korea, aiming to meet the increasing demand for artificial intelligence chips

-

Canada

- Honda is nearing a deal to build an electric vehicle assembly plant in Ontario, Canada, with the Canadian government agreeing to offset some of the capital costs through newly introduced tax breaks

-

Poland

- Russian missiles have breached Polish airspace several times since 2022, with the most recent incident occurring on March 24, 2024, when a Russian cruise missile entered Polish airspace for 39 seconds, posing a risk of wider conflict, according to Poland’s President Andrzej Duda

Commodities

-

Oil Prices

- WTI: $78.14 per barrel

- (6.81%) WoW; +9.06% YTD; +13.97% YoY

- Brent: $82.93 per barrel

- (7.34%) WoW; +7.65% YTD; +14.39% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended April 26, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 605, down 8 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 460.9 million barrels, up 0.3% YoY

- Refiners operated at a capacity utilization rate of 87.5% for the week, down from 88.5% in the prior week

- U.S. crude oil imports now amount to 6.497 million barrels per day, down 5.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.67 per gallon in the week of May 3,

up 3.0% YoY

- Gasoline prices on the East Coast amounted to $3.65, up 1.5% YoY

- Gasoline prices in the Midwest amounted to $3.53, down (0.7%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.28, down 1.6% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.54, down (3.0%) YoY

- Gasoline prices on the West Coast amounted to $4.92, up 5.9% YoY

- Motor gasoline inventories were down by 0.3 million barrels from the prior week

- Motor gasoline inventories amounted to 227.1 million barrels, up 1.9% YoY

- Production of motor gasoline averaged 9.40 million bpd, up 0.2% YoY

- Demand for motor gasoline amounted to 8.618 million bpd, down 0.0% YoY

-

Distillates

- Distillate inventories decreased by -0.7 million in the week of May 3

- Total distillate inventories amounted to 115.9 million barrels, up 5.0% YoY

- Distillate production averaged 4.508 million bpd, up (1.5%) YoY

- Demand for distillates averaged 3.678 million bpd in the week, down (5.0%) YoY

-

Natural Gas

- Natural gas inventories increased by 59 billion cubic feet last week

- Total natural gas inventories now amount to 2,484 billion cubic feet, up 20.4% YoY

Credit News

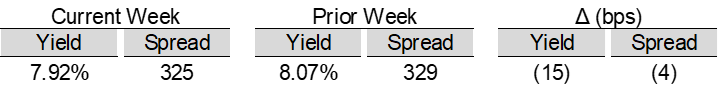

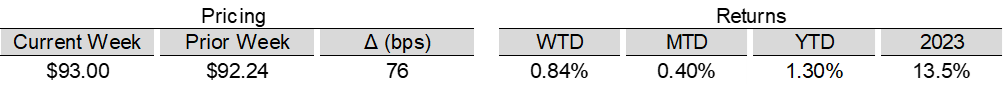

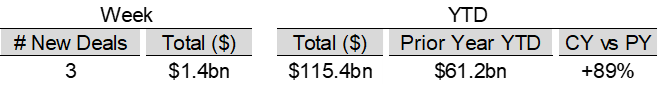

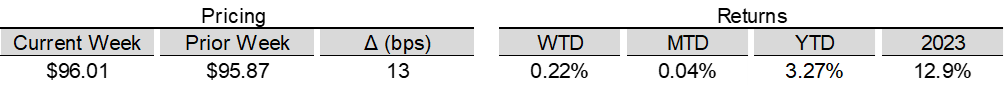

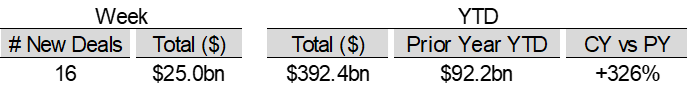

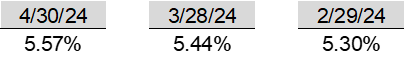

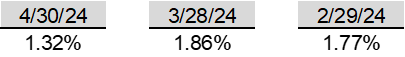

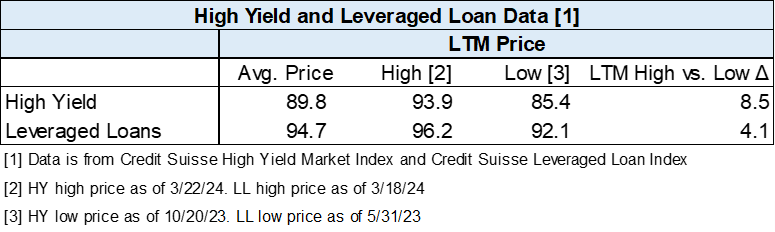

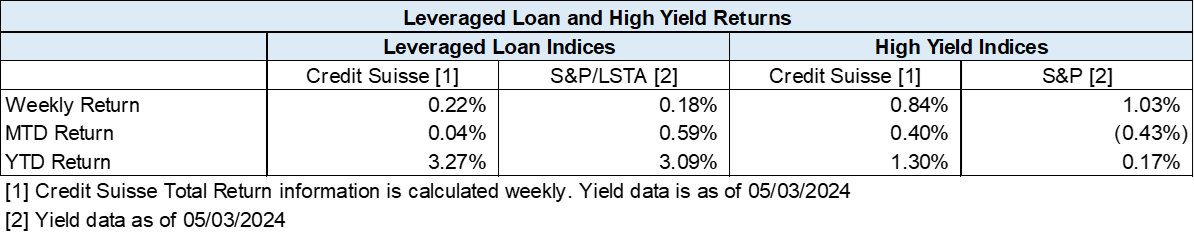

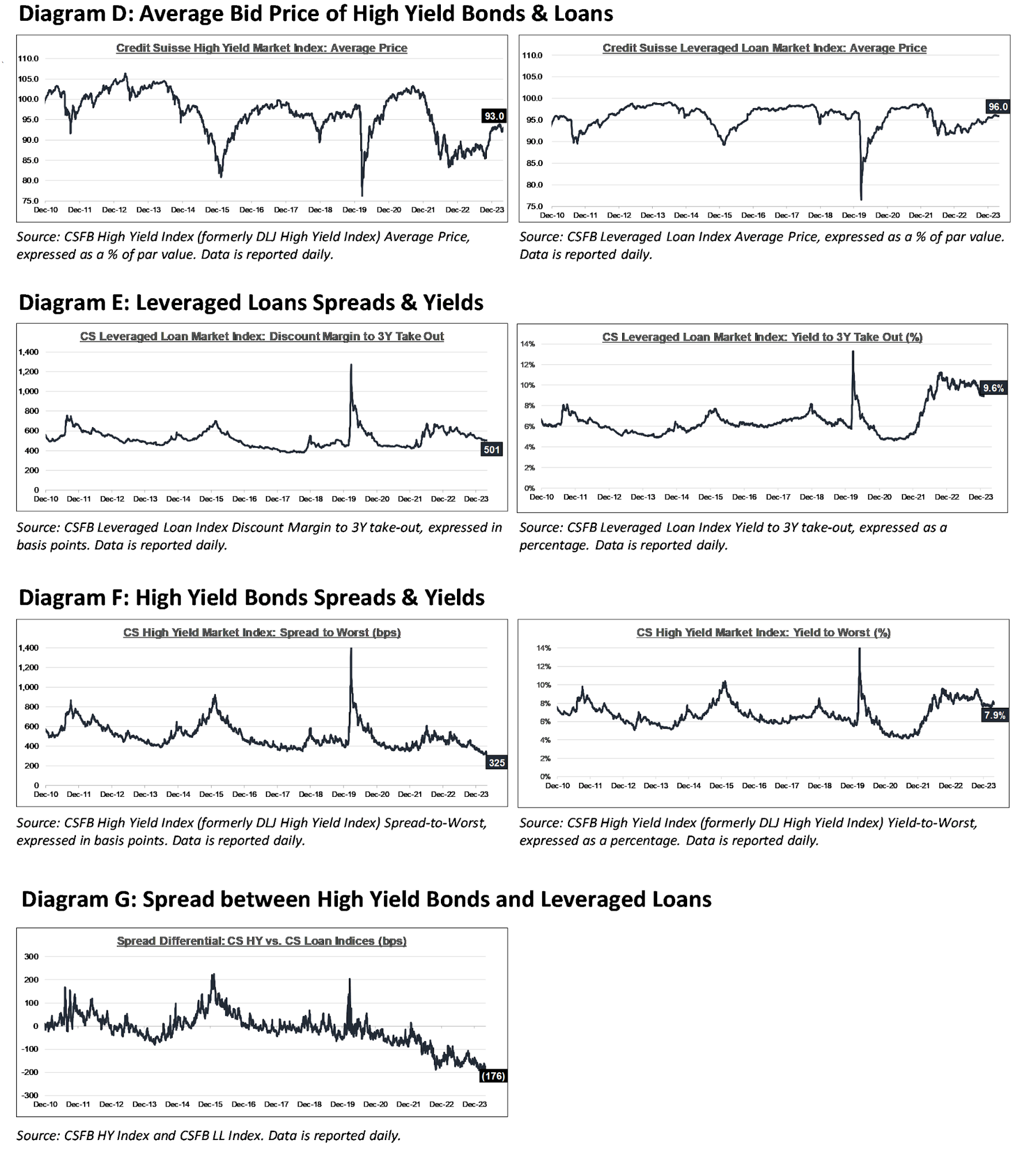

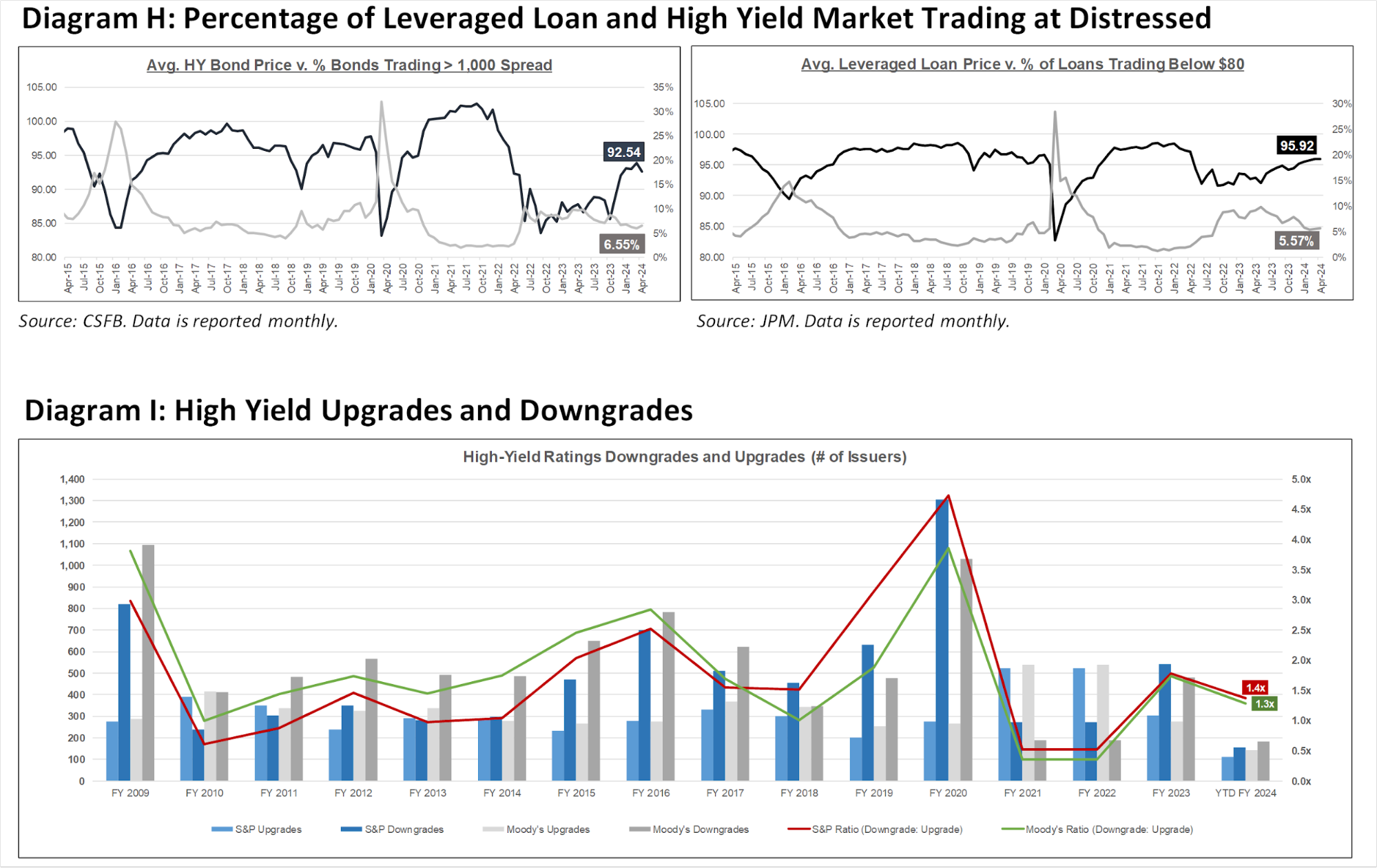

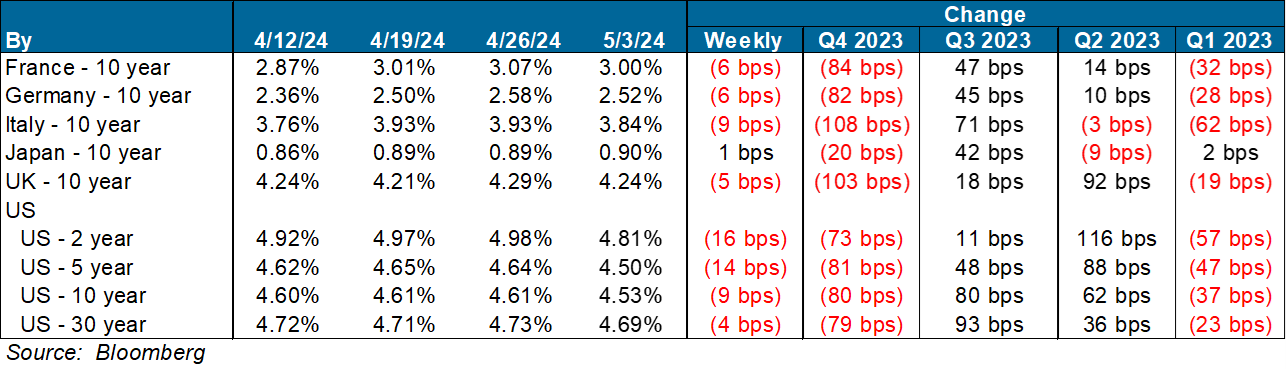

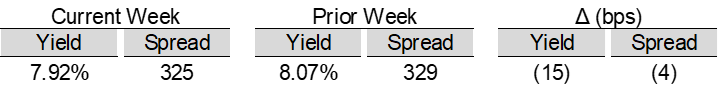

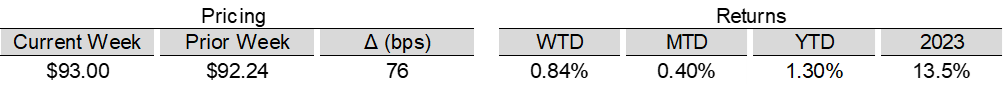

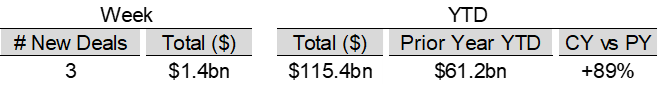

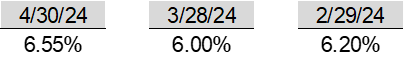

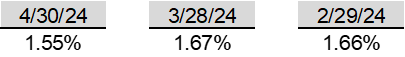

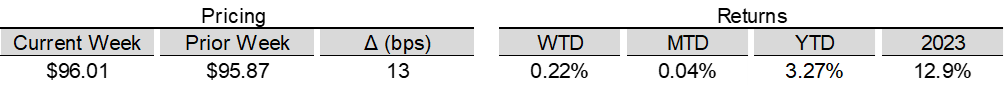

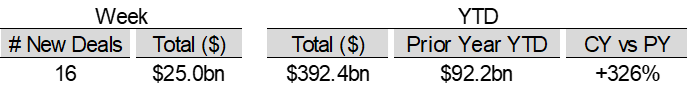

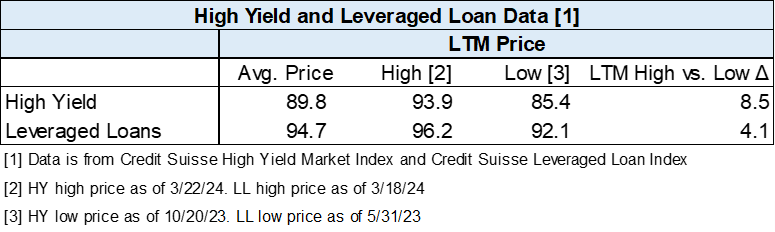

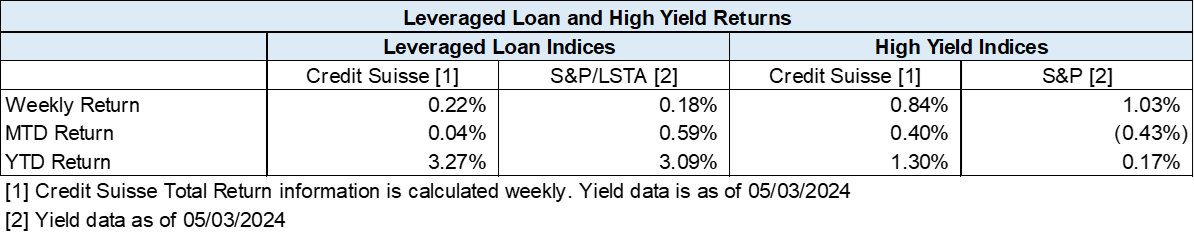

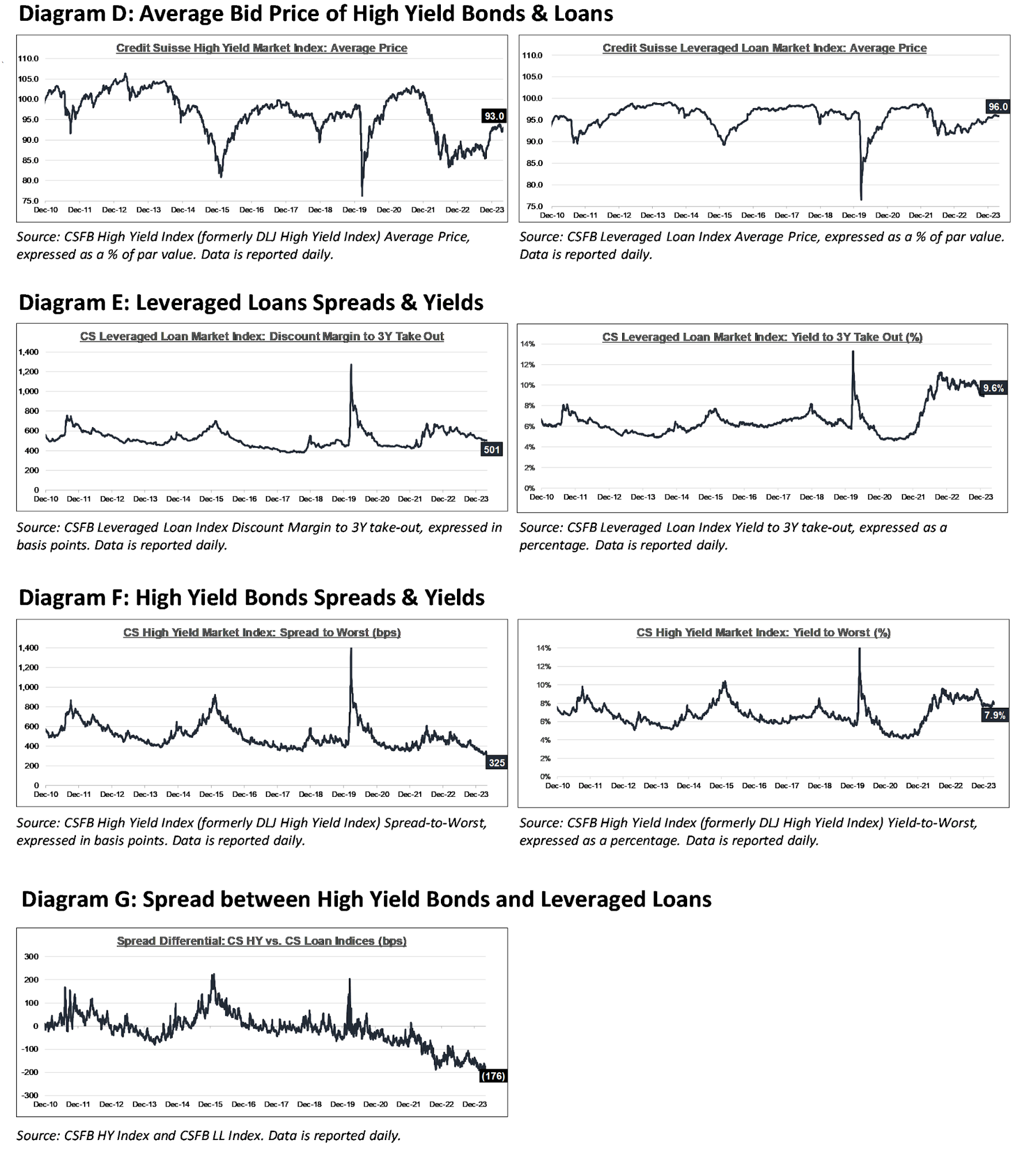

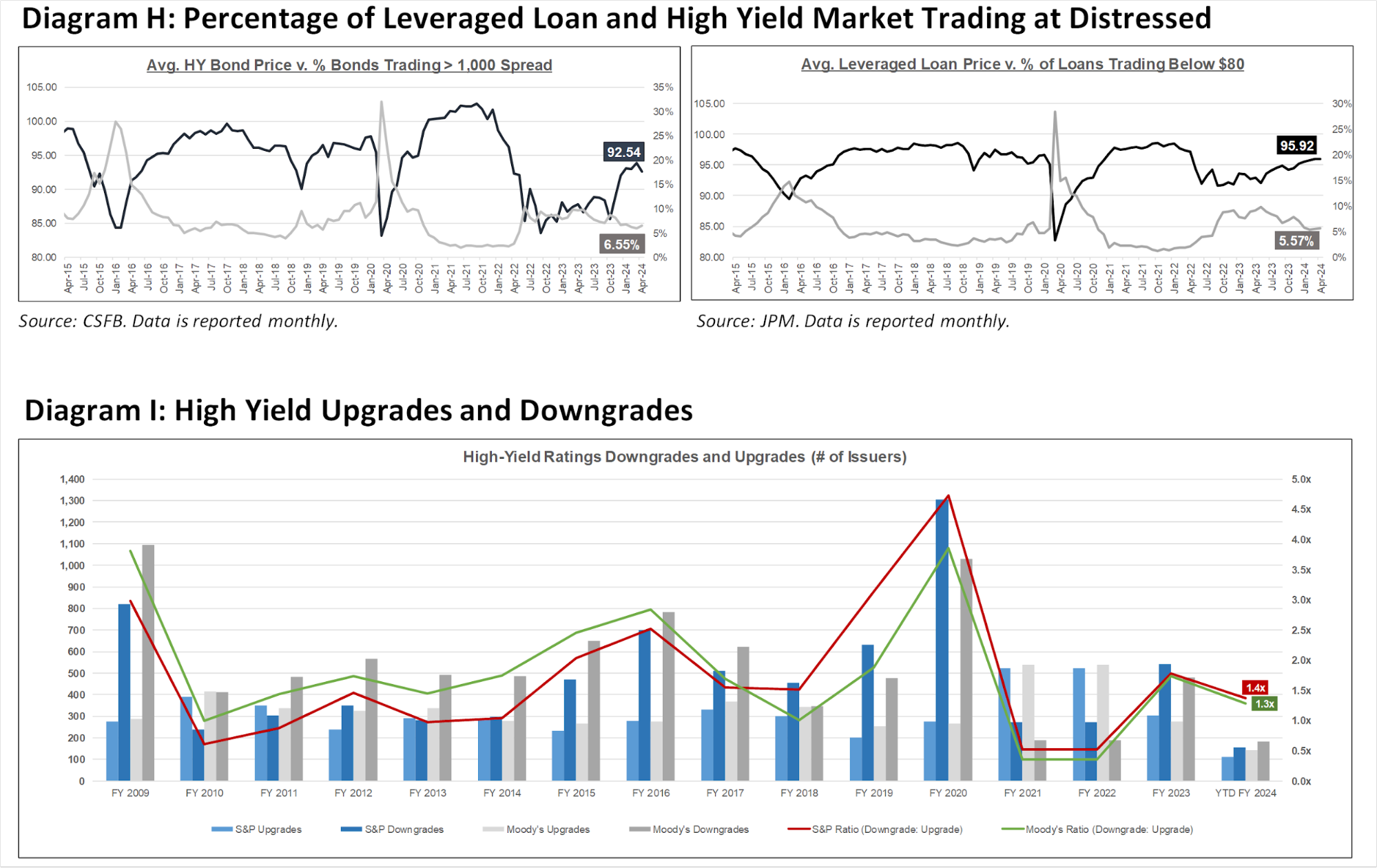

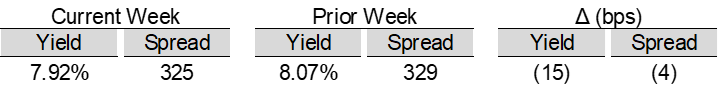

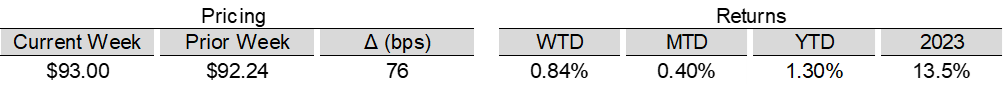

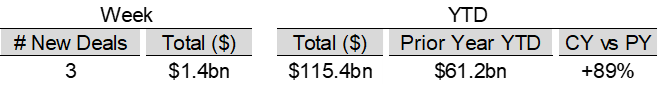

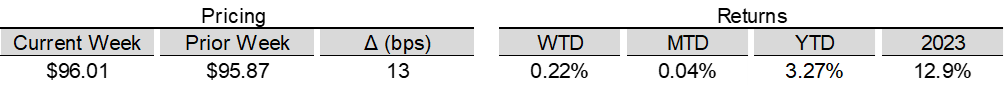

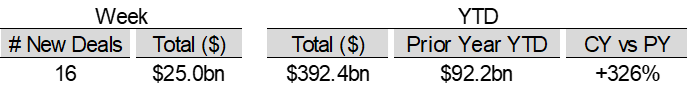

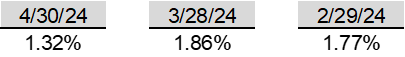

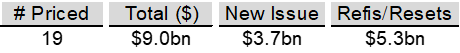

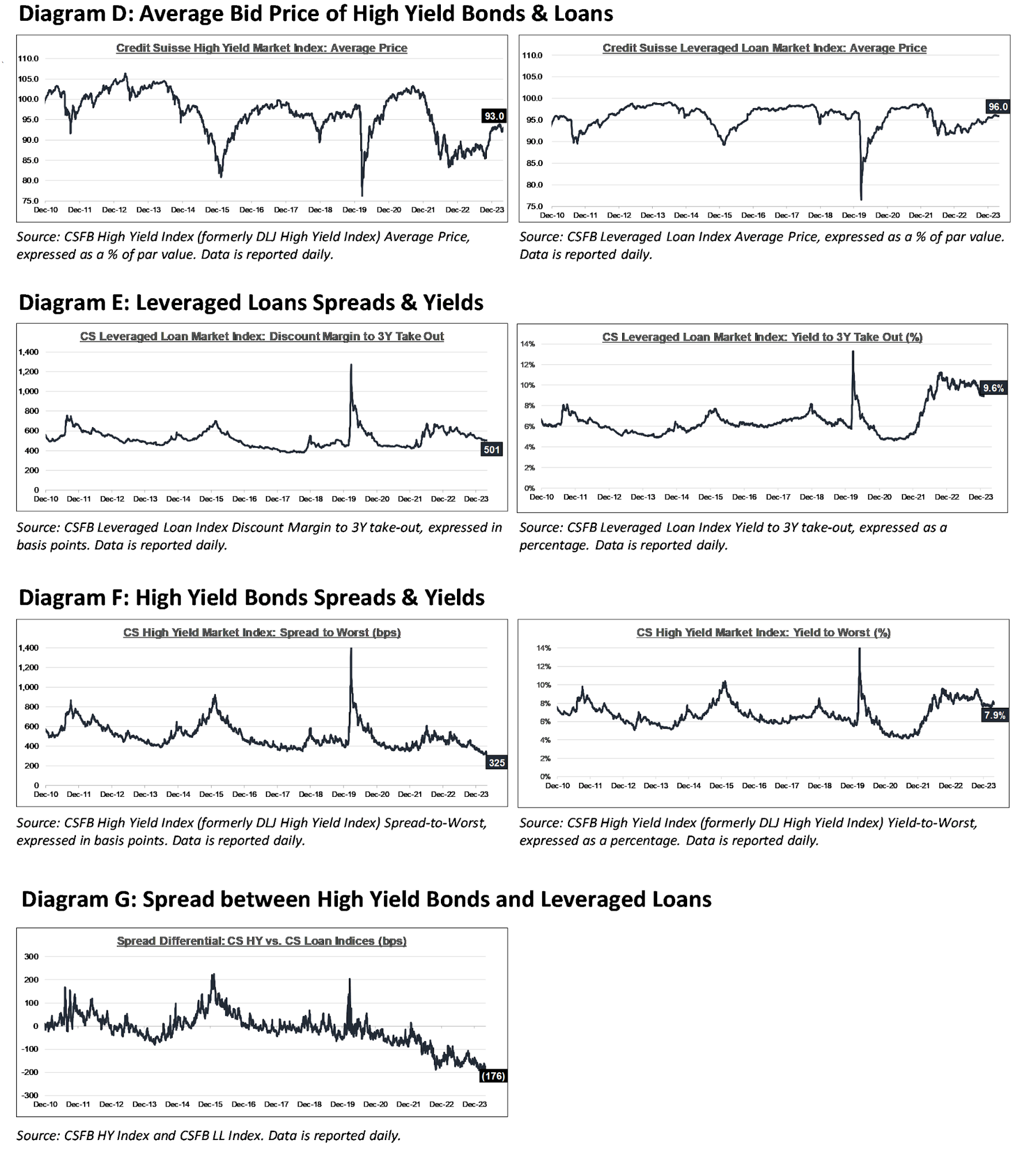

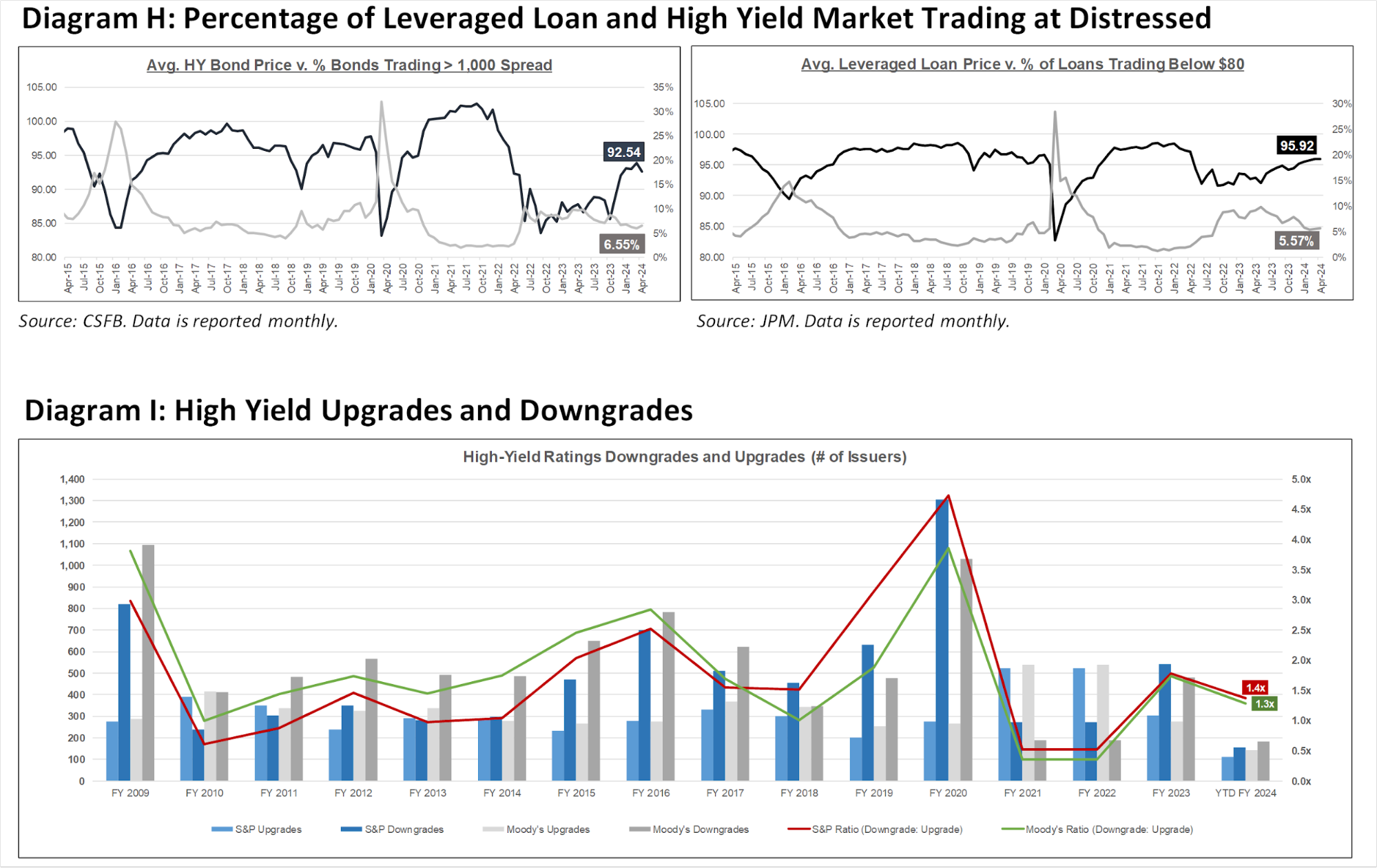

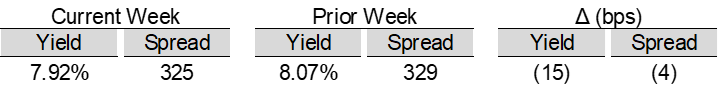

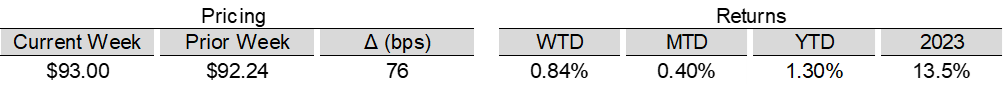

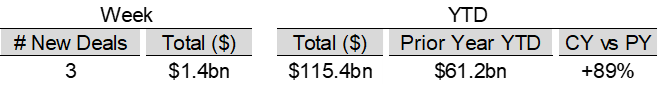

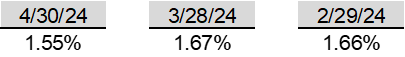

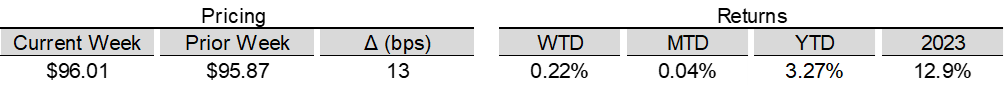

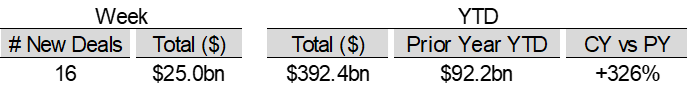

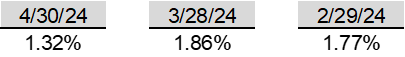

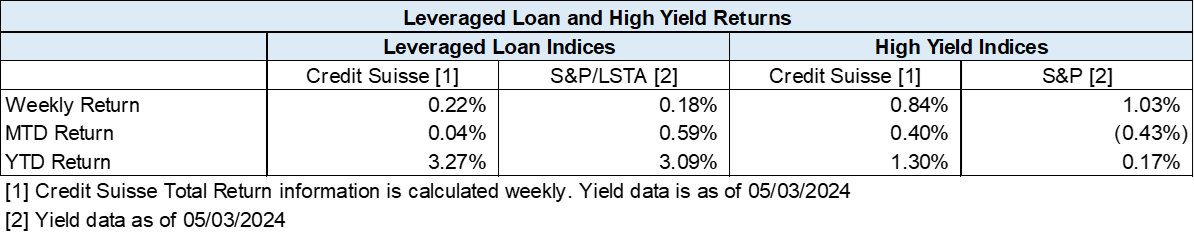

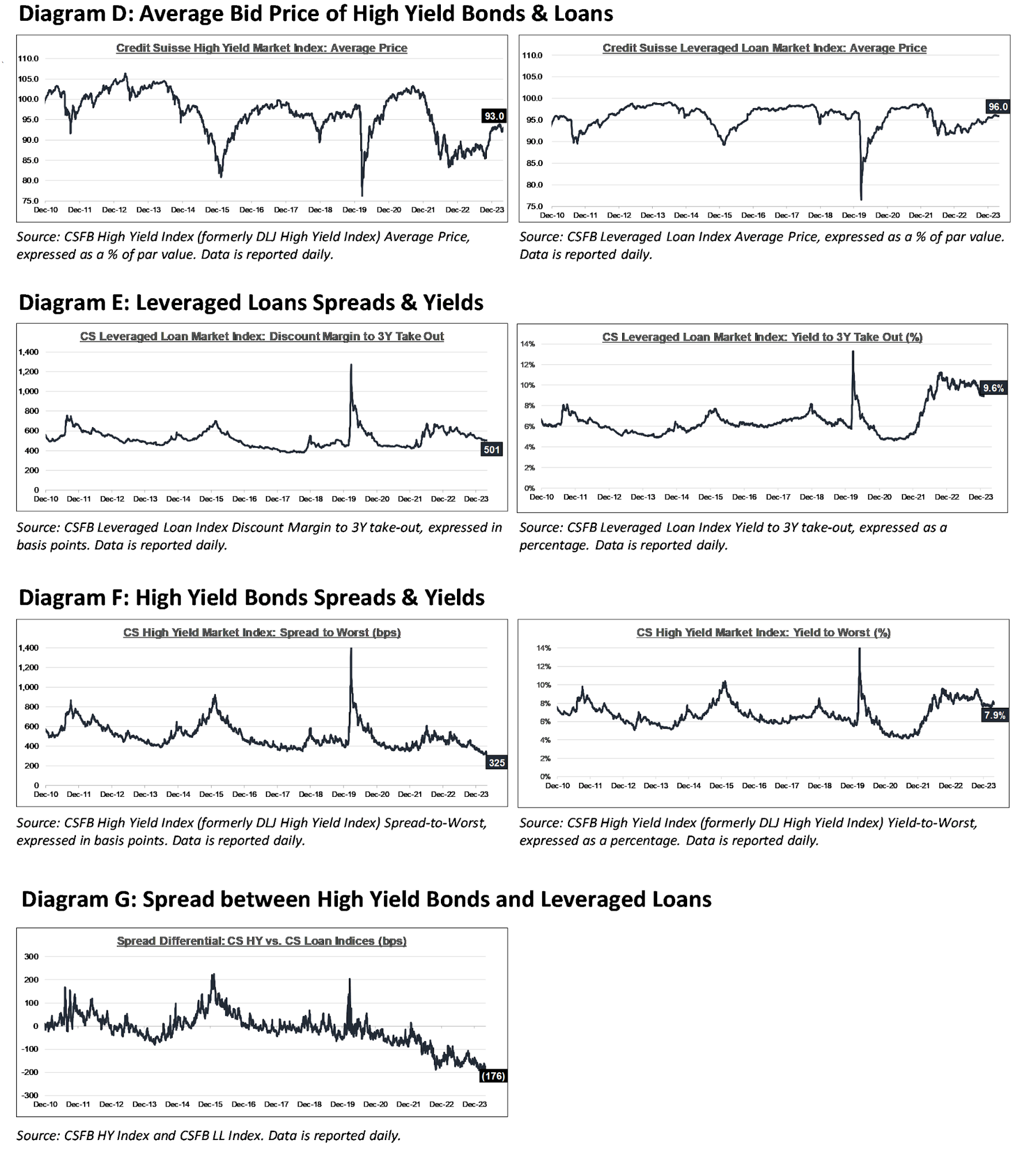

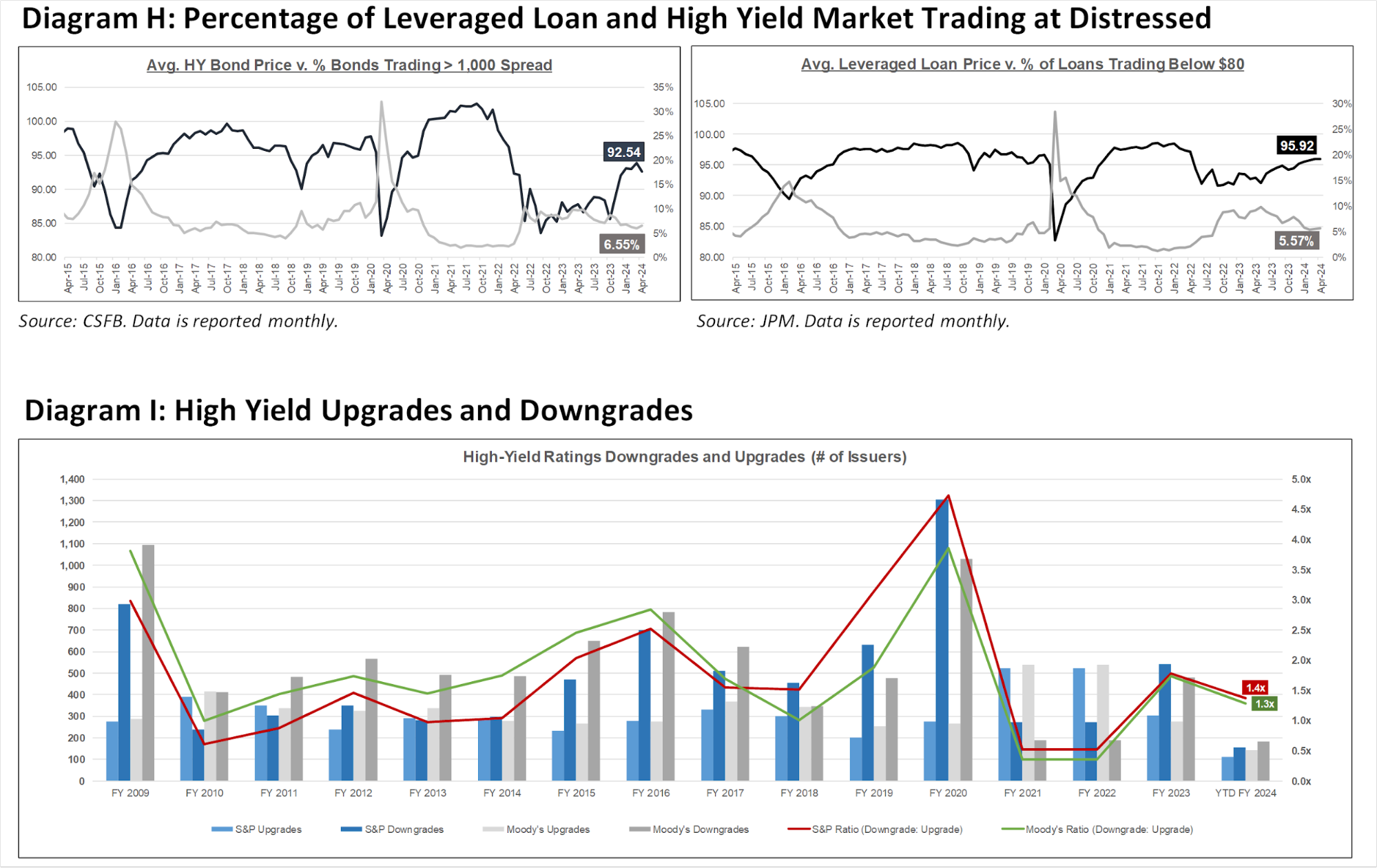

High yield bond yields decreased 15bps to 7.92% and spreads decreased 4bps to 325bps. Leveraged loan yields decreased 14bps to 9.62% and spreads decreased 5bps to 501bps. WTD Leveraged loan returns were positive 22bps. WTD high yield bond returns were positive 84bps. 10yr treasury yields decreased 13bps to 4.57%. For the week, yields and spreads widened as investors continue to digest Wednesday’s less hawkish than expected FOMC meeting, absorbed earnings, and mixed data.

High-yield:

Week ended 05/03/2024

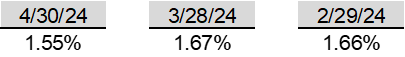

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 05/03/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

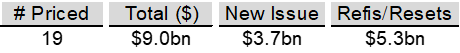

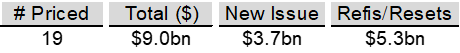

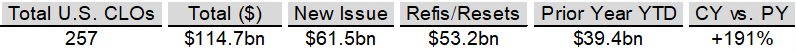

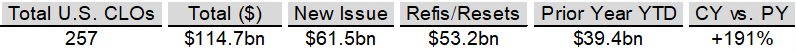

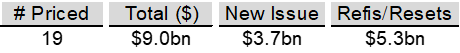

CLOs:

Week ended 05/03/2024

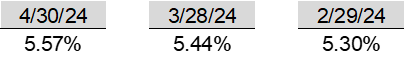

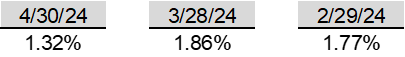

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

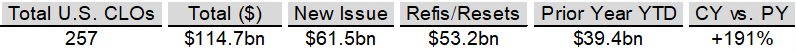

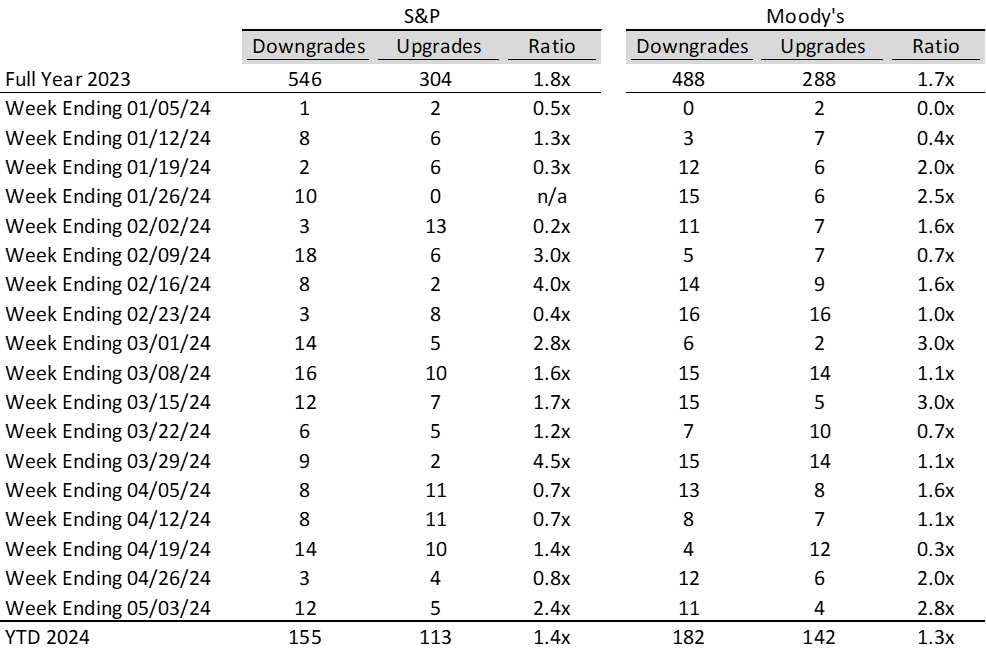

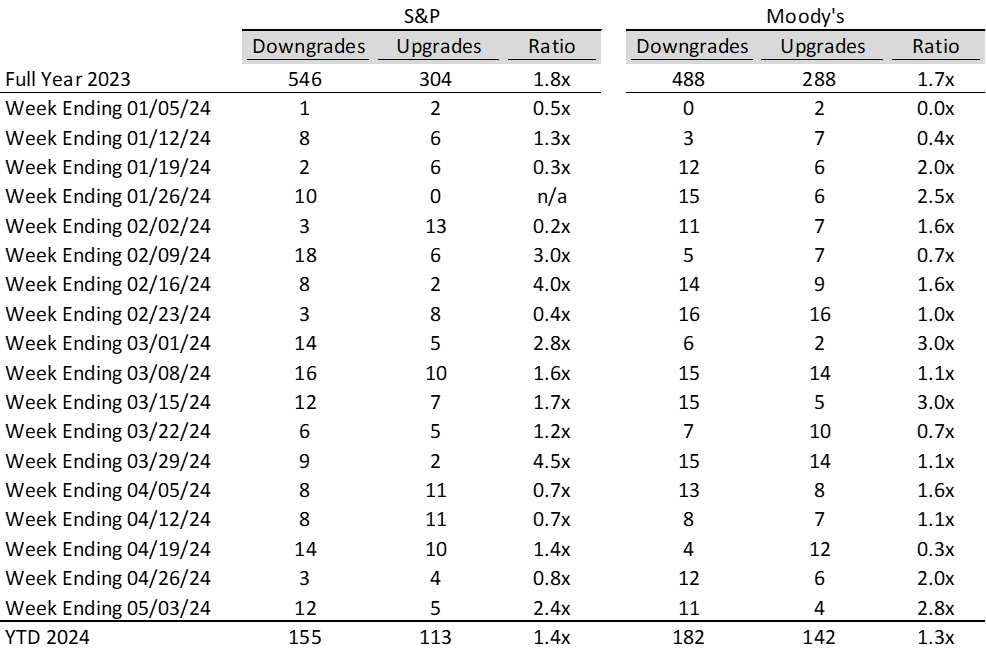

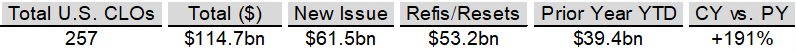

Ratings activity:

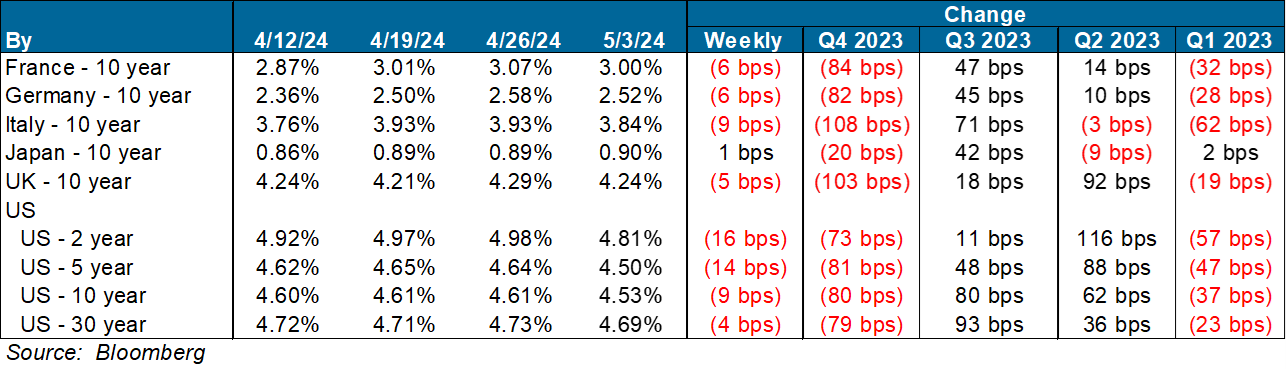

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

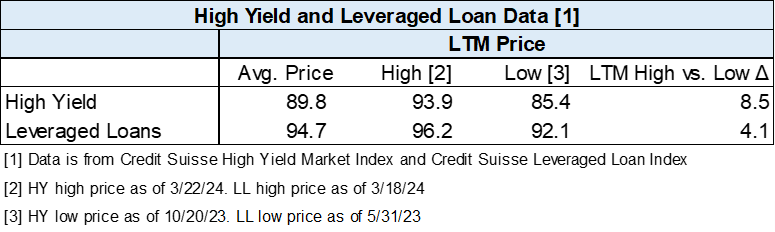

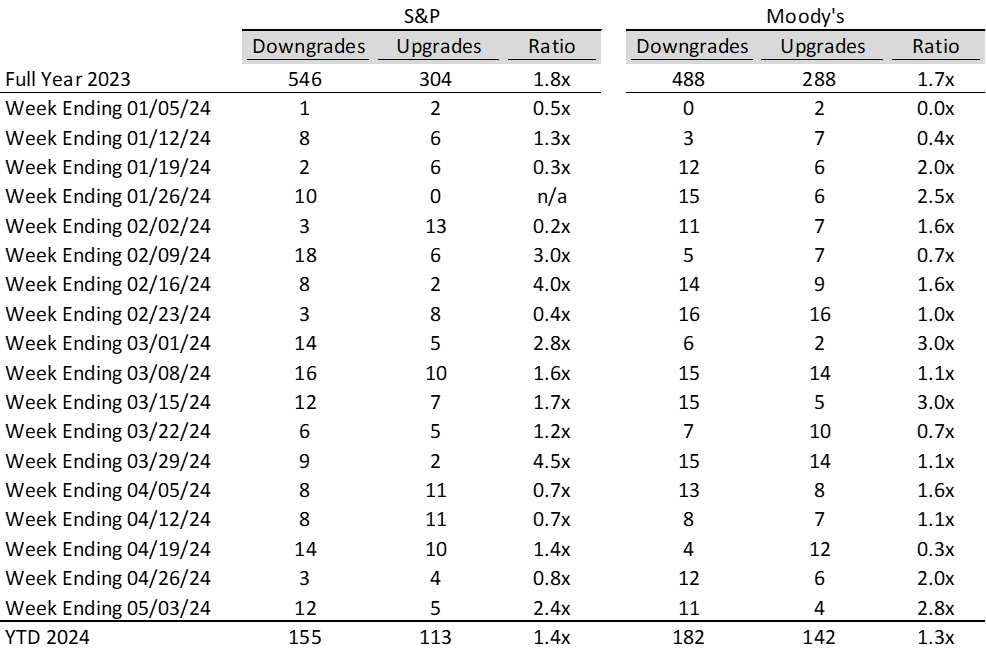

Diagram B: High Yield and Leveraged Loan LTM Price

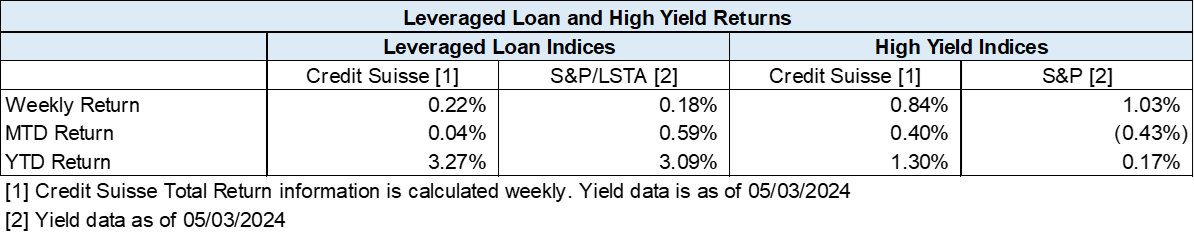

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

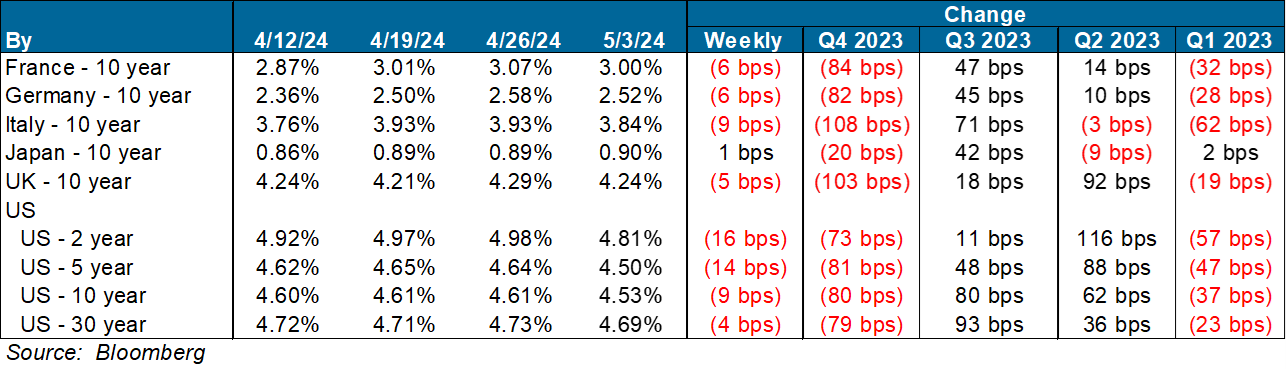

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- FOMC Interest Rate Decision

- The Federal Reserve on Wednesday kept its benchmark short-term borrowing rate in a targeted range between 5.25% – 5.50%

- With its decision to hold the line on rates, the committee in its post-meeting statement noted a lack of further progress in getting inflation back down to its 2% target

- The Federal Open Market Committee did vote to ease the pace at which it is reducing bond holdings on the central bank’s balance sheet

- Consumer Confidence

- Consumer confidence fell in April for the third straight month to 97.0 and touched a 21-month low due to the high cost of food and gas and fresh worries about the jobs market

- Confidence has retreated since the start of the year and sits well below the pre-pandemic high

- Historically, readings below 80 in the expectations index signal a forthcoming recession

- Construction Spending

- Spending on construction projects fell 0.2% in March to $2.08 trillion as U.S. companies and the government scaled back projects across the nation

- Private residential construction fell 0.7% in March, with single-family construction falling 0.2% and multifamily construction falling 0.6%. Spending on public residential construction rose by 0.5%

- Over the past year construction spending is up 9.6%

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., flat to 208,000 in the week ended April 26, compared from the prior week

- The four-week moving average was 210,000, down 3500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – flat by 0,000 to 1.774 million in the week ended April 19. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.362 trillion in the week ended May 3, down $40.0 billion from the prior week

- Treasury holdings totaled $4.534 trillion, down $5.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.37 trillion in the week, down $16.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.56 trillion as of May 3, an increase of 9.9% from the previous year

- Debt held by the public was $24.64 trillion, and intragovernmental holdings were $7.08 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.5% in March year over year

- On a monthly basis, the CPI increased 0.4% in March on a seasonally adjusted basis, after increasing 0.4% in February

- The index for all items less food and energy (core CPI) rose 0.4% in March, after rising 0.4% in February

- Core CPI increased 3.8% for the 12 months ending March

- Food and Beverages:

- The food at home index increased 1.2% in March from the same month a year earlier, and decreased 0.0% in March month over month

- The food away from home index increased 4.2% in March from the same month a year earlier, and increased 0.3% in March month over month

- Commodities:

- The energy commodities index increased 1.5% in March after increasing 3.6%

- The energy commodities index fell 0.9% over the last 12 months

- The energy services index (0.0%) in March after increasing 0.1% in February

- The energy services index rose 3.1% over the last 12 months

- The gasoline index rose 1.3% over the last 12 months

- The fuel oil index fell (3.7%) over the last 12 months

- The index for electricity rose 5.0% over the last 12 months

- The index for natural gas fell (3.2%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $2,725.45 per 40ft

- Drewry’s composite World Container Index has increased by 54.6% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in March after increasing 0.4% in February

- The rent index increased 0.5% in March after increasing 0.4% in February

- The index for lodging away from home increased 5.6% in March after increasing 3.1% in February

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel

- The fate of a deal that would free Israeli hostages and stop the war in Gaza is now in the hands of two leaders whose future is at stake in the war: Israeli Prime Minister Benjamin Netanyahu and Hamas’s top leader in Gaza, Yahya Sinwar

- The calculations of both men, whose strategies have left them little room to reach a compromise, pose a challenge for the Biden administration which has been working to free the hostages and secure a cease-fire

- Negotiations over a cease-fire deal are at a critical point. The Israeli government has said it plans to send forces into Rafah, a city at the southern edge of the Gaza Strip where more than a million Palestinian civilians are sheltering. Rafah’s border crossing with Egypt is also a lifeline bringing humanitarian aid to the people of Gaza, many of whom are on the edge of starvation. Netanyahu says the operation is necessary to destroy Hamas’s remaining military forces in the area

-

China

- This past week China’s government hinted at lowering borrowing costs further and extending new help for the property market while announcing plans to convene a long-deferred policy meeting, whose delay had fueled unease about Beijing’s economic management

- The promise of further action comes as data continue to suggest growth is softening with surveys pointing to weakening activity in manufacturing and services, and figures showing a recent plunge in industrial profits

- Thornier challenges around trade, foreign investment and an aging and shrinking workforce are clouding the longer-term outlook. Above all, China’s drawn-out real estate bust remains a major drag despite a number of small measures last year aimed at soothing the sector

-

Russia

- The United States on Wednesday accused Russia of violating the international chemical weapons ban by deploying the choking agent chloropicrin against Ukrainian troops and using riot control agents “as a method of warfare” in Ukraine. The Russian embassy in Washington did not immediately respond to a request for comment

- Earlier this month, the Ukrainian military reported that Russia had stepped up its illegal use of riot control agents as it presses its biggest advances in eastern Ukraine in more than two years

- In addition to chloropicrin, Russian forces have used grenades loaded with CS and CN gases, the Ukrainian military says. It says at least 500 Ukrainian soldiers have been treated for exposure to toxic substances and one was killed by suffocating on tear gas

-

France

- French President Emmanuel Macron is rekindling debate over whether France’s nuclear arsenal should play a role in deterring attacks against European allies, igniting criticism across the political spectrum from lawmakers who say any move to extend the country’s nuclear umbrella risks compromising a linchpin of national sovereignty

-

Germany

- German inflation held steady this month, adding to signs that price pressures have cooled sustainably in the eurozone’s most important economy. Consumer prices were on average 2.2% higher than in April of last year, the same rate booked in March, according to national-standard figures set out Monday by German statistics authority Destatis

-

Japan

- Japan has intervened to prop up the yen after it hit a multidecade low against the dollar. The currency has plummeted against the dollar this year, hurt by increasing doubts among traders about the timing of U.S. interest rate cuts

-

Finland

- Finland, sharing NATO’s longest border with Russia at 830 miles, has escalated its security measures, including constructing new fences and enhancing surveillance, in response to increased Russian aggression and hybrid warfare tactics

-

South Korea

- SK Hynix plans to invest an additional $14.6 billion to expand its semiconductor production capacity in South Korea, aiming to meet the increasing demand for artificial intelligence chips

-

Canada

- Honda is nearing a deal to build an electric vehicle assembly plant in Ontario, Canada, with the Canadian government agreeing to offset some of the capital costs through newly introduced tax breaks

-

Poland

- Russian missiles have breached Polish airspace several times since 2022, with the most recent incident occurring on March 24, 2024, when a Russian cruise missile entered Polish airspace for 39 seconds, posing a risk of wider conflict, according to Poland’s President Andrzej Duda

Commodities

-

Oil Prices

- WTI: $78.14 per barrel

- (6.81%) WoW; +9.06% YTD; +13.97% YoY

- Brent: $82.93 per barrel

- (7.34%) WoW; +7.65% YTD; +14.39% YoY

-

US Production

- U.S. oil production amounted to 13.1 million bpd for the week ended April 26, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 605, down 8 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 460.9 million barrels, up 0.3% YoY

- Refiners operated at a capacity utilization rate of 87.5% for the week, down from 88.5% in the prior week

- U.S. crude oil imports now amount to 6.497 million barrels per day, down 5.9% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.67 per gallon in the week of May 3,

up 3.0% YoY

- Gasoline prices on the East Coast amounted to $3.65, up 1.5% YoY

- Gasoline prices in the Midwest amounted to $3.53, down (0.7%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.28, down 1.6% YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.54, down (3.0%) YoY

- Gasoline prices on the West Coast amounted to $4.92, up 5.9% YoY

- Motor gasoline inventories were down by 0.3 million barrels from the prior week

- Motor gasoline inventories amounted to 227.1 million barrels, up 1.9% YoY

- Production of motor gasoline averaged 9.40 million bpd, up 0.2% YoY

- Demand for motor gasoline amounted to 8.618 million bpd, down 0.0% YoY

-

Distillates

- Distillate inventories decreased by -0.7 million in the week of May 3

- Total distillate inventories amounted to 115.9 million barrels, up 5.0% YoY

- Distillate production averaged 4.508 million bpd, up (1.5%) YoY

- Demand for distillates averaged 3.678 million bpd in the week, down (5.0%) YoY

-

Natural Gas

- Natural gas inventories increased by 59 billion cubic feet last week

- Total natural gas inventories now amount to 2,484 billion cubic feet, up 20.4% YoY

Credit News

High yield bond yields decreased 15bps to 7.92% and spreads decreased 4bps to 325bps. Leveraged loan yields decreased 14bps to 9.62% and spreads decreased 5bps to 501bps. WTD Leveraged loan returns were positive 22bps. WTD high yield bond returns were positive 84bps. 10yr treasury yields decreased 13bps to 4.57%. For the week, yields and spreads widened as investors continue to digest Wednesday’s less hawkish than expected FOMC meeting, absorbed earnings, and mixed data.

High-yield:

Week ended 05/03/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 05/03/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), Careismatic ($700mn, 1/22/24), Enviva Partners ($750mn, 1/15/24), Ligado Networks ($4.2bn, 11/1/23), and Air Methods ($1.7bn, 10/24/23).

CLOs:

Week ended 05/03/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

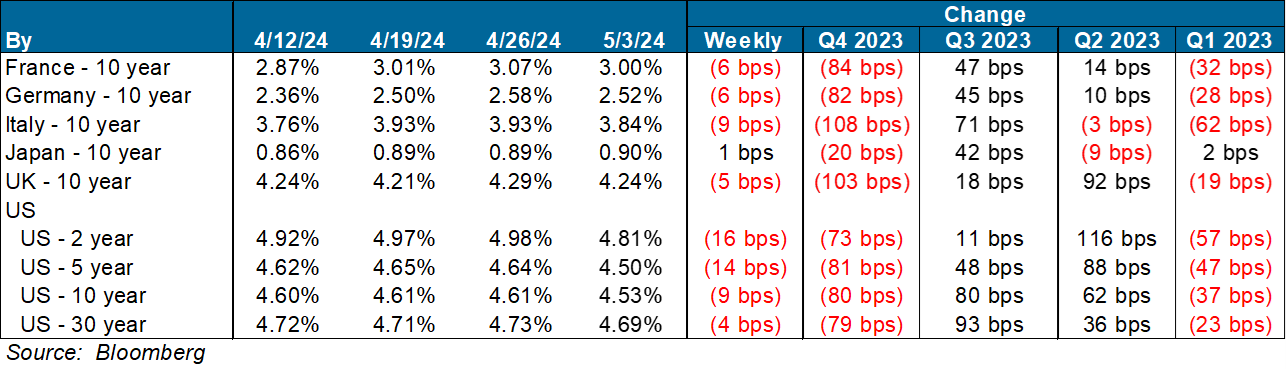

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index