U.S. News

- Consumer Price Index

- The CPI increased 0.2% in August, meeting forecasts

- The core CPI increased 0.3%, higher than the forecasted 0.2%. The rise represents the largest increase in five months

- The increase in overall inflation dropped from 2.9% to 2.5%, hitting the lowest levels since 2021

- Producer Price Index

- The PPI increased 0.2% in August, meeting forecasts

- The rise in wholesale prices decreased from 2.1% in July to 1.7% in August, reaching the lowest levels in six months

- The price of services rose 0.4%, bringing the 12-month increase of 2.7% to near prepandemic levels

- Consumer Credit

- Consumer credit increased by an annual rate of 6.0%, seasonally adjusted, in July, up from 1.2% in June

- Revolving credit increased by an annual rate of 9.4% after decreasing 0.3% in June, while nonrevolving credit increased at an annual rate of 4.8% after increasing 1.8% the month prior. The rise in nonrevolving credit is partially driven by auto loans, as consumers delayed vehicle purchases after a cyberattack affected dealers in June

- Total credit outstanding increased by $25.5 billion, more than doubling expectations

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 230,000 in the week ended September 6, up 2,000 from the prior week

- The four-week moving average was 230,750, up 500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 5,000 to 1.850 million in the week ended August 30. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.115 trillion in the week ended September 13, up $2.4 billion from the prior week

- Treasury holdings totaled $4.389 trillion, down $7.0 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.30 trillion in the week, down $8.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.27 trillion as of September 13, an increase of 6.9% from the previous year

- Debt held by the public was $26.17 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 2.5% in August year over year

- On a monthly basis, the CPI increased 0.2% in August on a seasonally adjusted basis, after increasing 0.2% in June

- The index for all items less food and energy (core CPI) rose 0.3% in August, after rising 0.2% in July

- Core CPI increased 3.2% for the 12 months ending August

- Food and Beverages:

- The food at home index increased 0.9% in August from the same month a year earlier, and increased 0.0% in August month over month

- The food away from home index increased 4.0% in August from the same month a year earlier, and increased 0.3% in August month over month

- Commodities:

- The energy commodities index decreased (0.6%) in August after increasing 0.1% in July

- The energy commodities index fell (10.2%) over the last 12 months

- The energy services index (0.8%) in August after decreasing (0.0%) in June

- The energy services index rose 3.1% over the last 12 months

- The gasoline index rose (10.3%) over the last 12 months

- The fuel oil index fell (12.1%) over the last 12 months

- The index for electricity rose 3.9% over the last 12 months

- The index for natural gas fell (0.1%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $4,168.47 per 40ft container for

- Drewry’s composite World Container Index has increased by 167.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in August after increasing 0.4% in July

- The rent index increased 0.5% in August after increasing 0.3% in July

- The index for lodging away from home decreased (0.7%) in August after decreasing (0.5%) in June

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- The Houthis fired a missile at central Israel on Sunday morning. The missile did not hit its intended target, and the strike resulted in no casualties. Still, the action marks an escalation in the Houthi’s attacks on the country. The Houthi’s military spokesman stated that “[Israel] should expect more strikes and advanced operations in the future.” Benjamin Netanyahu said that Israel would retaliate against the Houthis in response to the attack

- The Syrian government stated that Israel launched missiles into its territory, killing 16 people. Israel claimed that the attack was in response to ongoing Iranian arms transfers

- On Tuesday, the Israeli military launched an airstrike in a designated zone for displaced people in Gaza, destroying 20 tents and killing at least 19 people, according to Gaza officials. Israel claims that it used precise weapons and aerial surveillance to limit civilian casualties and targeted a command center with senior Hamas operatives

-

Russia

- U.S. Secretary of State Anthony Blinken signaled that the West is considering loosening restrictions on Ukrainian missile strikes. Ukraine has pressed the U.S. for permission to use long-range missiles supplied by the United States to break up Russian offensives deeper within Russia’s territory and disrupt Russia’s long-range attacks into Ukraine. Until now, the U.S. was reluctant to allow these strikes, as they would escalate the conflict

- The move comes as Russia brings Iranian ballistic missiles into the fight and begins its counteroffensive against Ukrainian forces in the Kursk region. Further, as Russia targets civilians and civilian infrastructure—including the electricity grid—the West is concerned that Ukrainians will have to flee their homes during the winter

- Multiple drone attacks struck targets near Moscow last week, killing one woman, injuring six others, and forcing the temporary closure of three of the capital’s airports. The drones targeted air bases, oil refineries, and ammunition stores. The assault represents one of the largest drone attacks since the start of the war

-

Americas

- Air Canada reached a tentative four-year labor agreement early Sunday. The agreement averts a strike at the country’s largest airline with a union representing over 5,000 pilots, which would have disrupted domestic and cross-border travel

- Protestors stormed the Mexican Senate after the legislative body approved a constitutional amendment to replace all the country’s federal judges. Critics say that the move, which would require elections for all judges, could undermine judicial independence and discourage foreign investment into the country

- Tren de Aragua, a prison gang from Venezuela, is now suspected in 100 violent and drug crimes in the United States, signaling that the group is bringing its operations further north. One U.S. official dubbed the group “MS-13 on steroids”

-

China

- To support the country’s pension system, Beijing moved to raise the retirement age for men from 60 to 63, and for some women from 50 to 55. Upcoming economic strains caused the Chinese government to reconsider their relatively low retirement ages

- China’s new home sales fell 25% year over year in the first eight months of the year, and new construction starts decreased 22.5%

- This, among other indicators released by the statistics bureau and concerns over population age demographics, indicate that the country risks a slide into deflation

-

Tibet

- The Dalai Lama announced that he would discuss how to choose his successor, amid worsening health and a recent surgery in the U.S. Beijing asserts that they will intercede and have final say over the succession issue

-

North Korea

- For the first time, North Korea published photos of an uranium-enrichment facility. The move comes after an agreement between North Korea and Russia to defend each other if attacked

-

Canada

- The Bank of Canada cut its main interest rate by a quarter point to 4.25% for the third consecutive time, citing concerns about a weakening economy and the risk of inflation slowing too quickly

-

Germany

- The German far right AfD won almost a third of the vote in the eastern state of Thuringia and placed second in the state of Saxony. The result in Thuringia gives the far-right its first win in a state parliament election since World War Two

-

Netherlands

- The Netherlands expanded export control rules requiring ASML to seek licenses for shipping certain chip-making equipment outside the EU, citing increased security risks linked to technological advancements and geopolitical concerns, especially regarding China. ASML doesn’t expect the new requirements to affect its financial targets

-

Japan

- Japan plans to launch a $2 billion satellite network to monitor ships and military sites as part of its defense response to increasing Chinese incursions, including a recent violation of Japanese airspace by a Chinese military aircraft

-

Thailand

- Paetongtarn Shinawatra, daughter of former Thai prime minister Thaksin Shinawatra, was sworn in as Thailand’s youngest-ever prime minister, marking the Shinawatra family’s return to power. This comes as Thailand’s military and royalists supported her rise to counter a youth-led progressive movement that threatened their influence

-

Brazil

- Tens of thousands of supporters of Jair Bolsonaro protested in São Paulo against Brazil’s Supreme Court ban on Elon Musk’s X platform, accusing the court of censorship ahead of upcoming municipal elections

-

Uganda

- Ugandan Olympic runner Rebecca Cheptegei has died after her boyfriend allegedly set her on fire, highlighting ongoing concerns about domestic violence against female athletes in East Africa

-

France

- French manufacturing sentiment improved in August, rising to 99 from 95 in July, according to a survey by the national statistics agency Insee, driven by better production prospects and foreign order books. However, the sentiment level remains below the long-term average of 100, reflecting ongoing challenges like geopolitical uncertainty and high interest rates

Commodities

-

Oil Prices

- WTI: $68.65 per barrel

- 1.45% WoW; (4.19%) YTD; (23.86%) YoY

- Brent: $71.61 per barrel

- 0.77% WoW; (7.05%) YTD; (23.58%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended September 6, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 590, up 8 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 419.1 million barrels, down (0.3%) YoY

- Refiners operated at a capacity utilization rate of 92.8% for the week, down from 93.3% in the prior week

- U.S. crude oil imports now amount to 5.792 million barrels per day, down (9.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.22 per gallon in the week of September 13,

down (16.8%) YoY

- Gasoline prices on the East Coast amounted to $3.26, down (12.7%) YoY

- Gasoline prices in the Midwest amounted to $3.18, down (15.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.90, down (16.1%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.47, down (15.9%) YoY

- Gasoline prices on the West Coast amounted to $4.24, down (16.7%) YoY

- Motor gasoline inventories were up by 2.3 million barrels from the prior week

- Motor gasoline inventories amounted to 221.6 million barrels, up 0.6% YoY

- Production of motor gasoline averaged 9.38 million bpd, up 1.8% YoY

- Demand for motor gasoline amounted to 8.478 million bpd, up 2.1% YoY

-

Distillates

- Distillate inventories decreased by 2.3 million in the week of September 13

- Total distillate inventories amounted to 125.0 million barrels, up 2.0% YoY

- Distillate production averaged 5.209 million bpd, up 4.0% YoY

- Demand for distillates averaged 3.558 million bpd in the week, down (0.6%) YoY

-

Natural Gas

- Natural gas inventories increased by 40 billion cubic feet last week

- Total natural gas inventories now amount to 3,387 billion cubic feet, up 5.7% YoY

Credit News

High yield bond yields unchanged at 7.15% and spreads increased 10bps to 362bps. Leveraged loan yields decreased 13bps to 8.20% and spreads were flat at 497bps. WTD Leveraged loan returns were positive 19bps. WTD high yield bond returns were positive 16bps. 10yr treasury yields decreased 5bps to 3.68%. Leveraged loan prices were mixed amid mild outflows, a multi-month high in capital market activity, and an escalating debate around whether the Fed will deliver a 25bp or 50bp rate cut when the Committee convenes next Wednesday.

High-yield:

Week ended 09/13/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 09/13/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: SunPower ($143mn, 8/5/2024), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), Quorum Health Group ($688mn, 7/10/24), Vyaire Medical ($339mn, 6/9/24), 99 Cents Only Stores ($350mn, 4/7/24), and ConvergeOne ($1.3bn, 4/4/24).

CLOs:

Week ended 09/13/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

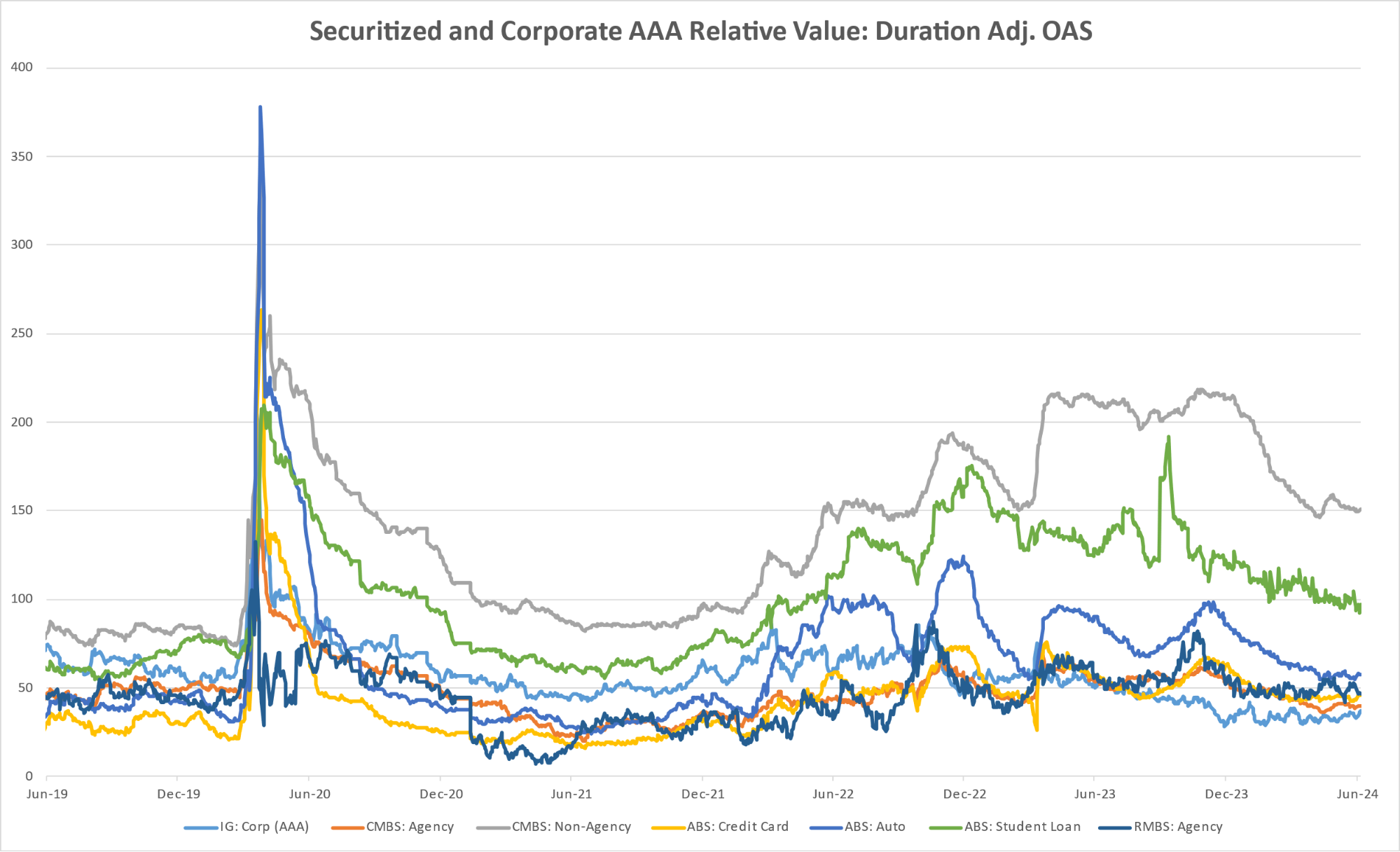

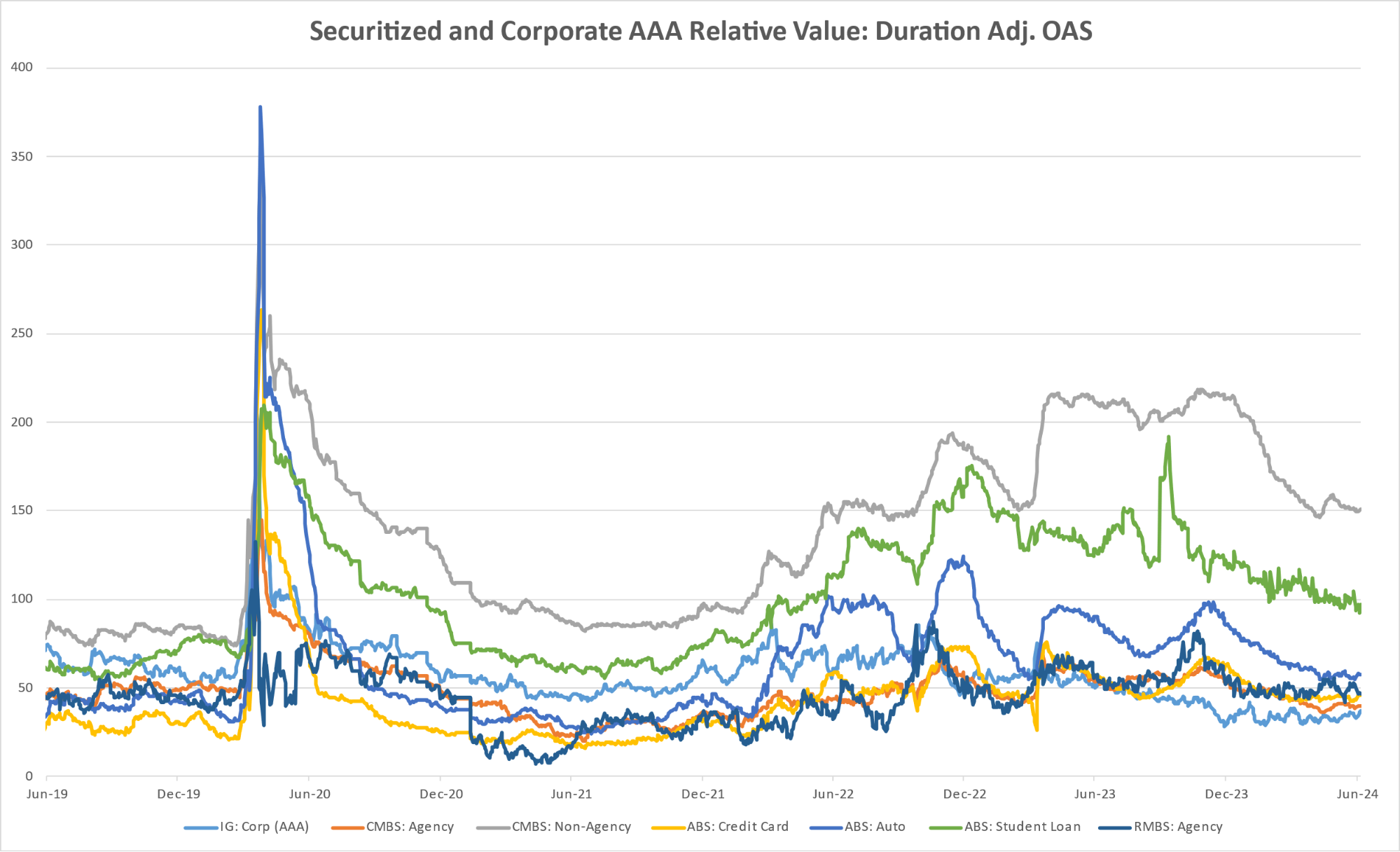

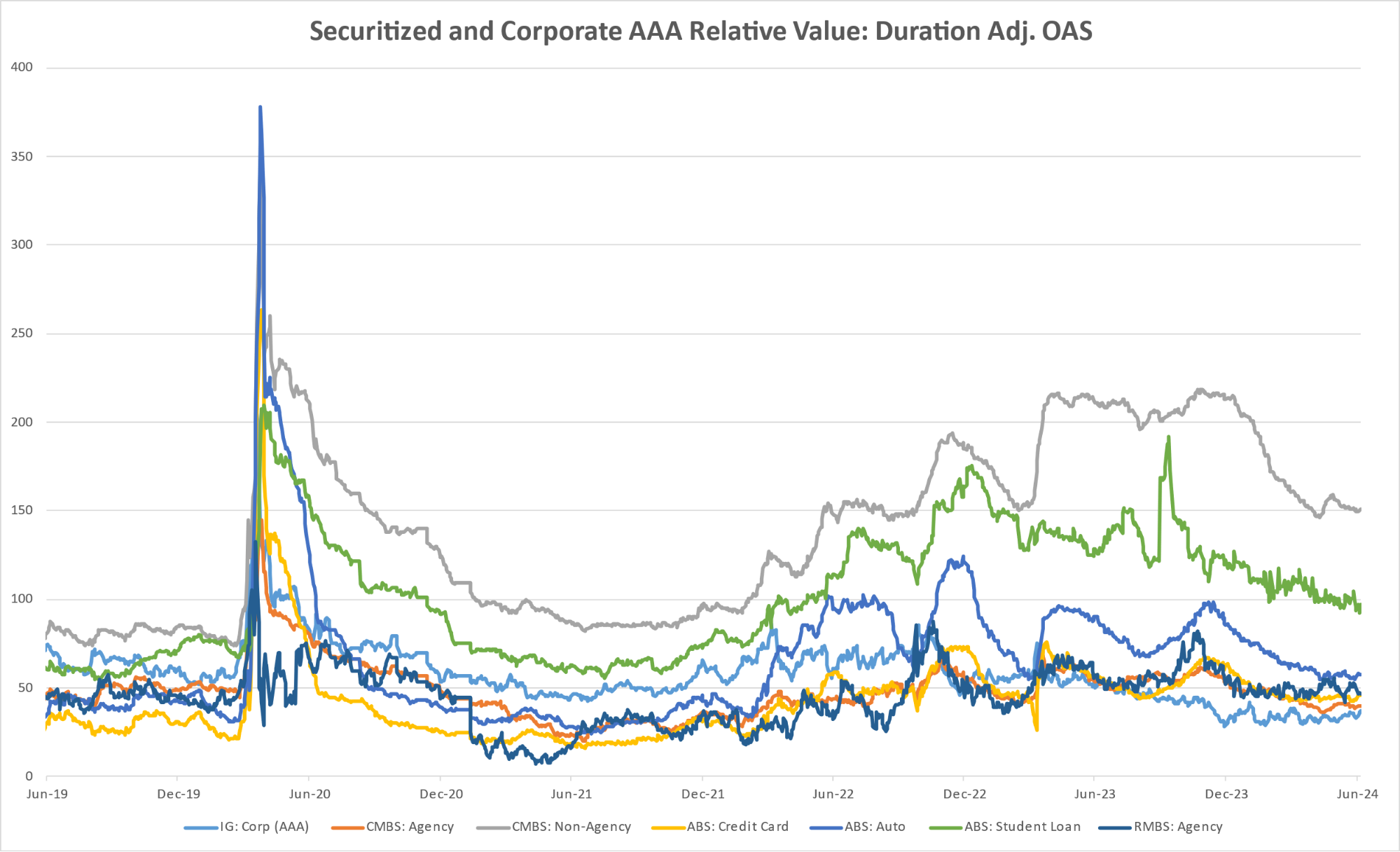

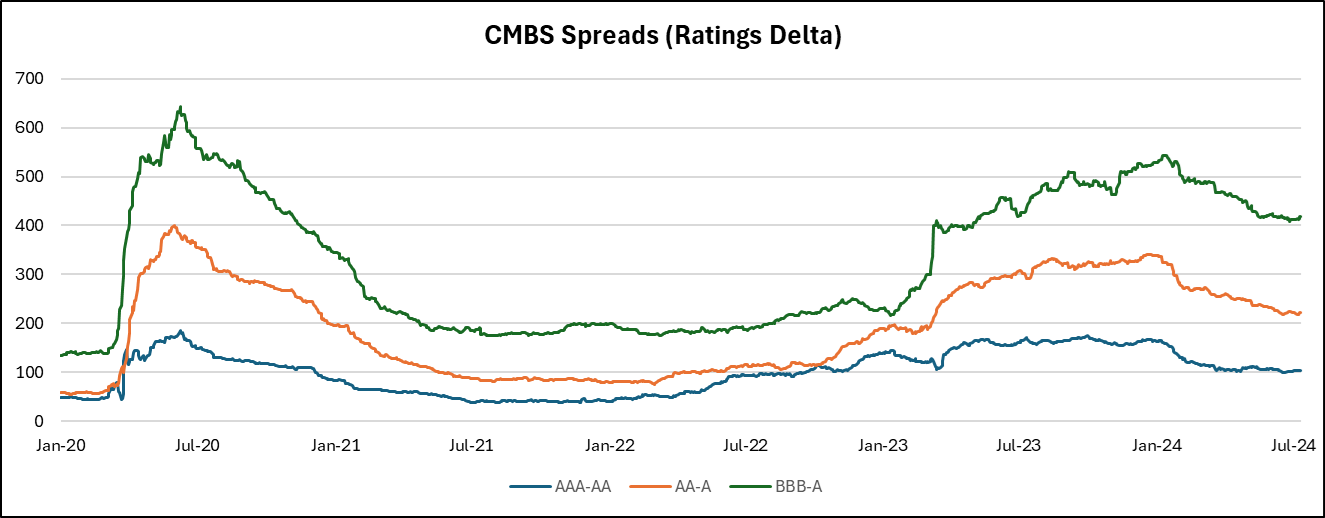

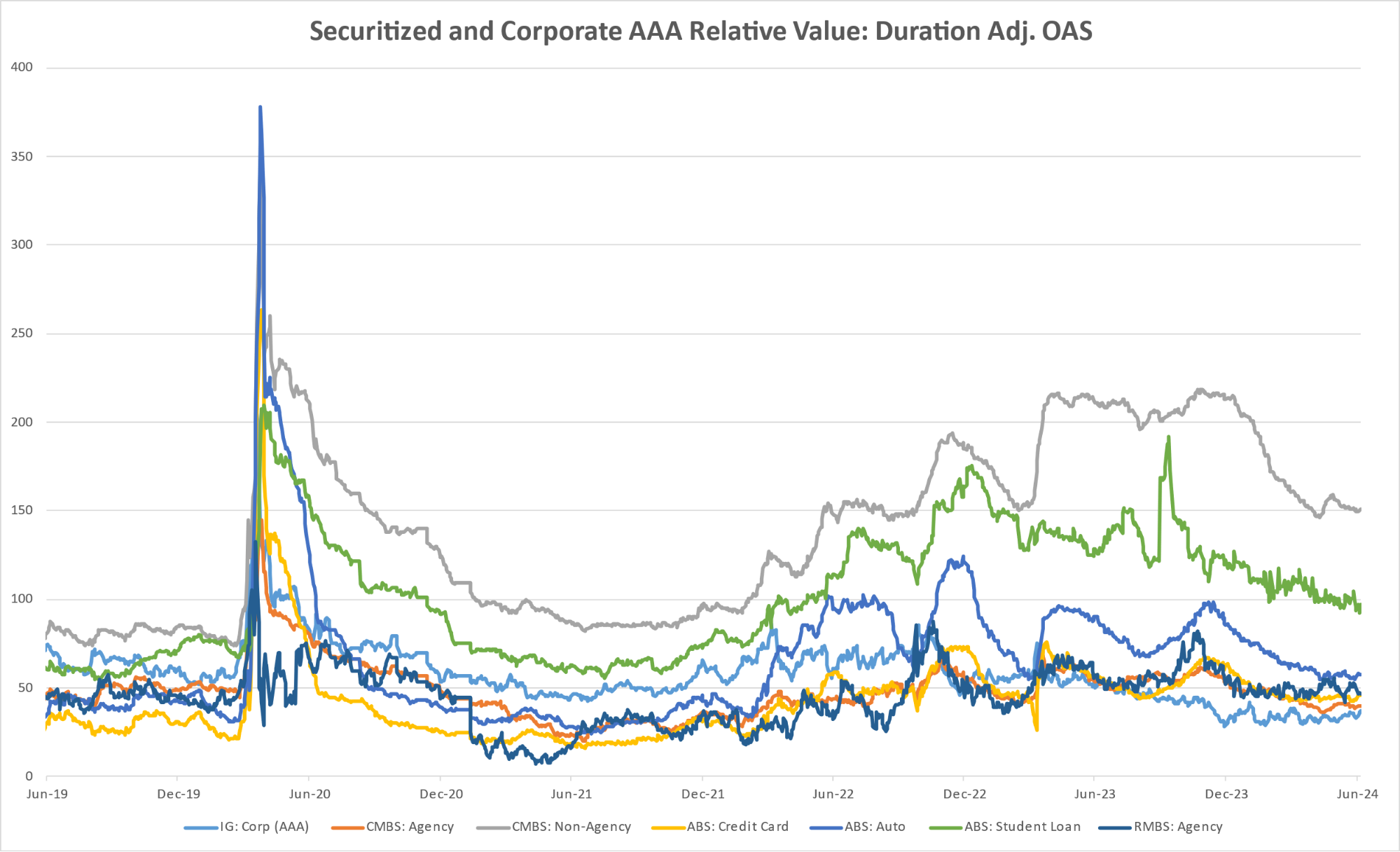

Diagram S: Structured Credit Spreads

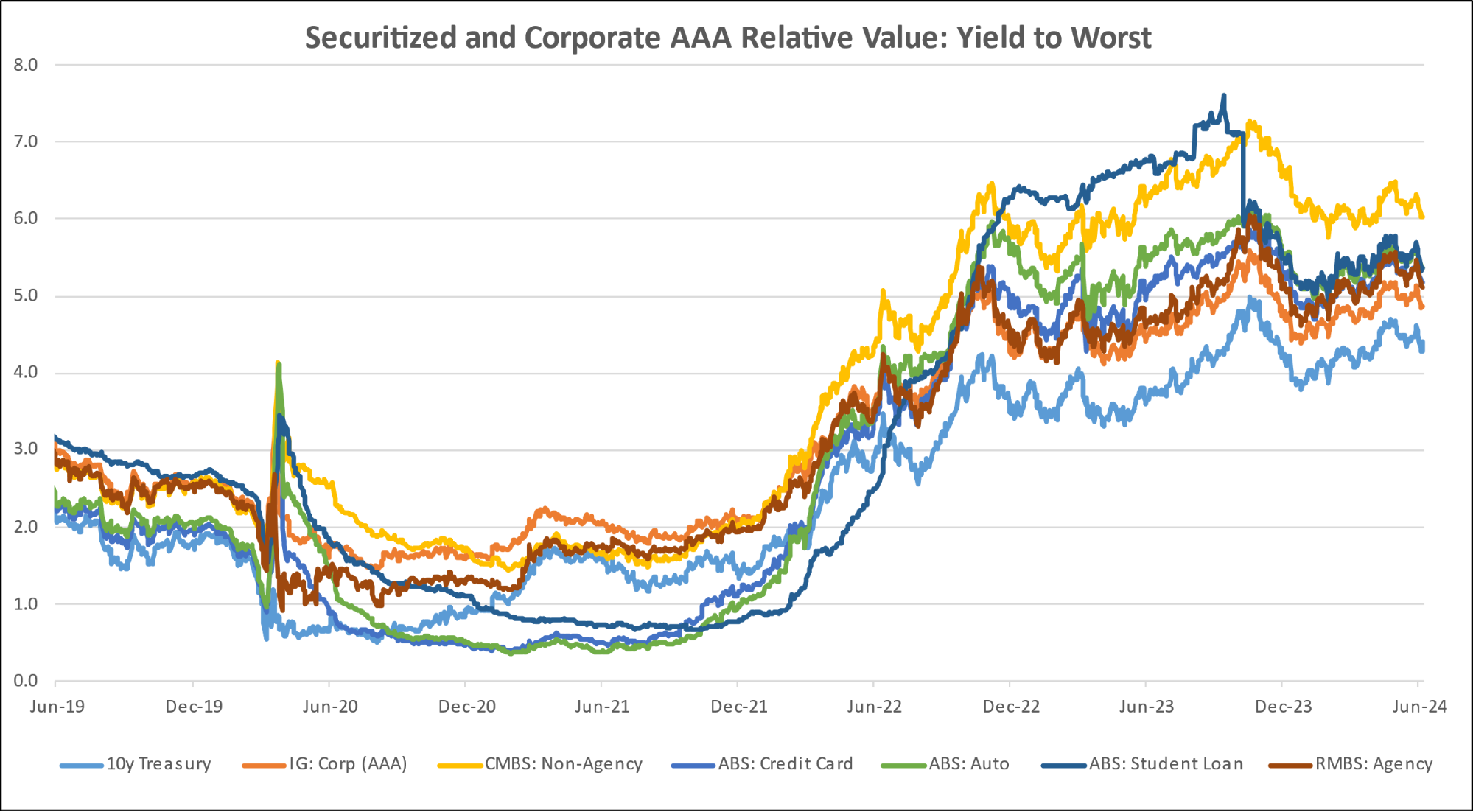

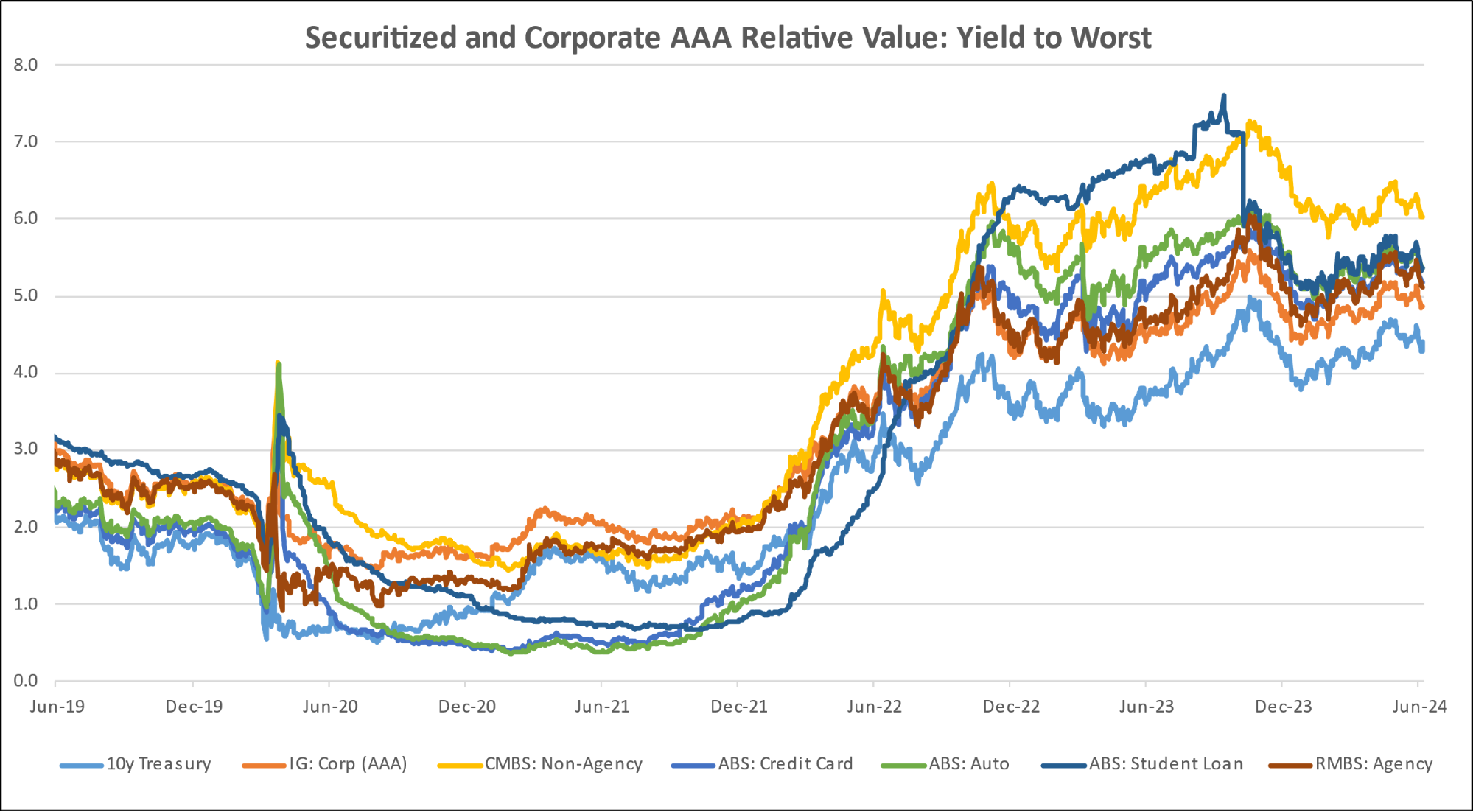

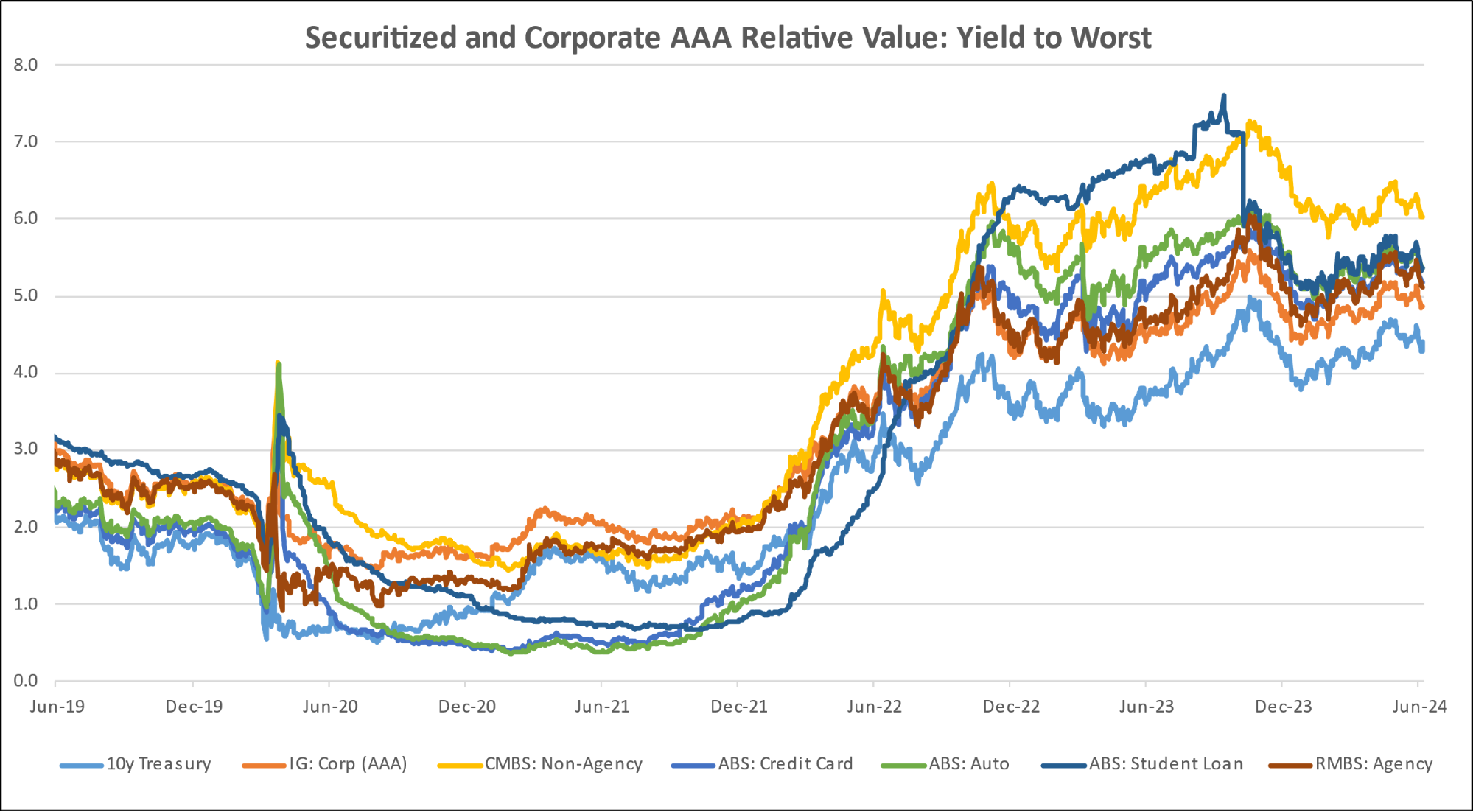

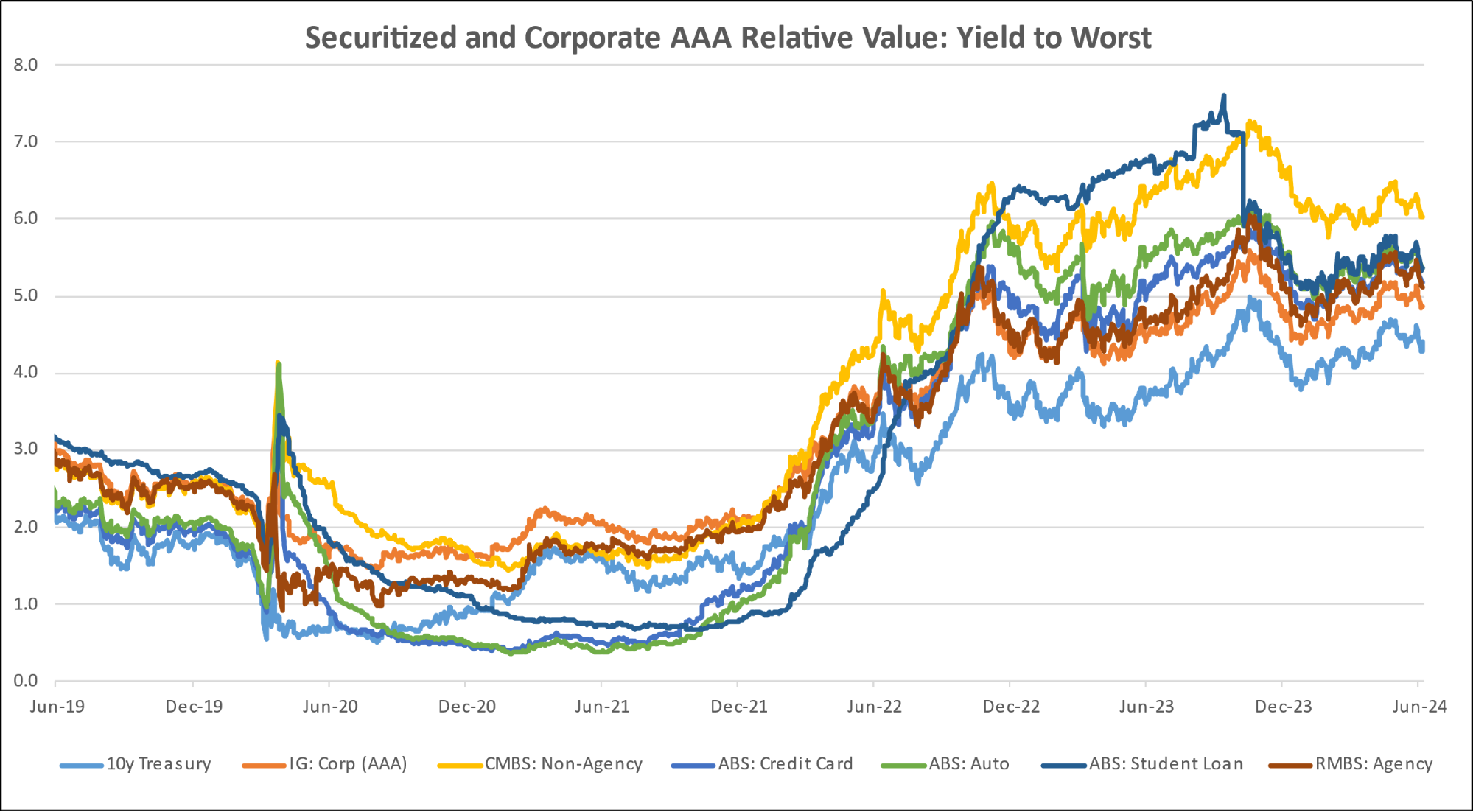

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

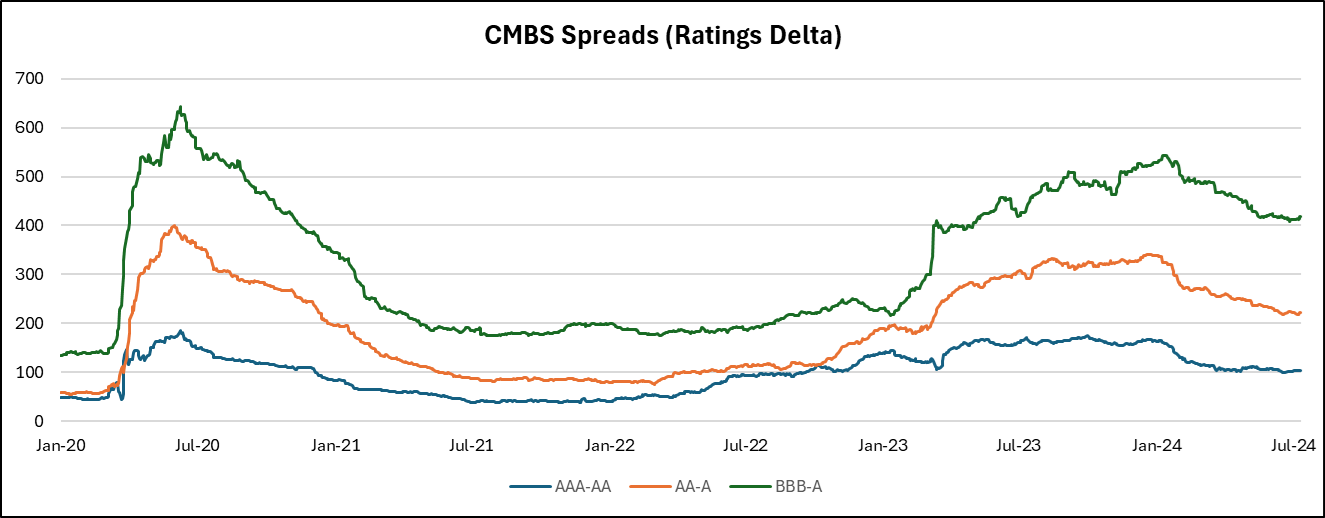

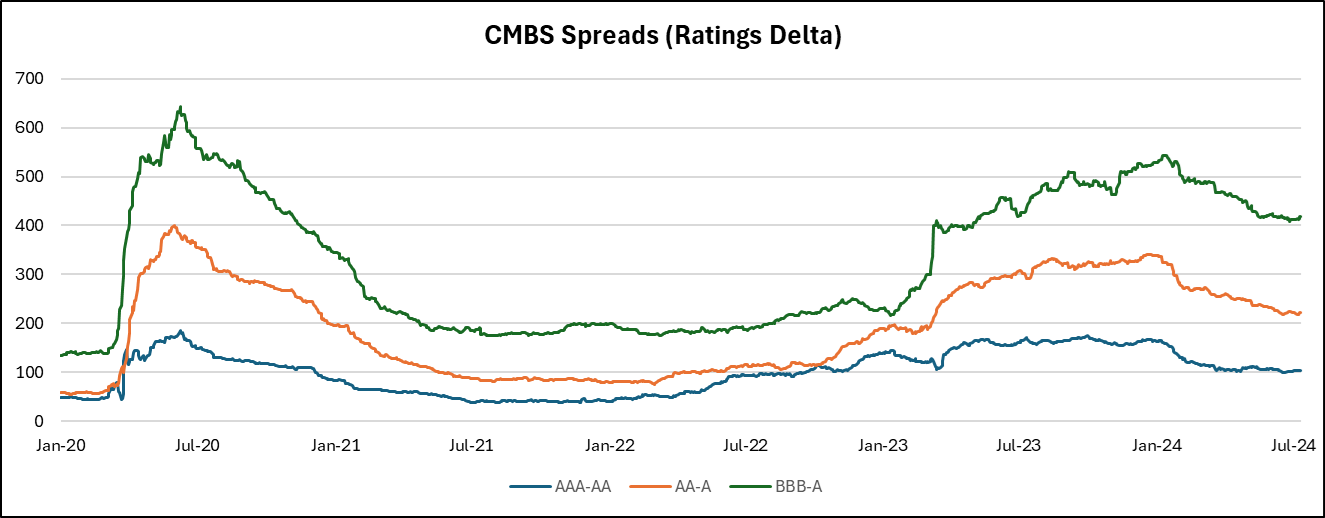

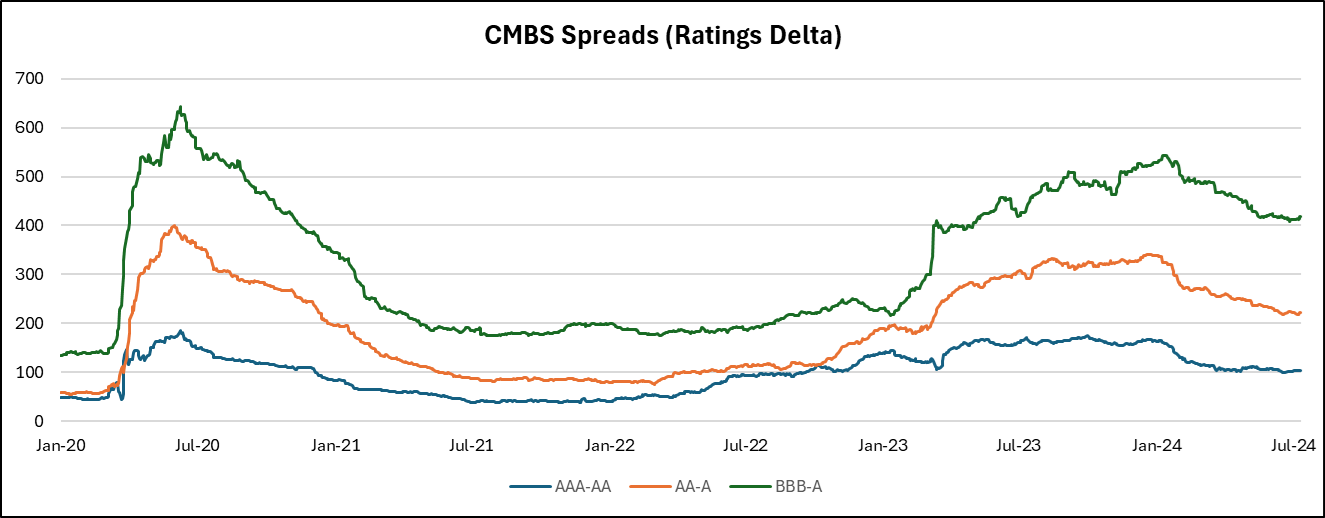

Diagram V: CMBS Spreads

Real Estate

ZCGC RE Research: CRE Maturities

- In 2024, $950 billion in commercial real estate (CRE) loans are set to mature, with this amount expected to peak at $1.26 trillion by 2027.

- Borrowers face rising interest rates, with new loans averaging 6.2%, compared to 4.3% on maturing loans, making refinancing more challenging.

- Office properties, which account for about 10% of the maturing loans, are particularly concerning due to remote work trends, elevated vacancies, and delinquencies.

- Lenders are offering some relief by extending loan terms, giving borrowers more time to refinance and manage their debt.

- Delinquencies and credit quality are expected to worsen slightly in 2024 and 2025, though the situation is not expected to escalate into a crisis.

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- Consumer Price Index

- The CPI increased 0.2% in August, meeting forecasts

- The core CPI increased 0.3%, higher than the forecasted 0.2%. The rise represents the largest increase in five months

- The increase in overall inflation dropped from 2.9% to 2.5%, hitting the lowest levels since 2021

- Producer Price Index

- The PPI increased 0.2% in August, meeting forecasts

- The rise in wholesale prices decreased from 2.1% in July to 1.7% in August, reaching the lowest levels in six months

- The price of services rose 0.4%, bringing the 12-month increase of 2.7% to near prepandemic levels

- Consumer Credit

- Consumer credit increased by an annual rate of 6.0%, seasonally adjusted, in July, up from 1.2% in June

- Revolving credit increased by an annual rate of 9.4% after decreasing 0.3% in June, while nonrevolving credit increased at an annual rate of 4.8% after increasing 1.8% the month prior. The rise in nonrevolving credit is partially driven by auto loans, as consumers delayed vehicle purchases after a cyberattack affected dealers in June

- Total credit outstanding increased by $25.5 billion, more than doubling expectations

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 230,000 in the week ended September 6, up 2,000 from the prior week

- The four-week moving average was 230,750, up 500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 5,000 to 1.850 million in the week ended August 30. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.115 trillion in the week ended September 13, up $2.4 billion from the prior week

- Treasury holdings totaled $4.389 trillion, down $7.0 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.30 trillion in the week, down $8.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.27 trillion as of September 13, an increase of 6.9% from the previous year

- Debt held by the public was $26.17 trillion, and intragovernmental holdings were $7.09 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 2.5% in August year over year

- On a monthly basis, the CPI increased 0.2% in August on a seasonally adjusted basis, after increasing 0.2% in June

- The index for all items less food and energy (core CPI) rose 0.3% in August, after rising 0.2% in July

- Core CPI increased 3.2% for the 12 months ending August

- Food and Beverages:

- The food at home index increased 0.9% in August from the same month a year earlier, and increased 0.0% in August month over month

- The food away from home index increased 4.0% in August from the same month a year earlier, and increased 0.3% in August month over month

- Commodities:

- The energy commodities index decreased (0.6%) in August after increasing 0.1% in July

- The energy commodities index fell (10.2%) over the last 12 months

- The energy services index (0.8%) in August after decreasing (0.0%) in June

- The energy services index rose 3.1% over the last 12 months

- The gasoline index rose (10.3%) over the last 12 months

- The fuel oil index fell (12.1%) over the last 12 months

- The index for electricity rose 3.9% over the last 12 months

- The index for natural gas fell (0.1%) over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $4,168.47 per 40ft container for

- Drewry’s composite World Container Index has increased by 167.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.5% in August after increasing 0.4% in July

- The rent index increased 0.5% in August after increasing 0.3% in July

- The index for lodging away from home decreased (0.7%) in August after decreasing (0.5%) in June

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- The Houthis fired a missile at central Israel on Sunday morning. The missile did not hit its intended target, and the strike resulted in no casualties. Still, the action marks an escalation in the Houthi’s attacks on the country. The Houthi’s military spokesman stated that “[Israel] should expect more strikes and advanced operations in the future.” Benjamin Netanyahu said that Israel would retaliate against the Houthis in response to the attack

- The Syrian government stated that Israel launched missiles into its territory, killing 16 people. Israel claimed that the attack was in response to ongoing Iranian arms transfers

- On Tuesday, the Israeli military launched an airstrike in a designated zone for displaced people in Gaza, destroying 20 tents and killing at least 19 people, according to Gaza officials. Israel claims that it used precise weapons and aerial surveillance to limit civilian casualties and targeted a command center with senior Hamas operatives

-

Russia

- U.S. Secretary of State Anthony Blinken signaled that the West is considering loosening restrictions on Ukrainian missile strikes. Ukraine has pressed the U.S. for permission to use long-range missiles supplied by the United States to break up Russian offensives deeper within Russia’s territory and disrupt Russia’s long-range attacks into Ukraine. Until now, the U.S. was reluctant to allow these strikes, as they would escalate the conflict

- The move comes as Russia brings Iranian ballistic missiles into the fight and begins its counteroffensive against Ukrainian forces in the Kursk region. Further, as Russia targets civilians and civilian infrastructure—including the electricity grid—the West is concerned that Ukrainians will have to flee their homes during the winter

- Multiple drone attacks struck targets near Moscow last week, killing one woman, injuring six others, and forcing the temporary closure of three of the capital’s airports. The drones targeted air bases, oil refineries, and ammunition stores. The assault represents one of the largest drone attacks since the start of the war

-

Americas

- Air Canada reached a tentative four-year labor agreement early Sunday. The agreement averts a strike at the country’s largest airline with a union representing over 5,000 pilots, which would have disrupted domestic and cross-border travel

- Protestors stormed the Mexican Senate after the legislative body approved a constitutional amendment to replace all the country’s federal judges. Critics say that the move, which would require elections for all judges, could undermine judicial independence and discourage foreign investment into the country

- Tren de Aragua, a prison gang from Venezuela, is now suspected in 100 violent and drug crimes in the United States, signaling that the group is bringing its operations further north. One U.S. official dubbed the group “MS-13 on steroids”

-

China

- To support the country’s pension system, Beijing moved to raise the retirement age for men from 60 to 63, and for some women from 50 to 55. Upcoming economic strains caused the Chinese government to reconsider their relatively low retirement ages

- China’s new home sales fell 25% year over year in the first eight months of the year, and new construction starts decreased 22.5%

- This, among other indicators released by the statistics bureau and concerns over population age demographics, indicate that the country risks a slide into deflation

-

Tibet

- The Dalai Lama announced that he would discuss how to choose his successor, amid worsening health and a recent surgery in the U.S. Beijing asserts that they will intercede and have final say over the succession issue

-

North Korea

- For the first time, North Korea published photos of an uranium-enrichment facility. The move comes after an agreement between North Korea and Russia to defend each other if attacked

-

Canada

- The Bank of Canada cut its main interest rate by a quarter point to 4.25% for the third consecutive time, citing concerns about a weakening economy and the risk of inflation slowing too quickly

-

Germany

- The German far right AfD won almost a third of the vote in the eastern state of Thuringia and placed second in the state of Saxony. The result in Thuringia gives the far-right its first win in a state parliament election since World War Two

-

Netherlands

- The Netherlands expanded export control rules requiring ASML to seek licenses for shipping certain chip-making equipment outside the EU, citing increased security risks linked to technological advancements and geopolitical concerns, especially regarding China. ASML doesn’t expect the new requirements to affect its financial targets

-

Japan

- Japan plans to launch a $2 billion satellite network to monitor ships and military sites as part of its defense response to increasing Chinese incursions, including a recent violation of Japanese airspace by a Chinese military aircraft

-

Thailand

- Paetongtarn Shinawatra, daughter of former Thai prime minister Thaksin Shinawatra, was sworn in as Thailand’s youngest-ever prime minister, marking the Shinawatra family’s return to power. This comes as Thailand’s military and royalists supported her rise to counter a youth-led progressive movement that threatened their influence

-

Brazil

- Tens of thousands of supporters of Jair Bolsonaro protested in São Paulo against Brazil’s Supreme Court ban on Elon Musk’s X platform, accusing the court of censorship ahead of upcoming municipal elections

-

Uganda

- Ugandan Olympic runner Rebecca Cheptegei has died after her boyfriend allegedly set her on fire, highlighting ongoing concerns about domestic violence against female athletes in East Africa

-

France

- French manufacturing sentiment improved in August, rising to 99 from 95 in July, according to a survey by the national statistics agency Insee, driven by better production prospects and foreign order books. However, the sentiment level remains below the long-term average of 100, reflecting ongoing challenges like geopolitical uncertainty and high interest rates

Commodities

-

Oil Prices

- WTI: $68.65 per barrel

- 1.45% WoW; (4.19%) YTD; (23.86%) YoY

- Brent: $71.61 per barrel

- 0.77% WoW; (7.05%) YTD; (23.58%) YoY

-

US Production

- U.S. oil production amounted to 13.3 million bpd for the week ended September 6, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 590, up 8 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 419.1 million barrels, down (0.3%) YoY

- Refiners operated at a capacity utilization rate of 92.8% for the week, down from 93.3% in the prior week

- U.S. crude oil imports now amount to 5.792 million barrels per day, down (9.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.22 per gallon in the week of September 13,

down (16.8%) YoY

- Gasoline prices on the East Coast amounted to $3.26, down (12.7%) YoY

- Gasoline prices in the Midwest amounted to $3.18, down (15.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.90, down (16.1%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.47, down (15.9%) YoY

- Gasoline prices on the West Coast amounted to $4.24, down (16.7%) YoY

- Motor gasoline inventories were up by 2.3 million barrels from the prior week

- Motor gasoline inventories amounted to 221.6 million barrels, up 0.6% YoY

- Production of motor gasoline averaged 9.38 million bpd, up 1.8% YoY

- Demand for motor gasoline amounted to 8.478 million bpd, up 2.1% YoY

-

Distillates

- Distillate inventories decreased by 2.3 million in the week of September 13

- Total distillate inventories amounted to 125.0 million barrels, up 2.0% YoY

- Distillate production averaged 5.209 million bpd, up 4.0% YoY

- Demand for distillates averaged 3.558 million bpd in the week, down (0.6%) YoY

-

Natural Gas

- Natural gas inventories increased by 40 billion cubic feet last week

- Total natural gas inventories now amount to 3,387 billion cubic feet, up 5.7% YoY

Credit News

High yield bond yields unchanged at 7.15% and spreads increased 10bps to 362bps. Leveraged loan yields decreased 13bps to 8.20% and spreads were flat at 497bps. WTD Leveraged loan returns were positive 19bps. WTD high yield bond returns were positive 16bps. 10yr treasury yields decreased 5bps to 3.68%. Leveraged loan prices were mixed amid mild outflows, a multi-month high in capital market activity, and an escalating debate around whether the Fed will deliver a 25bp or 50bp rate cut when the Committee convenes next Wednesday.

High-yield:

Week ended 09/13/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 09/13/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: SunPower ($143mn, 8/5/2024), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), Quorum Health Group ($688mn, 7/10/24), Vyaire Medical ($339mn, 6/9/24), 99 Cents Only Stores ($350mn, 4/7/24), and ConvergeOne ($1.3bn, 4/4/24).

CLOs:

Week ended 09/13/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Diagram V: CMBS Spreads

Real Estate

ZCGC RE Research: CRE Maturities

- In 2024, $950 billion in commercial real estate (CRE) loans are set to mature, with this amount expected to peak at $1.26 trillion by 2027.

- Borrowers face rising interest rates, with new loans averaging 6.2%, compared to 4.3% on maturing loans, making refinancing more challenging.

- Office properties, which account for about 10% of the maturing loans, are particularly concerning due to remote work trends, elevated vacancies, and delinquencies.

- Lenders are offering some relief by extending loan terms, giving borrowers more time to refinance and manage their debt.

- Delinquencies and credit quality are expected to worsen slightly in 2024 and 2025, though the situation is not expected to escalate into a crisis.

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index