U.S. News

- FOMC Interest Rate Decision

- Fed Reserve held interest rates steady at their current range of 5.25% to 5.5% and revised its outlook for rate cuts to just one in 2024

- Fed Chair Jerome Powell emphasized the cautious approach due to the volatility in inflation data and the resilient job market

- Recent indicators show solid economic activity, strong job gains, low unemployment, and easing but still elevated inflation

- Consumer Price Index

- CPI for May remained unchanged, the first flat month in almost two years, with annual inflation falling to 3.3% from 3.4% in April

- Gasoline prices declined by 2.8% in May, contributing to the flat inflation reading

- The core inflation rate, which excludes food and energy, rose by 0.2%, the smallest increase in seven months, with the annual core rate slowing to 3.4% from 3.6%

- Consumer Sentiment

- U.S. consumer sentiment fell to a seven-month low in June, dropping to 65.6 from 69.1 in May

- A gauge measuring consumer views on the current state of the economy dropped to 62.5, the lowest since the end of 2022

- Consumers expect inflation to average 3.3% over the next year, consistent with the current annual rate of inflation reported for May

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 242,000 in the week ended June 7, up 13,000 from the prior week

- The four-week moving average was 227,000, up 4750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 30,000 to 1.820 million in the week ended May 31. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.259 trillion in the week ended June 14, up $3.3 billion from the prior week

- Treasury holdings totaled $4.462 trillion, down $3.6 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.35 trillion in the week, down $9.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.68 trillion as of June 14, an increase of 8.3% from the previous year

- Debt held by the public was $25.18 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.3% in May year over year

- On a monthly basis, the CPI increased 0.0% in May on a seasonally adjusted basis, after increasing 0.3% in April

- The index for all items less food and energy (core CPI) rose 0.2% in May, after rising 0.3% in April

- Core CPI increased 3.4% for the 12 months ending May

- Food and Beverages:

- The food at home index increased 1.0% in May from the same month a year earlier, and decreased 0.0% in May month over month

- The food away from home index increased 4.0% in May from the same month a year earlier, and increased 0.4% in May month over month

- Commodities:

- The energy commodities index decreased (3.5%) in May after increasing 2.7% in

- The energy commodities index fell 2.1% over the last 12 months

- The energy services index 0.3% in May after decreasing (1.3%) in April

- The energy services index rose 4.7% over the last 12 months

- The gasoline index rose 2.2% over the last 12 months

- The fuel oil index fell 3.6% over the last 12 months

- The index for electricity rose 5.9% over the last 12 months

- The index for natural gas fell 0.2% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $4,800.64 per 40ft container for

- Drewry’s composite World Container Index has increased by 201.5% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in May after increasing 0.4% in April

- The rent index increased 0.4% in May after increasing 0.4% in April

- The index for lodging away from home increased 1.4% in May after increasing 0.9% in April

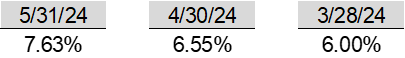

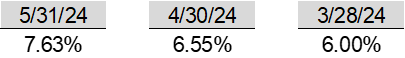

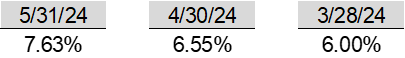

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- Hamas has hardened its stance on a cease-fire proposal, demanding a quicker Israeli withdrawal from Gaza and a permanent cease-fire before releasing additional hostages

- The U.S. Secretary of State Antony Blinken is consulting with other proponents of the peace plan regarding Hamas’s new demands

- Violence continues on Israel’s northern border with Lebanon, with Hezbollah launching significant attacks on Israel, further escalating tensions

-

Russia

- Russia suspended trading in U.S. dollars, euros, and Hong Kong dollars on its flagship stock exchange due to new U.S. sanctions

- The U.S. Treasury sanctioned the Moscow exchange and Russia’s central securities depository to limit Russia’s access to foreign technology, equipment, software, and IT services

- The Biden administration imposed sanctions on over 300 entities and individuals, including seven China-based entities, for aiding Russia’s war in Ukraine

-

UK

- The U.K. economy was flat in April, with no growth compared to the previous month, due to declines in industrial production and construction

- The International Monetary Fund projects only 0.5% growth for the U.K. economy this year, highlighting ongoing issues like low productivity and high economic inactivity

- U.K. businesses expect wage rises to slow to 4.5% over the next 12 months, down from 4.8% in April, according to a BOE survey, indicating easing inflation concerns for policymakers

-

China

- China is building a $3.5 billion megaport in Chancay, Peru, which will be the first on South America’s Pacific coast able to receive megaships due to its nearly 60 feet of depth

- The port, majority-owned by China Ocean Shipping group (Cosco), aims to speed trade between Asia and South America, benefiting regions as far away as Brazil by reducing sailing times across the Pacific

- The U.S. is concerned that China’s control over this port could strengthen Beijing’s influence over South America’s resources and potentially provide strategic military advantages

-

France

- Over a quarter of a million people protested across France against Marine Le Pen’s far-right National Rally, which is projected to win the most seats in upcoming parliamentary elections, with antiracism groups, unions, and a new left-wing coalition participating in the demonstrations

-

South Africa

- South African President Cyril Ramaphosa was re-elected after forming a coalition government with the pro-business Democratic Alliance and the Inkatha Freedom Party, following the ANC’s loss of its absolute majority in recent elections

-

Japan

- The Bank of Japan will reduce government bond purchases, signaling monetary tightening, but left its interest rate unchanged. Despite this, the yen weakened due to a lack of specifics on the bond reduction plan

-

Taiwan

- Taiwan’s central bank kept interest rates unchanged at 2.000%, citing cooling inflation and solid economic growth. The bank also raised the reserve requirement ratio by 25 basis points to address the heating property market

-

South Korea

- South Korea’s exports rose 11.7% in May, led by a 55% increase in semiconductor shipments, contributing to a trade surplus of $4.96 billion

-

Iceland

- Argentina’s Senate approved a slimmed-down version of President Javier Milei’s economic reform package, including labor reforms and limited privatizations, amid violent protests and concerns about his ability to enact further measures

-

Mexico

- Claudia Sheinbaum, Mexico City’s former mayor, is projected to become Mexico’s first female president, winning by a landslide against the opposition coalition’s candidate, Xóchitl Gálvez

-

Canada

- The Bank of Canada cut its main interest rate by 0.25%, becoming the first G-7 central bank to ease policy amid cooling inflation and slower economic growth

Commodities

-

Oil Prices

- WTI: $78.37 per barrel

- 3.76% WoW; +9.38% YTD; +10.97% YoY

- Brent: $82.55 per barrel

- 3.68% WoW; +7.15% YTD; +9.09% YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended June 7, up 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 590, down 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 459.7 million barrels, down (1.6%) YoY

- Refiners operated at a capacity utilization rate of 95.0% for the week, down from 95.4% in the prior week

- U.S. crude oil imports now amount to 7.058 million barrels per day, down 30.1% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.46 per gallon in the week of June 14,

down (3.4%) YoY

- Gasoline prices on the East Coast amounted to $3.48, down (1.4%) YoY

- Gasoline prices in the Midwest amounted to $3.34, down (6.8%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.05, down (5.7%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.38, down (11.6%) YoY

- Gasoline prices on the West Coast amounted to $4.50, down (4.1%) YoY

- Motor gasoline inventories were up by 2.6 million barrels from the prior week

- Motor gasoline inventories amounted to 233.5 million barrels, up 5.7% YoY

- Production of motor gasoline averaged 10.09 million bpd, down (0.8%) YoY

- Demand for motor gasoline amounted to 9.040 million bpd, down (1.7%) YoY

-

Distillates

- Distillate inventories decreased by 0.9 million in the week of June 14

- Total distillate inventories amounted to 123.4 million barrels, up 8.4% YoY

- Distillate production averaged 5.032 million bpd, up 0.9% YoY

- Demand for distillates averaged 3.649 million bpd in the week, up 2.1% YoY

-

Natural Gas

- Natural gas inventories increased by 74 billion cubic feet last week

- Total natural gas inventories now amount to 2,974 billion cubic feet, up 12.9% YoY

Credit News

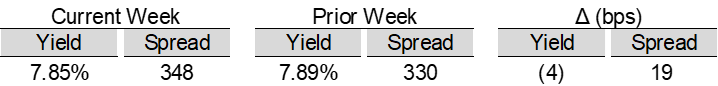

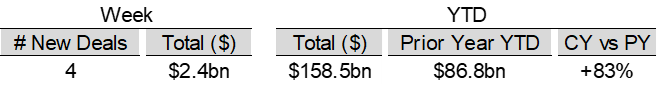

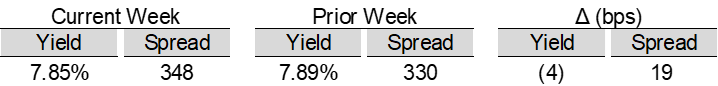

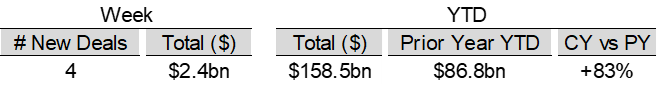

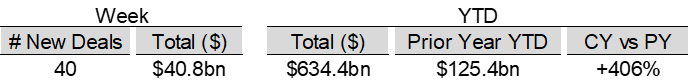

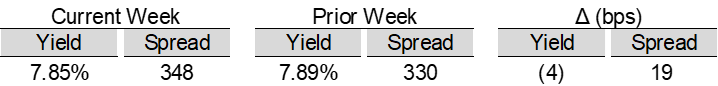

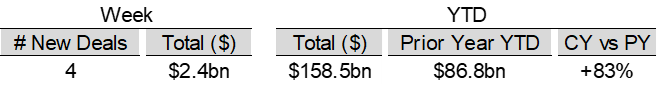

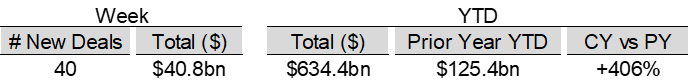

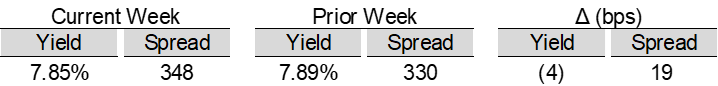

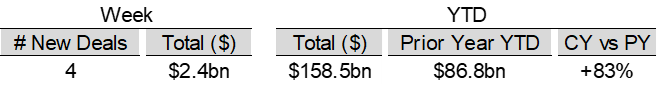

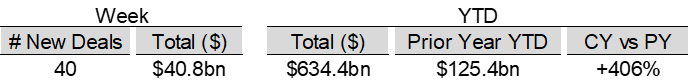

High yield bond yields decreased 4bps to 7.85% and spreads increased 19bps to 348bps. Leveraged loan yields decreased 16bps to 9.21% and spreads increased 8bps to 500bps. WTD Leveraged loan returns were negative 3bps. WTD high yield bond returns were positive 27bps. 10yr treasury yields decreased 4bps to 4.24%. Spreads widened as investors absorbed softer US CPI report, political turmoil in France, rise in jobless claims, and Fed DOTS which support a view of delayed but not necessarily shallower easing cycle.

High-yield:

Week ended 06/14/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 06/14/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

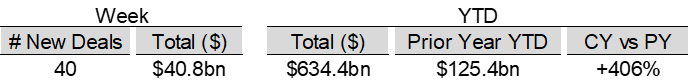

CLOs:

Week ended 06/14/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

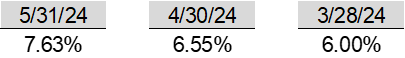

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate

Section 1:

- While most U.S. homeowners are sitting on a mountain of home equity after years of rising house prices, in some pockets of the country an increasing share of mortgage holders are underwater on their loans.

- Why it matters: That means these folks owe more on the mortgage than their home is worth, which puts them in a horrendous financial situation if they need to sell their house.

- State of play: The South and Midwest have the highest share of underwater mortgages, per Attom.

- That’s because in these areas home values have fallen from their peak during the pandemic housing boom.

- And people who bought at the top are seeing their home value dip below what they paid (or borrowed) for the house.

- Zoom in: Louisiana has highest share of underwater mortgages (11.3%), up about a percentage point from a year ago. Home values dropped 6% from their summer 2022 peak, per Redfin data.

- In Wyoming, No. 2 on the list, the share grew from 3.3% to 8.8%, and home values are down roughly 12% since June 2023.

- Reality check: These shares are still relatively small. After the housing crisis of 2008 1 in 4 homes with mortgages were underwater.

- Unemployment was high in that recession and many people who couldn’t pay back their loans by selling their house were forced into foreclosure or short sales.

- Right now unemployment in the U.S. is low — and the economy is strong.

- What they’re saying: Don’t panic. “It could be a temporary increase and not necessarily a major concern,” National Association of Realtors chief economist Lawrence Yun tells us.

- Yes, but: If the labor market or economy takes a turn, underwater homeowners are more at risk.

- With today’s high mortgage rates, the most financially secure people are buying in cash, Redfin chief economist Daryl Fairweather says.

- Recent buyers who took out a mortgage likely have less cash to fall back on.

- What’s next: “This year’s spring buying season will be of heightened importance in telling us if there is a new long-term market pattern developing,” according to Attom CEO Rob Barber.

Section 2:

30 Year Fixed Mortgage

6/13/24: 6.95

10-year US Treasury

6/13/24: 4.24

U.S. News

- FOMC Interest Rate Decision

- Fed Reserve held interest rates steady at their current range of 5.25% to 5.5% and revised its outlook for rate cuts to just one in 2024

- Fed Chair Jerome Powell emphasized the cautious approach due to the volatility in inflation data and the resilient job market

- Recent indicators show solid economic activity, strong job gains, low unemployment, and easing but still elevated inflation

- Consumer Price Index

- CPI for May remained unchanged, the first flat month in almost two years, with annual inflation falling to 3.3% from 3.4% in April

- Gasoline prices declined by 2.8% in May, contributing to the flat inflation reading

- The core inflation rate, which excludes food and energy, rose by 0.2%, the smallest increase in seven months, with the annual core rate slowing to 3.4% from 3.6%

- Consumer Sentiment

- U.S. consumer sentiment fell to a seven-month low in June, dropping to 65.6 from 69.1 in May

- A gauge measuring consumer views on the current state of the economy dropped to 62.5, the lowest since the end of 2022

- Consumers expect inflation to average 3.3% over the next year, consistent with the current annual rate of inflation reported for May

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 242,000 in the week ended June 7, up 13,000 from the prior week

- The four-week moving average was 227,000, up 4750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 30,000 to 1.820 million in the week ended May 31. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.259 trillion in the week ended June 14, up $3.3 billion from the prior week

- Treasury holdings totaled $4.462 trillion, down $3.6 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.35 trillion in the week, down $9.7 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $34.68 trillion as of June 14, an increase of 8.3% from the previous year

- Debt held by the public was $25.18 trillion, and intragovernmental holdings were $7.06 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.3% in May year over year

- On a monthly basis, the CPI increased 0.0% in May on a seasonally adjusted basis, after increasing 0.3% in April

- The index for all items less food and energy (core CPI) rose 0.2% in May, after rising 0.3% in April

- Core CPI increased 3.4% for the 12 months ending May

- Food and Beverages:

- The food at home index increased 1.0% in May from the same month a year earlier, and decreased 0.0% in May month over month

- The food away from home index increased 4.0% in May from the same month a year earlier, and increased 0.4% in May month over month

- Commodities:

- The energy commodities index decreased (3.5%) in May after increasing 2.7% in

- The energy commodities index fell 2.1% over the last 12 months

- The energy services index 0.3% in May after decreasing (1.3%) in April

- The energy services index rose 4.7% over the last 12 months

- The gasoline index rose 2.2% over the last 12 months

- The fuel oil index fell 3.6% over the last 12 months

- The index for electricity rose 5.9% over the last 12 months

- The index for natural gas fell 0.2% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $4,800.64 per 40ft container for

- Drewry’s composite World Container Index has increased by 201.5% over the last 12 months

- Housing Market:

- The shelter index increased 0.4% in May after increasing 0.4% in April

- The rent index increased 0.4% in May after increasing 0.4% in April

- The index for lodging away from home increased 1.4% in May after increasing 0.9% in April

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- Hamas has hardened its stance on a cease-fire proposal, demanding a quicker Israeli withdrawal from Gaza and a permanent cease-fire before releasing additional hostages

- The U.S. Secretary of State Antony Blinken is consulting with other proponents of the peace plan regarding Hamas’s new demands

- Violence continues on Israel’s northern border with Lebanon, with Hezbollah launching significant attacks on Israel, further escalating tensions

-

Russia

- Russia suspended trading in U.S. dollars, euros, and Hong Kong dollars on its flagship stock exchange due to new U.S. sanctions

- The U.S. Treasury sanctioned the Moscow exchange and Russia’s central securities depository to limit Russia’s access to foreign technology, equipment, software, and IT services

- The Biden administration imposed sanctions on over 300 entities and individuals, including seven China-based entities, for aiding Russia’s war in Ukraine

-

UK

- The U.K. economy was flat in April, with no growth compared to the previous month, due to declines in industrial production and construction

- The International Monetary Fund projects only 0.5% growth for the U.K. economy this year, highlighting ongoing issues like low productivity and high economic inactivity

- U.K. businesses expect wage rises to slow to 4.5% over the next 12 months, down from 4.8% in April, according to a BOE survey, indicating easing inflation concerns for policymakers

-

China

- China is building a $3.5 billion megaport in Chancay, Peru, which will be the first on South America’s Pacific coast able to receive megaships due to its nearly 60 feet of depth

- The port, majority-owned by China Ocean Shipping group (Cosco), aims to speed trade between Asia and South America, benefiting regions as far away as Brazil by reducing sailing times across the Pacific

- The U.S. is concerned that China’s control over this port could strengthen Beijing’s influence over South America’s resources and potentially provide strategic military advantages

-

France

- Over a quarter of a million people protested across France against Marine Le Pen’s far-right National Rally, which is projected to win the most seats in upcoming parliamentary elections, with antiracism groups, unions, and a new left-wing coalition participating in the demonstrations

-

South Africa

- South African President Cyril Ramaphosa was re-elected after forming a coalition government with the pro-business Democratic Alliance and the Inkatha Freedom Party, following the ANC’s loss of its absolute majority in recent elections

-

Japan

- The Bank of Japan will reduce government bond purchases, signaling monetary tightening, but left its interest rate unchanged. Despite this, the yen weakened due to a lack of specifics on the bond reduction plan

-

Taiwan

- Taiwan’s central bank kept interest rates unchanged at 2.000%, citing cooling inflation and solid economic growth. The bank also raised the reserve requirement ratio by 25 basis points to address the heating property market

-

South Korea

- South Korea’s exports rose 11.7% in May, led by a 55% increase in semiconductor shipments, contributing to a trade surplus of $4.96 billion

-

Iceland

- Argentina’s Senate approved a slimmed-down version of President Javier Milei’s economic reform package, including labor reforms and limited privatizations, amid violent protests and concerns about his ability to enact further measures

-

Mexico

- Claudia Sheinbaum, Mexico City’s former mayor, is projected to become Mexico’s first female president, winning by a landslide against the opposition coalition’s candidate, Xóchitl Gálvez

-

Canada

- The Bank of Canada cut its main interest rate by 0.25%, becoming the first G-7 central bank to ease policy amid cooling inflation and slower economic growth

Commodities

-

Oil Prices

- WTI: $78.37 per barrel

- 3.76% WoW; +9.38% YTD; +10.97% YoY

- Brent: $82.55 per barrel

- 3.68% WoW; +7.15% YTD; +9.09% YoY

-

US Production

- U.S. oil production amounted to 13.2 million bpd for the week ended June 7, up 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 590, down 4 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 459.7 million barrels, down (1.6%) YoY

- Refiners operated at a capacity utilization rate of 95.0% for the week, down from 95.4% in the prior week

- U.S. crude oil imports now amount to 7.058 million barrels per day, down 30.1% YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.46 per gallon in the week of June 14,

down (3.4%) YoY

- Gasoline prices on the East Coast amounted to $3.48, down (1.4%) YoY

- Gasoline prices in the Midwest amounted to $3.34, down (6.8%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.05, down (5.7%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.38, down (11.6%) YoY

- Gasoline prices on the West Coast amounted to $4.50, down (4.1%) YoY

- Motor gasoline inventories were up by 2.6 million barrels from the prior week

- Motor gasoline inventories amounted to 233.5 million barrels, up 5.7% YoY

- Production of motor gasoline averaged 10.09 million bpd, down (0.8%) YoY

- Demand for motor gasoline amounted to 9.040 million bpd, down (1.7%) YoY

-

Distillates

- Distillate inventories decreased by 0.9 million in the week of June 14

- Total distillate inventories amounted to 123.4 million barrels, up 8.4% YoY

- Distillate production averaged 5.032 million bpd, up 0.9% YoY

- Demand for distillates averaged 3.649 million bpd in the week, up 2.1% YoY

-

Natural Gas

- Natural gas inventories increased by 74 billion cubic feet last week

- Total natural gas inventories now amount to 2,974 billion cubic feet, up 12.9% YoY

Credit News

High yield bond yields decreased 4bps to 7.85% and spreads increased 19bps to 348bps. Leveraged loan yields decreased 16bps to 9.21% and spreads increased 8bps to 500bps. WTD Leveraged loan returns were negative 3bps. WTD high yield bond returns were positive 27bps. 10yr treasury yields decreased 4bps to 4.24%. Spreads widened as investors absorbed softer US CPI report, political turmoil in France, rise in jobless claims, and Fed DOTS which support a view of delayed but not necessarily shallower easing cycle.

High-yield:

Week ended 06/14/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 06/14/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 99 Cents Only Stores ($350mn, 4/7/24), ConvergeOne ($1.3bn, 4/4/24), Xplornet Communications ($1.2bn, 3/31/24), JoAnn Stores ($658mn, 3/18/24), New Insight Holdings ($1.2bn, 3/13/24), Robertshaw ($820mn, 2/29/24), Thrasio LLC ($724mn, 2/28/24), Hornblower ($838mn, 2/20/24), and Careismatic ($700mn, 1/22/24).

CLOs:

Week ended 06/14/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

Real Estate

Section 1:

- While most U.S. homeowners are sitting on a mountain of home equity after years of rising house prices, in some pockets of the country an increasing share of mortgage holders are underwater on their loans.

- Why it matters: That means these folks owe more on the mortgage than their home is worth, which puts them in a horrendous financial situation if they need to sell their house.

- State of play: The South and Midwest have the highest share of underwater mortgages, per Attom.

- That’s because in these areas home values have fallen from their peak during the pandemic housing boom.

- And people who bought at the top are seeing their home value dip below what they paid (or borrowed) for the house.

- Zoom in: Louisiana has highest share of underwater mortgages (11.3%), up about a percentage point from a year ago. Home values dropped 6% from their summer 2022 peak, per Redfin data.

- In Wyoming, No. 2 on the list, the share grew from 3.3% to 8.8%, and home values are down roughly 12% since June 2023.

- Reality check: These shares are still relatively small. After the housing crisis of 2008 1 in 4 homes with mortgages were underwater.

- Unemployment was high in that recession and many people who couldn’t pay back their loans by selling their house were forced into foreclosure or short sales.

- Right now unemployment in the U.S. is low — and the economy is strong.

- What they’re saying: Don’t panic. “It could be a temporary increase and not necessarily a major concern,” National Association of Realtors chief economist Lawrence Yun tells us.

- Yes, but: If the labor market or economy takes a turn, underwater homeowners are more at risk.

- With today’s high mortgage rates, the most financially secure people are buying in cash, Redfin chief economist Daryl Fairweather says.

- Recent buyers who took out a mortgage likely have less cash to fall back on.

- What’s next: “This year’s spring buying season will be of heightened importance in telling us if there is a new long-term market pattern developing,” according to Attom CEO Rob Barber.

Section 2:

30 Year Fixed Mortgage

6/13/24: 6.95

10-year US Treasury

6/13/24: 4.24