U.S. News

- U.S. Employment Report

- The US added only 12,000 jobs in October, far below the expected 120,000, primarily due to the Boeing strike and hurricane disruptions

- The unemployment rate remained at 4.1%, with average hourly earnings rising by 0.4% to $35.46, a 4.0% year-over-year increase

- Health care and government employment grew, adding 52,000 and 40,000 jobs, respectively, while manufacturing lost 46,000 jobs and temporary help services declined by 49,000

- Consumer Sentiment

- The U.S. Consumer Confidence Index reached a nine-month high of 108.7 in October, reversing last month’s decline

- The Present Situation Index rose 14.2 points to 138.0, and the Expectations Index increased 6.3 points to 89.1, reflecting optimism in business and labor markets

- Consumers’ recession expectations hit a record low since tracking began in July 2022, with improved outlooks on future finances and job prospects

- Construction Spending

- Construction spending rose 0.1% in September to $2.15 trillion, reaching a four-month high and surpassing expectations

- Private residential construction increased by 0.2%, with single-family projects up 0.4% and multi-family down 0.1%

- Public residential construction spending rose by 2.3% in September

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 216,000 in the week ended October 25, down 12,000 from the prior week

- The four-week moving average was 236,500, down 2250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 26,000 to 1.862 million in the week ended October 18. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.013 trillion in the week ended November 1, down $15.9 billion from the prior week

- Treasury holdings totaled $4.358 trillion, up $0.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.27 trillion in the week, down $14.3 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.95 trillion as of November 1, an increase of 6.7% from the previous year

- Debt held by the public was $28.57 trillion, and intragovernmental holdings were $7.16 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 2.4% in September year over year

- On a monthly basis, the CPI increased 0.2% in September on a seasonally adjusted basis, after increasing 0.2% in August

- The index for all items less food and energy (core CPI) rose 0.3% in September, after rising 0.3% in August

- Core CPI increased 3.3% for the 12 months ending September

- Food and Beverages:

- The food at home index increased 1.3% in September from the same month a year earlier, and increased 0.4% in September month over month

- The food away from home index increased 3.9% in September from the same month a year earlier, and increased 0.3% in September month over month

- Commodities:

- The energy commodities index decreased (4.0%) in September after decreasing (0.6%)

- The energy commodities index fell (15.3%) over the last 12 months

- The energy services index 0.4% in September after decreasing (0.8%) in June

- The energy services index rose 3.4% over the last 12 months

- The gasoline index rose (15.3%) over the last 12 months

- The fuel oil index fell (22.4%) over the last 12 months

- The index for electricity rose 3.7% over the last 12 months

- The index for natural gas fell 2.0% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,213.02 per 40ft container

- Drewry’s composite World Container Index has increased by 128.5% over the last 12 months

- Housing Market:

- The shelter index increased 0.2% in September after increasing 0.5% in August

- The rent index increased 0.2% in September after increasing 0.5% in August

- The index for lodging away from home decreased (3.8%) in August after decreasing (0.7%) in June

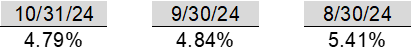

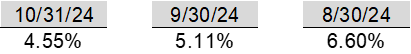

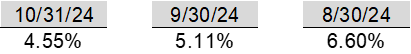

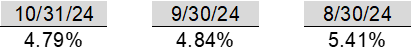

- Federal Funds Rate

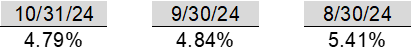

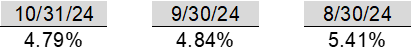

- The effective Federal Funds Rate is at 4.83%, down (0.50%) year to date

World News

-

Middle East

- Israeli naval commandos from Shayetet 13 conducted a nighttime raid in Batroun, northern Lebanon, capturing Imad Amhaz, a 38-year-old Lebanese national. Israel claims Amhaz is a senior Hezbollah operative involved in the group’s naval operations

- Iran has warned of significant retaliation following the Israeli airstrike, which killed four soldiers and damaged advanced air defenses. Iranian officials, including Supreme Leader Ayatollah Ali Khamenei, have issued strong statements, escalating concerns of a broader regional conflict, with the U.S. deploying additional military assets to the area in response

- Senior U.S. officials are in Israel discussing a draft agreement to end the war in Lebanon, which includes a 60-day period allowing Israel to strike Lebanon in response to imminent threats and calls for the enforcement of U.N. Security Council Resolution 1701; however, Hezbollah and Lebanese officials are resistant due to sovereignty concerns, though they are open to further negotiations

- Israel’s Parliament passed a law to ban the United Nations agency for Palestinian refugees (Unrwa) from operating in Israeli territory, limiting its ability to deliver aid in Gaza and the West Bank, despite opposition from the U.S. and other allies. Israel cited concerns of alleged bias and suspected ties with Hamas among Unrwa staff, viewing it as a security risk

-

Russia

- The U.S. has confirmed that around 8,000 North Korean troops are in Russia’s Kursk region, with plans for imminent deployment against Ukraine, marking a significant escalation involving foreign troops in the conflict

- U.S. Secretary of State Antony Blinken stated that North Korean troops fighting in Ukraine would be considered “legitimate military targets.” However, Washington faces limited options for response, with existing sanctions on Russia and North Korea already heavily enforced

- Ukraine has prepared prisoner-of-war facilities and encouraged North Korean soldiers to surrender, signaling Kyiv’s efforts to mitigate the impact of these foreign forces while pressing Western allies, including South Korea, for additional military support and air defenses

-

China

- China’s National People’s Congress (NPC) will hold a five-day meeting starting Monday, where expectations are set for a possible $1.4 trillion stimulus package to address economic challenges

- Analysts anticipate a local-government debt swap, potentially around 6 trillion yuan ($842.9 billion), aimed at refinancing debt, although it may not directly drive real economic demand

- The Caixin manufacturing purchasing managers index for China rose to 50.3 in October, indicating growth after five months of contraction, aligning with an official gauge showing similar expansion

- Despite growth in domestic demand, external demand remained weak, with the gauge for new export orders showing contraction for the third consecutive month in October

-

Spain

- Following torrential rains on the night of October 29, 2024, flash floods in the Valencia region of Spain led to at least 214 deaths and significant devastation in towns like Paiporta and Picanya. The Spanish government deployed over 7,500 military personnel, along with 400 vehicles, 30 helicopters, and an amphibious ship, to assist in rescue efforts and restore water, electricity, and telecommunications amid restricted road access and reports of looting

-

UK

- Kemi Badenoch, the first Black woman to lead the U.K.’s Conservative Party, has been chosen to revitalize the Tories after a historic defeat, focusing on cultural conservatism, limited government, and immigration control, while facing challenges from Labour’s Keir Starmer and Nigel Farage’s Reform UK. Known for her direct style, Badenoch emphasizes honesty about past mistakes and the need for pragmatic policies

-

Japan

- Japan’s ruling coalition lost its parliamentary majority in the recent election, creating political uncertainty that could delay interest rate hikes by the Bank of Japan, leading to a weakened yen. Despite this, Japan’s domestic economic conditions, such as a tight job market and core inflation of 2.1%, still point towards gradual monetary tightening

-

Canada

- Canada has accused India’s Home Minister, Amit Shah, of authorizing operations targeting Sikh separatists in Canada, escalating tensions between the two countries. The allegations come after previous claims that Indian agents were involved in the 2023 killing of Sikh activist Hardeep Singh Nijjar in Canada, a charge India has denied, calling the accusations politically motivated

-

India

- A former employee of India’s intelligence service has been charged by U.S. prosecutors for allegedly directing a plot to kill Sikh activist Gurpatwant Singh Pannun in New York, escalating tensions between India and Western countries regarding the targeting of Sikh separatists

-

Peru

- Former Peruvian President Alejandro Toledo was sentenced to more than 20 years in prison for taking a $20 million dollar bribe from Brazilian construction company Odebrecht in exchange for a highway contract

-

Cuba

- Cuba’s government has struggled to return power to millions of Cubans after a blackout impacted everything from running water to the operation of banks and ATMs

-

Africa

- A new deal gives Ethiopia naval access to Somaliland in exchange for recognizing Somaliland’s independence, escalating tensions with Somalia, which strongly opposes the move. The conflict risks undermining anti-al-Shabaab efforts, involving Egypt, and destabilizing the Horn of Africa further, raising international concerns

Commodities

-

Oil Prices

- WTI: $69.45 per barrel

- (3.25%) WoW; (3.01%) YTD; (15.78%) YoY

- Brent: $73.03 per barrel

- (3.97%) WoW; (5.11%) YTD; (15.91%) YoY

-

US Production

- U.S. oil production amounted to 13.5 million bpd for the week ended October 25, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 585, down 0 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 425.5 million barrels, up 0.9% YoY

- Refiners operated at a capacity utilization rate of 89.1% for the week, down from 89.5% in the prior week

- U.S. crude oil imports now amount to 6.431 million barrels per day, down (7.0%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.12 per gallon in the week of November 1,

down (9.2%) YoY

- Gasoline prices on the East Coast amounted to $3.16, down (8.1%) YoY

- Gasoline prices in the Midwest amounted to $3.00, down (9.8%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.74, down (10.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.32, down (10.1%) YoY

- Gasoline prices on the West Coast amounted to $4.11, down (15.3%) YoY

- Motor gasoline inventories were down by 2.7 million barrels from the prior week

- Motor gasoline inventories amounted to 210.9 million barrels, down (5.7%) YoY

- Production of motor gasoline averaged 9.70 million bpd, up 2.1% YoY

- Demand for motor gasoline amounted to 9.159 million bpd, up 5.3% YoY

-

Distillates

- Distillate inventories decreased by -1.0 million in the week of November 1

- Total distillate inventories amounted to 112.9 million barrels, up 1.4% YoY

- Distillate production averaged 4.863 million bpd, up 6.2% YoY

- Demand for distillates averaged 3.881 million bpd in the week, up 5.4% YoY

-

Natural Gas

- Natural gas inventories increased by 78 billion cubic feet last week

- Total natural gas inventories now amount to 3,863 billion cubic feet, up 2.2% YoY

Credit News

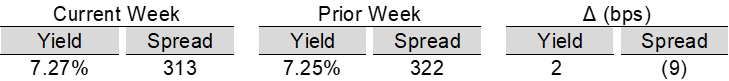

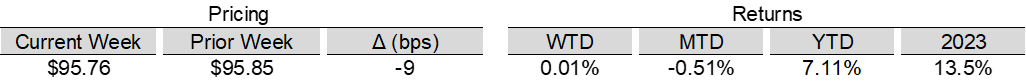

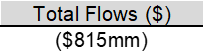

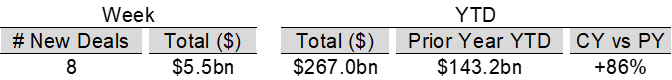

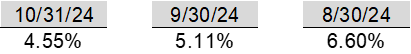

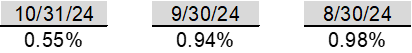

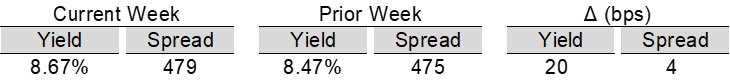

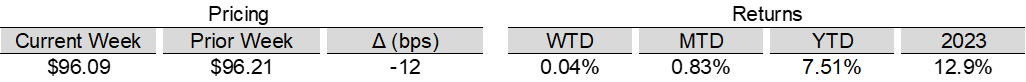

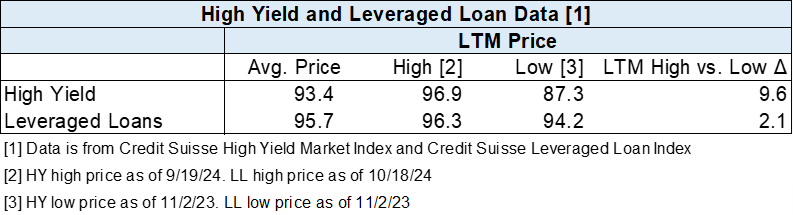

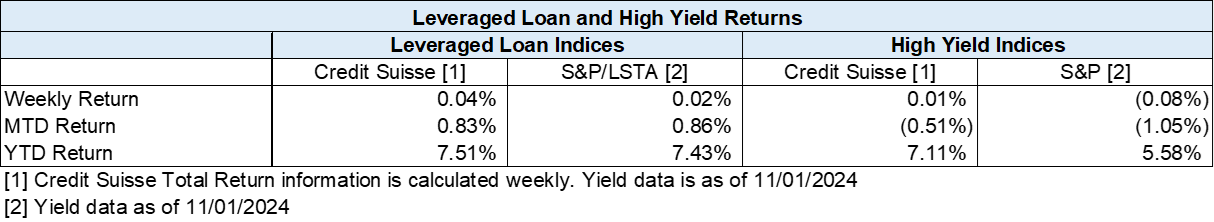

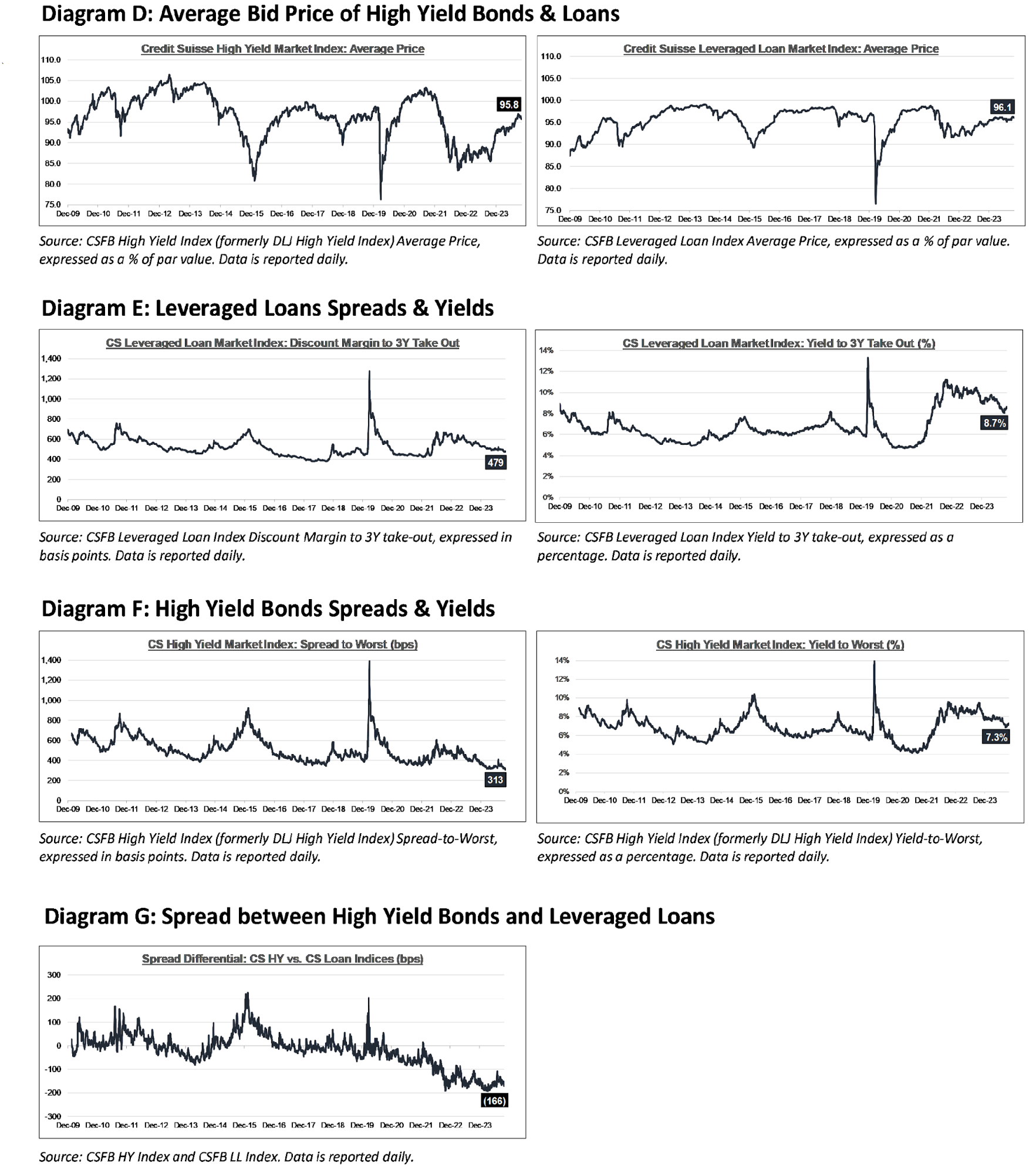

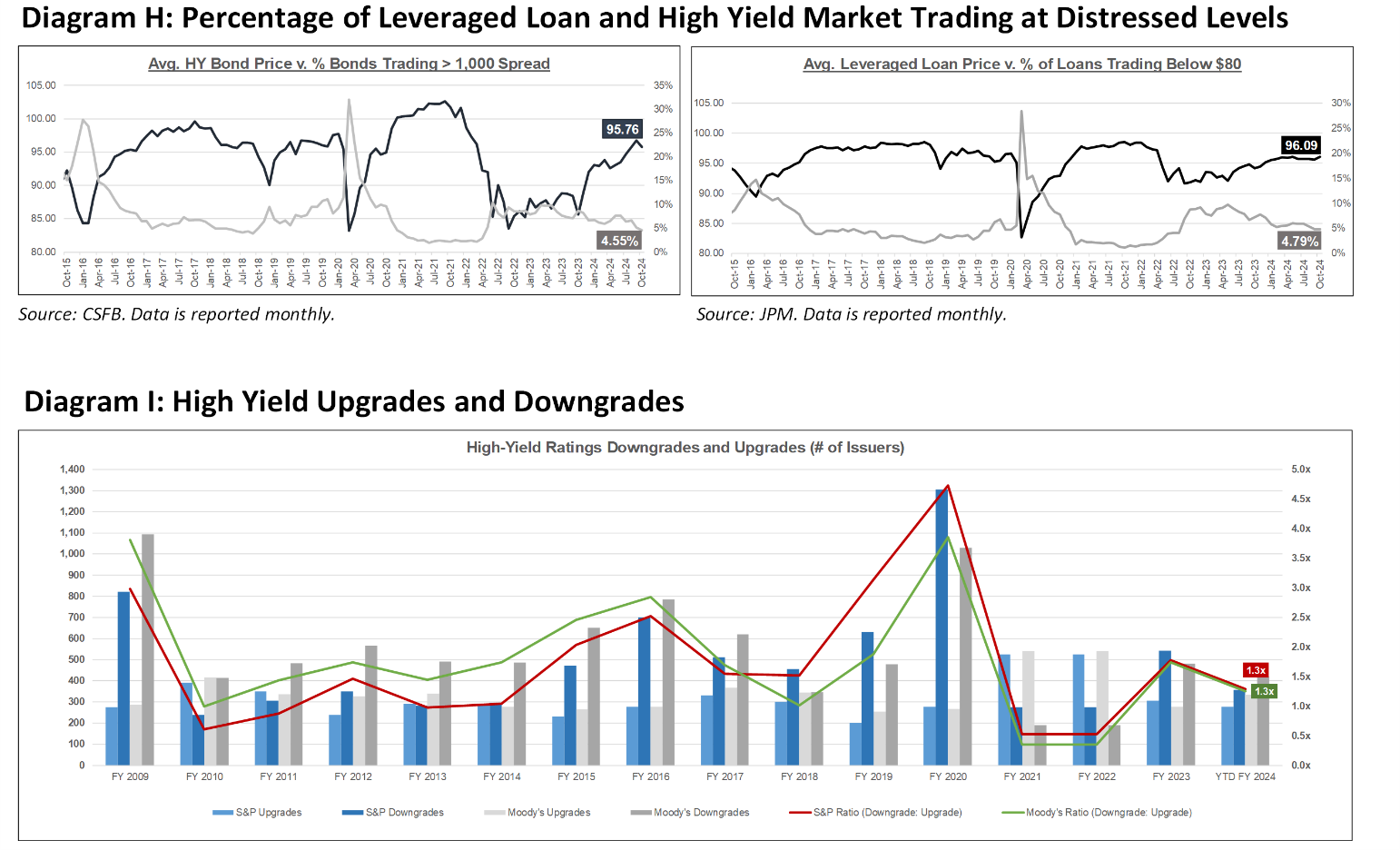

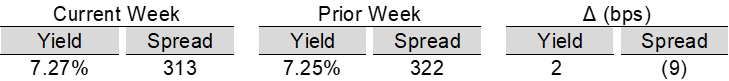

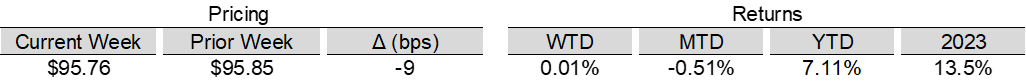

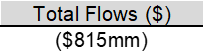

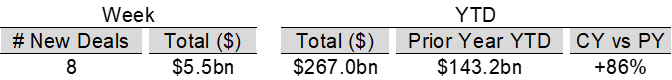

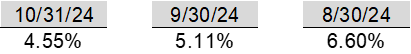

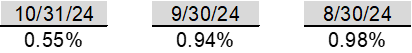

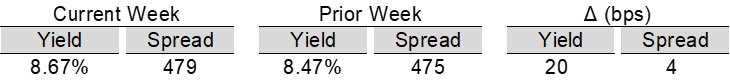

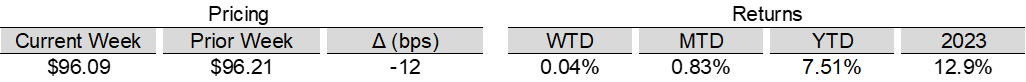

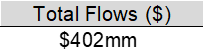

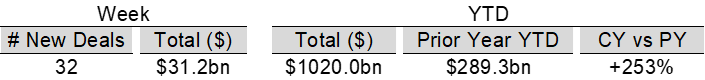

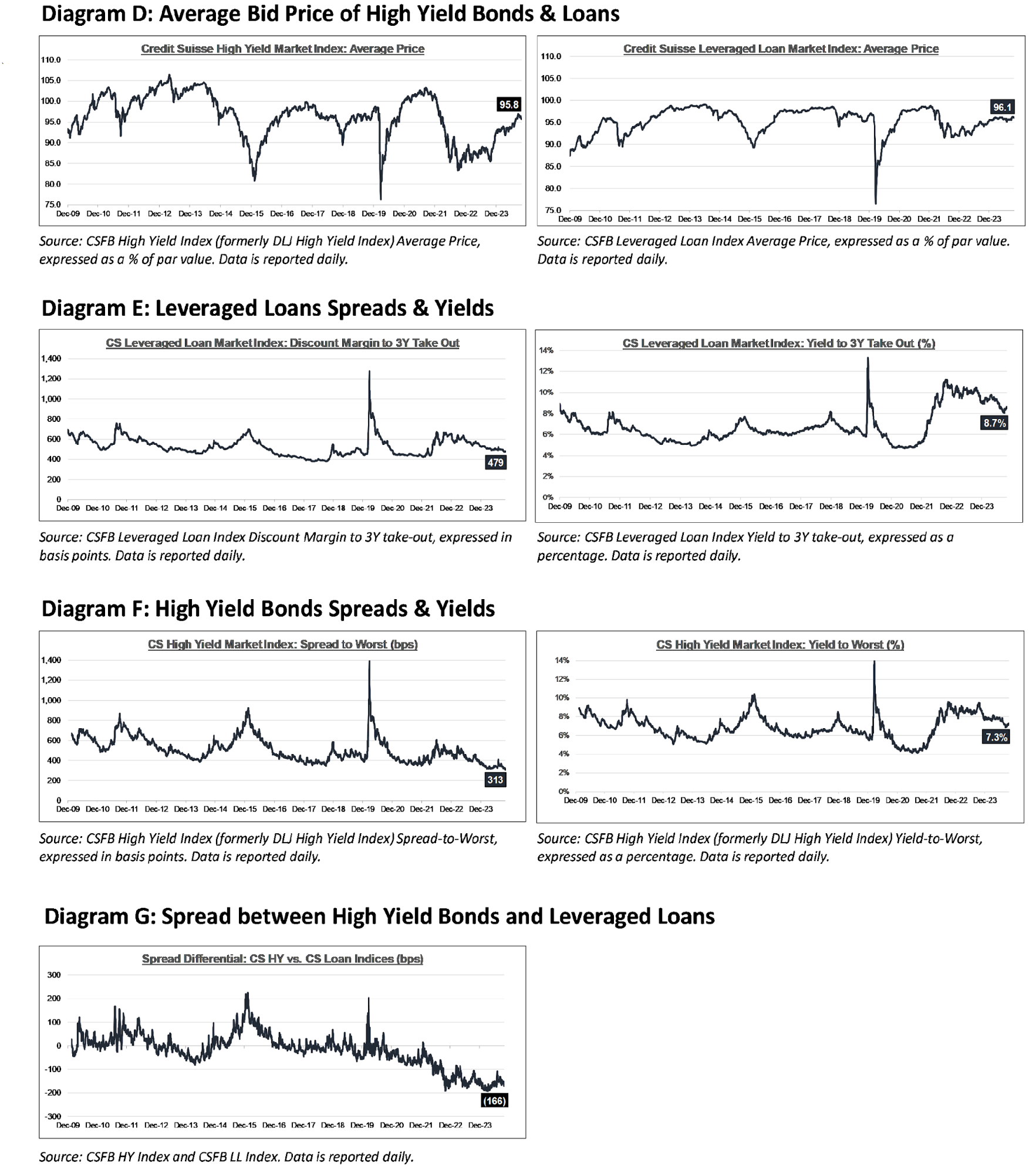

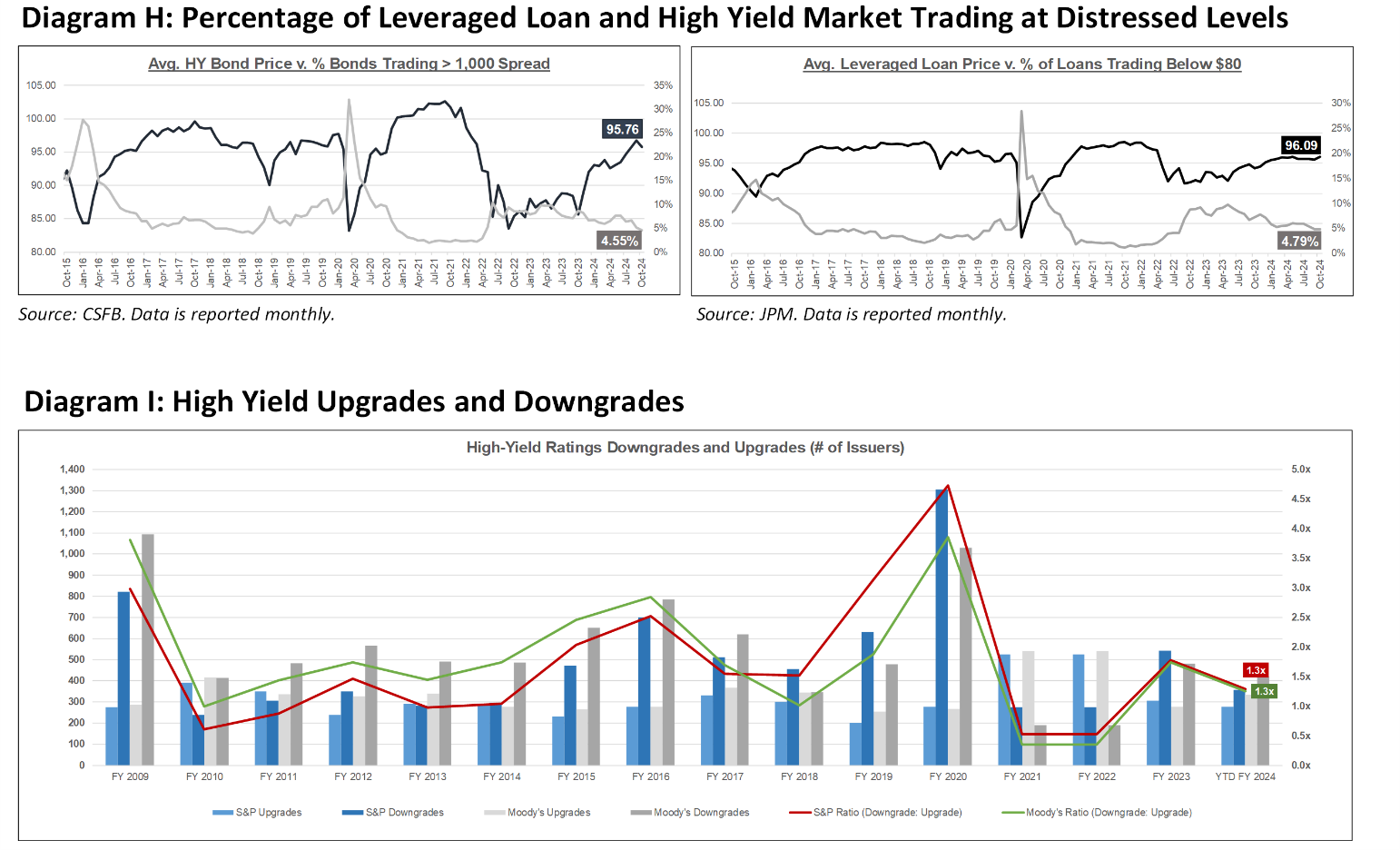

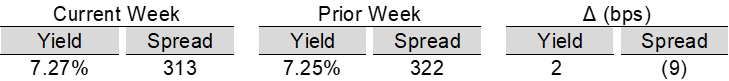

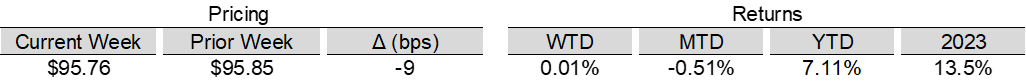

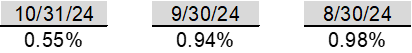

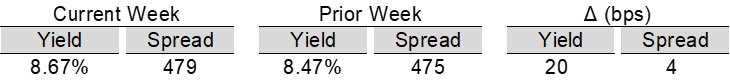

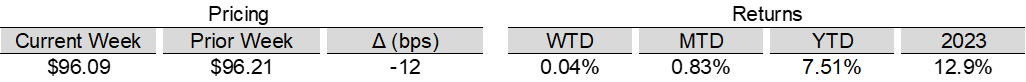

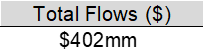

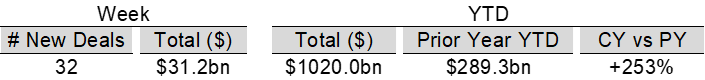

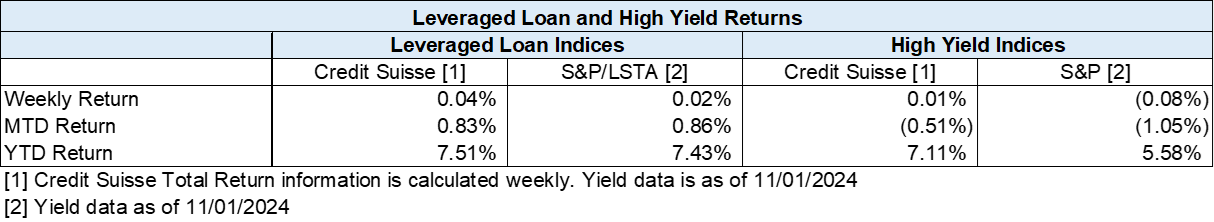

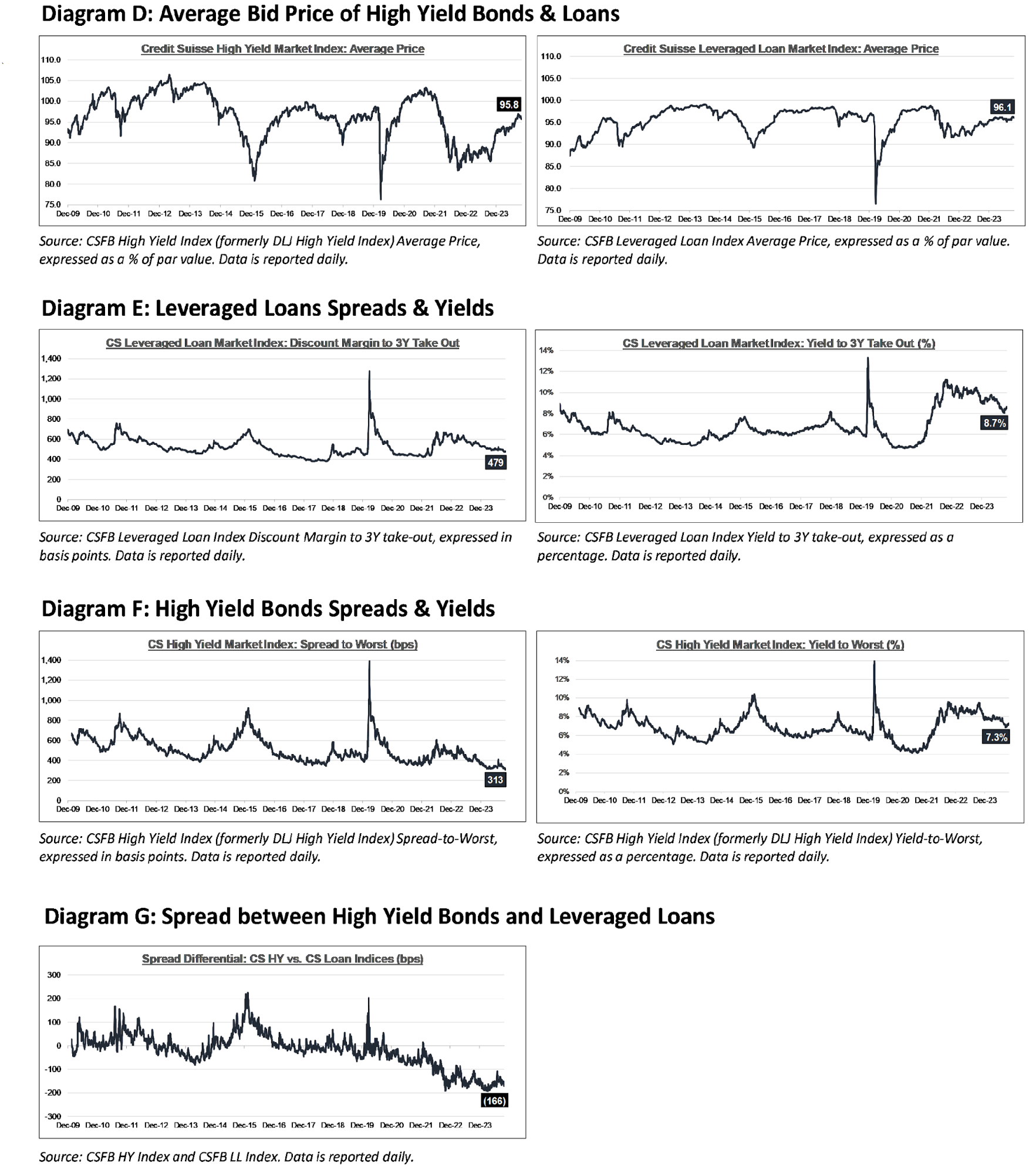

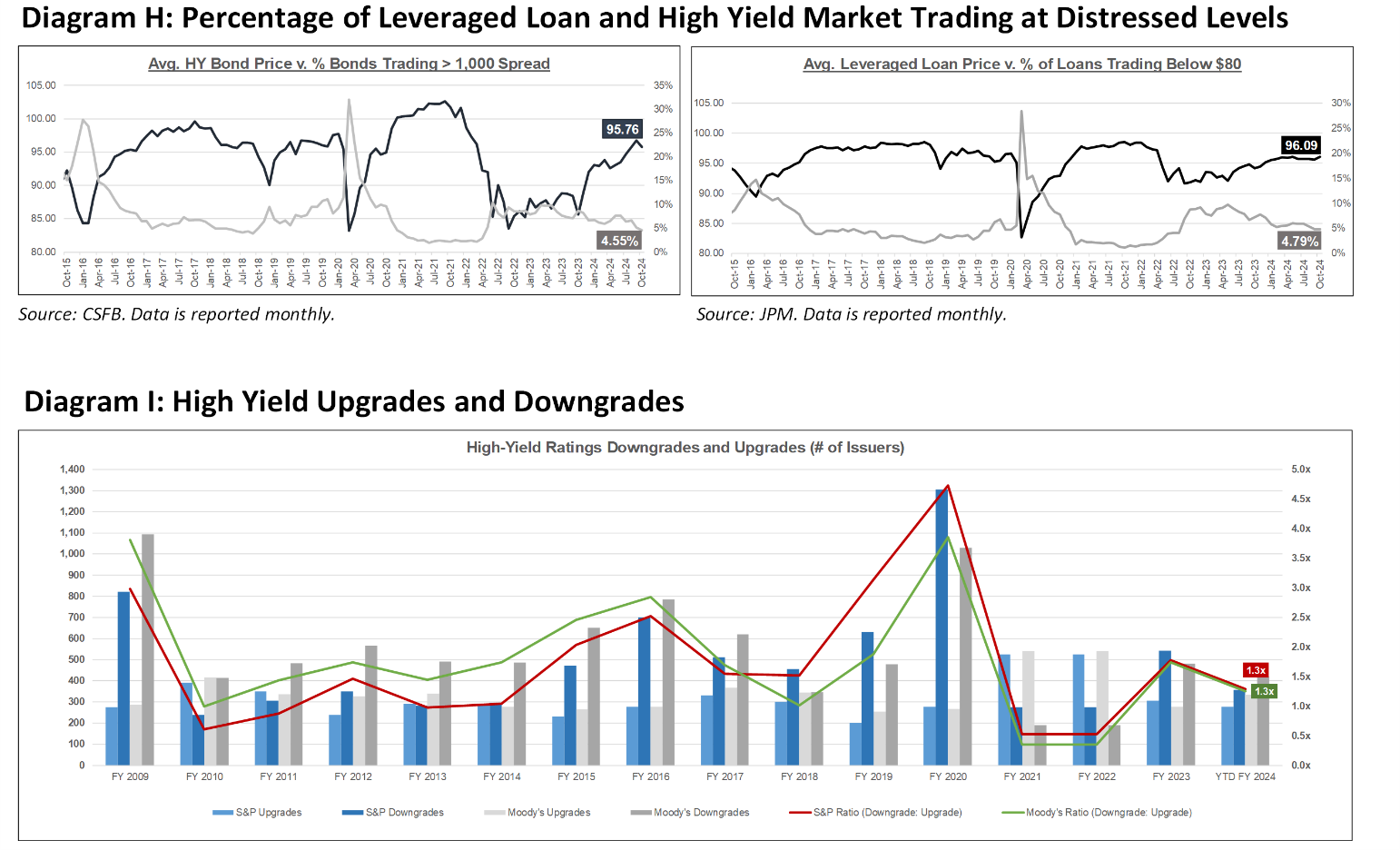

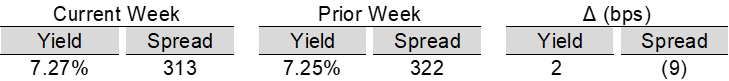

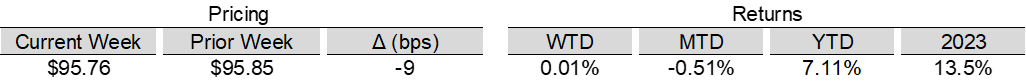

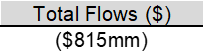

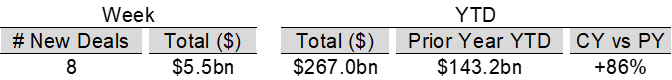

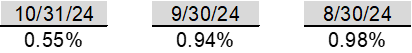

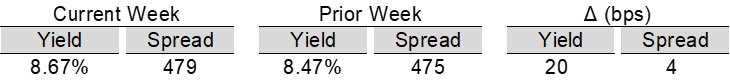

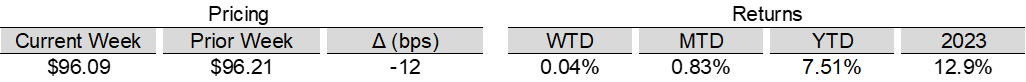

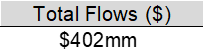

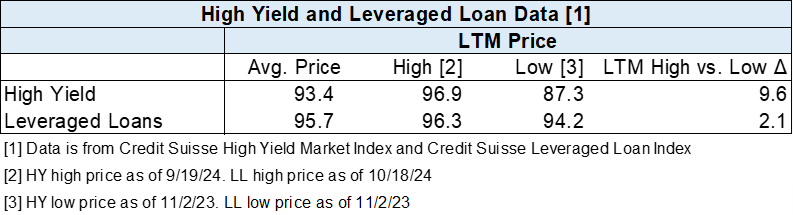

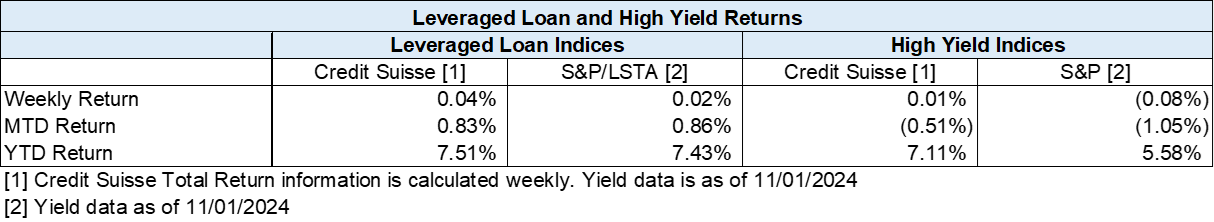

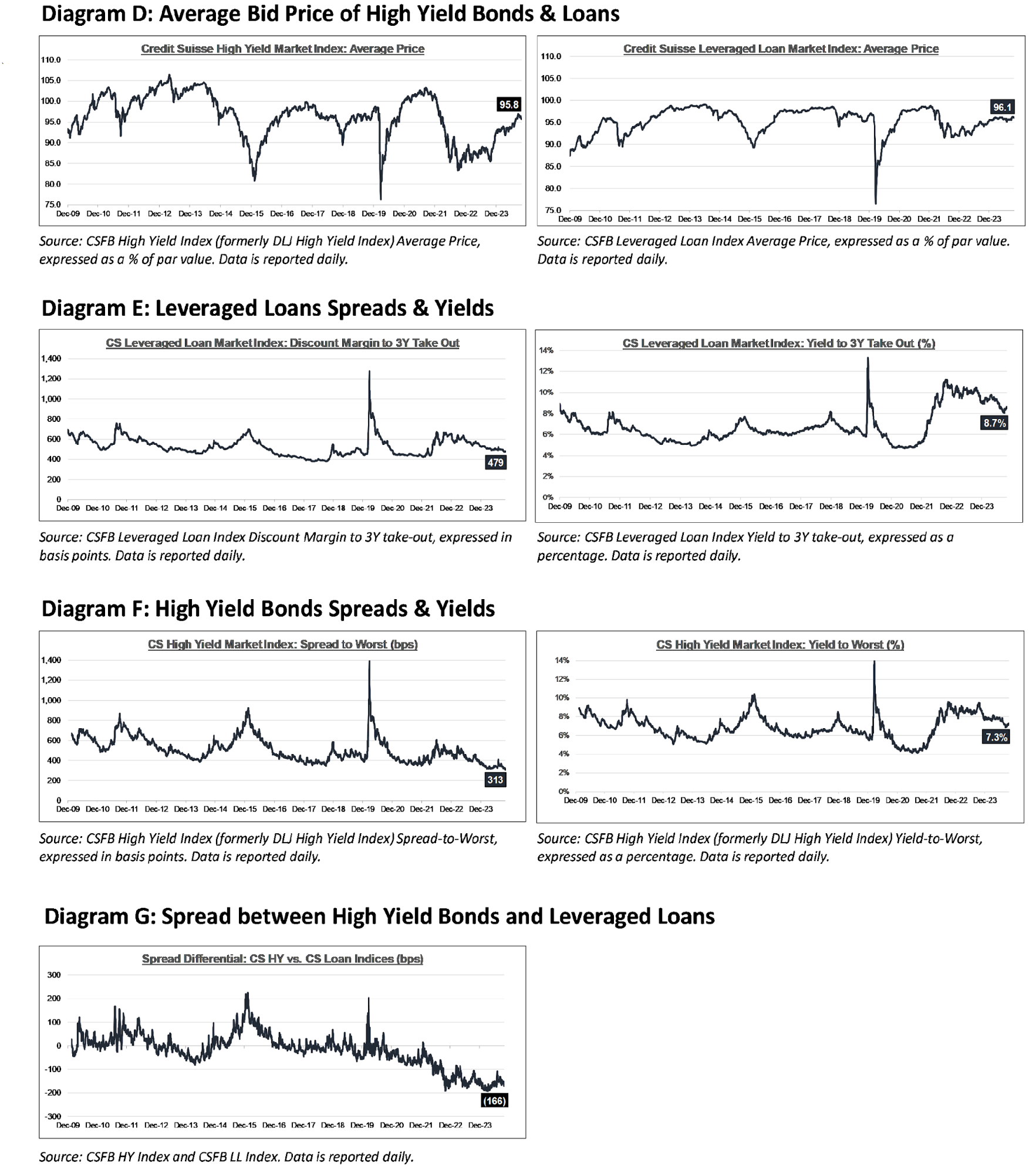

High yield bond yields increased 2bps to 7.27% and spreads decreased 9bps to 313bps. Leveraged loan yields increased 20bps to 8.67% and spreads increased 4bps to 479bps. WTD Leveraged loan returns were positive 4bps. WTD high yield bond returns were positive 1bps. 10yr treasury yields increased 8bps to 4.28%. High-yield bond spreads reached a post GFC low this week as investors absorbed 3Q earnings, elevated rate volatility, retail outflows, and economic data which continue to align with a soft or no landing economic narrative. Leveraged loans provided their strongest gains in 5 months in October amid steady ETF inflows, heavy CLO origination, the most active primary for October on record, and as investors calibrate less Fed cuts amid a resilient economy.

High-yield:

Week ended 11/01/2024

- Yields & Spreads1

- Pricing & Returns1

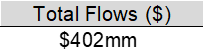

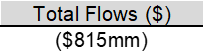

- Fund Flows2

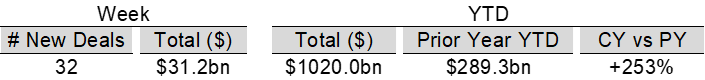

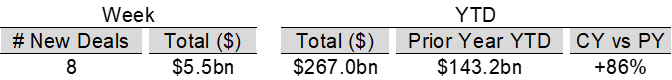

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 11/01/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24), Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions ($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), and Quorum Health Group ($688mn, 7/10/24).

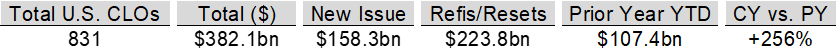

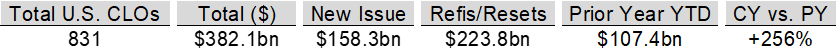

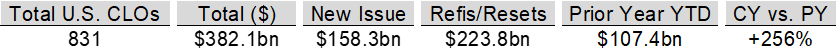

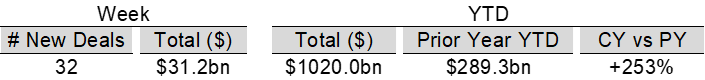

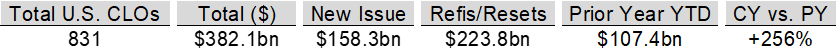

CLOs:

Week ended 11/01/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

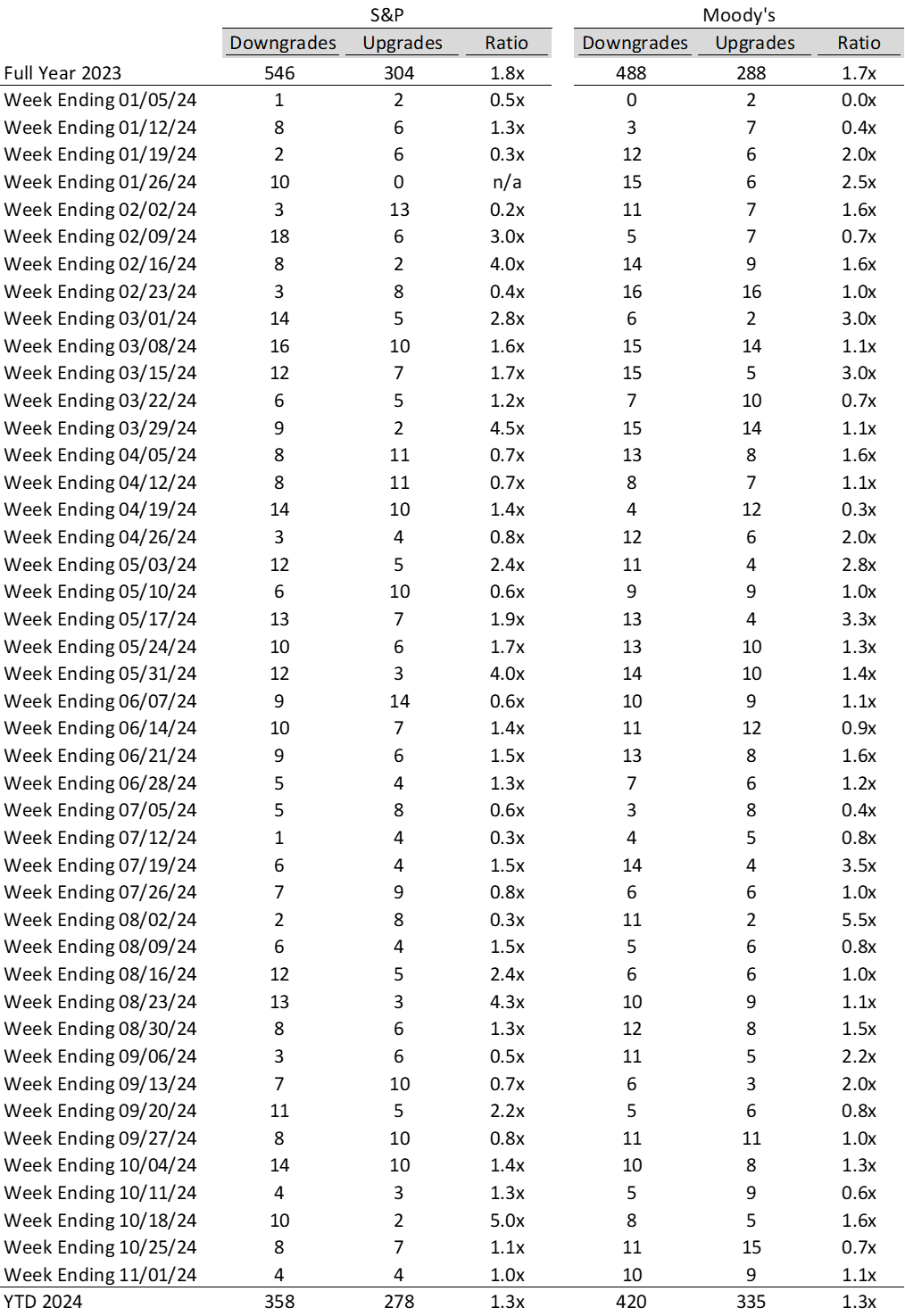

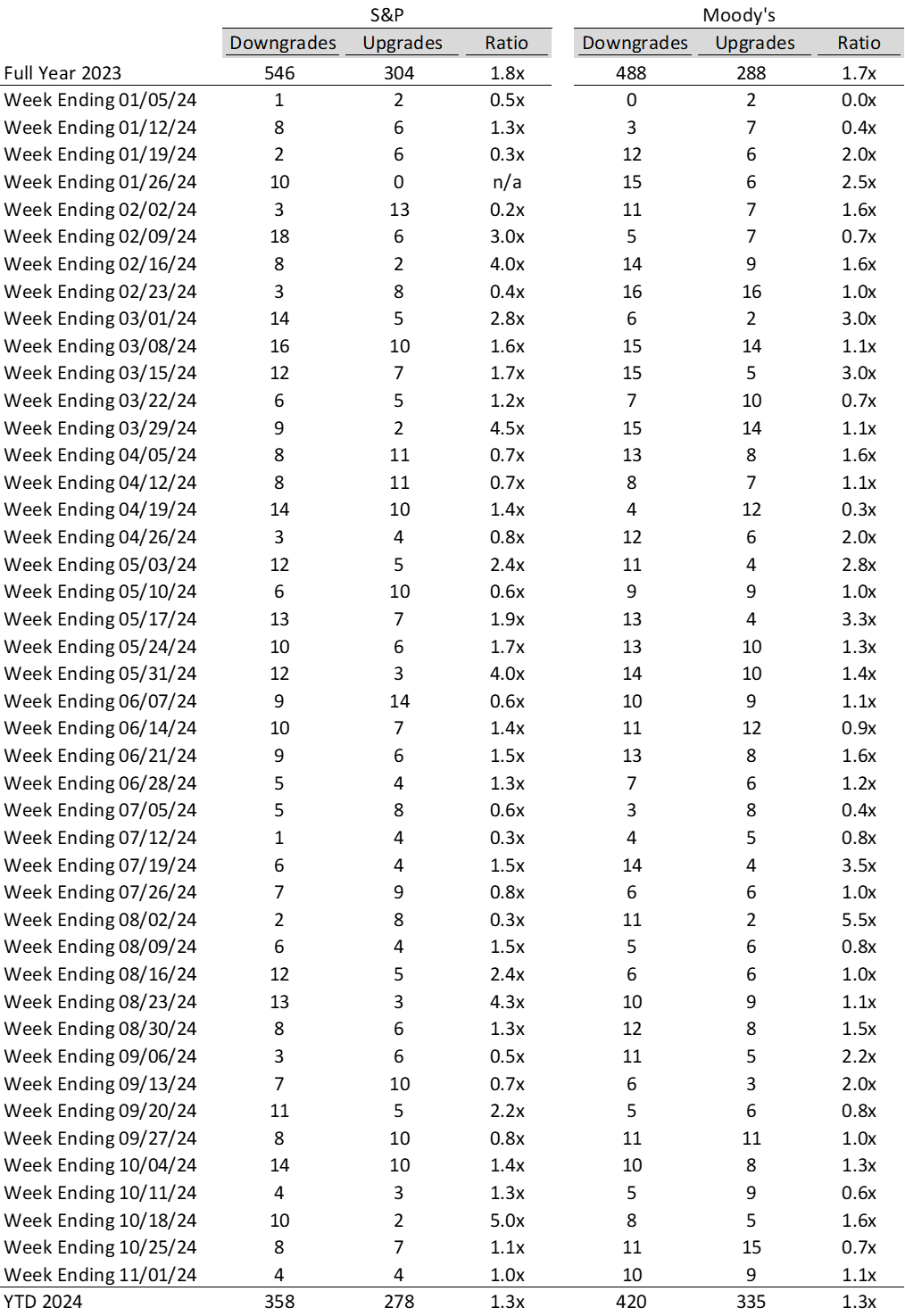

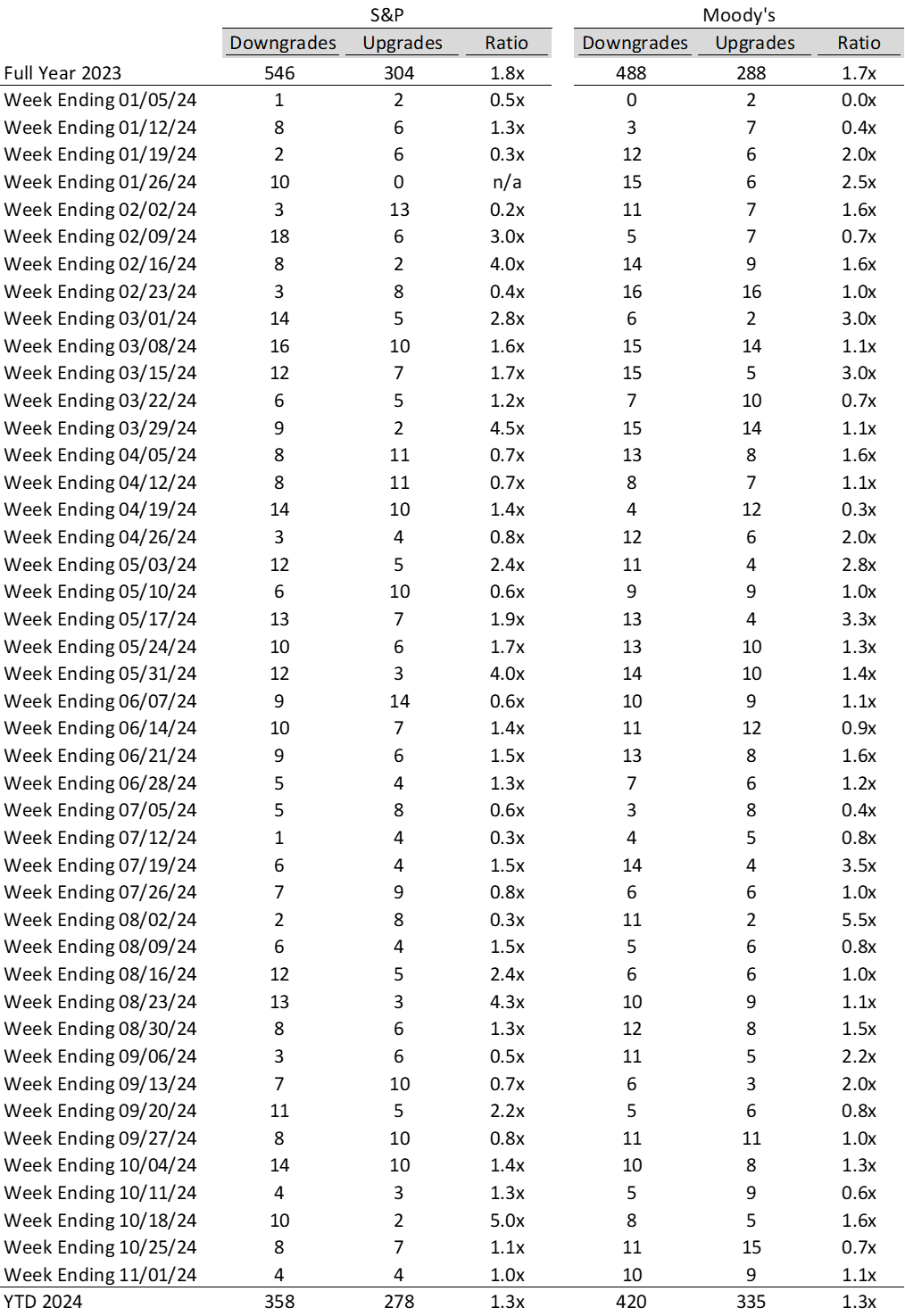

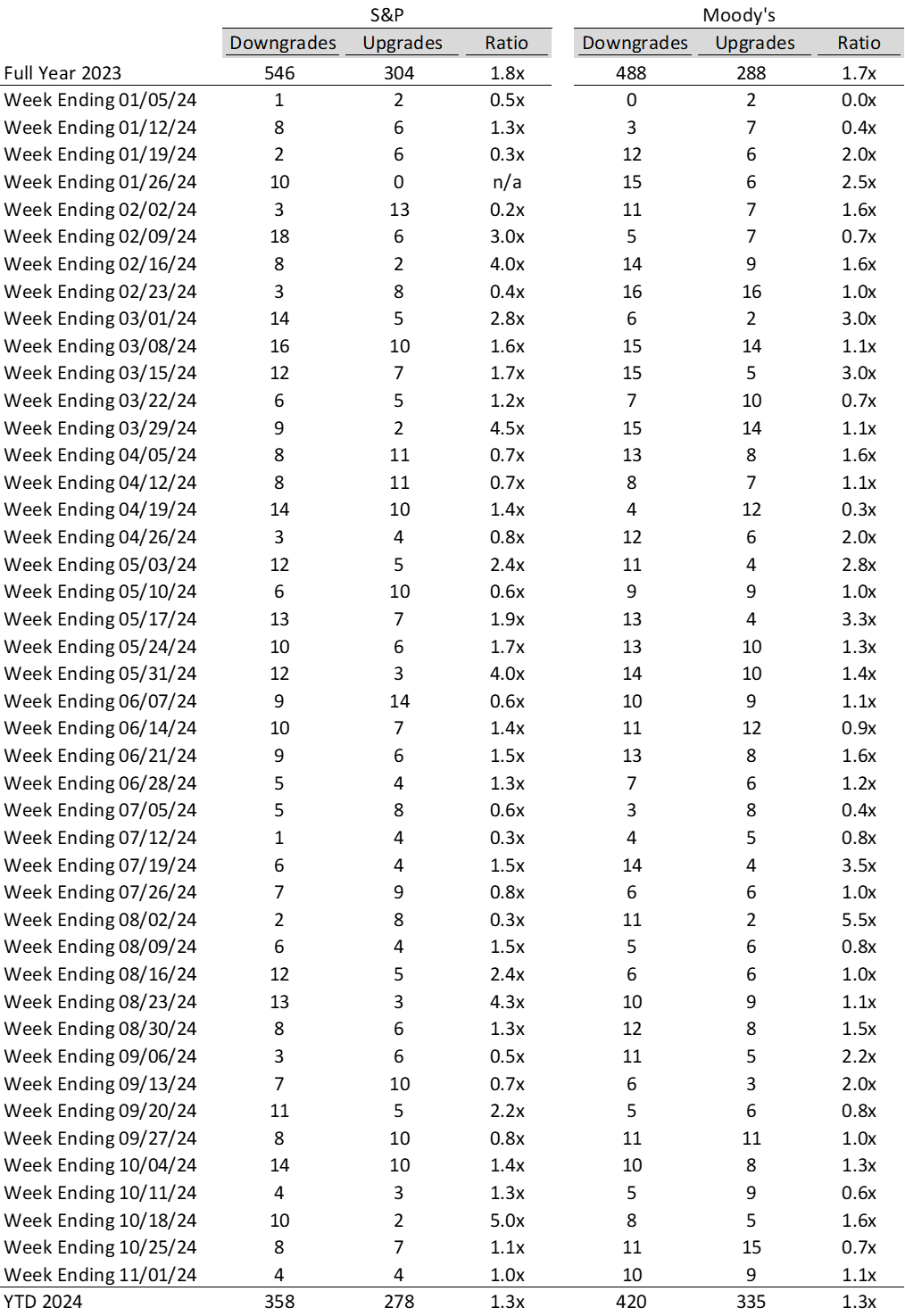

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

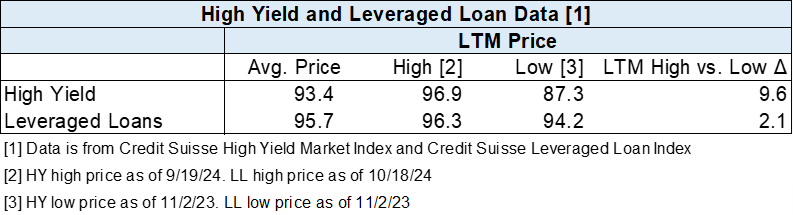

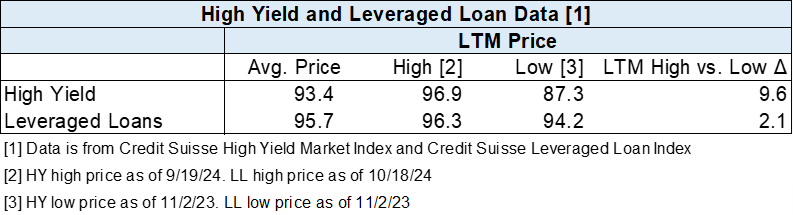

Diagram B: High Yield and Leveraged Loan LTM Price

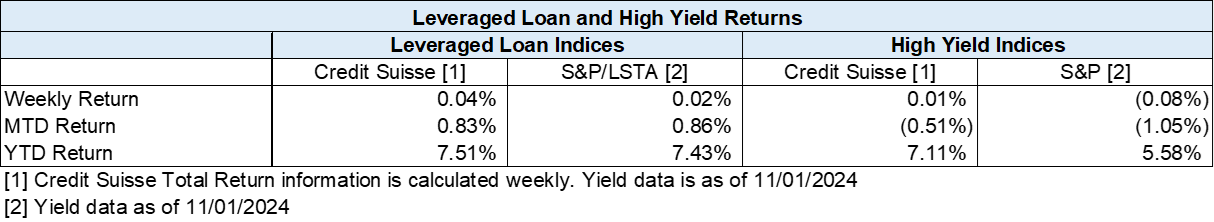

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

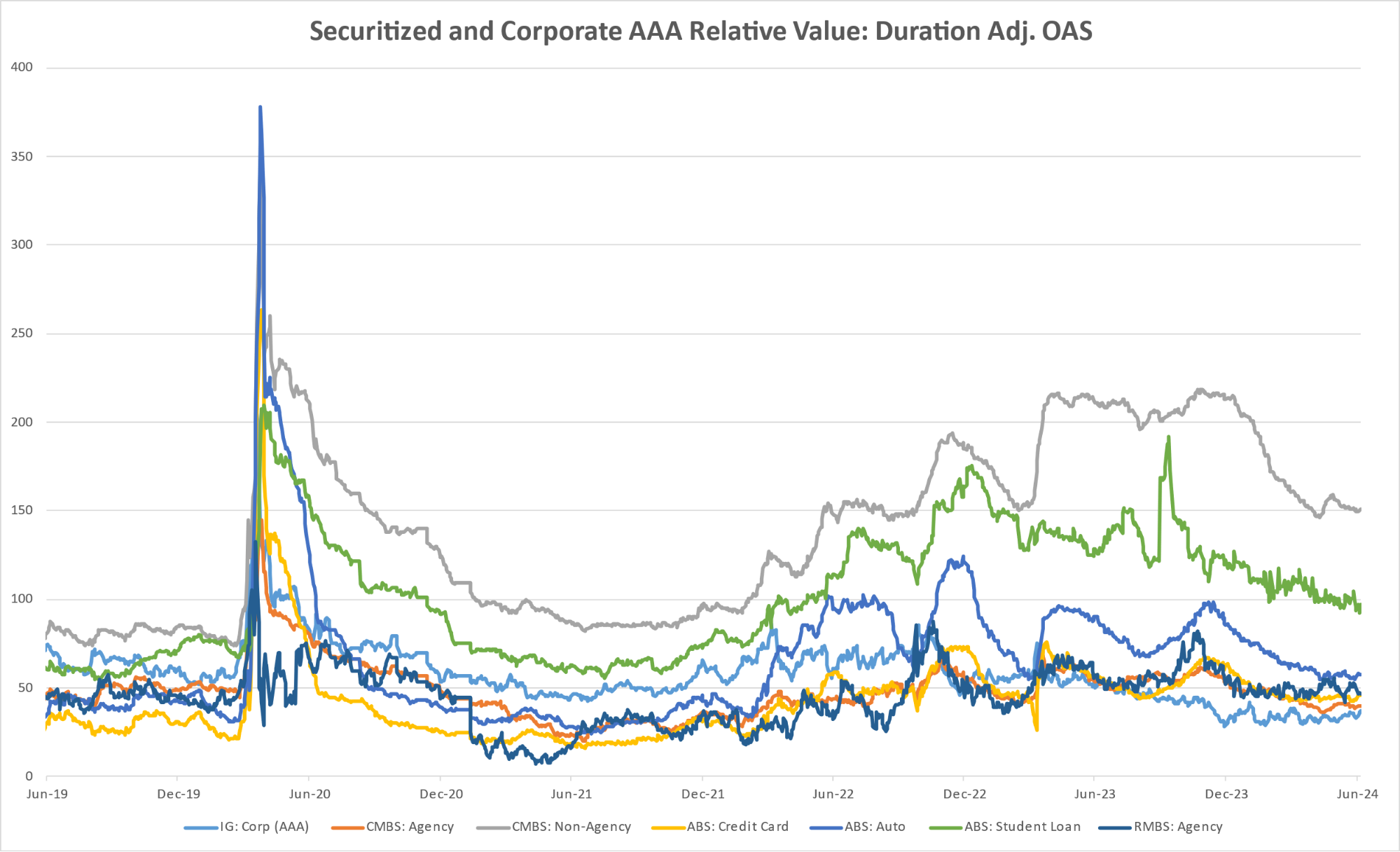

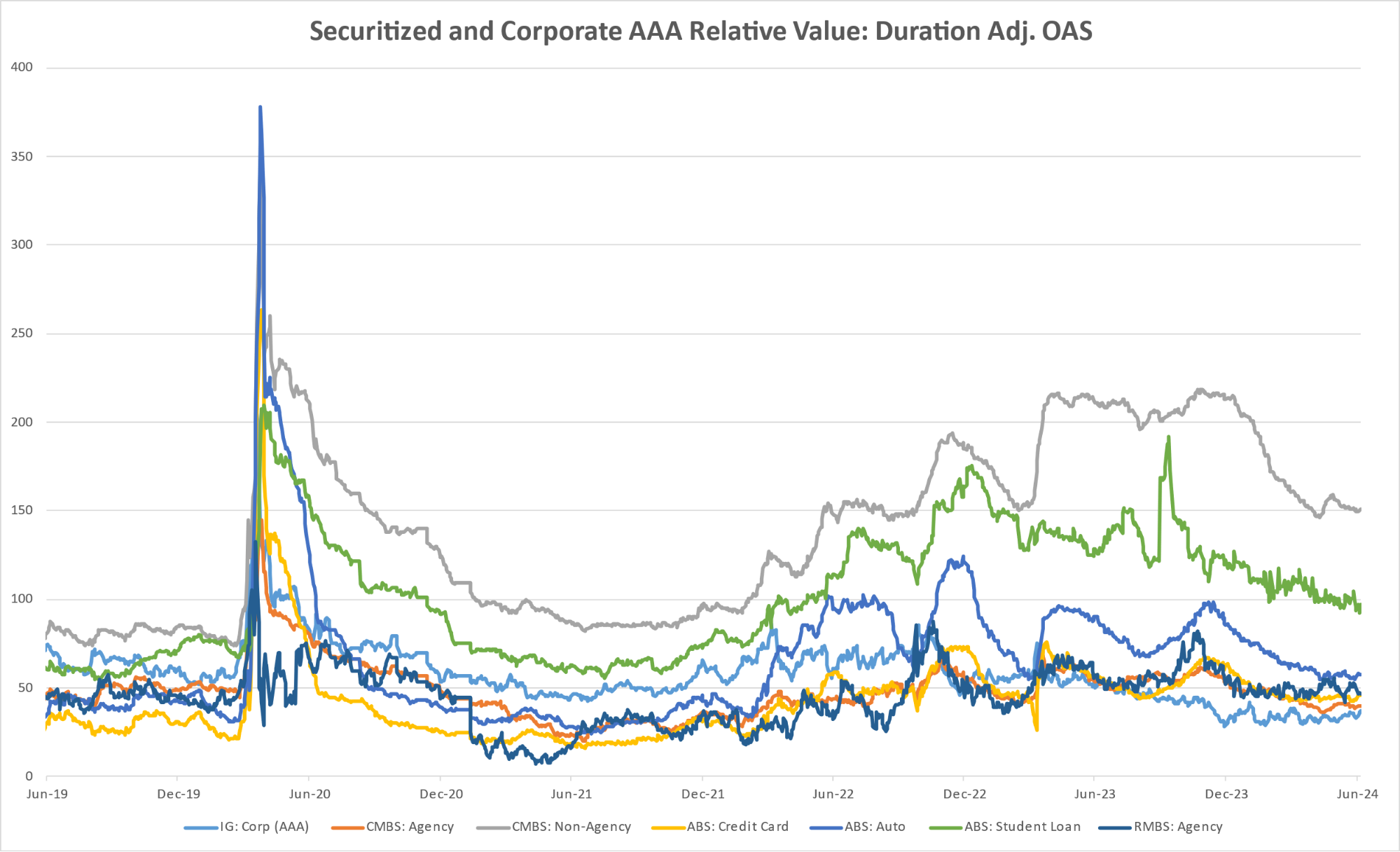

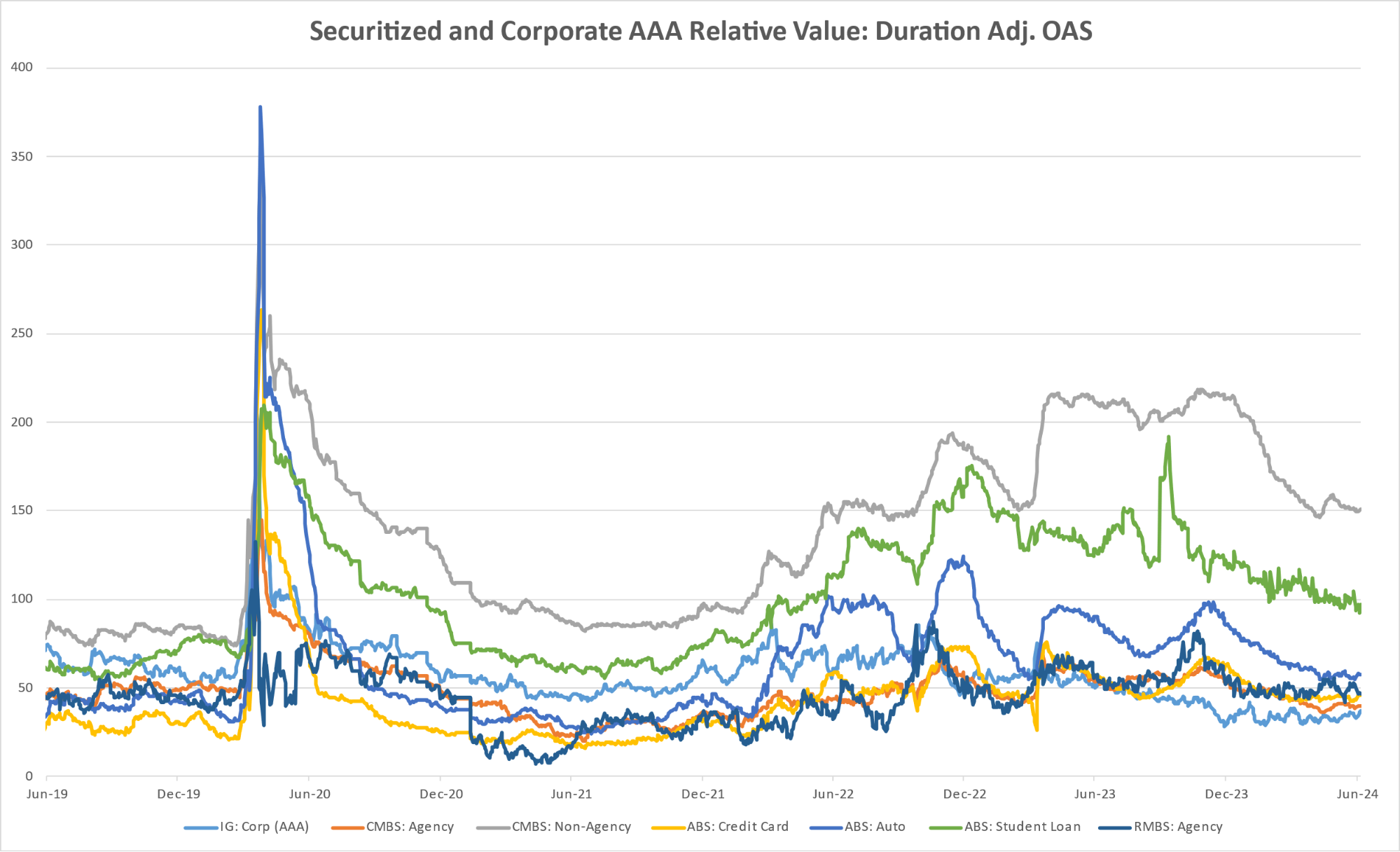

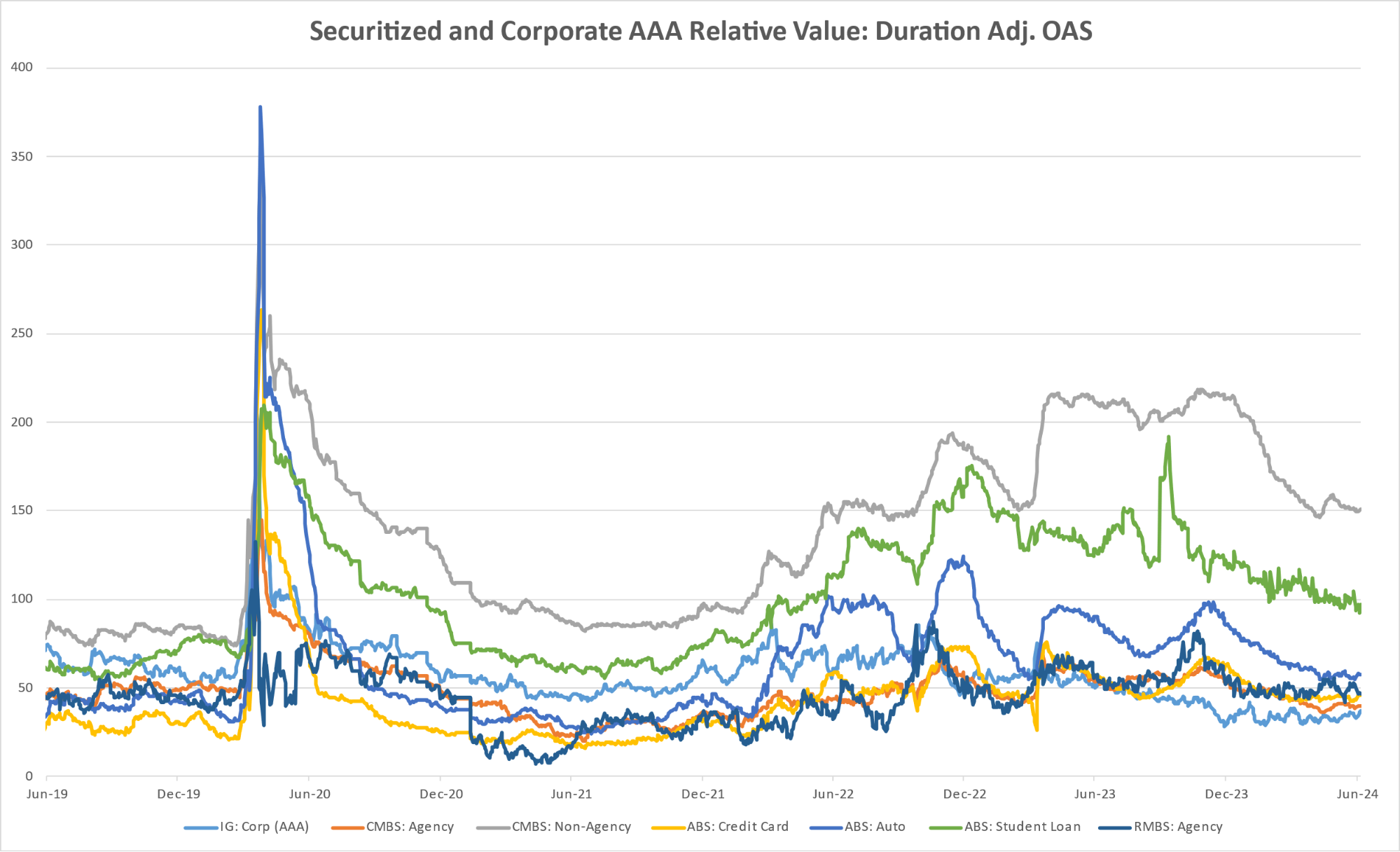

Diagram S: Structured Credit Spreads

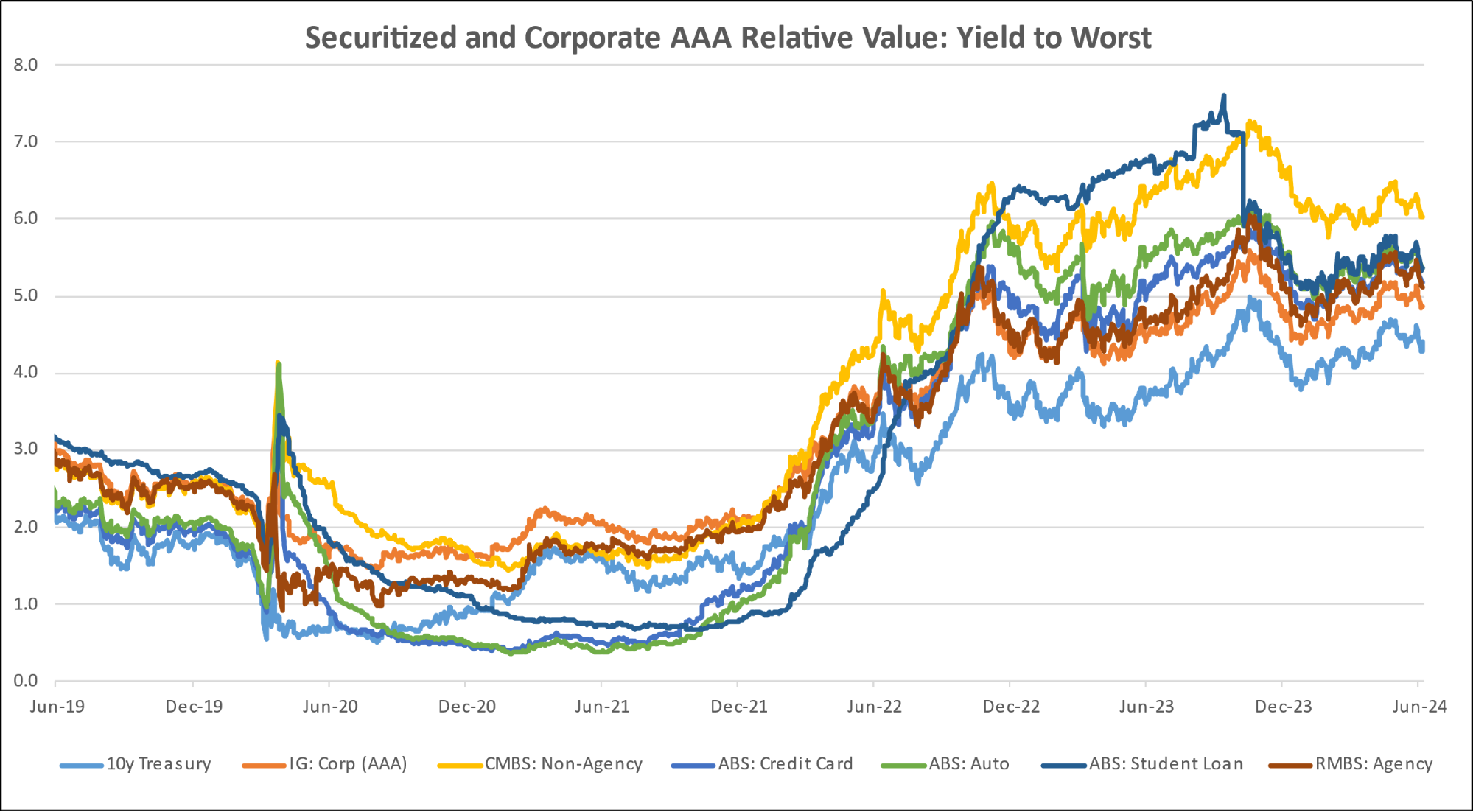

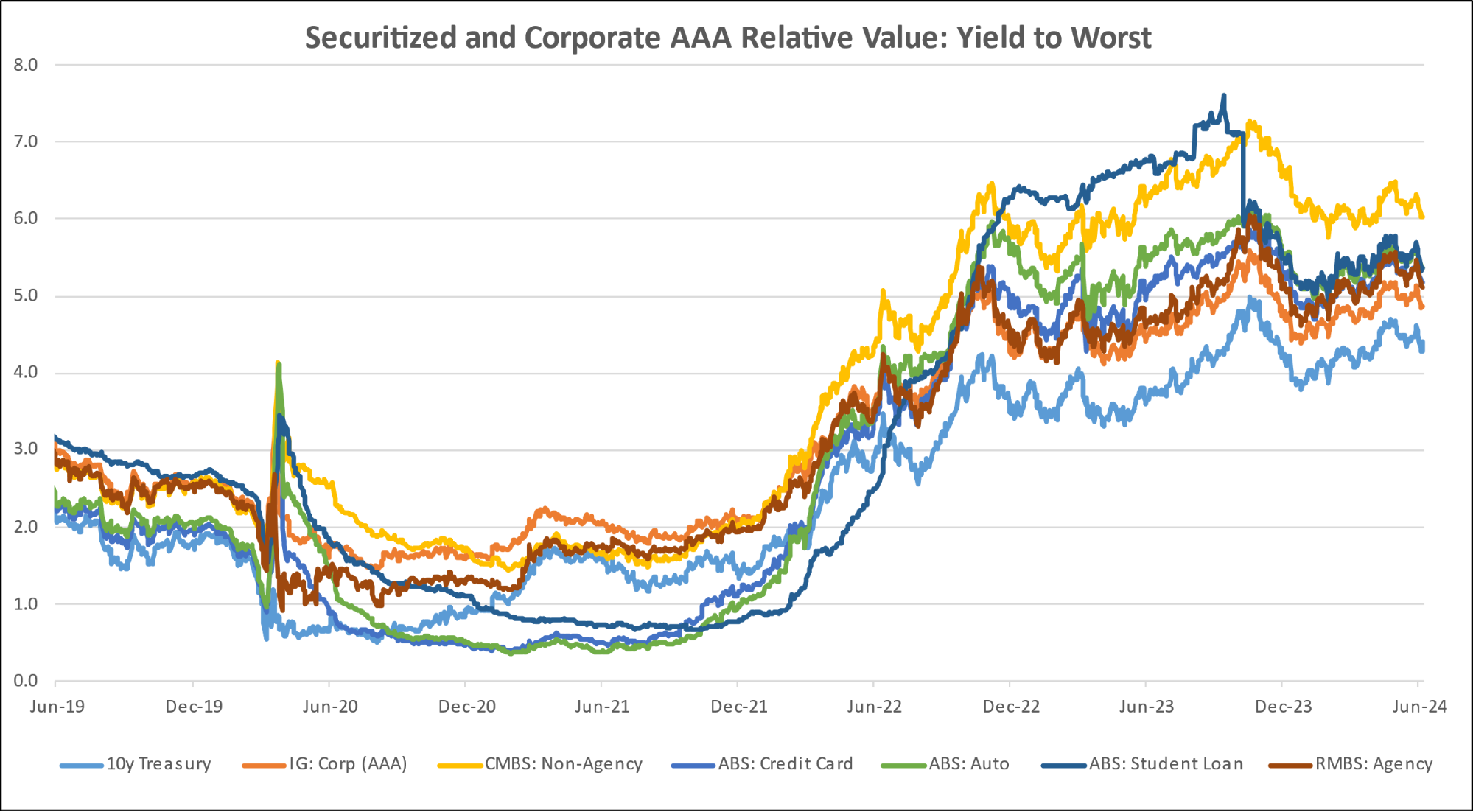

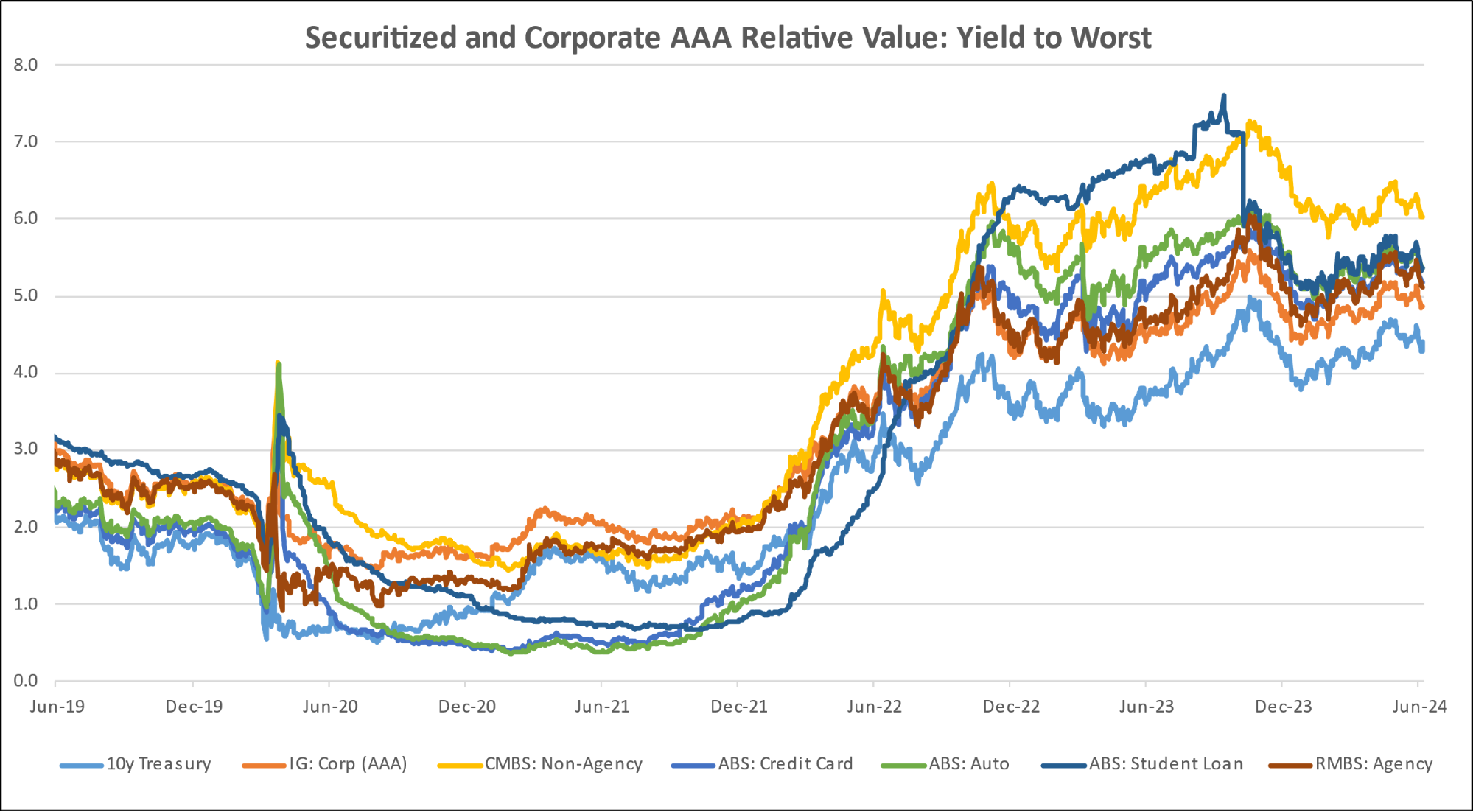

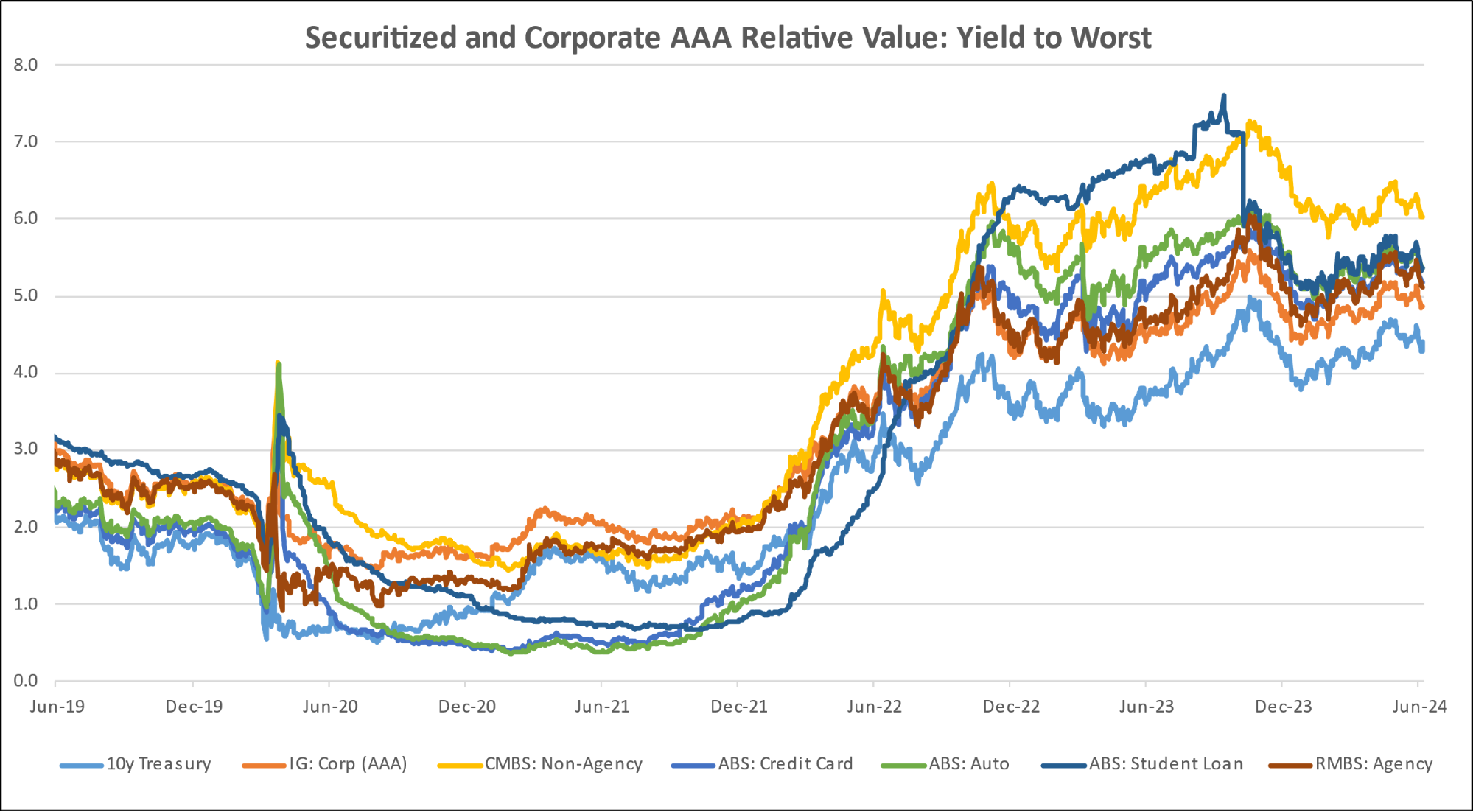

Diagram T: Structured Credit Yield

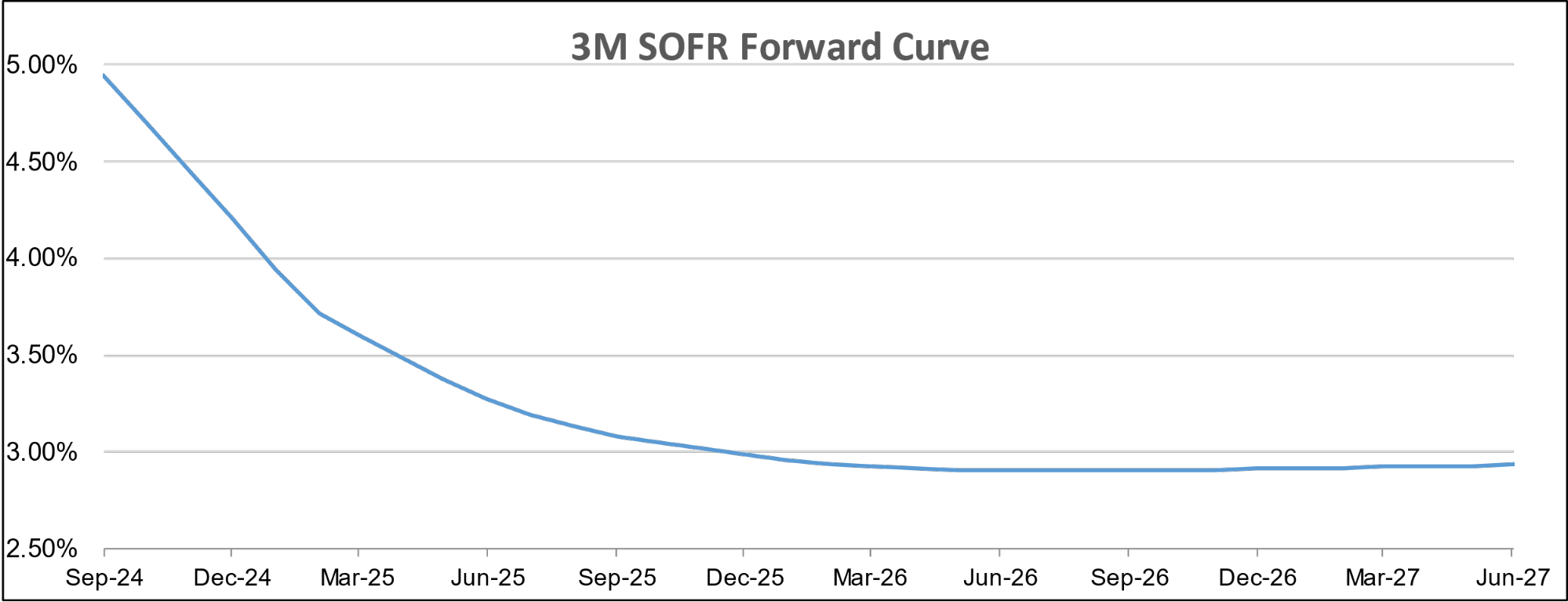

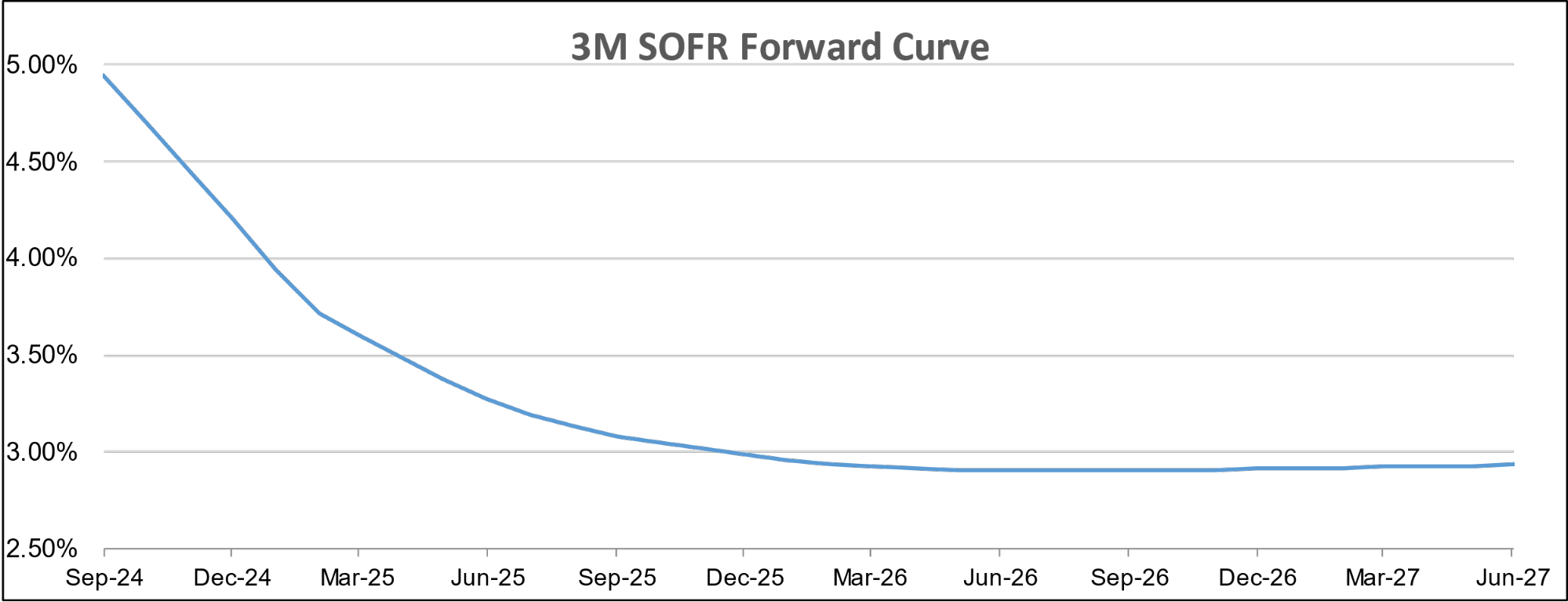

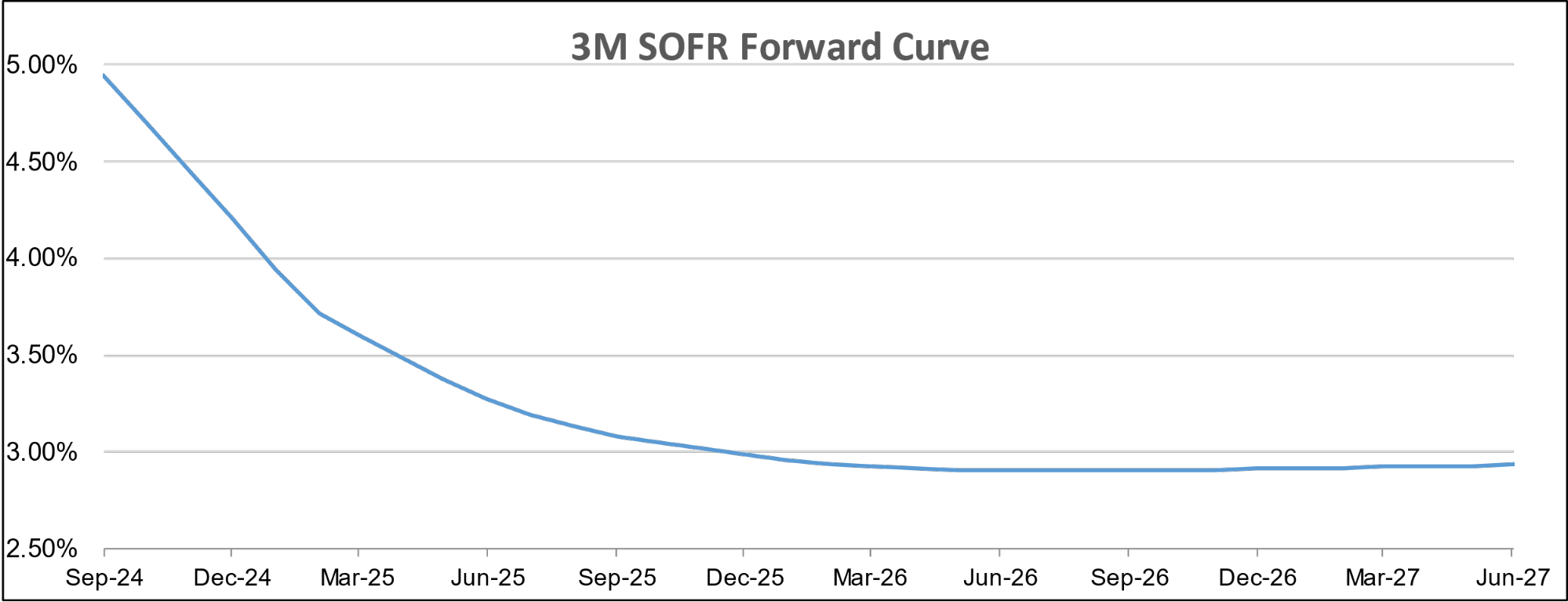

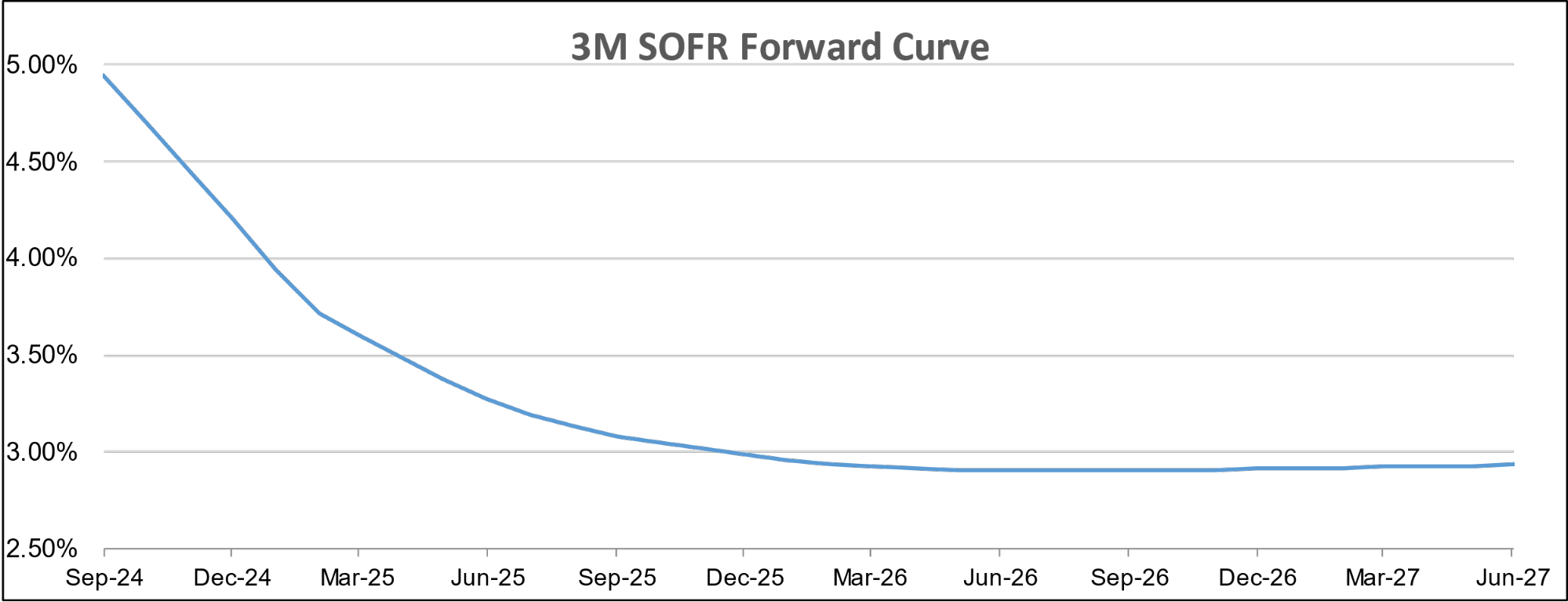

Diagram U: SOFR CURVE

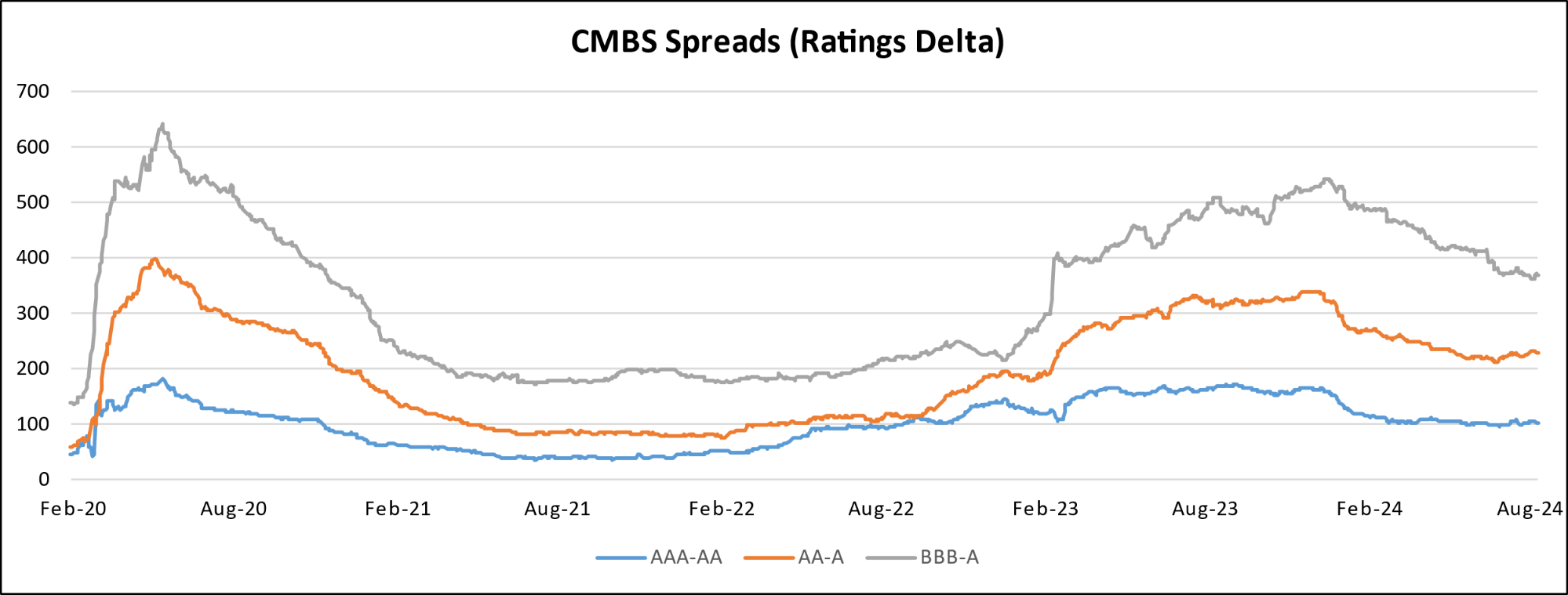

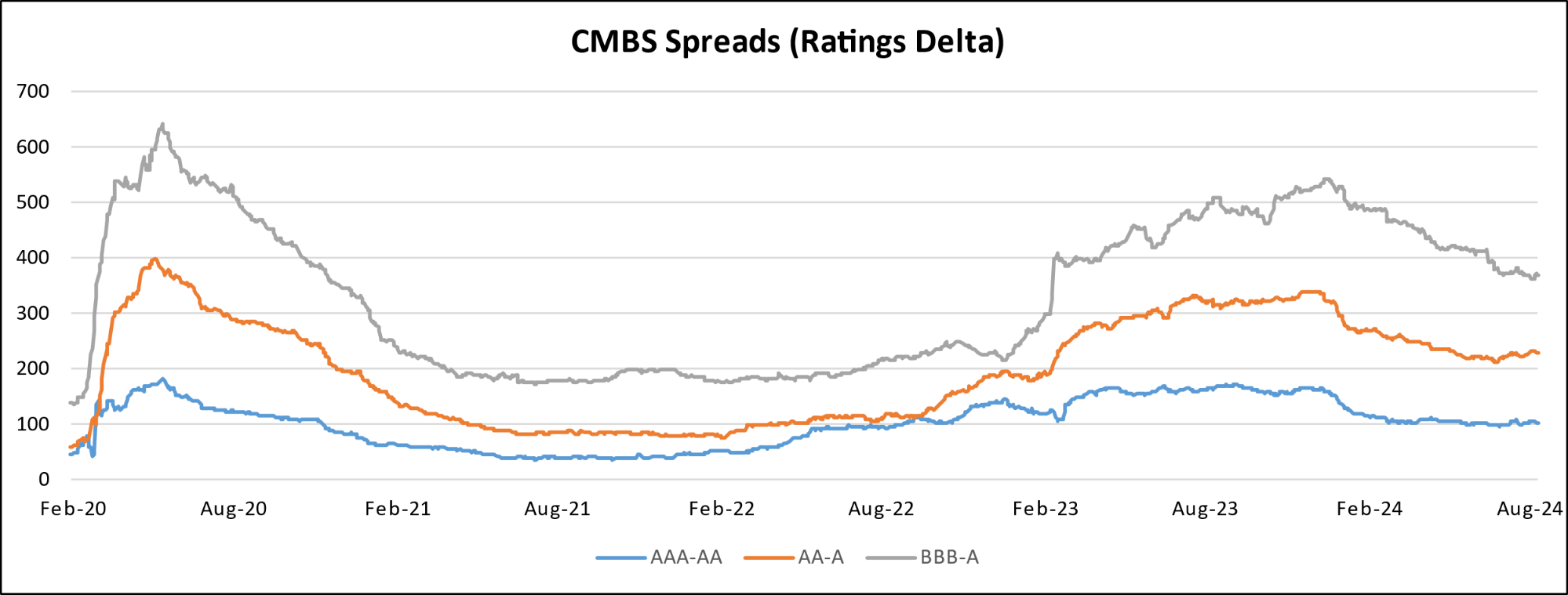

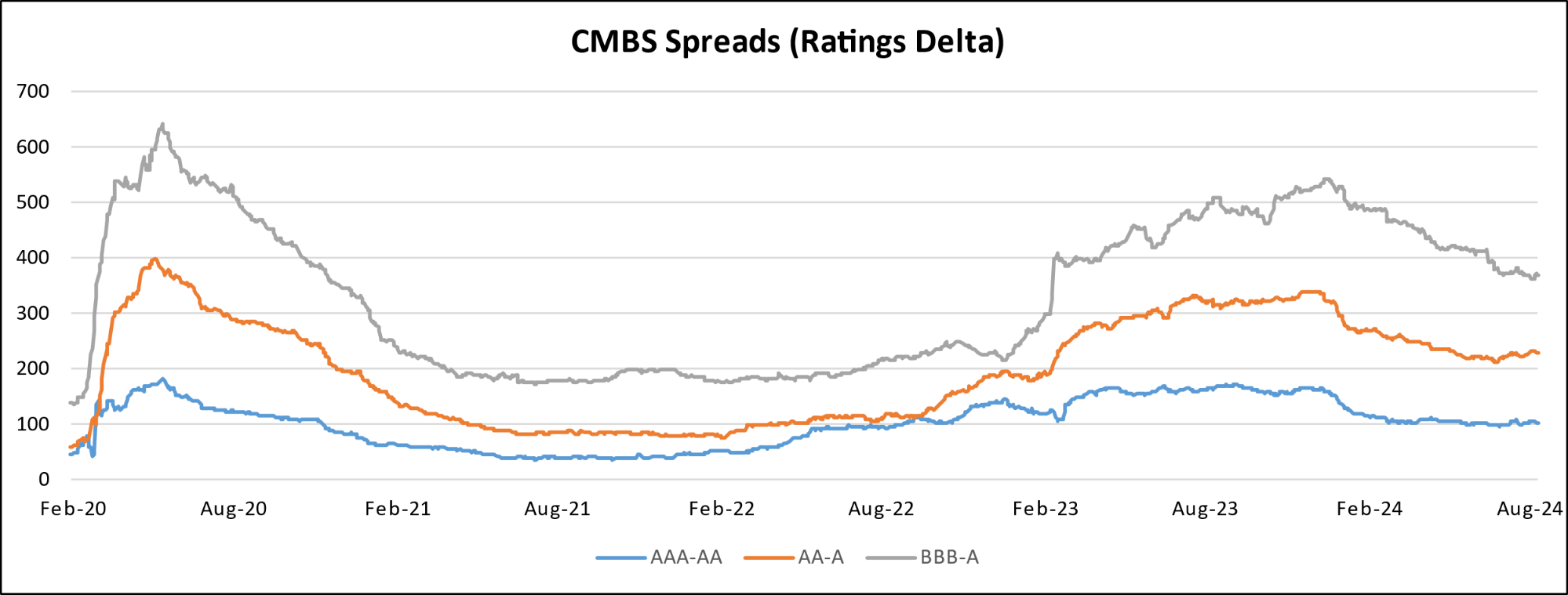

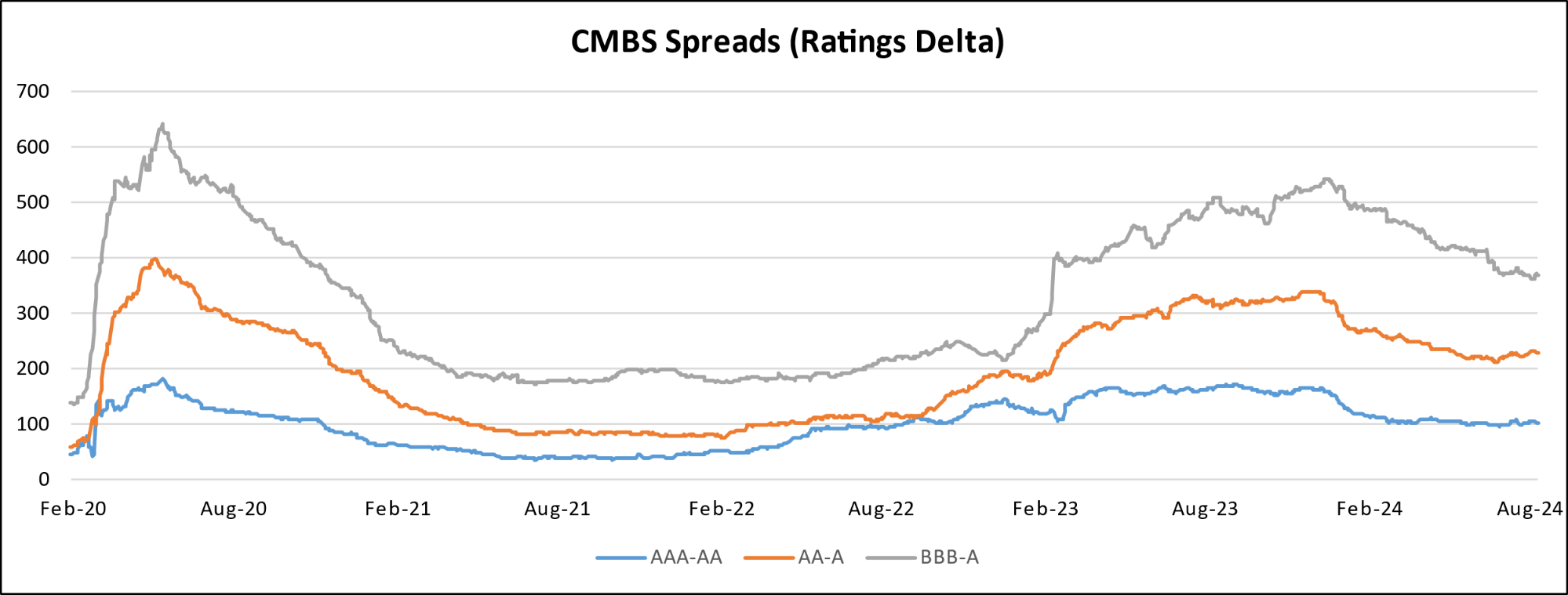

Diagram V: CMBS Spreads

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- U.S. Employment Report

- The US added only 12,000 jobs in October, far below the expected 120,000, primarily due to the Boeing strike and hurricane disruptions

- The unemployment rate remained at 4.1%, with average hourly earnings rising by 0.4% to $35.46, a 4.0% year-over-year increase

- Health care and government employment grew, adding 52,000 and 40,000 jobs, respectively, while manufacturing lost 46,000 jobs and temporary help services declined by 49,000

- Consumer Sentiment

- The U.S. Consumer Confidence Index reached a nine-month high of 108.7 in October, reversing last month’s decline

- The Present Situation Index rose 14.2 points to 138.0, and the Expectations Index increased 6.3 points to 89.1, reflecting optimism in business and labor markets

- Consumers’ recession expectations hit a record low since tracking began in July 2022, with improved outlooks on future finances and job prospects

- Construction Spending

- Construction spending rose 0.1% in September to $2.15 trillion, reaching a four-month high and surpassing expectations

- Private residential construction increased by 0.2%, with single-family projects up 0.4% and multi-family down 0.1%

- Public residential construction spending rose by 2.3% in September

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 216,000 in the week ended October 25, down 12,000 from the prior week

- The four-week moving average was 236,500, down 2250 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – decreased by 26,000 to 1.862 million in the week ended October 18. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.013 trillion in the week ended November 1, down $15.9 billion from the prior week

- Treasury holdings totaled $4.358 trillion, up $0.1 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.27 trillion in the week, down $14.3 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.95 trillion as of November 1, an increase of 6.7% from the previous year

- Debt held by the public was $28.57 trillion, and intragovernmental holdings were $7.16 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 2.4% in September year over year

- On a monthly basis, the CPI increased 0.2% in September on a seasonally adjusted basis, after increasing 0.2% in August

- The index for all items less food and energy (core CPI) rose 0.3% in September, after rising 0.3% in August

- Core CPI increased 3.3% for the 12 months ending September

- Food and Beverages:

- The food at home index increased 1.3% in September from the same month a year earlier, and increased 0.4% in September month over month

- The food away from home index increased 3.9% in September from the same month a year earlier, and increased 0.3% in September month over month

- Commodities:

- The energy commodities index decreased (4.0%) in September after decreasing (0.6%)

- The energy commodities index fell (15.3%) over the last 12 months

- The energy services index 0.4% in September after decreasing (0.8%) in June

- The energy services index rose 3.4% over the last 12 months

- The gasoline index rose (15.3%) over the last 12 months

- The fuel oil index fell (22.4%) over the last 12 months

- The index for electricity rose 3.7% over the last 12 months

- The index for natural gas fell 2.0% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,213.02 per 40ft container

- Drewry’s composite World Container Index has increased by 128.5% over the last 12 months

- Housing Market:

- The shelter index increased 0.2% in September after increasing 0.5% in August

- The rent index increased 0.2% in September after increasing 0.5% in August

- The index for lodging away from home decreased (3.8%) in August after decreasing (0.7%) in June

- Federal Funds Rate

- The effective Federal Funds Rate is at 4.83%, down (0.50%) year to date

World News

-

Middle East

- Israeli naval commandos from Shayetet 13 conducted a nighttime raid in Batroun, northern Lebanon, capturing Imad Amhaz, a 38-year-old Lebanese national. Israel claims Amhaz is a senior Hezbollah operative involved in the group’s naval operations

- Iran has warned of significant retaliation following the Israeli airstrike, which killed four soldiers and damaged advanced air defenses. Iranian officials, including Supreme Leader Ayatollah Ali Khamenei, have issued strong statements, escalating concerns of a broader regional conflict, with the U.S. deploying additional military assets to the area in response

- Senior U.S. officials are in Israel discussing a draft agreement to end the war in Lebanon, which includes a 60-day period allowing Israel to strike Lebanon in response to imminent threats and calls for the enforcement of U.N. Security Council Resolution 1701; however, Hezbollah and Lebanese officials are resistant due to sovereignty concerns, though they are open to further negotiations

- Israel’s Parliament passed a law to ban the United Nations agency for Palestinian refugees (Unrwa) from operating in Israeli territory, limiting its ability to deliver aid in Gaza and the West Bank, despite opposition from the U.S. and other allies. Israel cited concerns of alleged bias and suspected ties with Hamas among Unrwa staff, viewing it as a security risk

-

Russia

- The U.S. has confirmed that around 8,000 North Korean troops are in Russia’s Kursk region, with plans for imminent deployment against Ukraine, marking a significant escalation involving foreign troops in the conflict

- U.S. Secretary of State Antony Blinken stated that North Korean troops fighting in Ukraine would be considered “legitimate military targets.” However, Washington faces limited options for response, with existing sanctions on Russia and North Korea already heavily enforced

- Ukraine has prepared prisoner-of-war facilities and encouraged North Korean soldiers to surrender, signaling Kyiv’s efforts to mitigate the impact of these foreign forces while pressing Western allies, including South Korea, for additional military support and air defenses

-

China

- China’s National People’s Congress (NPC) will hold a five-day meeting starting Monday, where expectations are set for a possible $1.4 trillion stimulus package to address economic challenges

- Analysts anticipate a local-government debt swap, potentially around 6 trillion yuan ($842.9 billion), aimed at refinancing debt, although it may not directly drive real economic demand

- The Caixin manufacturing purchasing managers index for China rose to 50.3 in October, indicating growth after five months of contraction, aligning with an official gauge showing similar expansion

- Despite growth in domestic demand, external demand remained weak, with the gauge for new export orders showing contraction for the third consecutive month in October

-

Spain

- Following torrential rains on the night of October 29, 2024, flash floods in the Valencia region of Spain led to at least 214 deaths and significant devastation in towns like Paiporta and Picanya. The Spanish government deployed over 7,500 military personnel, along with 400 vehicles, 30 helicopters, and an amphibious ship, to assist in rescue efforts and restore water, electricity, and telecommunications amid restricted road access and reports of looting

-

UK

- Kemi Badenoch, the first Black woman to lead the U.K.’s Conservative Party, has been chosen to revitalize the Tories after a historic defeat, focusing on cultural conservatism, limited government, and immigration control, while facing challenges from Labour’s Keir Starmer and Nigel Farage’s Reform UK. Known for her direct style, Badenoch emphasizes honesty about past mistakes and the need for pragmatic policies

-

Japan

- Japan’s ruling coalition lost its parliamentary majority in the recent election, creating political uncertainty that could delay interest rate hikes by the Bank of Japan, leading to a weakened yen. Despite this, Japan’s domestic economic conditions, such as a tight job market and core inflation of 2.1%, still point towards gradual monetary tightening

-

Canada

- Canada has accused India’s Home Minister, Amit Shah, of authorizing operations targeting Sikh separatists in Canada, escalating tensions between the two countries. The allegations come after previous claims that Indian agents were involved in the 2023 killing of Sikh activist Hardeep Singh Nijjar in Canada, a charge India has denied, calling the accusations politically motivated

-

India

- A former employee of India’s intelligence service has been charged by U.S. prosecutors for allegedly directing a plot to kill Sikh activist Gurpatwant Singh Pannun in New York, escalating tensions between India and Western countries regarding the targeting of Sikh separatists

-

Peru

- Former Peruvian President Alejandro Toledo was sentenced to more than 20 years in prison for taking a $20 million dollar bribe from Brazilian construction company Odebrecht in exchange for a highway contract

-

Cuba

- Cuba’s government has struggled to return power to millions of Cubans after a blackout impacted everything from running water to the operation of banks and ATMs

-

Africa

- A new deal gives Ethiopia naval access to Somaliland in exchange for recognizing Somaliland’s independence, escalating tensions with Somalia, which strongly opposes the move. The conflict risks undermining anti-al-Shabaab efforts, involving Egypt, and destabilizing the Horn of Africa further, raising international concerns

Commodities

-

Oil Prices

- WTI: $69.45 per barrel

- (3.25%) WoW; (3.01%) YTD; (15.78%) YoY

- Brent: $73.03 per barrel

- (3.97%) WoW; (5.11%) YTD; (15.91%) YoY

-

US Production

- U.S. oil production amounted to 13.5 million bpd for the week ended October 25, down 0.0 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 585, down 0 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 425.5 million barrels, up 0.9% YoY

- Refiners operated at a capacity utilization rate of 89.1% for the week, down from 89.5% in the prior week

- U.S. crude oil imports now amount to 6.431 million barrels per day, down (7.0%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.12 per gallon in the week of November 1,

down (9.2%) YoY

- Gasoline prices on the East Coast amounted to $3.16, down (8.1%) YoY

- Gasoline prices in the Midwest amounted to $3.00, down (9.8%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.74, down (10.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.32, down (10.1%) YoY

- Gasoline prices on the West Coast amounted to $4.11, down (15.3%) YoY

- Motor gasoline inventories were down by 2.7 million barrels from the prior week

- Motor gasoline inventories amounted to 210.9 million barrels, down (5.7%) YoY

- Production of motor gasoline averaged 9.70 million bpd, up 2.1% YoY

- Demand for motor gasoline amounted to 9.159 million bpd, up 5.3% YoY

-

Distillates

- Distillate inventories decreased by -1.0 million in the week of November 1

- Total distillate inventories amounted to 112.9 million barrels, up 1.4% YoY

- Distillate production averaged 4.863 million bpd, up 6.2% YoY

- Demand for distillates averaged 3.881 million bpd in the week, up 5.4% YoY

-

Natural Gas

- Natural gas inventories increased by 78 billion cubic feet last week

- Total natural gas inventories now amount to 3,863 billion cubic feet, up 2.2% YoY

Credit News

High yield bond yields increased 2bps to 7.27% and spreads decreased 9bps to 313bps. Leveraged loan yields increased 20bps to 8.67% and spreads increased 4bps to 479bps. WTD Leveraged loan returns were positive 4bps. WTD high yield bond returns were positive 1bps. 10yr treasury yields increased 8bps to 4.28%. High-yield bond spreads reached a post GFC low this week as investors absorbed 3Q earnings, elevated rate volatility, retail outflows, and economic data which continue to align with a soft or no landing economic narrative. Leveraged loans provided their strongest gains in 5 months in October amid steady ETF inflows, heavy CLO origination, the most active primary for October on record, and as investors calibrate less Fed cuts amid a resilient economy.

High-yield:

Week ended 11/01/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 11/01/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24), Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions ($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), and Quorum Health Group ($688mn, 7/10/24).

CLOs:

Week ended 11/01/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Diagram V: CMBS Spreads

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index