S&P 500

Dow Jones

Nasdaq

10-Year US Treasury Yield

British Pound per USD

Euro per USD

USD per Yen

Swiss franc per EUR

U.S. News

Consumer confidence

- The consumer confidence index increased 2.2 points to 91.2 in February, the first monthly increase in six months

- In addition, January consumer confidence was revised to 89, significantly higher than the initial reading of 84.5

- Consumers were less negative about the employment outlook in February than in prior months

Factory orders

- New orders for manufactured goods in December decreased $4.3 billion, or 0.7%, to $617.5 billion

- Shipments of manufactured goods in December increased $3.1 billion, or 0.5%, to $609.2 billion

- Unfilled orders increased $13.4 billion, or 0.9%, to $1,527.5 billion. Unfilled orders have been up seventeen times in the last eighteen months

Wholesale inventories

- December sales of merchant wholesalers, excluding manufacturers’ sales branches and offices, were up 1.0% to $722.1 billion

- December inventories of merchant wholesalers, excluding manufacturers’ sales branches and offices, were up 0.2% to $918.0 billion

- The December 2025 inventory to sales ratio for merchant wholesalers was 1.27, down from the December 2024 ratio of 1.30

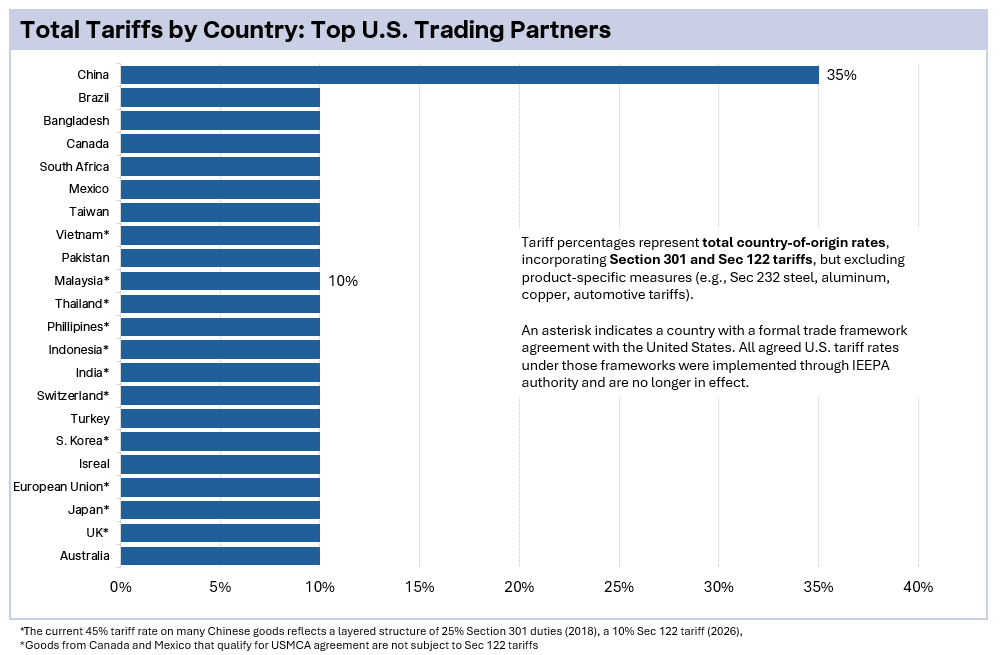

U.S. Tariff & Trade

- The Supreme Court IEEPA ruling continues to create operational uncertainty for importers as no procedural guidance on refunds has been issued by the Court of International Trade, CBP or Department of Justice

- Although President Trump publicly referenced implementing Section 122 tariffs at 15% on all countries, U.S. Customs and Border Protection operationalized the measure through a CSMS message establishing a 10 percent duty rate effective February 28 at 12:01 a.m.

- The International Trade Commission is accepting comments on potentially revoking China’s Permanent Normal Trade Relations status, which would shift Chinese goods from standard “Column 1” duty rates to significantly higher punitive “Column 2” rates meant to be used for non-market or adversarial countries; Due to an accelerated timeline, the ITC has advised that no public hearing will be planned

- Senate Democratic leaders introduced the Tariff Refund Act of 2026, which would require U.S. Customs and Border Protection to issue full refunds, with interest, of all IEEPA tariffs recently overturned by the Supreme Court, including entries that have already liquidated. The bill would mandate refunds within 180 days of enactment if passed

- U.S. Commerce Secretary Howard Lutnick made an unscheduled visit to New Delhi, as recent tariff disruptions have complicated existing deal frameworks given that prior negotiated tariff rates were implemented under IEEPA authority, which has since been overturned

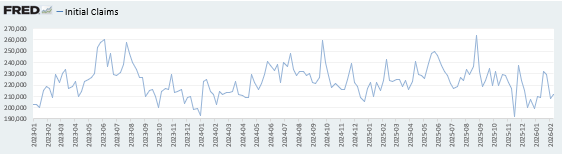

Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 212,000 in the week ended February 20, up 4,000 from the prior week.

- The four-week moving average was 220,250 up 7,50 from the prior week.

- Continuing claims - those filed by workers unemployed for longer than a week - decreased at 1.833 million in the week ended February 13. This figure is reported with a one-week lag.

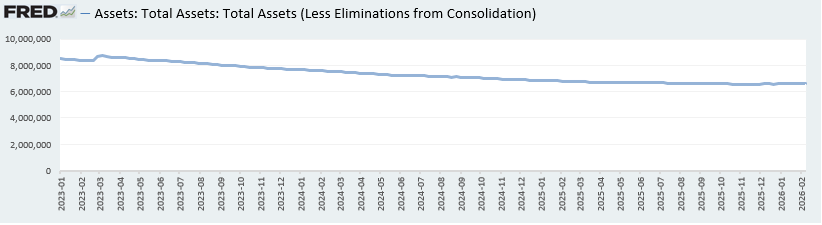

Fed’s Balance Sheet

- The Federal Reserve's assets totaled $6.614 trillion in the week ended February 27 up $0.4 billion from the prior week.

- Treasury holdings totaled $4.314 trillion, up $14.9 billion from the prior week.

- Holdings of mortgage-backed securities (MBS) were $2.02 trillion in the week, down $3.8 billion from the prior week.

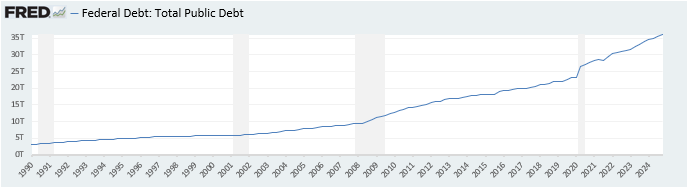

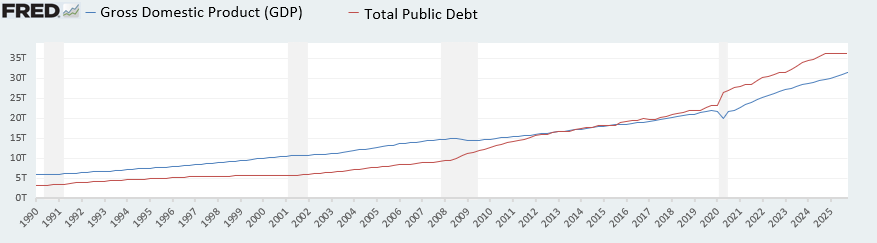

Total Public Debt

- Total public debt outstanding was $38.79 trillion as of February 27, an increase of 7.1% from the previous year.

- Debt held by the public was $31.15 trillion, and intragovernmental holdings were $7.60 trillion

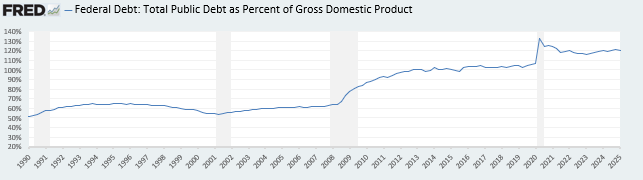

GDP

- The latest annualized U.S. GDP stands at $31.49 trillion as of December 31, 2025, an increase of 1.26% from the previous quarter , & an increase of 5.58% from the previous year

- The total public debt-to-GDP ratio is at 122.31% as of December 31, an increase of 0.87% from the previous year

Inflation Factors

CPI:

- The consumer-price index rose 2.4% in January year over year

- On a monthly basis, the CPI increased 0.2% in January on a seasonally adjusted basis, after increasing 0.3% in December

- The index for all items less food and energy (core CPI) rose 0.3% in January, after rising 0.2% in December

- Core CPI increased 2.5% for the 12 months ending January

Food & Beverages:

- The food at home index increased 2.2% in January from the same month a year earlier, and increased 0.2% in January month over month

- The food away from home index increased 4.0% in January from the same month a year earlier, and increased 0.1% in January month over month

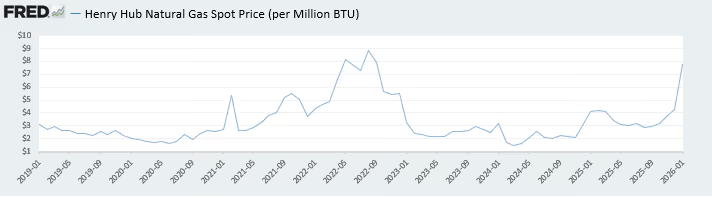

Commodities:

- The energy commodities index decreased (3.3%) in January after decreasing (0.3%) in December

- The energy commodities index fell (7.3%) over the last 12 months

- The energy services index rose 1.4% in January after increasing 1.1% in December

- The energy services index rose 7.2% over the last 12 months

- The gasoline index fell (7.5%) over the last 12 months

- The fuel oil index fell (4.2%) over the last 12 months

- The index for electricity rose 6.3% over the last 12 months

- The index for natural gas rose 9.8% over the last 12 months

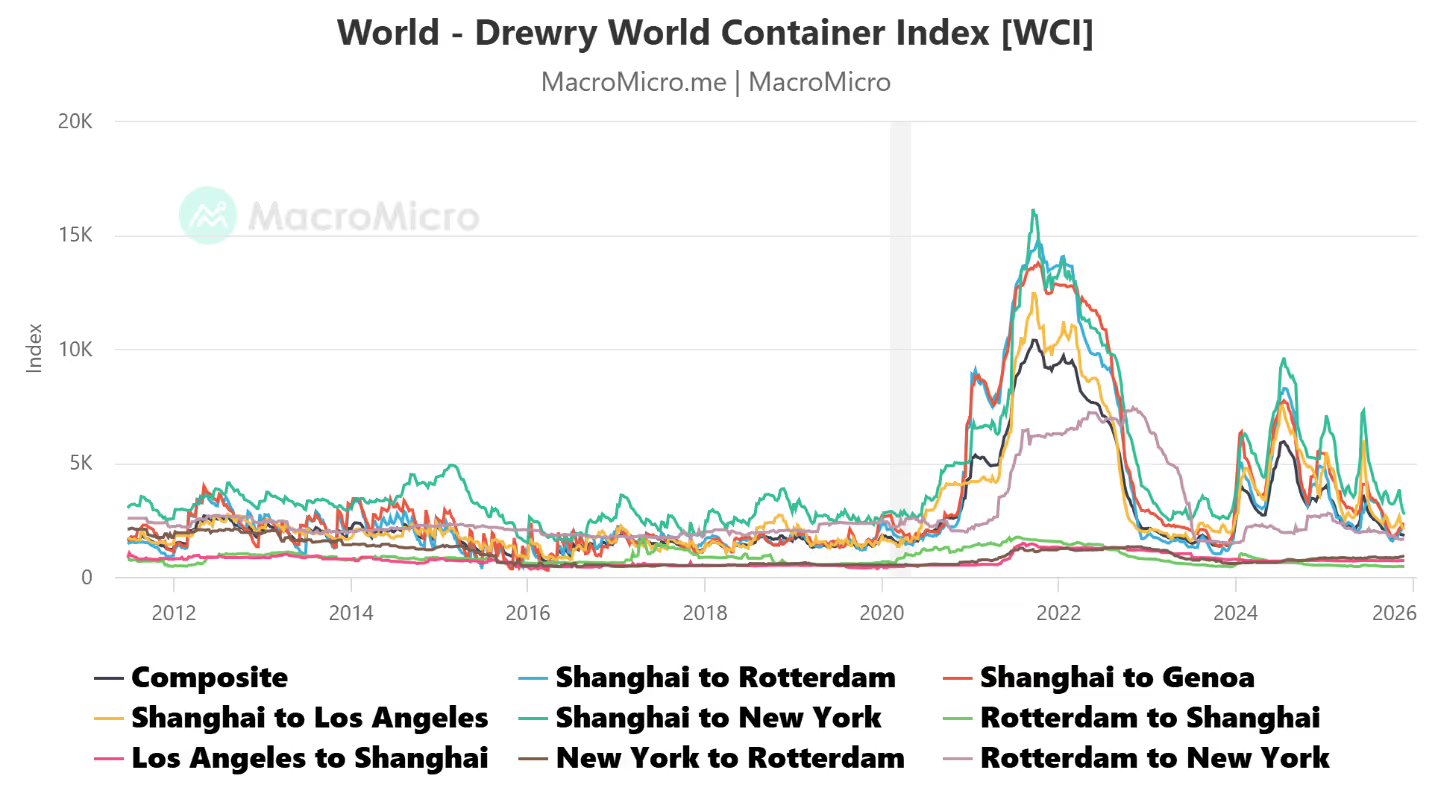

Supply Chain:

- Drewry’s composite World Container Index decreased to $1,898.54 per 40ft container for the week of February 27

- Drewry’s composite World Container Index has decreased by (27.8%) over the last 12 months

Housing Market:

- The shelter index increased 0.2% in January after increasing 0.4% in December

- The rent index increased 0.2% in January after increasing 0.4% in December

- The index for lodging away from home increased 2.7% in January after increasing 1.2% in December

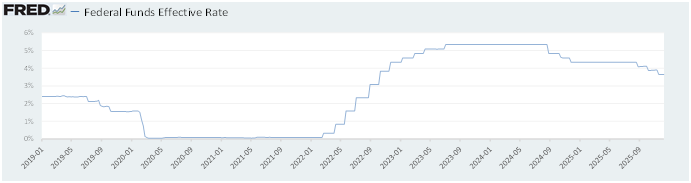

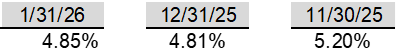

Federal Funds Rate

- The effective Federal Funds Rate is at 3.64%, flat 0.00% year to date

World News

Middle East

- The United States and Israel launched attacks on Iran on Saturday, with the goal of ending the existing regime. Strikes targeted Iranian leaders, symbols of the regime, and military assets, including senior IRGC commanders

- U.S. military action was contemplated for several weeks, but President Trump held off until the U.S. could amass enough military assets for a high-probability success. Israeli and U.S. intelligence also identified a unique opportunity to kill multiple senior political and military officials at once as they congregated for a meeting

- Iran’s Supreme Leader Ayatollah Ali Khamenei was killed during the airstrikes. In recent months, his regime brutally suppressed protests against the Iranian government, justifying U.S. and Israeli military intervention. Israel claims it killed several other top officials including a top security advisor, commander of the Islamic Revolutionary Guard Corps, and Iran’s Defense Minister

- In response, Iran launched missile attacks on U.S. military bases in the Gulf states and Israel, which were mostly intercepted

Europe

- European lawmakers tabled discussions on a U.S. trade deal after the Supreme Court ruled President Trump’s global tariffs illegal

- President Trump implemented new temporary global tariffs, but the European Commission seeks clarity before reaching a final trade deal

- The European Union will provisionally implement a free-trade deal with four Mercosur countries—Argentina, Brazil, Paraguay, and Uruguay

- The deal can only be fully concluded with consent from the European Parliament, which is awaiting a judicial review of the deal before voting

China

- Chinese officials see an opportunity receive concessions from the United States after the Supreme Court ruled against President Trump’s use of emergency powers for broad tariffs

- The effective tariff rate on Chinese goods will decrease from 32% to 23%, reducing the amount of leverage President Trump holds just weeks before a summit in Beijing

- During the summit, China’s primary objectives are to extend a one-year truce, roll back existing tariffs, receive relief from export controls on U.S. technology, and scale back U.S. support for Taiwan

- German Chancellor Friedrich Merz will visit Beijing on Wednesday for his inaugural visit. His trip follows multiple recent meetings between European leaders and China, such as Britain’s Kier Starmer, France’s Emmanuel Macron, and Spain’s Pedro Sanchez

North Korea

- According to South Korean intelligence, Kim Jong Un’s daughter Kim Ju Ae is increasingly positioned to succeed her father as Supreme Leader of North Korea. Until recently, she was the only child of Kim Jong Un to never be shown in public

Congo

- Eastern Congo is sliding toward mass hunger not from a lack of food, but because M23’s control around Goma has disrupted farming, blocked imports and aid routes, and driven prices sharply higher for civilians

Venezuela

- The U.S. issued a broad license allowing major global energy companies to resume and expand oil and gas investments in Venezuela following reforms to its hydrocarbon law, with revenues structured through U.S.-supervised channels

Japan

- Prime Minster Sanae Takaichi won a landslide victory in parliamentary elections, securing a two-thirds majority in the lower house

Cuba

- Cuba’s President Miguel Diaz-Canel said his government is willing to engage with the Trump administration. The announcement comes during the country’s worst crisis since the fall of the Soviet Union

Egypt

- The Rafah border between Egypt and Gaza reopened, allowing limited two-way traffic. Israel proposed allowing 150 Palestinians to leave and 50 to enter the checkpoint daily

Russia

- Lt. Gen. Vladimir Alekseyev, deputy head of Russia’s GRU intelligence agency, was shot multiple times while in Moscow

Canada

- President Donald Trump threatened to ground Canadian-made aircrafts and impose tariffs on Canadian imports after Canada delayed certification of U.S.-made Gulfstream jets, escalating trade tensions between Washington and Ottawa

Taiwan

- Taiwan pledged $250 billion to stand up semiconductor factories in the United States. In exchange, the U.S. agreed to cut tariffs on Taiwanese goods from 20% to 15%

Commodities News

Oil Prices

- WTI: $67.02 per barrel

- +0.95% WoW; (10.54%) YTD; (2.33%) YoY

- Brent: $72.48 per barrel

- +1.00% WoW; (7.73%) YTD; (2.11%) YoY

US Production

- U.S. oil production amounted to 13.7 million bpd for the week ended February 20, down 0.0 million bpd from the prior week.

Rig Count

- The total number of oil rigs amounted to 550, down 1 from last week.

Inventories

Crude Oil

- Total U.S. crude oil inventories now amount to 435.8 million barrels, up 0.5% YoY

- Refiners operated at a capacity utilization rate of 88.6% for the week, down from 91.0% in the prior week

- U.S. crude oil imports now amount to 6.524 million barrels per day, down 14.6% YoY

Gasoline

- Retail average regular gasoline prices amounted to $2.98 per gallon in the week of February 27, down (3.9%) YoY

- Gasoline prices on the East Coast amounted to $2.95, down (5.5%) YoY

- Gasoline prices in the Midwest amounted to $2.76, down (8.6%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.63, down (6.0%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $2.80, down (11.0%) YoY

- Gasoline prices on the West Coast amounted to $4.25, down (2.0%) YoY

- Motor gasoline inventories were down by 1.0 million barrels from the prior week

- Motor gasoline inventories amounted to 254.8 million barrels, up 3.2% YoY

- Production of motor gasoline averaged 9.22 million bpd, down (4.3%) YoY

- Demand for motor gasoline amounted to 8.733 million bpd, down (1.6%) YoY

Distillates

- Distillate inventories decreased by 0.3 million in the week of February 27

- Total distillate inventories amounted to 120.4 million barrels, up 1.0% YoY

- Distillate production averaged 4.751 million bpd, up 3.8% YoY

- Demand for distillates averaged 3.895 million bpd in the week, down (2.4%) YoY

Natural Gas

- Natural gas inventories decreased by 52 billion cubic feet last week

- Total natural gas inventories now amount to 2,018 billion cubic feet, up 14.7% YoY

Credit News

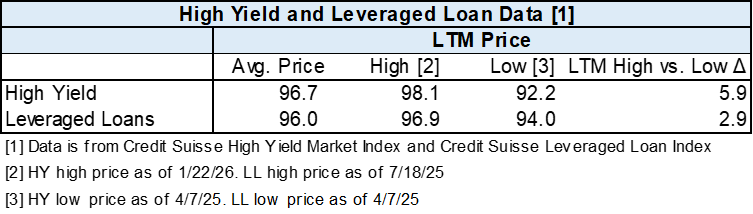

High-yield:

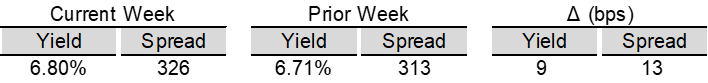

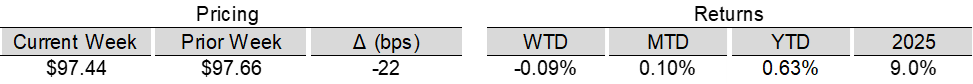

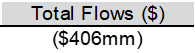

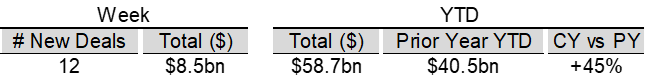

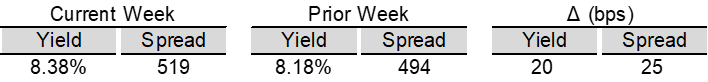

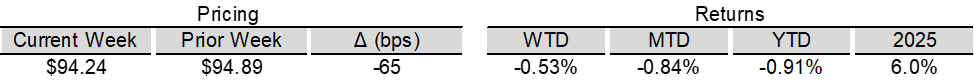

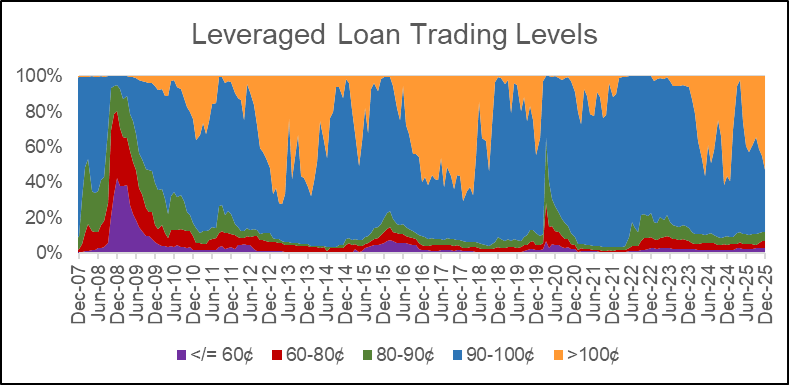

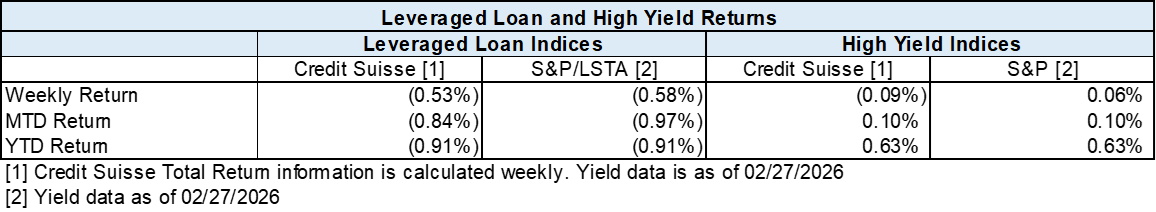

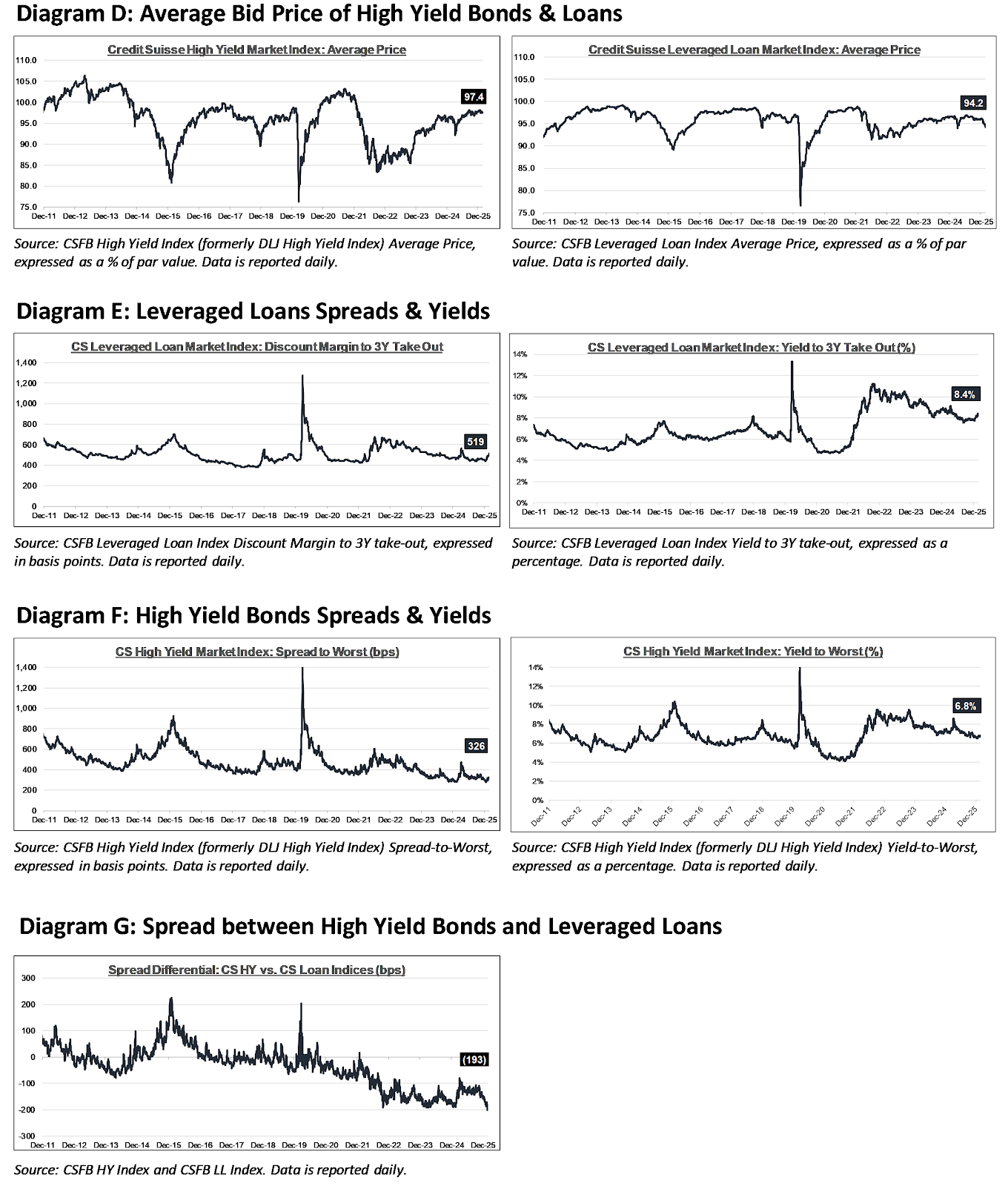

High yield bond yields increased 13bps to 6.80% and spreads widened 13bps to 326bps. Leveraged loan yields increased 20bps to 8.38% while spreads increased 25 bps to 519bps. WTD high yield bond returns were negative 9bps. WTD leveraged loan returns were negative 53bps. 10yr treasury yields decreased 6bps to 4.02%. High yield spreads widened to YTD highs this week amid ongoing concerns about AI-related disruption risks. Leveraged loans recorded their largest weekly loss since Liberation Day, alongside the largest retail outflows since April 2025 and continued weakness in AI-exposed sectors.

Week ended 02/27/2026

Yields & Spreads1

Pricing & Returns1

Fund Flows2

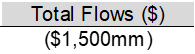

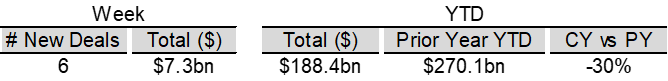

New Issue2

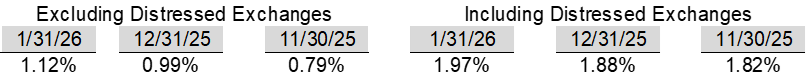

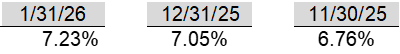

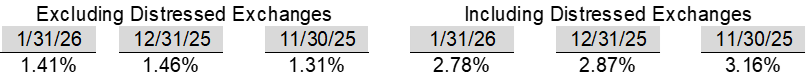

Distressed Level (trading in excess of 1,000 bps)2

Total HY Defaults

Leveraged loans:

Week ended 02/27/2026

Yields & Spreads1

Pricing & Returns1

Fund Flows2

New Issue2

Distressed Level (loan price below $80)1

Total Leveraged Loan Defaults

Default activity:

Most recent defaults include: Trinseo ($390mn, 02/17/2026), Beasley Broadcasting Group ($189mn, 02/01/2026), Nine Energy Service ($300mn, 02/01/2026), Multi-Color ($4.5bn, 01/29/2026), Pretium Packaging ($201mn, 01/28/2026), Saks Global Enterprises ($2.7bn, 12/30/2025), United Site Services ($2.6bn, 11/30/2025), New Fortress Energy ($3.5bn, 11/15/2025), Packers Sanitation Services ($1.2bn, 11/5/2025), and Office Properties Trust ($1.7bn, 10/31/25).

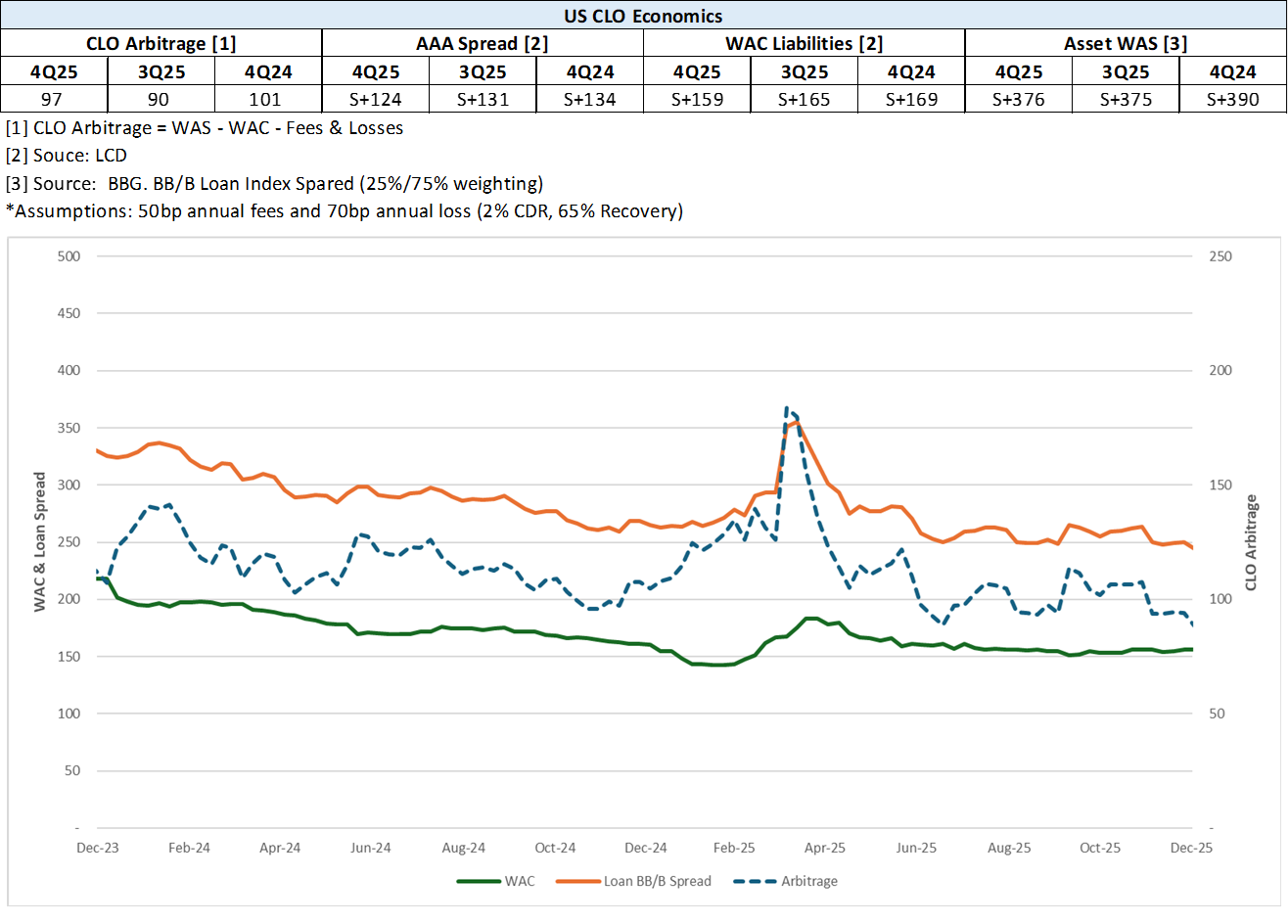

CLOs:

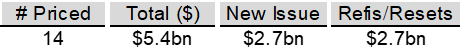

Week ended 02/27/2026

New U.S. CLO Issuance2

New U.S. CLO YTD Issuance2

Note: High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

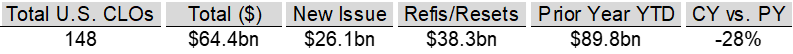

Ratings activity:

S&P and Moody’s High Yield Ratings

Source: Bloomberg

Appendix:

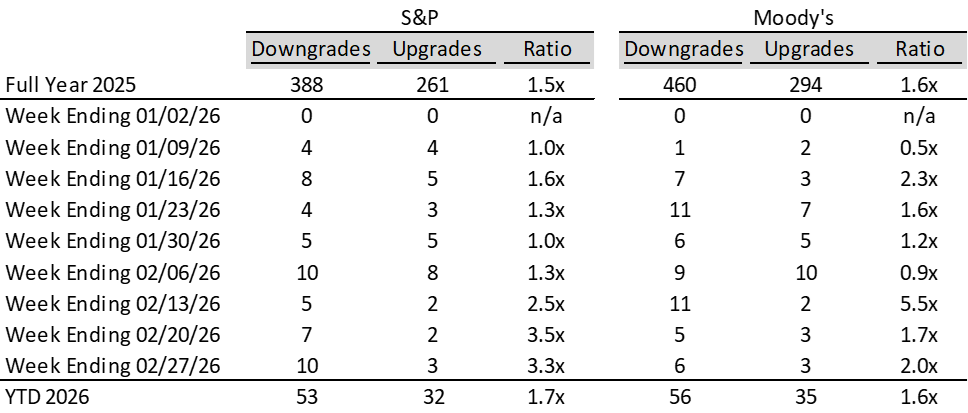

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

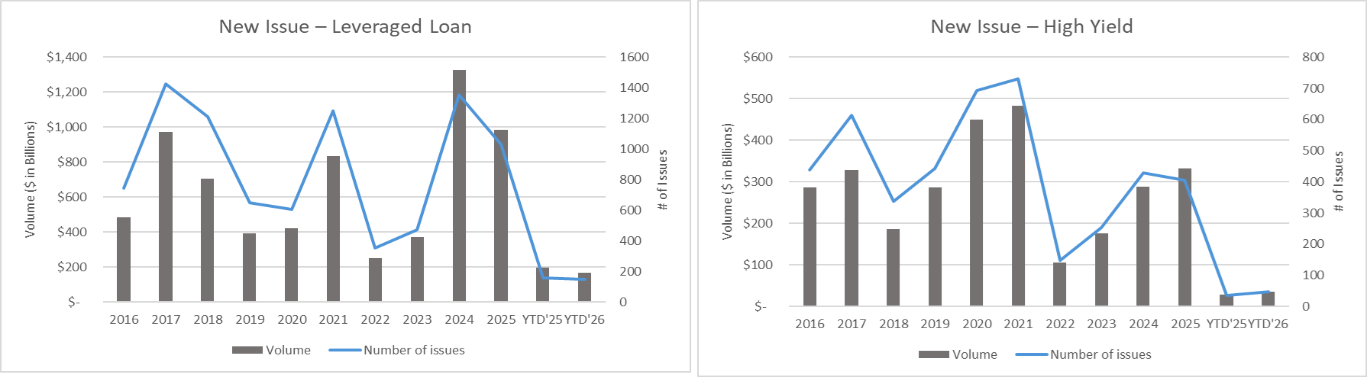

Diagram J: New Issue - Leveraged Loan and High Yield

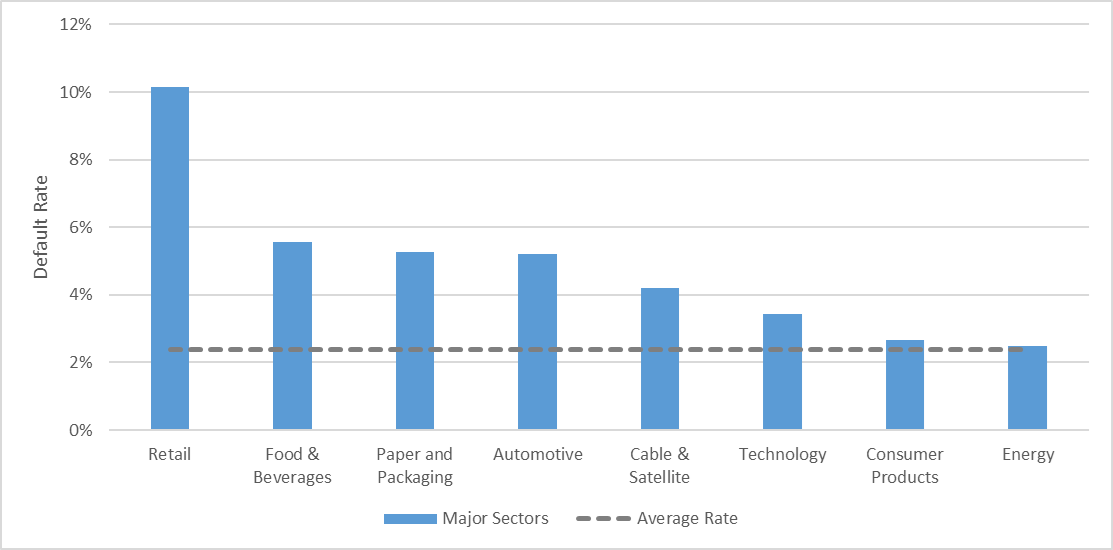

Diagram K: Leveraged Loan + HY Defaults by Sector – LTM

Diagram L: CLO Economics

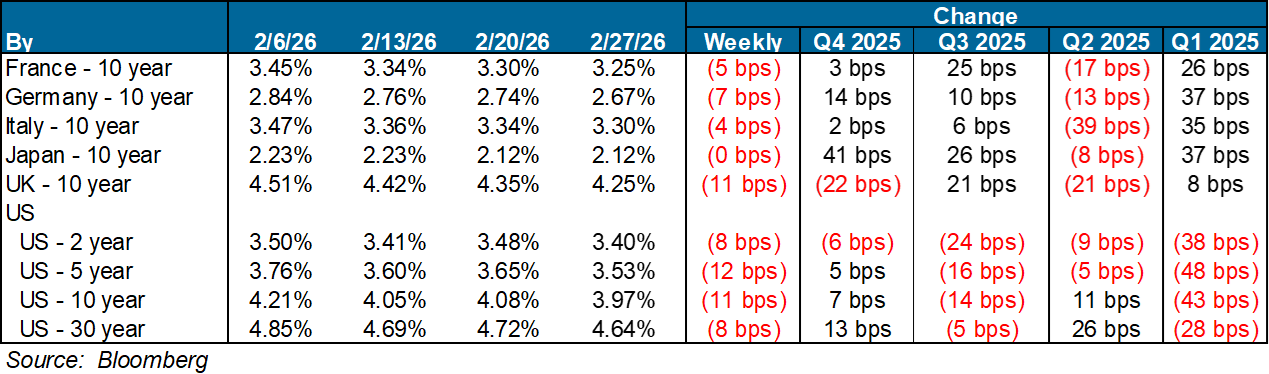

Diagram M: Developed Country Govt. Bond Yields (%)

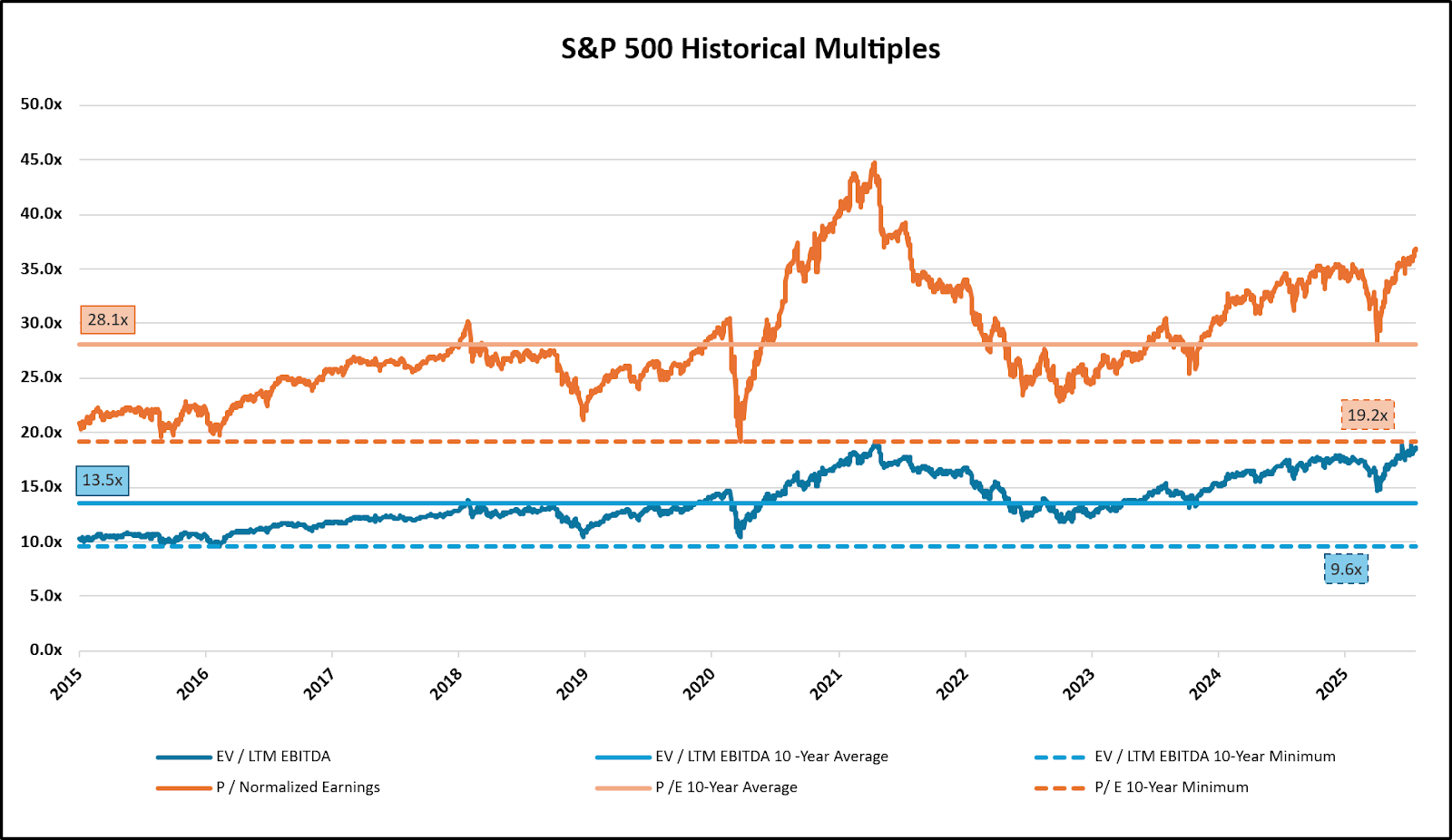

Diagram N: S&P 500 Historical Multiples

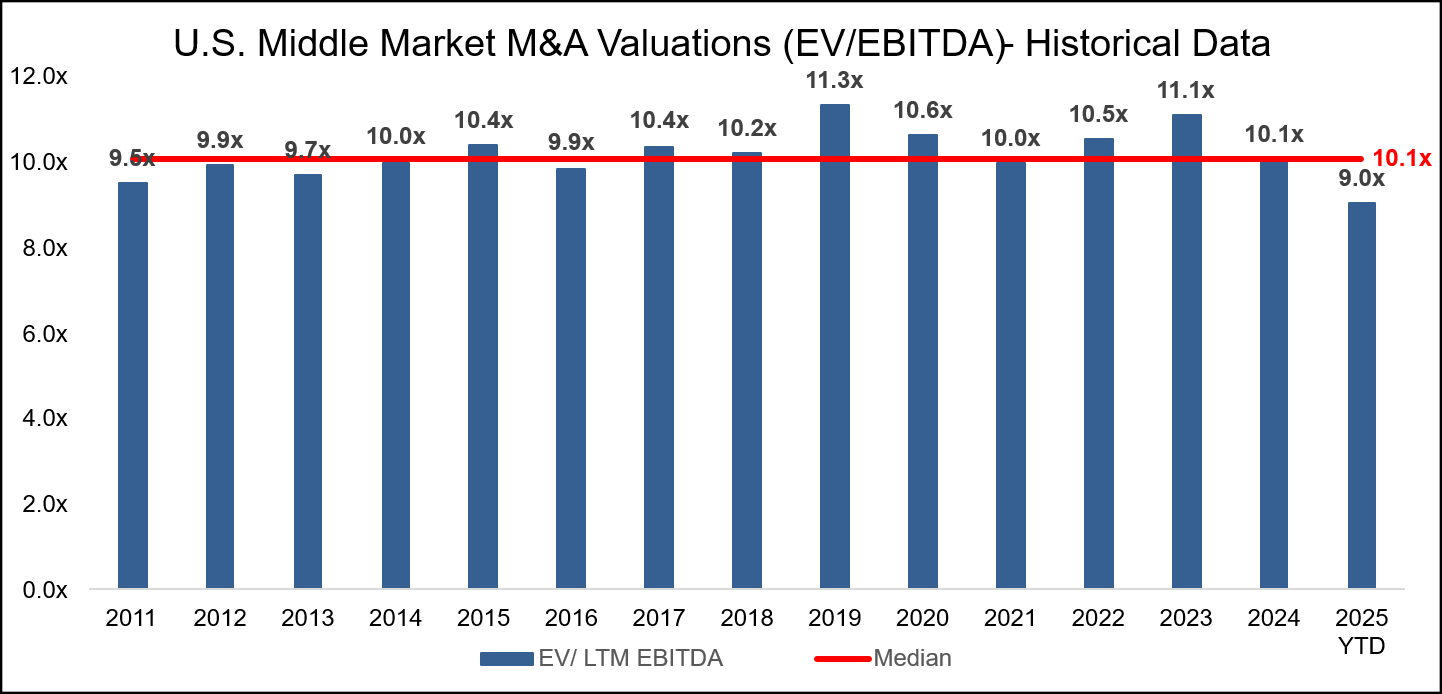

Diagram O: U.S. Middle-Market M&A Valuations (EV/EBITDA)

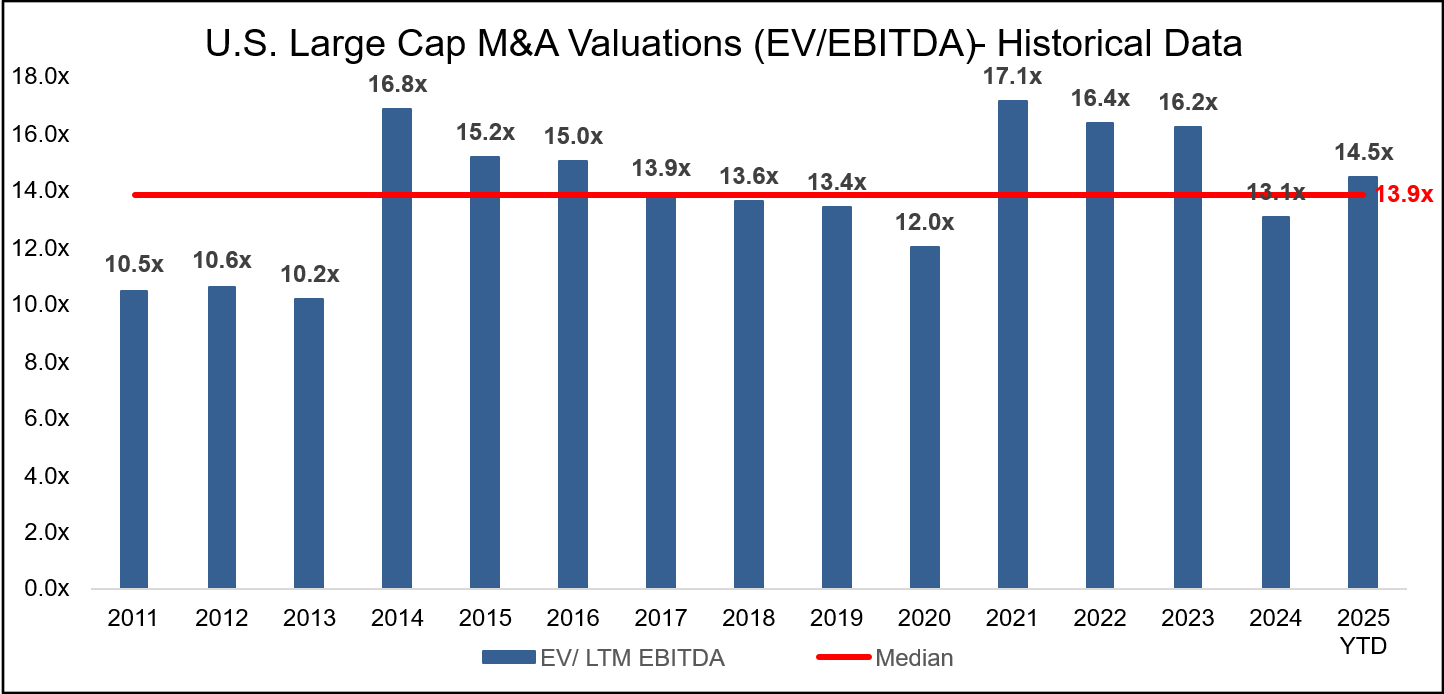

Diagram P: U.S. Large Cap M&A Valuations (EV/EBITDA)

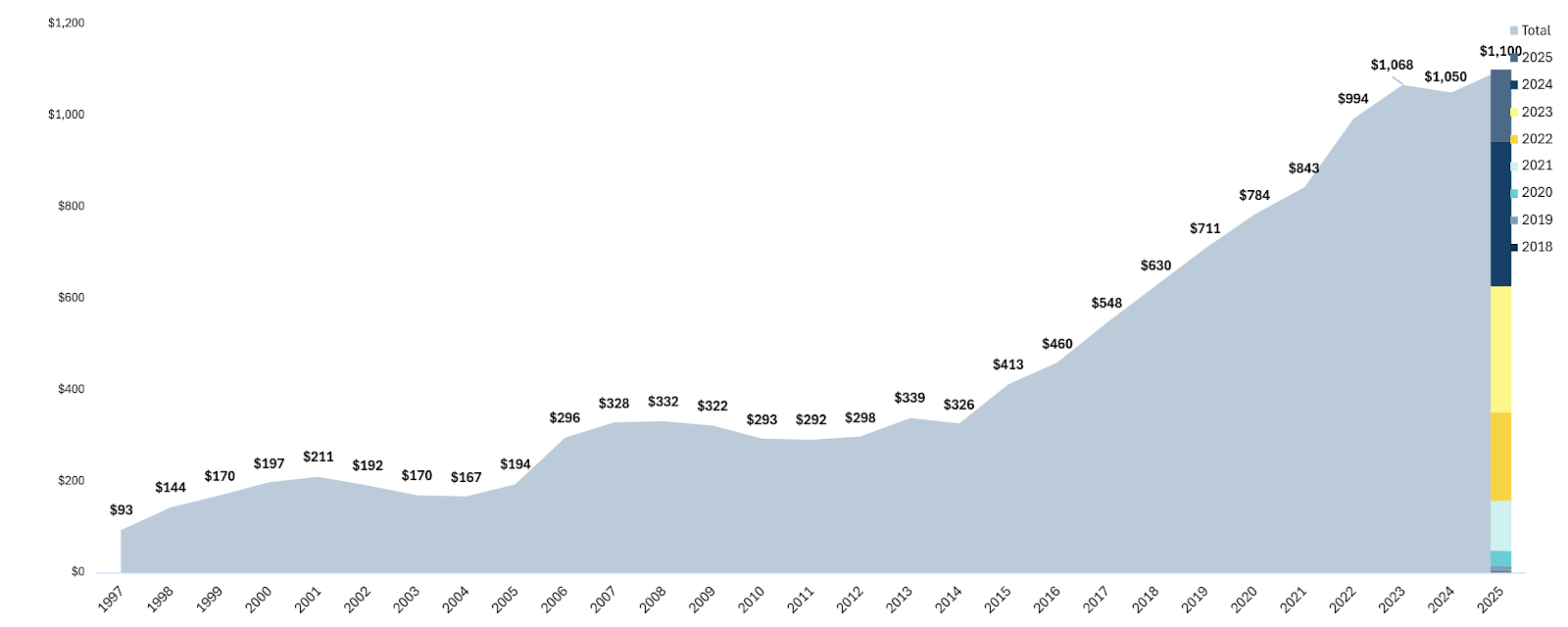

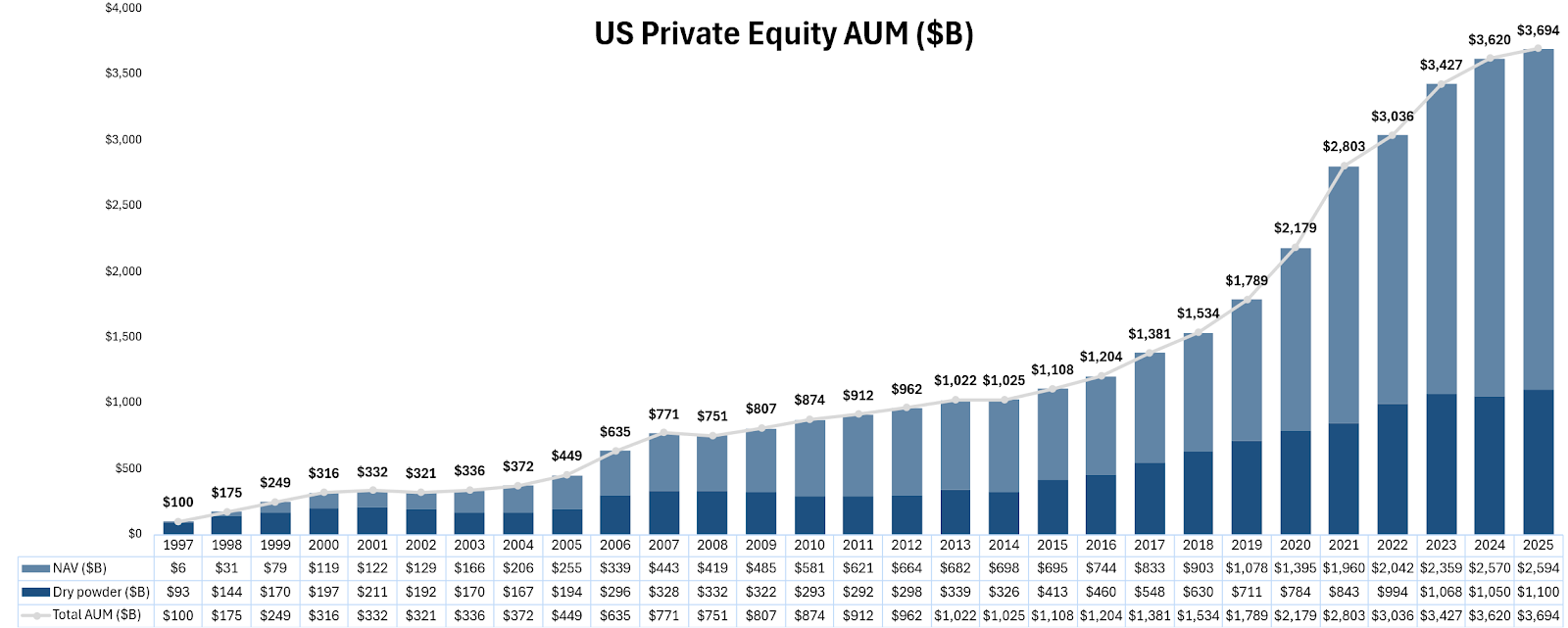

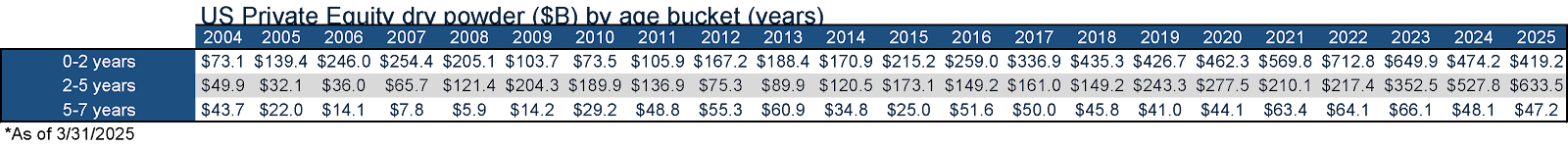

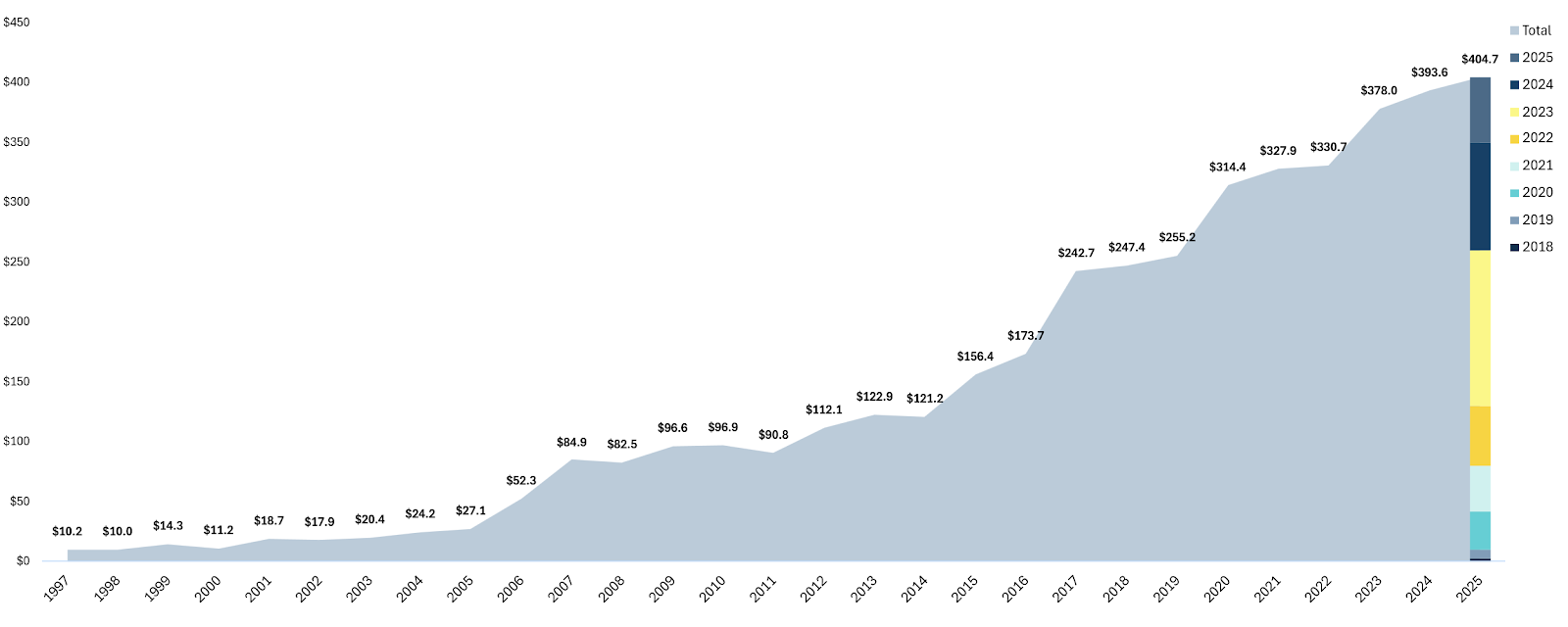

Diagram Q: Dry Powder for All Private Equity Buyouts ($B)

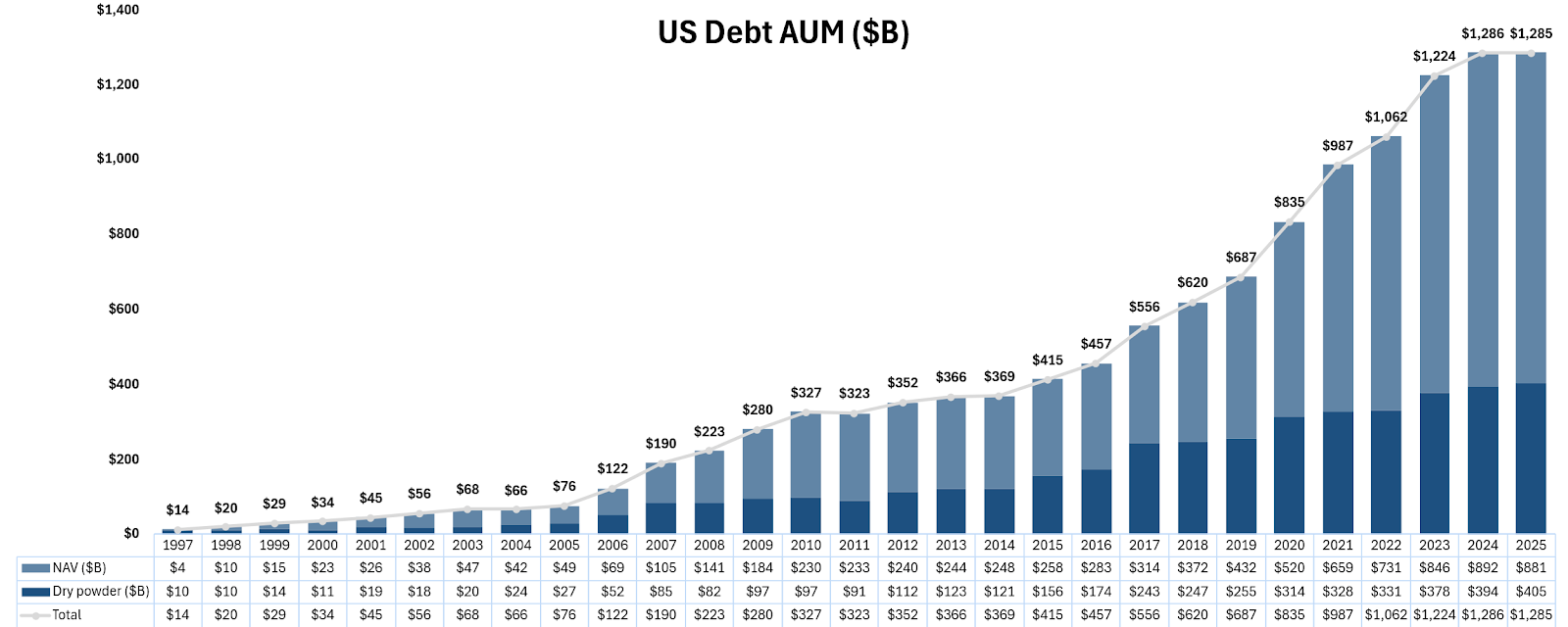

Diagram R: Dry Powder for All US Debt ($B)

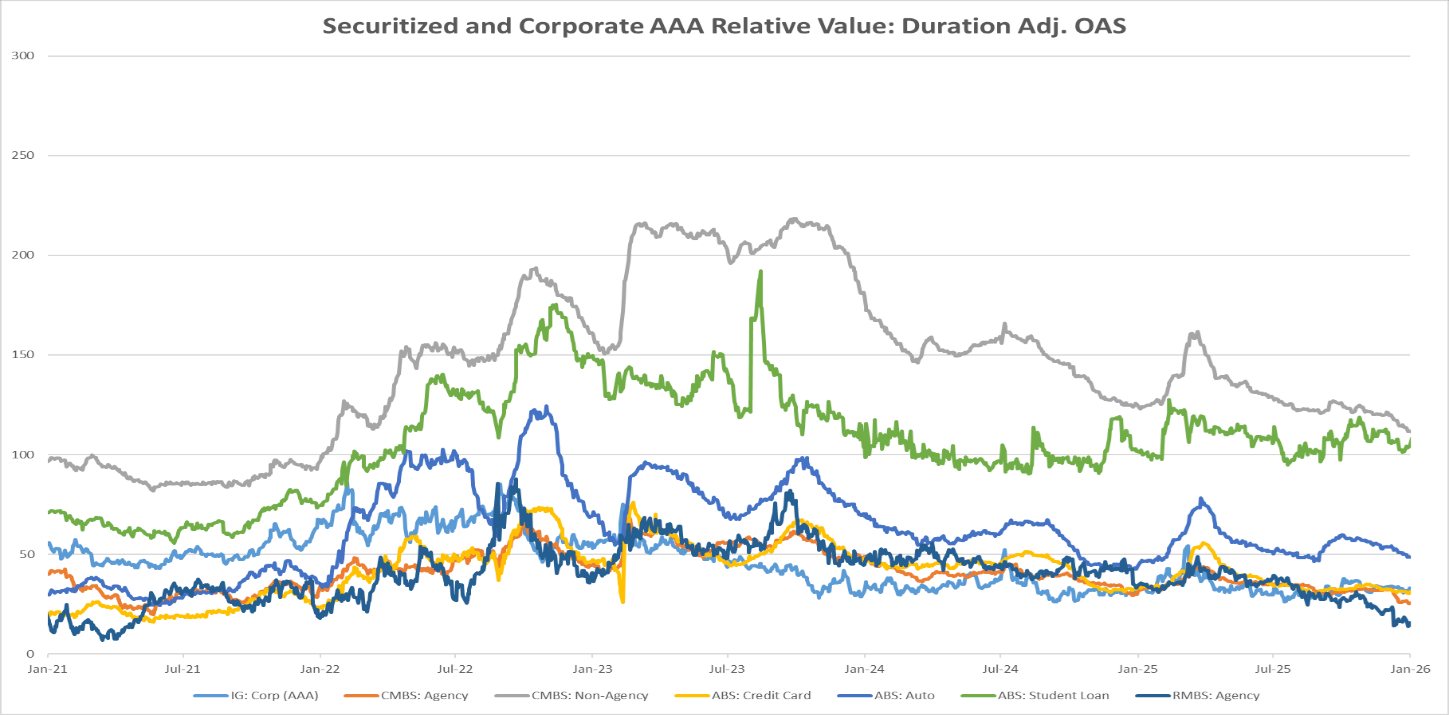

Diagram S: Structured Credit Spreads

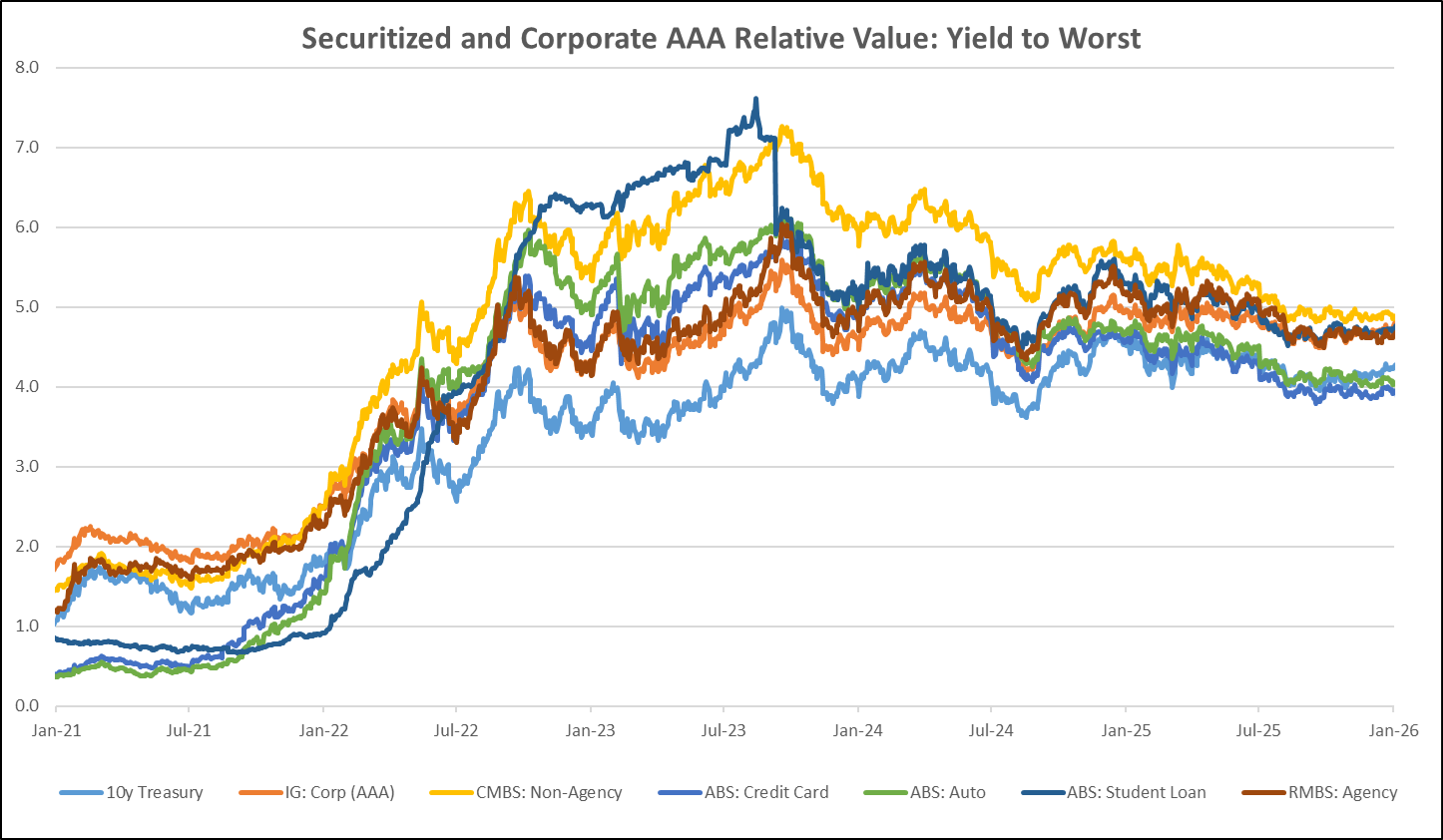

Diagram T: Structured Credit Yield

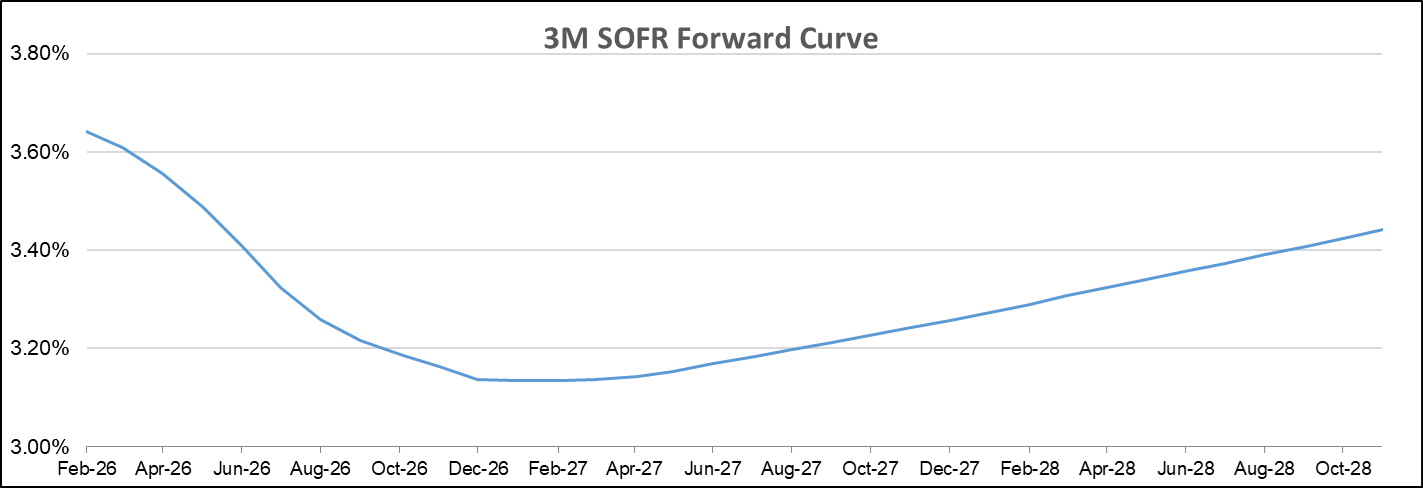

Diagram U: SOFR Curve

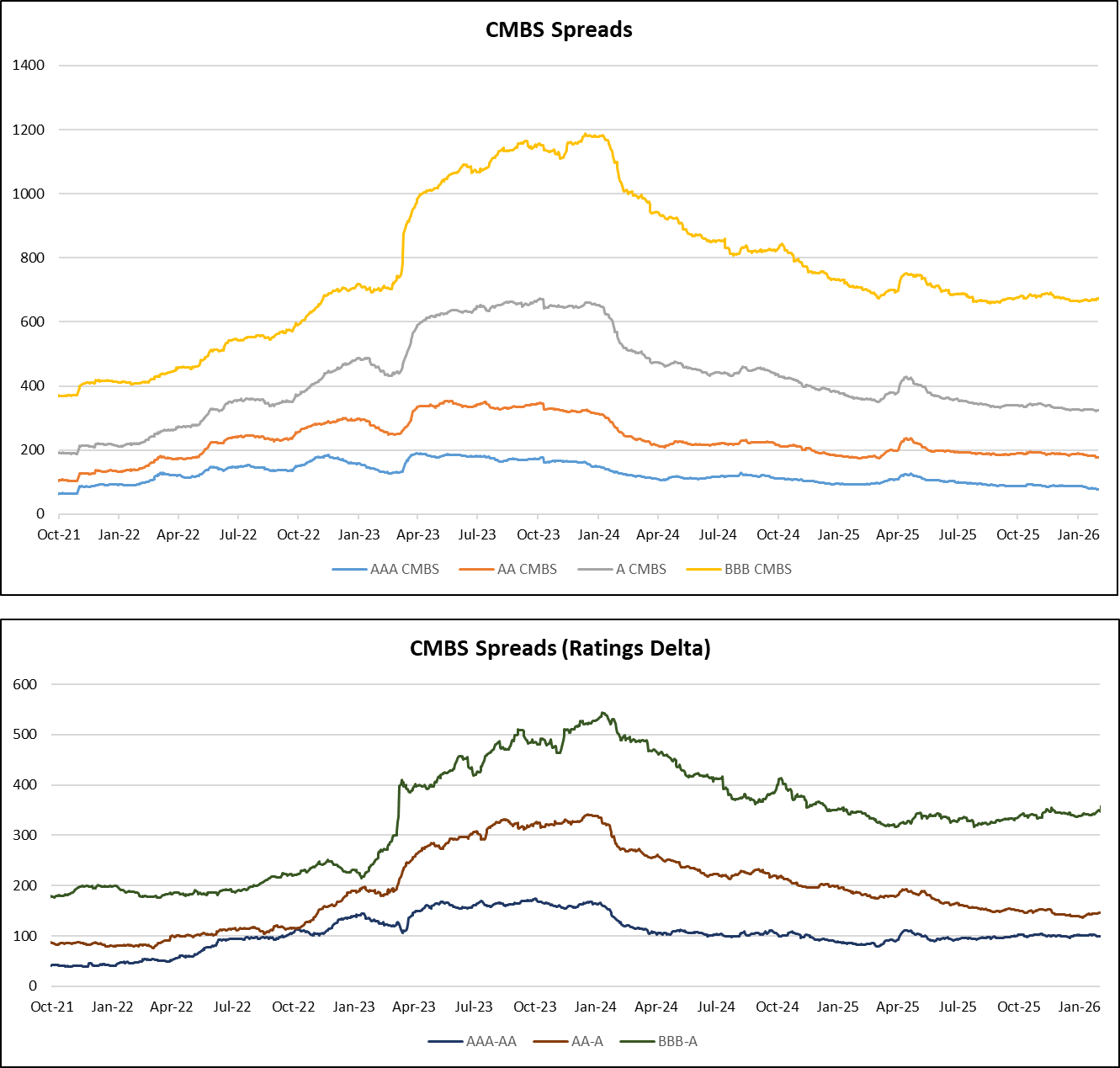

Diagram V: CMBS Spreads

Other News

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index