U.S. News

- Interest Rates

- The Federal Reserve approved a 0.25 percentage point interest rate cut, its second consecutive reduction, bringing the benchmark rate to 4.50% – 4.75%

- Powell said for now the economic outlook was solid and stated that “we think that the economy, and we think our policies, are both in a very good place”

- Markets expect one more rate cut in December

- Trade Deficit

- The U.S. trade deficit surged 19.2% to $84.4 billion in September from $70.8 billion in the prior month, the highest in 30 months, driven by a spike in imports

- The trade deficit shaved 0.6% percentage points off the rate of U.S. growth in the three months from July to September

- Imports rose 3.0% in September to a record $352.3 billion

- Factory Orders

- Orders for manufactured goods fell 0.5% in September, marking the fourth decline in five months, with a notable drop in civilian airplane orders driving the decrease

- Overall, the manufacturing sector has been sluggish for two years, with PMI in contraction territory for seven straight months

- Durable goods orders slid to a 0.7% decline for September, following a 0.9% drop in August

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S.,

increased to 221,000 in the week ended November 1, up 3,000 from the prior week

- The four-week moving average was 227,250, down 9,750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 39,000 to 1.892 million in the week ended October 25. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $6.994 trillion in the week ended November 8, down $19.2 billion from the prior week

- Treasury holdings totaled $4.340 trillion, down $17.9 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.27 trillion in the week, down $14.6 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.94 trillion as of November 8, an increase of 6.7% from the previous year

- Debt held by the public was $28.61 trillion, and intragovernmental holdings were $7.38 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 2.4% in September year over year

- On a monthly basis, the CPI increased 0.2% in September on a seasonally adjusted basis, after increasing 0.2% in August

- The index for all items less food and energy (core CPI) rose 0.3% in September, after rising 0.3% in August

- Core CPI increased 3.3% for the 12 months ending September

- Food and Beverages:

- The food at home index increased 1.3% in September from the same month a year earlier, and increased 0.4% in September month over month

- The food away from home index increased 3.9% in September from the same month a year earlier, and increased 0.3% in September month over month

- Commodities:

- The energy commodities index decreased (4.0%) in September after decreasing

- The energy commodities index fell (15.3%) over the last 12 months

- The energy services index 0.4% in September after decreasing (0.8%) in June

- The energy services index rose 3.4% over the last 12 months

- The gasoline index rose (15.3%) over the last 12 months

- The fuel oil index fell (22.4%) over the last 12 months

- The index for electricity rose 3.7% over the last 12 months

- The index for natural gas fell 2.0% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,443.90 per 40ft

- Drewry’s composite World Container Index has increased by 129.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.2% in September after increasing 0.5% in August

- The rent index increased 0.2% in September after increasing 0.5% in August

- The index for lodging away from home decreased (3.8%) in September after decreasing (0.7%) in August

- Federal Funds Rate

- The effective Federal Funds Rate is at 4.83%, down (0.50%) year to date

World News

-

Middle East

- Israeli Prime Minister Netanyahu fired his defense minister, Yoav Gallant, following months of public disagreement over the handling of the wars in Gaza and Lebanon

- Gallant has been a key figure in U.S.-Israel defense coordination and was a vocal advocate for a ceasefire in Gaza. Foreign Minister Israel Katz will replace Gallant as defense minister

- The FBI thwarted an Iranian plot to assassinate Donald Trump before he was re-elected as president. An Iranian operative told law enforcement that an official in Iran’s paramilitary Revolutionary Guard directed him in September to put together a plan to surveil and ultimately kill Trump

- The operative, identified as Farhad Shakeri, warned the official that crafting such a plan would be very costly. The official in October told Shakeri if he couldn’t pull together a plan within seven days, they would put the assassination plot on hold until after the election, believing Trump would lose and it would be easier to kill him then

-

Russia

- The Biden Administration has lifted restrictions on American military contractors deploying to Ukraine, allowing them to assist in maintaining and repairing U.S.-provided weapons systems such as fighter jets and air defense systems

- Contractors will be stationed away from the frontlines and will not engage in combat. This is to limit direct U.S. military involvement in Ukraine

- The Biden Administration plans to expedite as much as $9 billion dollars’ worth of security assistance to Ukraine before Biden leaves office in January. This includes the transfer of billions of dollars in weapons from U.S. stocks

-

China

- The National People’s Congress (NPC) approved a $1.4 trillion package to help local governments swap off some of their mounting off-balance-sheet debts

- The package includes issuing $837 billion in bonds over 3 years to replace local governments’ hidden debts. The total package is disappointing to investors, who expected a fiscal-stimulus package to be unveiled alongside the debt-swap program

- China’s exports rose at a faster-than-expected pace last month, with outbound shipments rising 12.7% from a year earlier in October, up sharply from the 2.4% increase in September

- The trade surplus rose to $95.7 billion in October, up from $81.7 billion in September, exceeding the expected $74.4 billion

-

Germany

- Germany’s government is in a political gridlock after a dispute over economic policy between coalition partners. The Free Democratic Party (FDP) is pushing for tax cuts and welfare reductions while the Social Democratic Party (SPD) is advocating for higher government spending, including subsidies for industries and additional support for Ukraine. This gridlock has led to a vote of confidence, potentially resulting in early elections

-

Pakistan

- Pakistan’s government is strengthening its control through new laws that limit judicial power, extend the army chief’s term, and allow detention without charges, amid growing political repression. Despite some economic improvements, the country remains politically unstable

-

Mexico

- Mexico’s Supreme Court narrowly voted against blocking a controversial judicial reform pushed by President Sheinbaum’s government, which would elect judges by popular vote. The reform has sparked concerns over the independence of the judiciary and its potential impact on Mexico’s democracy and business climate

-

Spain

- Following torrential rains and flash floods in the Valencia region of Spain led to at least 214 deaths and significant devastation in towns like Paiporta and Picanya. The Spanish government deployed over 7,500 military personnel, along with 400 vehicles, 30 helicopters, and an amphibious ship, to assist in rescue efforts and restore water, electricity, and telecommunications amid restricted road access and reports of looting

-

UK

- Kemi Badenoch, the first Black woman to lead the U.K.’s Conservative Party, has been chosen to revitalize the Tories after a historic defeat, focusing on cultural conservatism, limited government, and immigration control, while facing challenges from Labour’s Keir Starmer and Nigel Farage’s Reform UK. Known for her direct style, Badenoch emphasizes honesty about past mistakes and the need for pragmatic policies

-

Japan

- Japan’s ruling coalition lost its parliamentary majority in the recent election, creating political uncertainty that could delay interest rate hikes by the Bank of Japan, leading to a weakened yen. Despite this, Japan’s domestic economic conditions, such as a tight job market and core inflation of 2.1%, still point towards gradual monetary tightening

-

Canada

- Canada has accused India’s Home Minister, Amit Shah, of authorizing operations targeting Sikh separatists in Canada, escalating tensions between the two countries. The allegations come after previous claims that Indian agents were involved in the 2023 killing of Sikh activist Hardeep Singh Nijjar in Canada, a charge India has denied, calling the accusations politically motivated

Commodities

-

Oil Prices

- WTI: $70.49 per barrel

- +1.44% WoW; (1.62%) YTD; (6.93%) YoY

- Brent: $74.04 per barrel

- +1.29% WoW; (3.89%) YTD; (7.46%) YoY

-

US Production

- U.S. oil production amounted to 13.5 million bpd for the week ended November 1, down 0.0 million bpd from the prior week

-

Rig Count

- The total number of oil rigs amounted to 585, down 0 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 427.7 million barrels, down (1.9%) YoY

- Refiners operated at a capacity utilization rate of 90.5% for the week, up from 89.1% in the prior week

- U.S. crude oil imports now amount to 5.975 million barrels per day, down (2.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.10 per gallon in the week of

$5.5 November 8, down (8.6%) YoY

- Gasoline prices on the East Coast $2.5 $1.5 amounted to $3.10, down (7.7%) YoY

- Gasoline prices in the Midwest amounted to $3.02, down (8.1%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.72, down (8.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.23, down (9.7%) YoY

- Gasoline prices on the West Coast amounted to $4.08, down (13.7%)

- Motor gasoline inventories were up by 0.4 million barrels from the prior week

- Motor gasoline inventories amounted to 211.3 million barrels, down (2.7%)

- Production of motor gasoline averaged 9.71 million bpd, down (5.1%) YoY

- Demand for motor gasoline amounted to 8.828 million bpd, down (7.0%) YoY

-

Distillates

- Distillate inventories decreased by 2.9 million in the week of November 8

- Total distillate inventories amounted to 115.8 million barrels, up 7.2% YoY

- Distillate production averaged 5.096 million bpd, up 8.4% YoY

- Demand for distillates averaged 3.406 million bpd in the week, down (20.8%)

-

Natural Gas

- Natural gas inventories increased by 69 billion cubic feet last week

- Total natural gas inventories now amount to 3,932 billion cubic feet, up 4.2% YoY

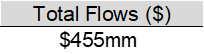

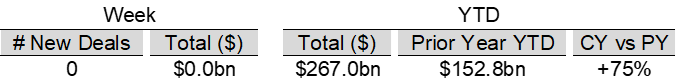

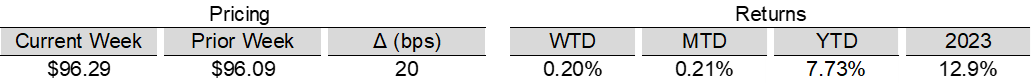

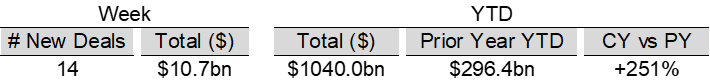

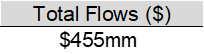

Credit News

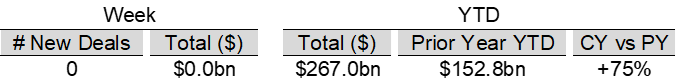

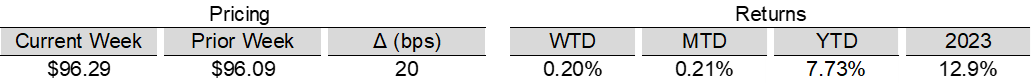

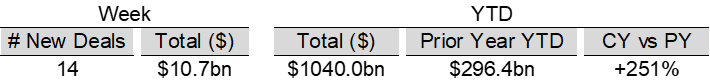

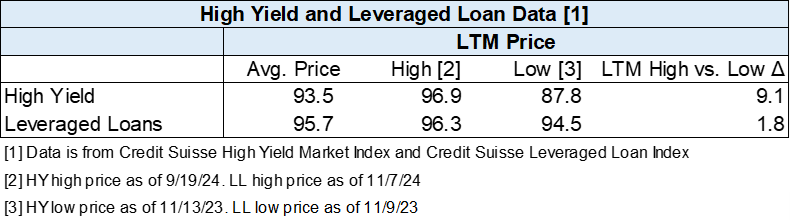

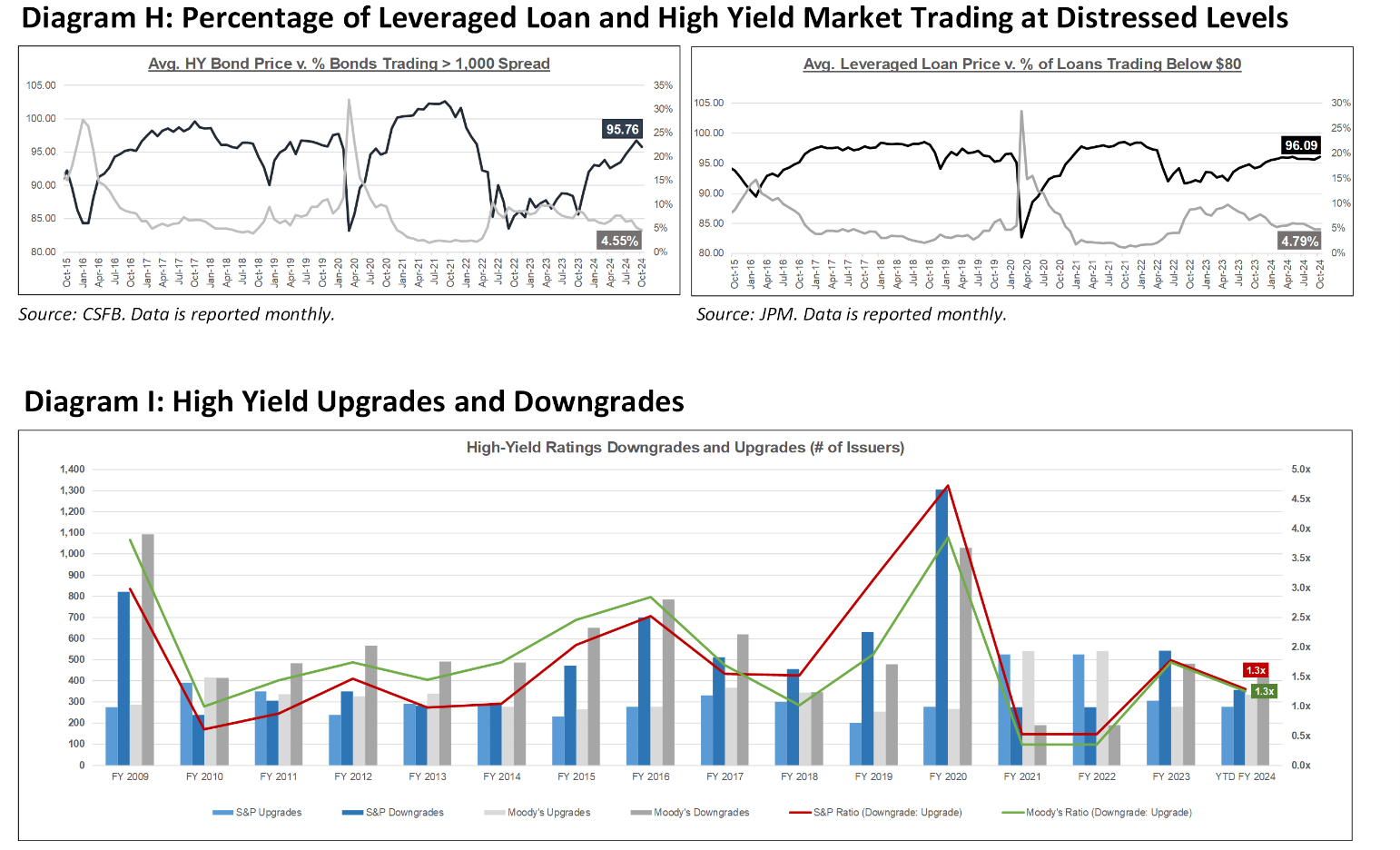

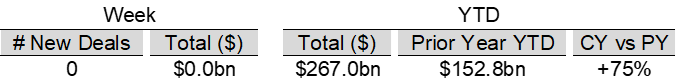

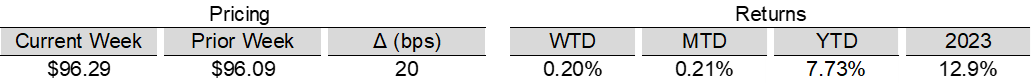

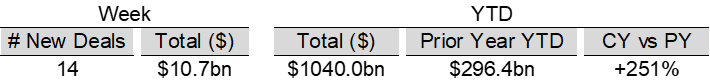

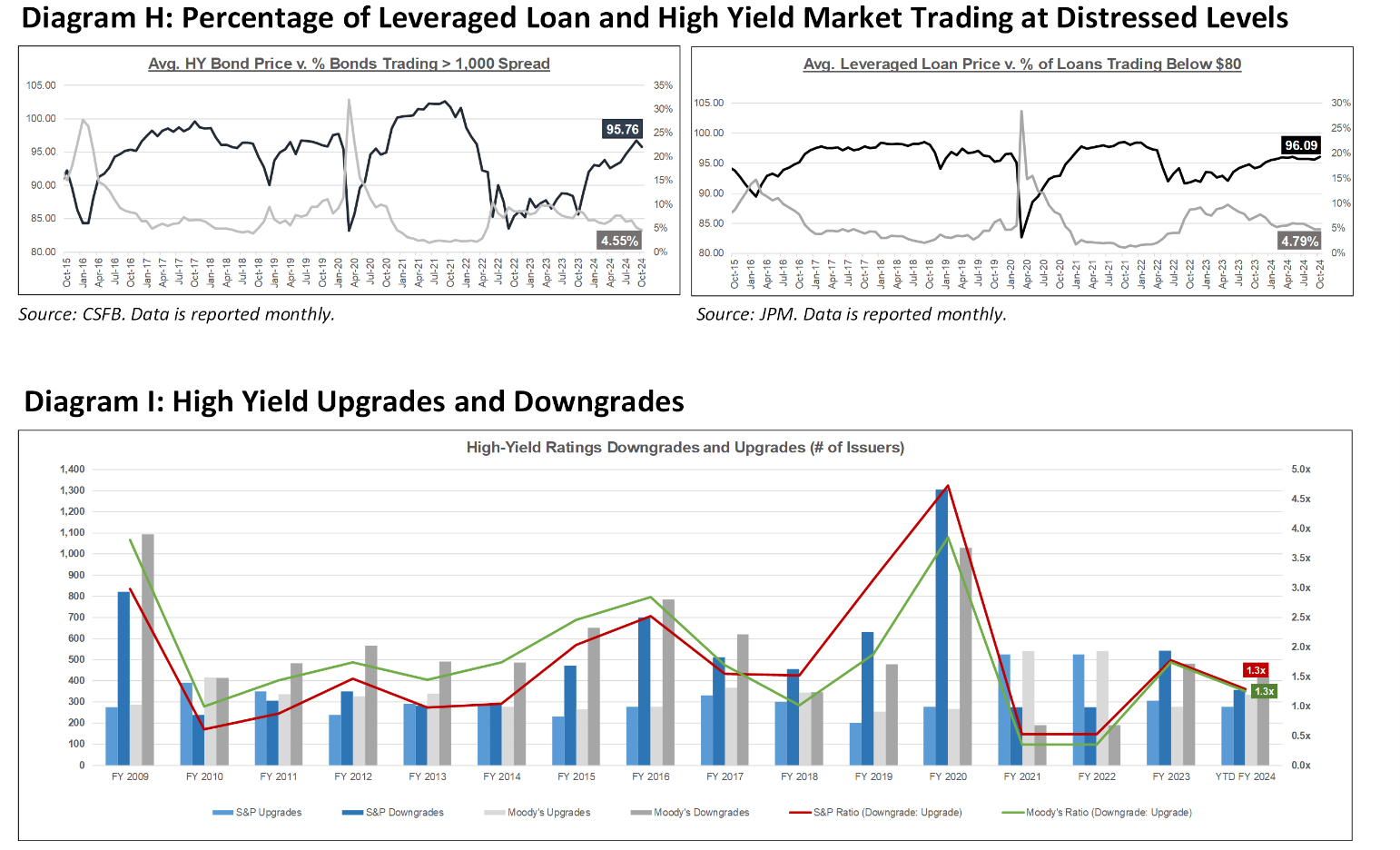

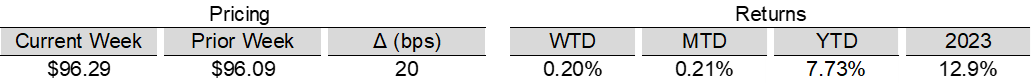

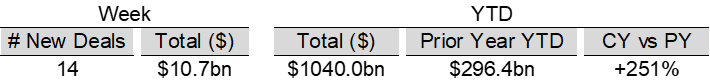

High yield bond yields decreased 11bps to 7.16% and spreads decreased 17bps to 297bps. Leveraged loan yields decreased 7bps to 8.60% and spreads decreased 10bps to 469bps. WTD Leveraged loan returns were positive 20bps. WTD high yield bond returns were positive 51bps. 10yr treasury yields increased 6bps to 4.34%. Yields and spreads decreased driven by election outcome and change in the Fed forecast.

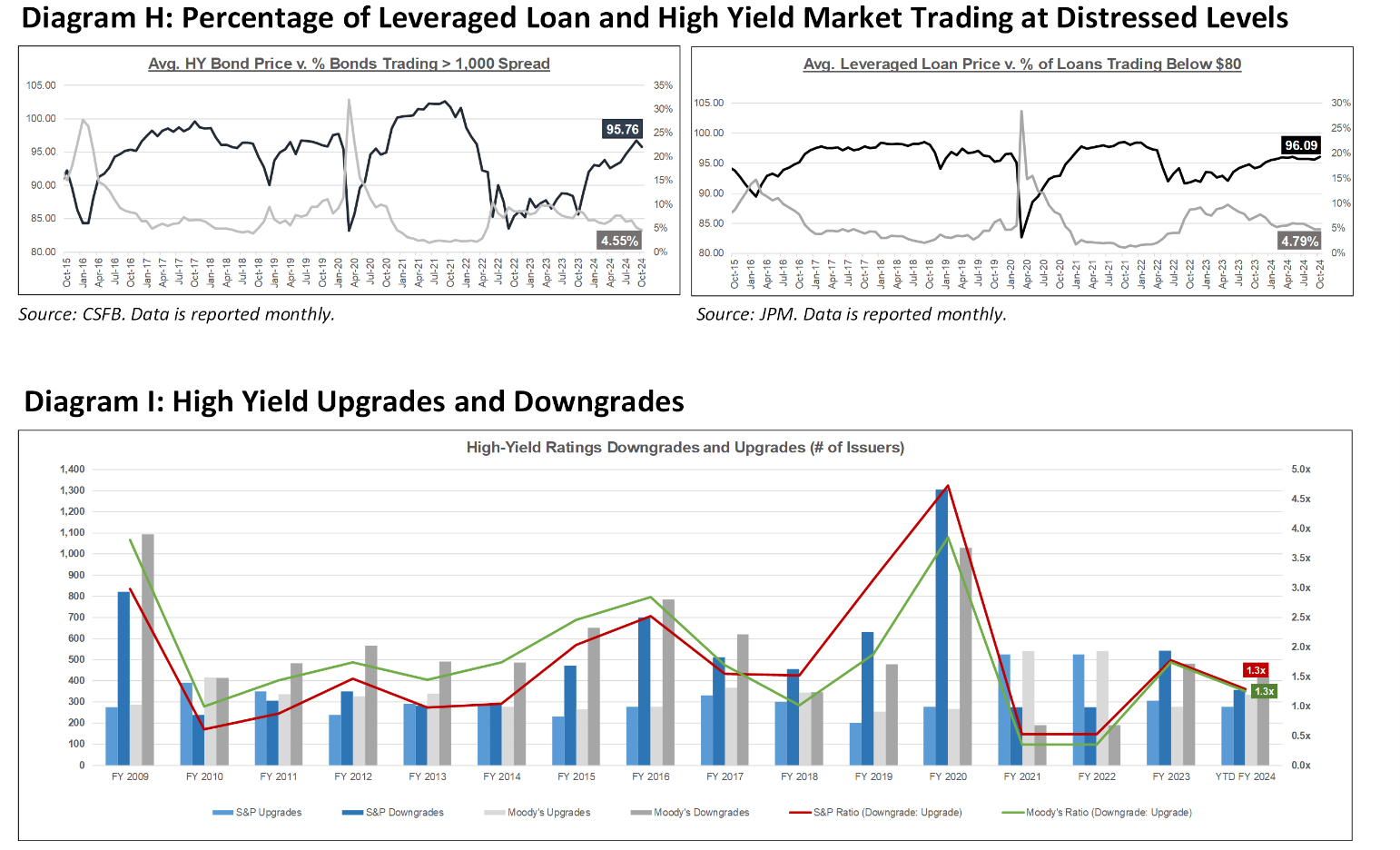

High-yield:

Week ended 11/08/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 11/08/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Franchise Group Inc ($1.1bn, 11/3/24), Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24), Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions ($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), and Quorum Health Group ($688mn, 7/10/24).

CLOs:

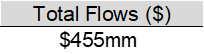

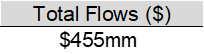

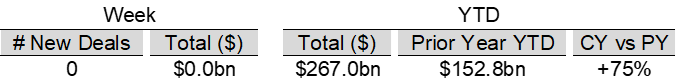

Week ended 11/08/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

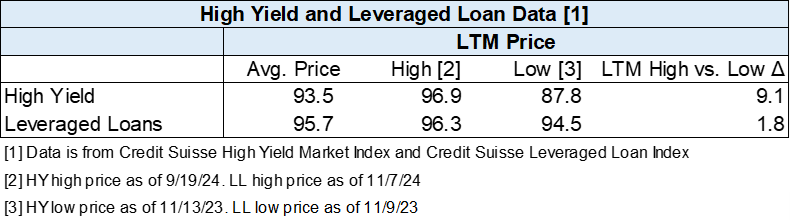

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

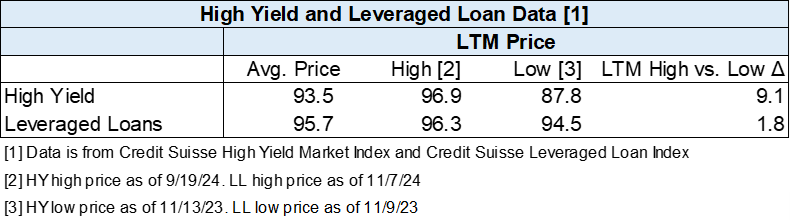

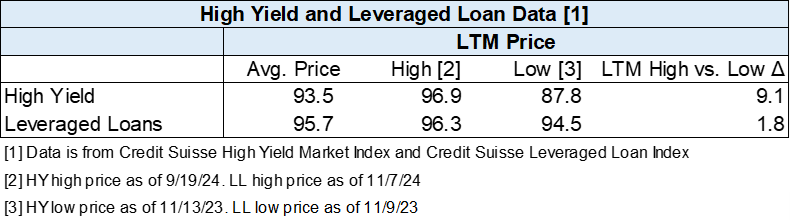

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

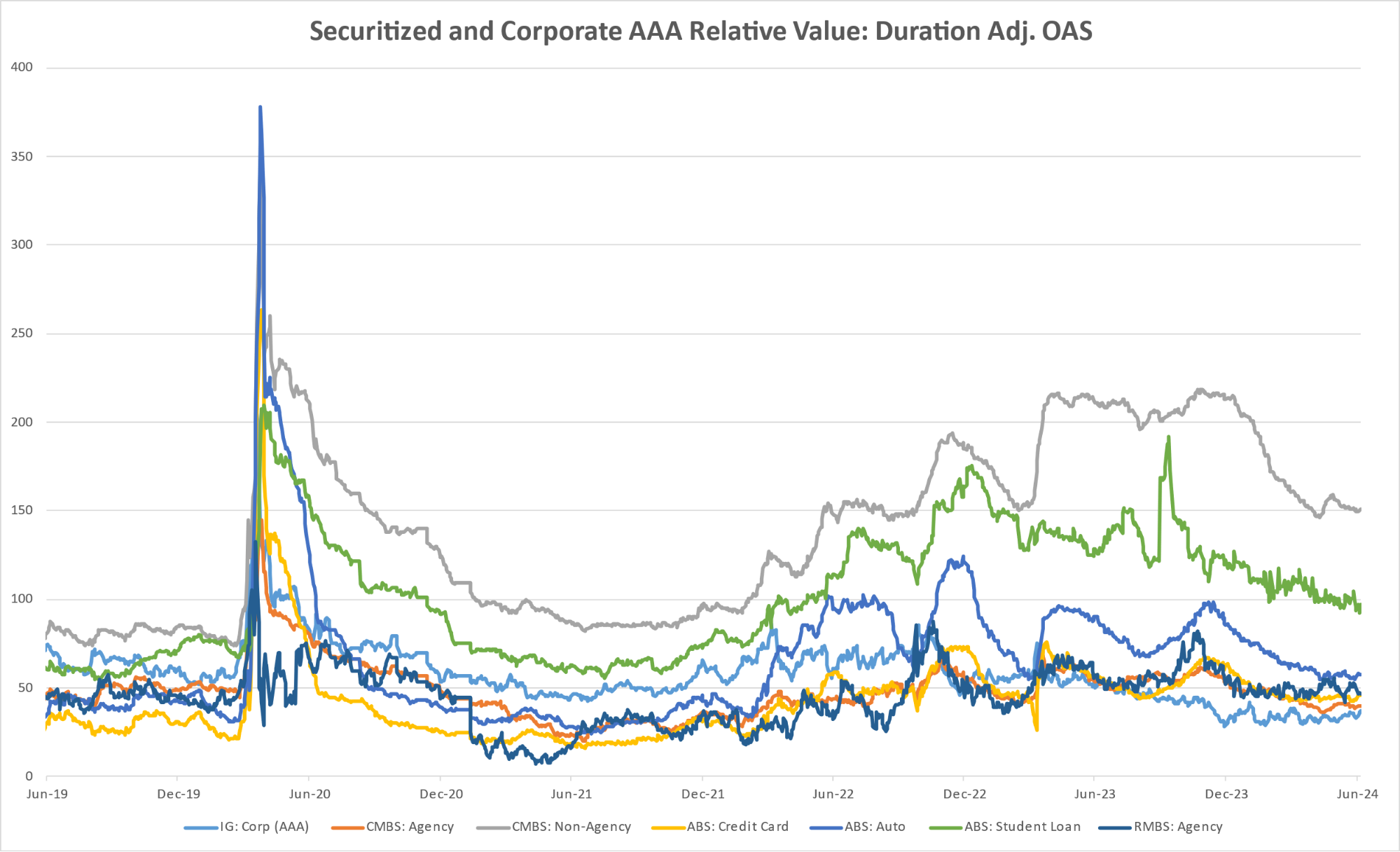

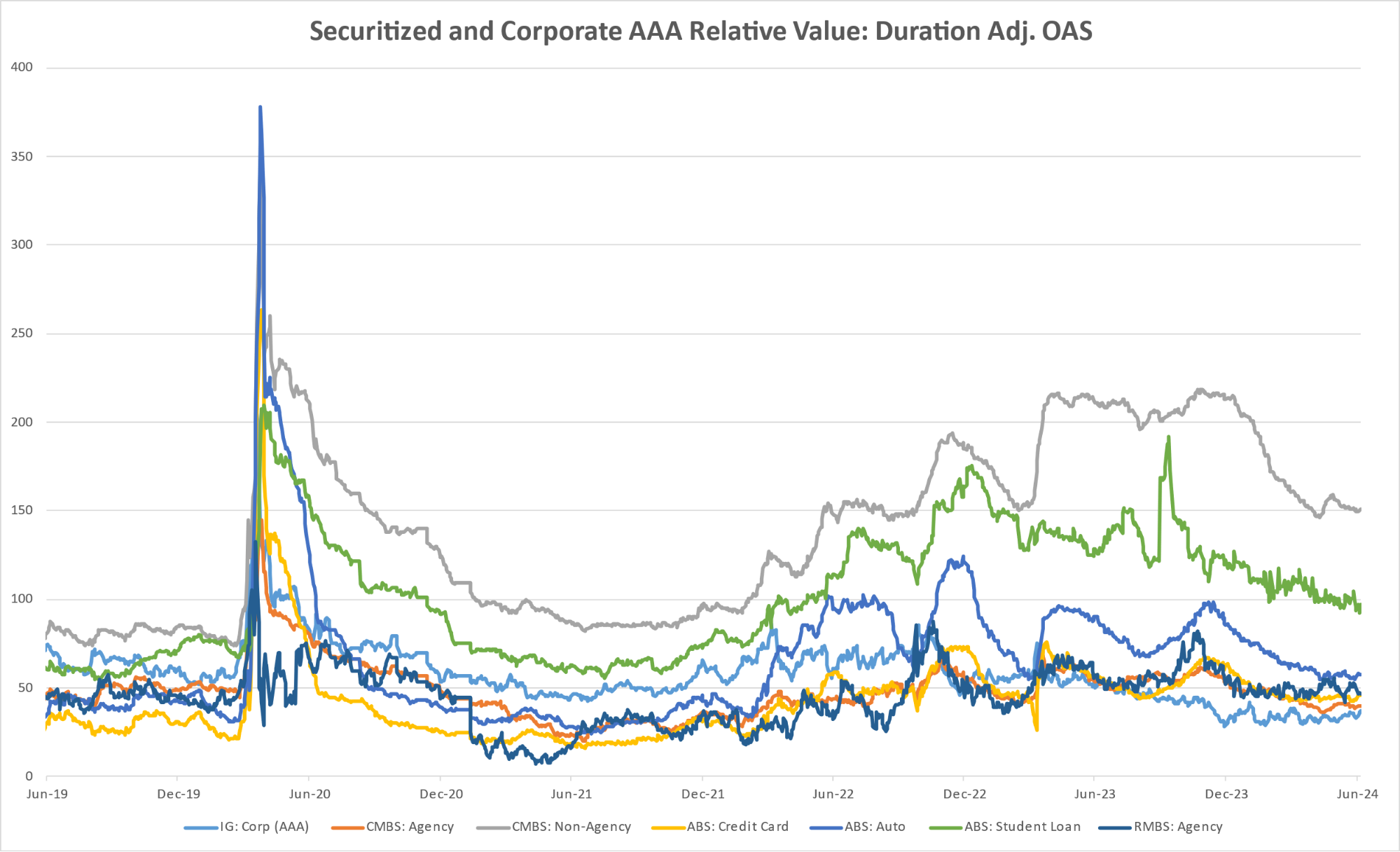

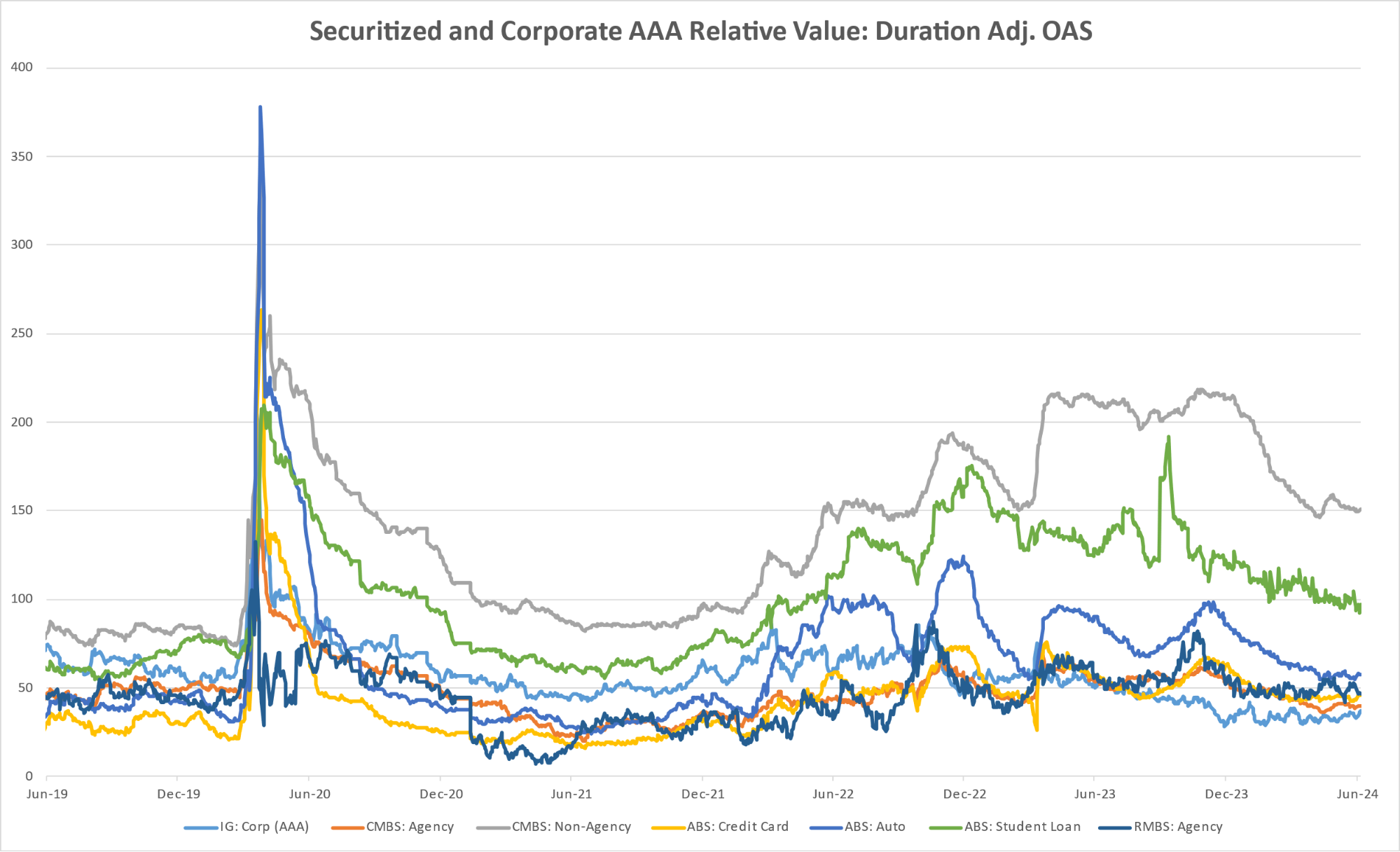

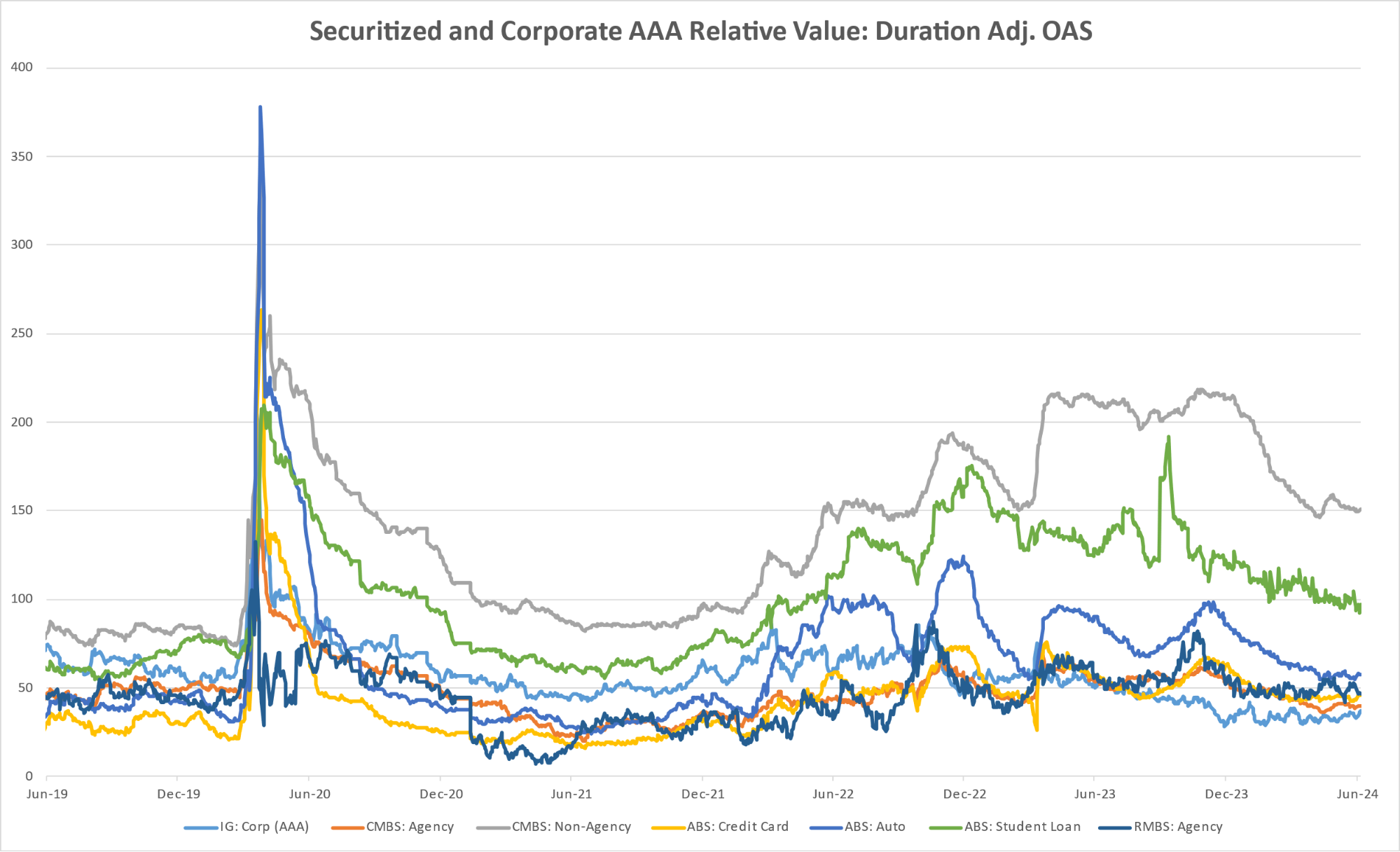

Diagram S: Structured Credit Spreads

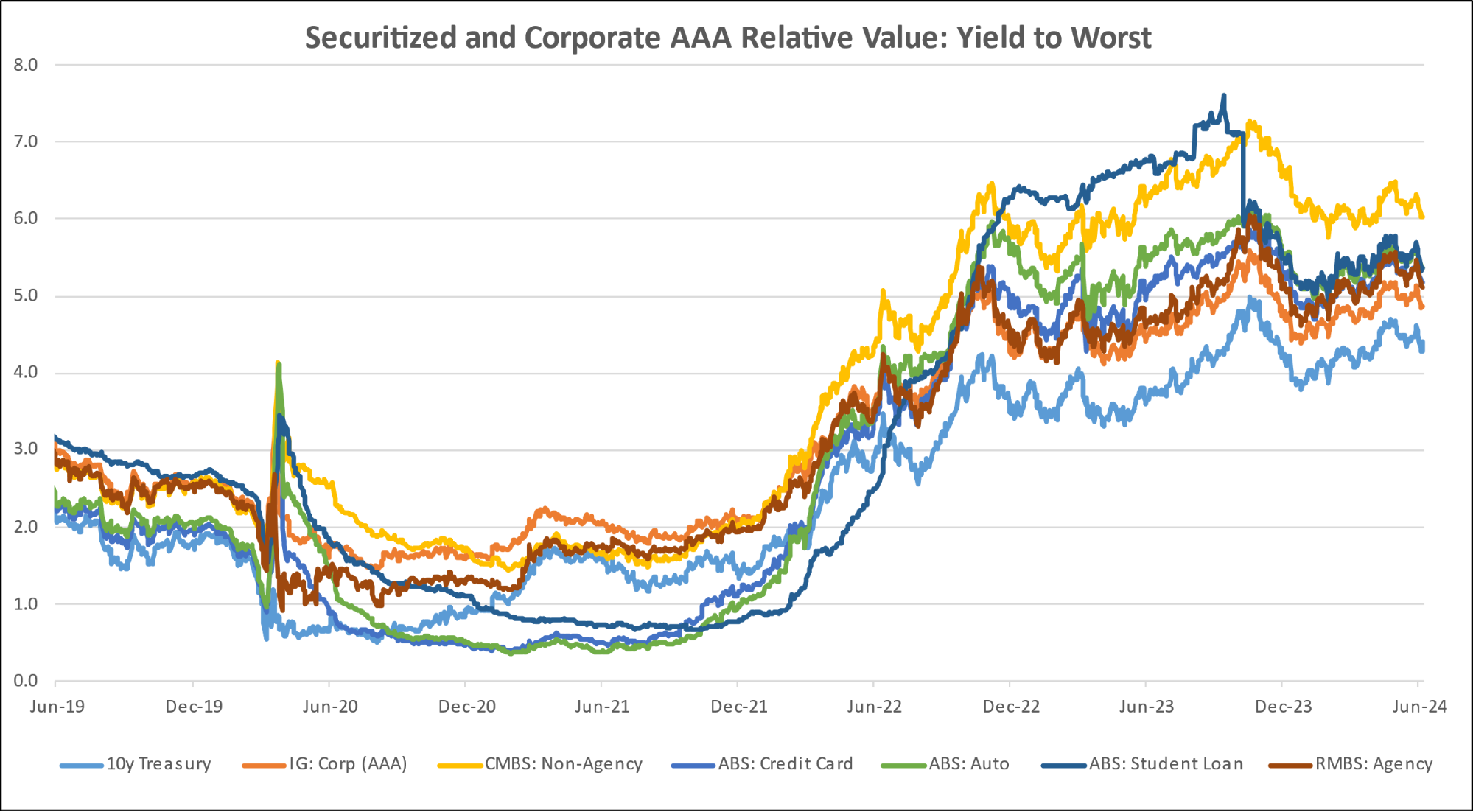

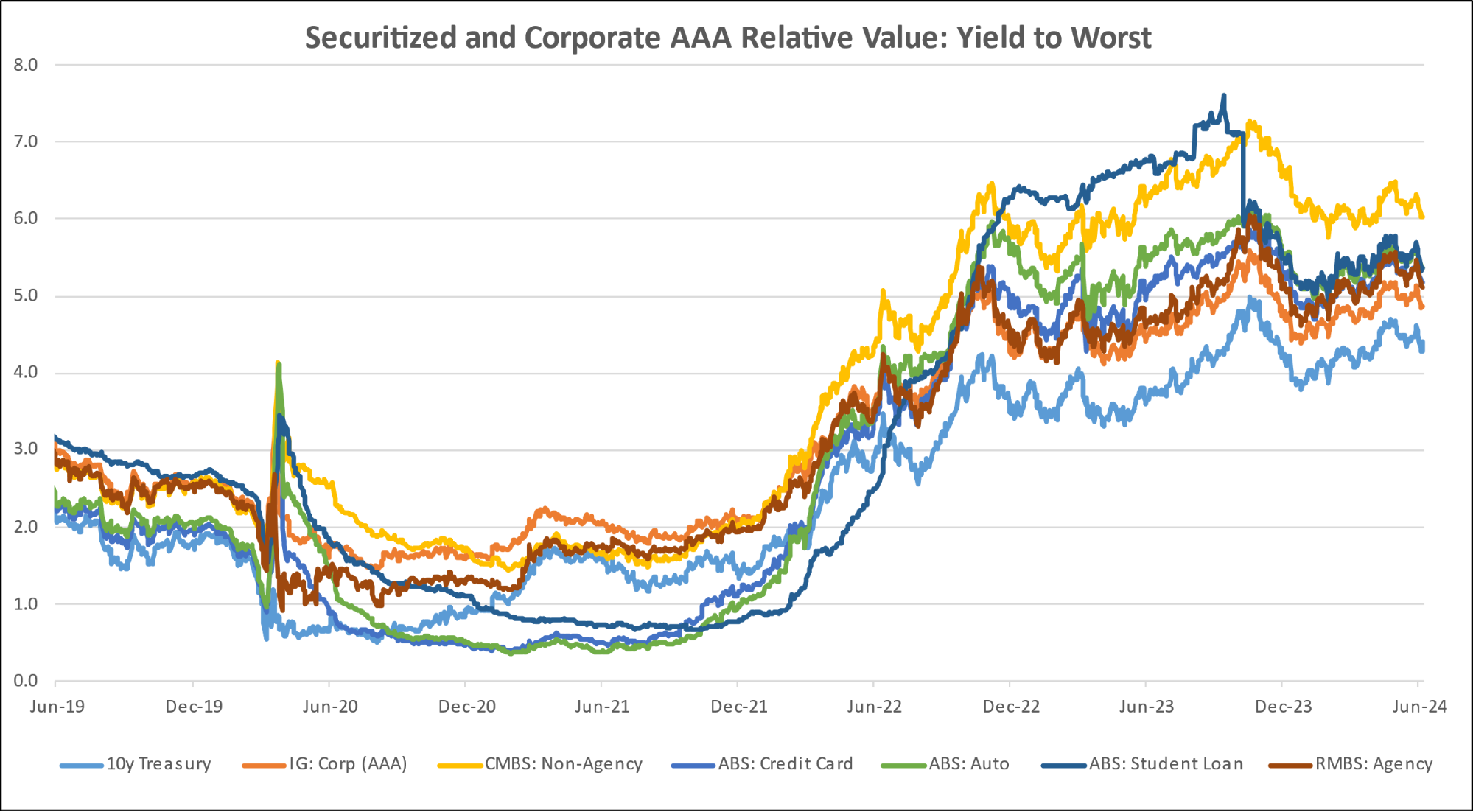

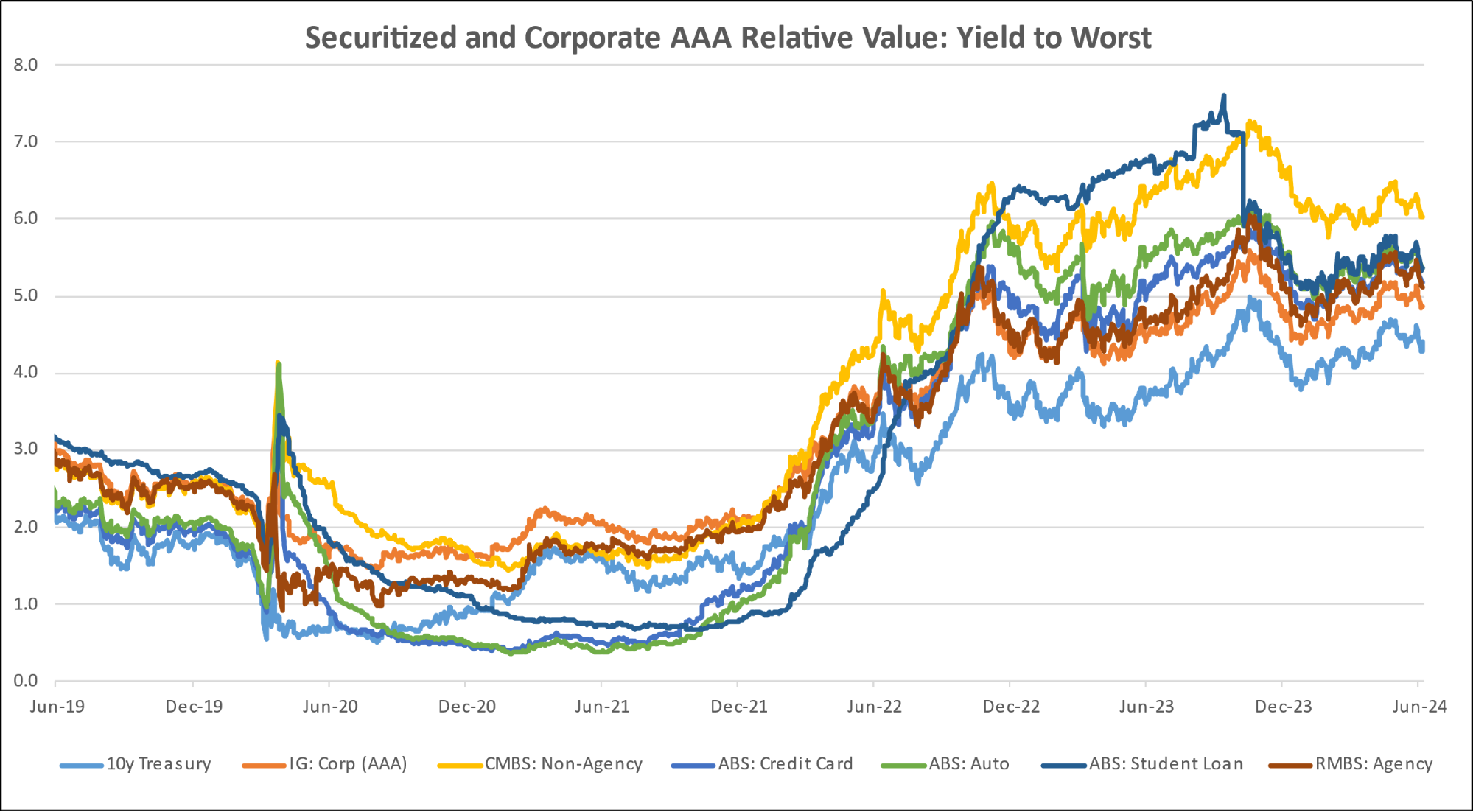

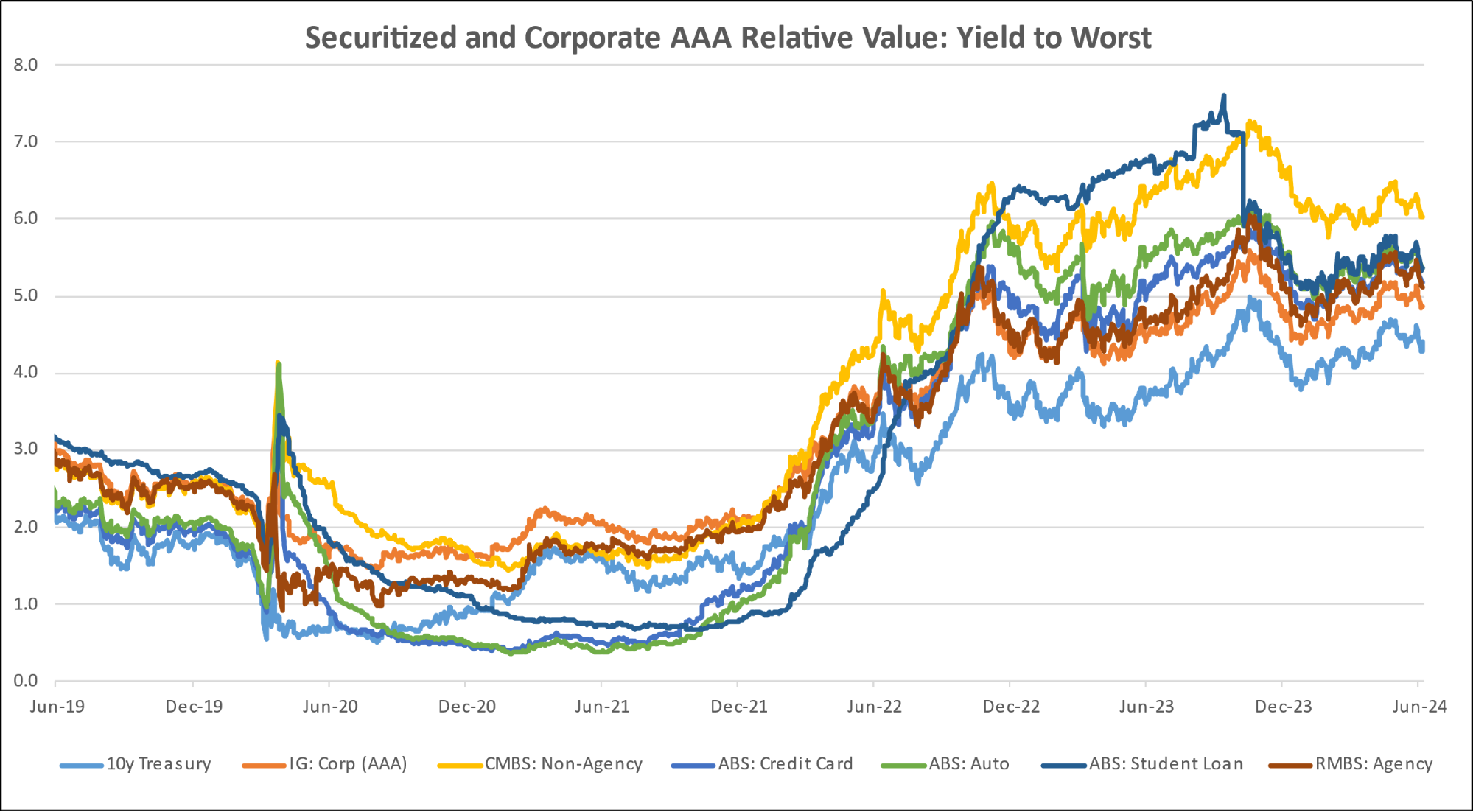

Diagram T: Structured Credit Yield

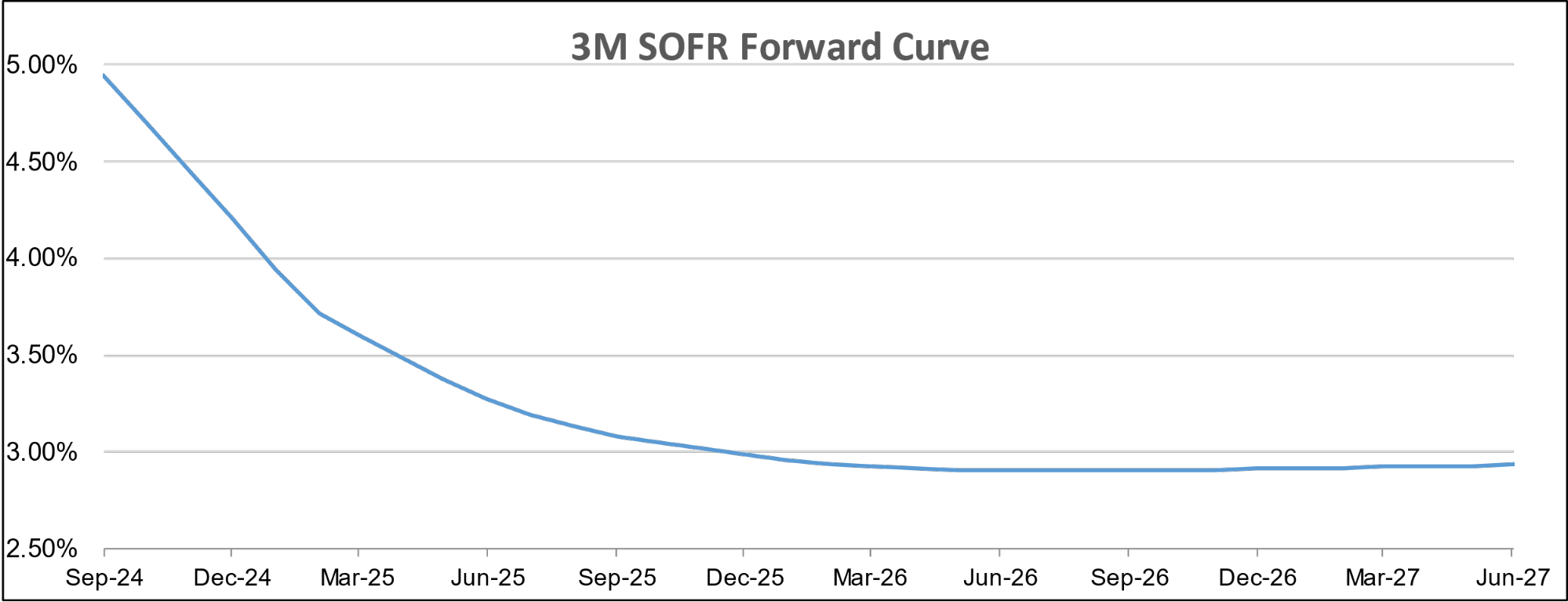

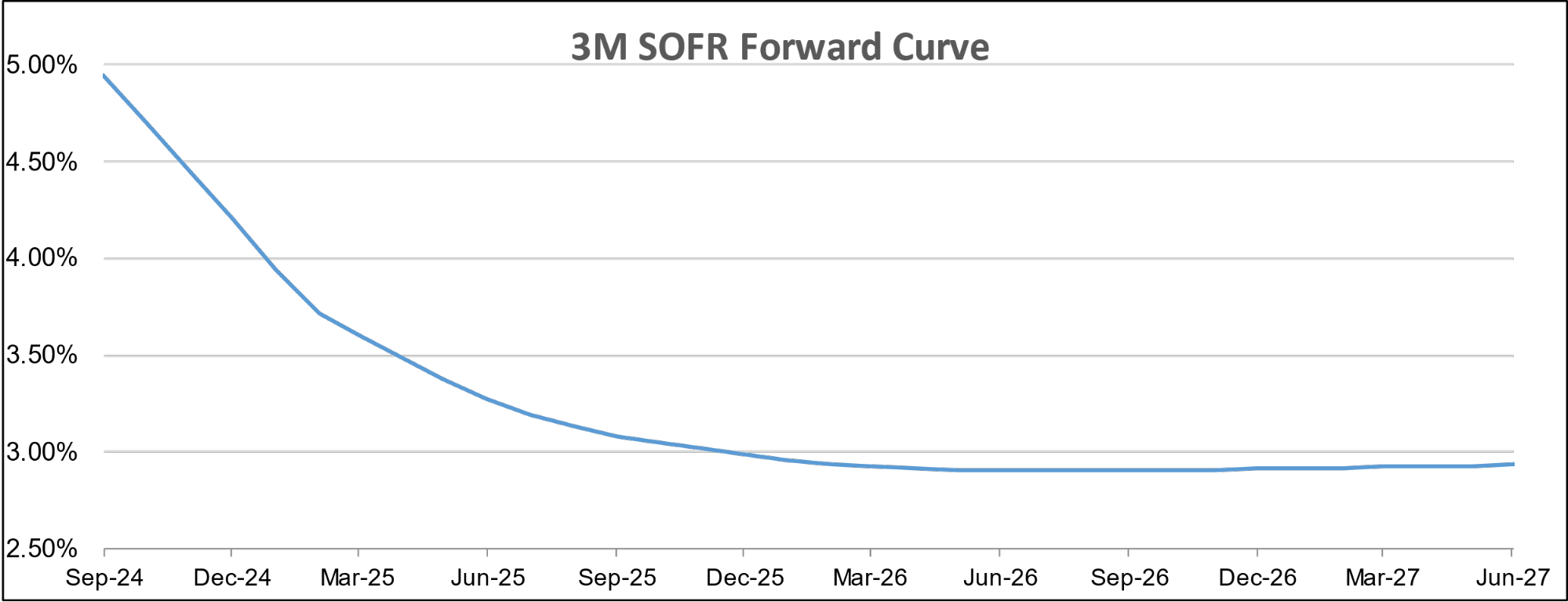

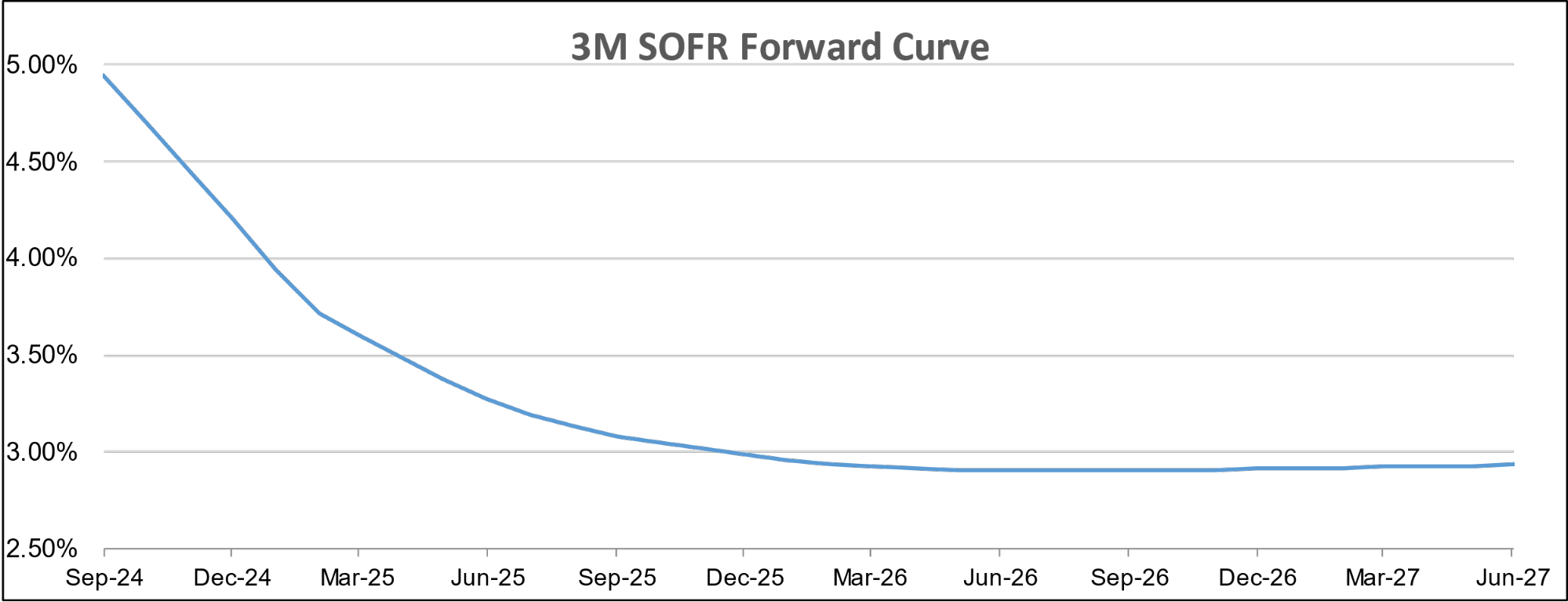

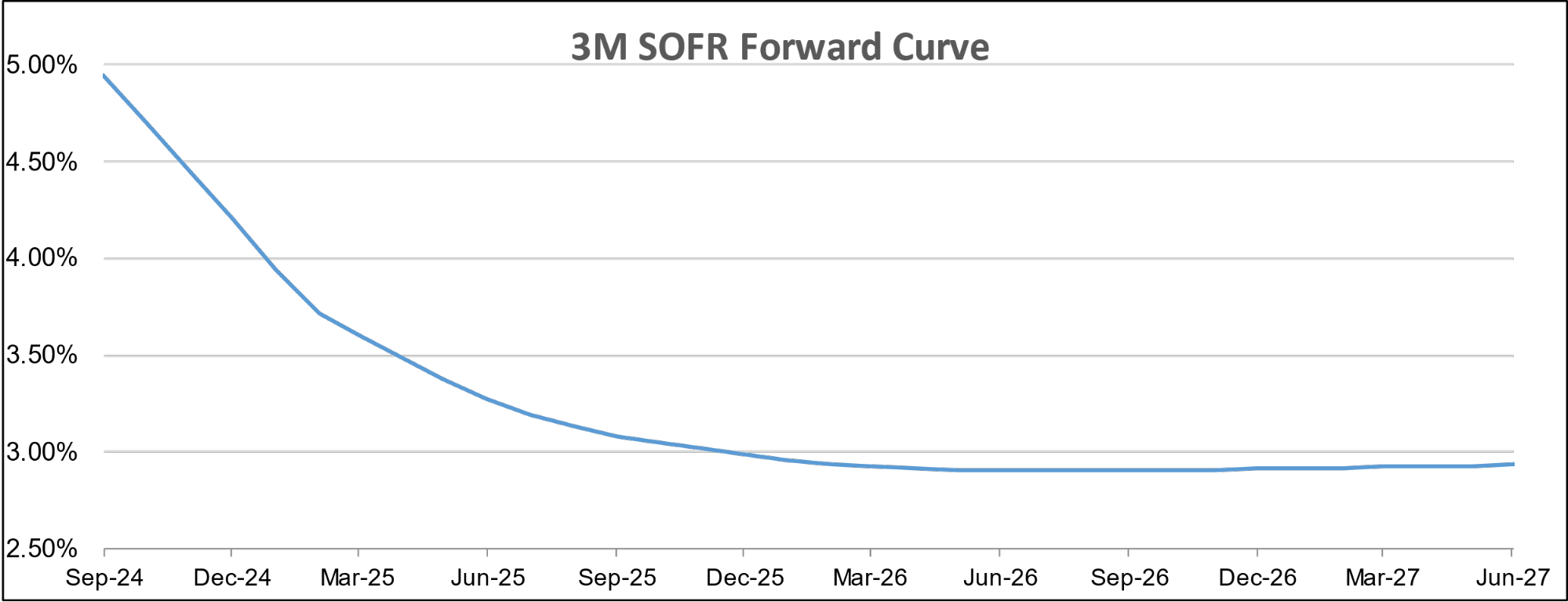

Diagram U: SOFR CURVE

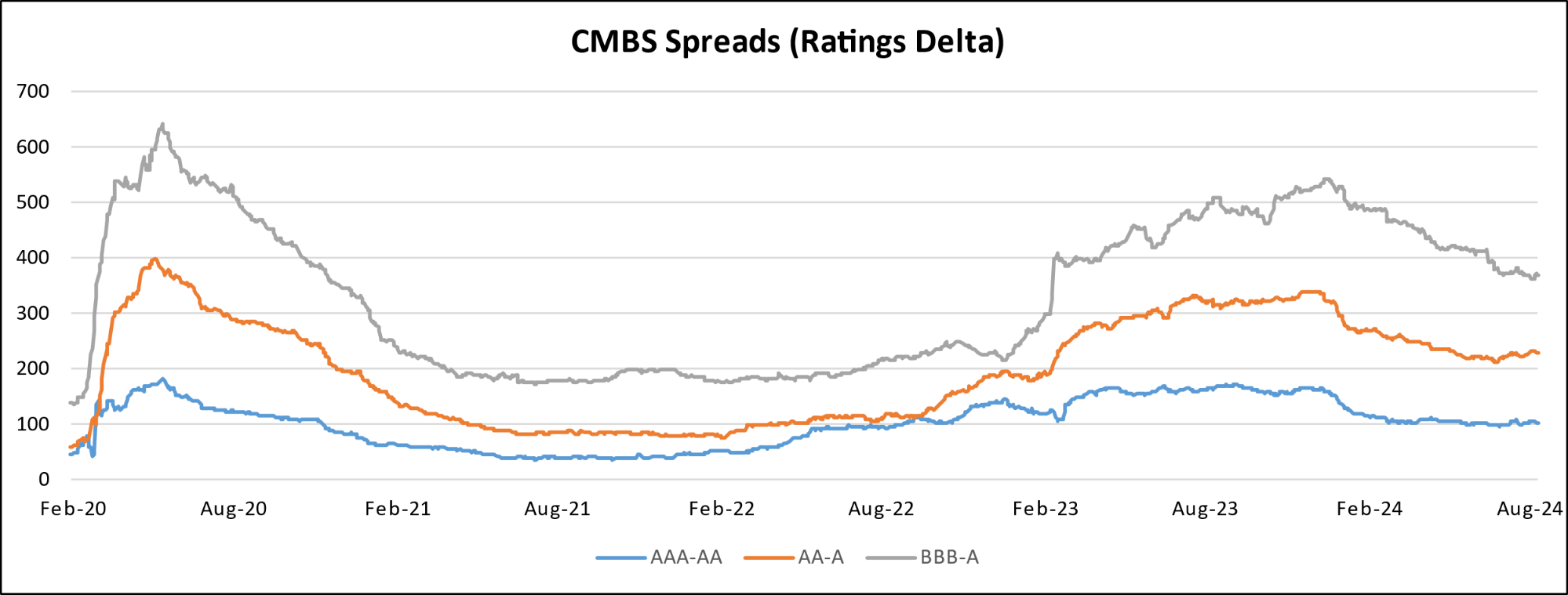

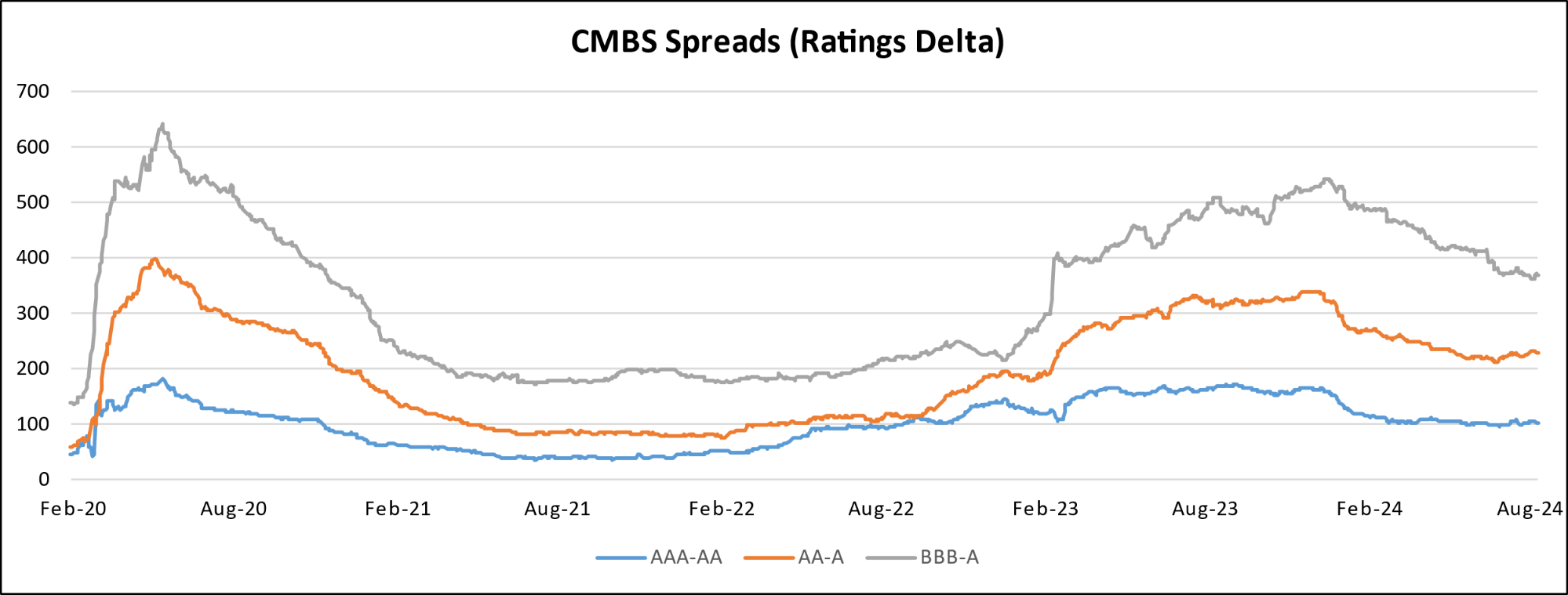

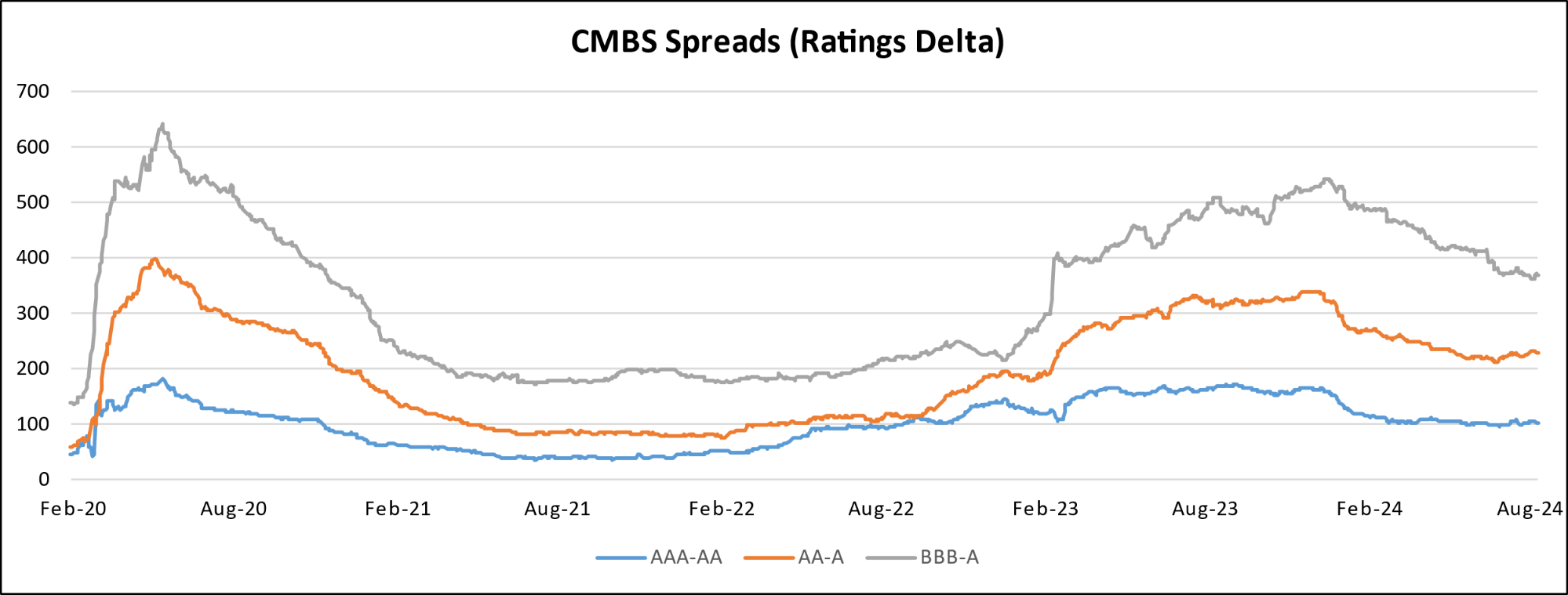

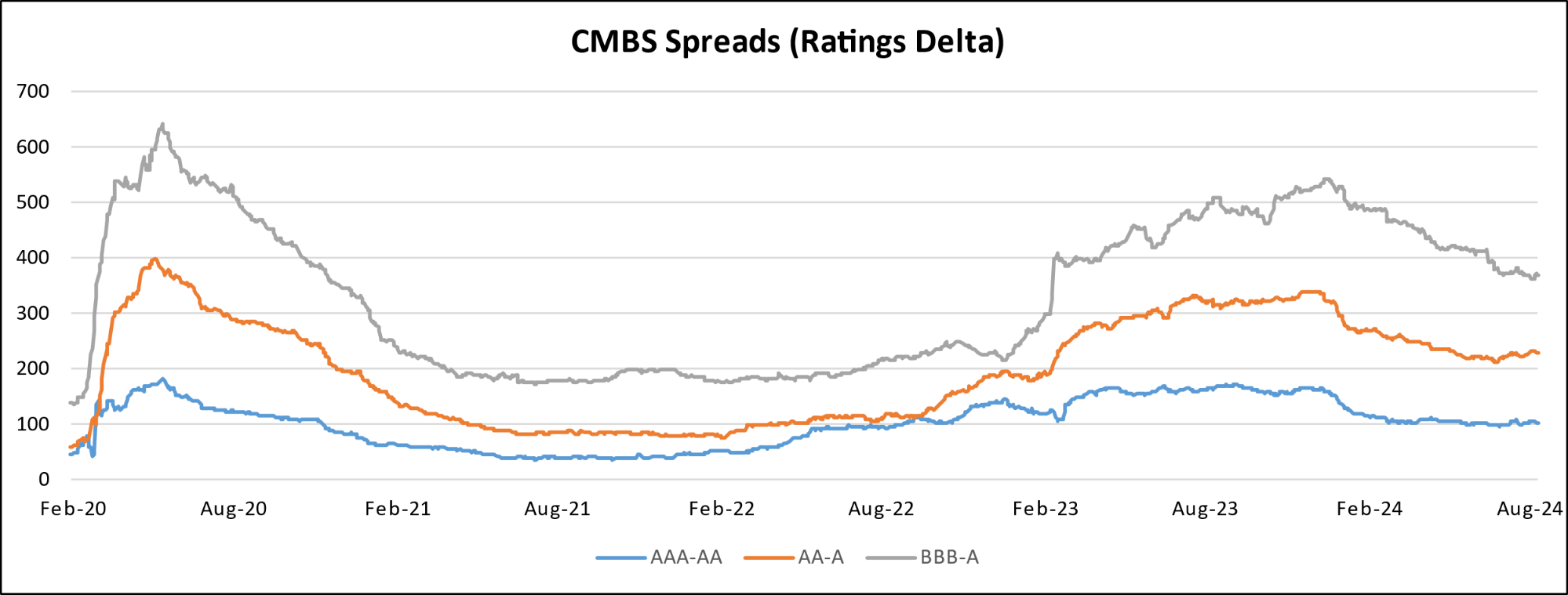

Diagram V: CMBS Spreads

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

ZCGC RE Research

Rising Costs Push More Americans to Rent as Homeownership Becomes Less Affordable

- High home prices, mortgage rates, property taxes, and spiking homeowners’ insurance have made home ownership less financially viable, pushing more people toward renting.

- The share of people preferring to rent rather than buy hit a record high of 36%, according to Fannie Mae’s survey, surpassing previous highs from the 2010 housing bust.

- The surge in home prices since 2020, driven by loose monetary policy, has made it significantly more expensive to buy than rent, leading to a trend of renting as a cost-effective alternative.

- Fannie Mae noted a growing preference for renting, expecting modest rent growth in 2025, making rental deals more attractive.

- The monthly costs of buying—factoring in mortgage rates, property taxes, and insurance—have far exceeded those of renting, especially with rents rising at a slower pace than home prices.

- People are increasingly opting to rent to avoid inflated costs, benefitting from flexibility and saving money rather than becoming “house-poor.”

- Declining demand for home purchases has caused supply levels of new and existing homes to spike, with home sales hitting lows unseen since 1995.

- Choosing to rent protects people from potential losses if property prices decline, a trend already visible in some markets.

U.S. News

- Interest Rates

- The Federal Reserve approved a 0.25 percentage point interest rate cut, its second consecutive reduction, bringing the benchmark rate to 4.50% – 4.75%

- Powell said for now the economic outlook was solid and stated that “we think that the economy, and we think our policies, are both in a very good place”

- Markets expect one more rate cut in December

- Trade Deficit

- The U.S. trade deficit surged 19.2% to $84.4 billion in September from $70.8 billion in the prior month, the highest in 30 months, driven by a spike in imports

- The trade deficit shaved 0.6% percentage points off the rate of U.S. growth in the three months from July to September

- Imports rose 3.0% in September to a record $352.3 billion

- Factory Orders

- Orders for manufactured goods fell 0.5% in September, marking the fourth decline in five months, with a notable drop in civilian airplane orders driving the decrease

- Overall, the manufacturing sector has been sluggish for two years, with PMI in contraction territory for seven straight months

- Durable goods orders slid to a 0.7% decline for September, following a 0.9% drop in August

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S.,

increased to 221,000 in the week ended November 1, up 3,000 from the prior week

- The four-week moving average was 227,250, down 9,750 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 39,000 to 1.892 million in the week ended October 25. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $6.994 trillion in the week ended November 8, down $19.2 billion from the prior week

- Treasury holdings totaled $4.340 trillion, down $17.9 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.27 trillion in the week, down $14.6 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.94 trillion as of November 8, an increase of 6.7% from the previous year

- Debt held by the public was $28.61 trillion, and intragovernmental holdings were $7.38 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 2.4% in September year over year

- On a monthly basis, the CPI increased 0.2% in September on a seasonally adjusted basis, after increasing 0.2% in August

- The index for all items less food and energy (core CPI) rose 0.3% in September, after rising 0.3% in August

- Core CPI increased 3.3% for the 12 months ending September

- Food and Beverages:

- The food at home index increased 1.3% in September from the same month a year earlier, and increased 0.4% in September month over month

- The food away from home index increased 3.9% in September from the same month a year earlier, and increased 0.3% in September month over month

- Commodities:

- The energy commodities index decreased (4.0%) in September after decreasing

- The energy commodities index fell (15.3%) over the last 12 months

- The energy services index 0.4% in September after decreasing (0.8%) in June

- The energy services index rose 3.4% over the last 12 months

- The gasoline index rose (15.3%) over the last 12 months

- The fuel oil index fell (22.4%) over the last 12 months

- The index for electricity rose 3.7% over the last 12 months

- The index for natural gas fell 2.0% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,443.90 per 40ft

- Drewry’s composite World Container Index has increased by 129.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.2% in September after increasing 0.5% in August

- The rent index increased 0.2% in September after increasing 0.5% in August

- The index for lodging away from home decreased (3.8%) in September after decreasing (0.7%) in August

- Federal Funds Rate

- The effective Federal Funds Rate is at 4.83%, down (0.50%) year to date

World News

-

Middle East

- Israeli Prime Minister Netanyahu fired his defense minister, Yoav Gallant, following months of public disagreement over the handling of the wars in Gaza and Lebanon

- Gallant has been a key figure in U.S.-Israel defense coordination and was a vocal advocate for a ceasefire in Gaza. Foreign Minister Israel Katz will replace Gallant as defense minister

- The FBI thwarted an Iranian plot to assassinate Donald Trump before he was re-elected as president. An Iranian operative told law enforcement that an official in Iran’s paramilitary Revolutionary Guard directed him in September to put together a plan to surveil and ultimately kill Trump

- The operative, identified as Farhad Shakeri, warned the official that crafting such a plan would be very costly. The official in October told Shakeri if he couldn’t pull together a plan within seven days, they would put the assassination plot on hold until after the election, believing Trump would lose and it would be easier to kill him then

-

Russia

- The Biden Administration has lifted restrictions on American military contractors deploying to Ukraine, allowing them to assist in maintaining and repairing U.S.-provided weapons systems such as fighter jets and air defense systems

- Contractors will be stationed away from the frontlines and will not engage in combat. This is to limit direct U.S. military involvement in Ukraine

- The Biden Administration plans to expedite as much as $9 billion dollars’ worth of security assistance to Ukraine before Biden leaves office in January. This includes the transfer of billions of dollars in weapons from U.S. stocks

-

China

- The National People’s Congress (NPC) approved a $1.4 trillion package to help local governments swap off some of their mounting off-balance-sheet debts

- The package includes issuing $837 billion in bonds over 3 years to replace local governments’ hidden debts. The total package is disappointing to investors, who expected a fiscal-stimulus package to be unveiled alongside the debt-swap program

- China’s exports rose at a faster-than-expected pace last month, with outbound shipments rising 12.7% from a year earlier in October, up sharply from the 2.4% increase in September

- The trade surplus rose to $95.7 billion in October, up from $81.7 billion in September, exceeding the expected $74.4 billion

-

Germany

- Germany’s government is in a political gridlock after a dispute over economic policy between coalition partners. The Free Democratic Party (FDP) is pushing for tax cuts and welfare reductions while the Social Democratic Party (SPD) is advocating for higher government spending, including subsidies for industries and additional support for Ukraine. This gridlock has led to a vote of confidence, potentially resulting in early elections

-

Pakistan

- Pakistan’s government is strengthening its control through new laws that limit judicial power, extend the army chief’s term, and allow detention without charges, amid growing political repression. Despite some economic improvements, the country remains politically unstable

-

Mexico

- Mexico’s Supreme Court narrowly voted against blocking a controversial judicial reform pushed by President Sheinbaum’s government, which would elect judges by popular vote. The reform has sparked concerns over the independence of the judiciary and its potential impact on Mexico’s democracy and business climate

-

Spain

- Following torrential rains and flash floods in the Valencia region of Spain led to at least 214 deaths and significant devastation in towns like Paiporta and Picanya. The Spanish government deployed over 7,500 military personnel, along with 400 vehicles, 30 helicopters, and an amphibious ship, to assist in rescue efforts and restore water, electricity, and telecommunications amid restricted road access and reports of looting

-

UK

- Kemi Badenoch, the first Black woman to lead the U.K.’s Conservative Party, has been chosen to revitalize the Tories after a historic defeat, focusing on cultural conservatism, limited government, and immigration control, while facing challenges from Labour’s Keir Starmer and Nigel Farage’s Reform UK. Known for her direct style, Badenoch emphasizes honesty about past mistakes and the need for pragmatic policies

-

Japan

- Japan’s ruling coalition lost its parliamentary majority in the recent election, creating political uncertainty that could delay interest rate hikes by the Bank of Japan, leading to a weakened yen. Despite this, Japan’s domestic economic conditions, such as a tight job market and core inflation of 2.1%, still point towards gradual monetary tightening

-

Canada

- Canada has accused India’s Home Minister, Amit Shah, of authorizing operations targeting Sikh separatists in Canada, escalating tensions between the two countries. The allegations come after previous claims that Indian agents were involved in the 2023 killing of Sikh activist Hardeep Singh Nijjar in Canada, a charge India has denied, calling the accusations politically motivated

Commodities

-

Oil Prices

- WTI: $70.49 per barrel

- +1.44% WoW; (1.62%) YTD; (6.93%) YoY

- Brent: $74.04 per barrel

- +1.29% WoW; (3.89%) YTD; (7.46%) YoY

-

US Production

- U.S. oil production amounted to 13.5 million bpd for the week ended November 1, down 0.0 million bpd from the prior week

-

Rig Count

- The total number of oil rigs amounted to 585, down 0 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 427.7 million barrels, down (1.9%) YoY

- Refiners operated at a capacity utilization rate of 90.5% for the week, up from 89.1% in the prior week

- U.S. crude oil imports now amount to 5.975 million barrels per day, down (2.4%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.10 per gallon in the week of

$5.5 November 8, down (8.6%) YoY

- Gasoline prices on the East Coast $2.5 $1.5 amounted to $3.10, down (7.7%) YoY

- Gasoline prices in the Midwest amounted to $3.02, down (8.1%) YoY

- Gasoline prices on the Gulf Coast amounted to $2.72, down (8.3%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.23, down (9.7%) YoY

- Gasoline prices on the West Coast amounted to $4.08, down (13.7%)

- Motor gasoline inventories were up by 0.4 million barrels from the prior week

- Motor gasoline inventories amounted to 211.3 million barrels, down (2.7%)

- Production of motor gasoline averaged 9.71 million bpd, down (5.1%) YoY

- Demand for motor gasoline amounted to 8.828 million bpd, down (7.0%) YoY

-

Distillates

- Distillate inventories decreased by 2.9 million in the week of November 8

- Total distillate inventories amounted to 115.8 million barrels, up 7.2% YoY

- Distillate production averaged 5.096 million bpd, up 8.4% YoY

- Demand for distillates averaged 3.406 million bpd in the week, down (20.8%)

-

Natural Gas

- Natural gas inventories increased by 69 billion cubic feet last week

- Total natural gas inventories now amount to 3,932 billion cubic feet, up 4.2% YoY

Credit News

High yield bond yields decreased 11bps to 7.16% and spreads decreased 17bps to 297bps. Leveraged loan yields decreased 7bps to 8.60% and spreads decreased 10bps to 469bps. WTD Leveraged loan returns were positive 20bps. WTD high yield bond returns were positive 51bps. 10yr treasury yields increased 6bps to 4.34%. Yields and spreads decreased driven by election outcome and change in the Fed forecast.

High-yield:

Week ended 11/08/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 11/08/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Franchise Group Inc ($1.1bn, 11/3/24), Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24), Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions ($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), and Quorum Health Group ($688mn, 7/10/24).

CLOs:

Week ended 11/08/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Diagram V: CMBS Spreads

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

ZCGC RE Research

Rising Costs Push More Americans to Rent as Homeownership Becomes Less Affordable

- High home prices, mortgage rates, property taxes, and spiking homeowners’ insurance have made home ownership less financially viable, pushing more people toward renting.

- The share of people preferring to rent rather than buy hit a record high of 36%, according to Fannie Mae’s survey, surpassing previous highs from the 2010 housing bust.

- The surge in home prices since 2020, driven by loose monetary policy, has made it significantly more expensive to buy than rent, leading to a trend of renting as a cost-effective alternative.

- Fannie Mae noted a growing preference for renting, expecting modest rent growth in 2025, making rental deals more attractive.

- The monthly costs of buying—factoring in mortgage rates, property taxes, and insurance—have far exceeded those of renting, especially with rents rising at a slower pace than home prices.

- People are increasingly opting to rent to avoid inflated costs, benefitting from flexibility and saving money rather than becoming “house-poor.”

- Declining demand for home purchases has caused supply levels of new and existing homes to spike, with home sales hitting lows unseen since 1995.

- Choosing to rent protects people from potential losses if property prices decline, a trend already visible in some markets.