U.S. News

- Consumer Credit

- Consumer credit rose by $8.9 billion in June, below the expected $9.7 billion, with a growth rate of 1.9%, down from 5.3% last year

- Revolving credit, such as credit card debt, decreased for the second time in three months, a trend last seen in 2021. Credit card interest rates remain high, at 20% or more

- Non-revolving credit, including auto and student loans, grew at a 3.4% annual rate in June, showing less volatility compared to revolving credit

- US Trade Deficit

- The U.S. trade deficit decreased by 2.5% in June to $73.1 billion, down from a 19-month high of $75.0 billion in May

- Exports rose by 1.5% in June to $265.9 billion, near a record high, while imports increased by 0.6% to $339.0 billion, about 3% below the 2022 record

- The larger trade deficit in Q2 lowered GDP growth by 0.7 percentage points from 2.8%

- S&P Final US Services PMI

- The S&P Global US Services PMI Business Activity Index for July was 55.0, indicating a marked expansion in services activity, with new business rising for the third consecutive month

- Input costs rose, driven by wages and transportation, but selling price inflation slowed due to competition.

- The service sector’s growth contributes to an estimated 2.2% annualized GDP growth rate, contrasting with the nearly stalled manufacturing sector

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 233,000 in the week ended August 2, down 17,000 from the prior week

- The four-week moving average was 240,750, up 2500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 6,000 to 1.877 million in the week ended July 26. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.175 trillion in the week ended August 9, down $3.1 billion from the prior week

- Treasury holdings totaled $4.414 trillion, down $8.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.32 trillion in the week, down $16.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.12 trillion as of August 9, an increase of 7.5% from the previous year

- Debt held by the public was $25.81 trillion, and intragovernmental holdings were $7.17 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.0% in June year over year

- On a monthly basis, the CPI decreased -0.1% in June on a seasonally adjusted basis, after increasing 0.0% in May

- The index for all items less food and energy (core CPI) rose 0.1% in June, after rising 0.2% in May

- Core CPI increased 3.3% for the 12 months ending June

- Food and Beverages:

- The food at home index increased 1.1% in June from the same month a year earlier, and increased 0.1% in June month over month

- The food away from home index increased 4.1% in June from the same month a year earlier, and increased 0.4% in June month over month

- Commodities:

- The energy commodities index decreased (3.7%) in May after decreasing (3.5%) in

- The energy commodities index fell (2.3%) over the last 12 months

- The energy services index 2.1% in May after increasing 0.3% in May

- The energy services index rose 4.3% over the last 12 months

- The gasoline index rose (2.5%) over the last 12 months

- The fuel oil index fell 0.8% over the last 12 months

- The index for electricity rose 4.4% over the last 12 months

- The index for natural gas fell 3.7% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $5,550.76 per 40ft container for

- Drewry’s composite World Container Index has increased by 210.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.2% in June after increasing 0.4% in May

- The rent index increased 0.2% in May after increasing 0.4% in May

- The index for lodging away from home decreased (0.6%) in June after increasing 1.4% in May

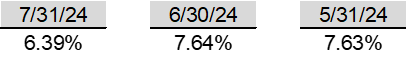

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- An Israeli airstrike on a Gaza City school complex, used as both a shelter and a militant command post, killed dozens of civilians and 19 members of Hamas and Islamic Jihad

- The strike drew criticism from Arab governments and complicated U.S.-led efforts to restart cease-fire talks between Israel and Hamas

- Israel’s military claimed measures were taken to minimize civilian harm, while Palestinian authorities reported significant casualties, including women and children

- Forty-four Palestinian detainees have died in Israeli military custody from October 7 through July 2, raising allegations of abuse and mistreatment by Israeli authorities

-

Russia

- Ukrainian forces have advanced at least 20 miles into Russia’s Kursk region, marking the first major foreign military invasion of Russian territory since World War II, causing over 76,000 Russian civilians to flee the area

- Despite the Ukrainian incursion, Russian authorities and state media have downplayed the events, referring to the situation as a “counterterrorist operation” and describing Ukrainian forces as “saboteurs.”

- The recent U.S.-Russia prisoner swap did not include Russian cybercriminals Alexander Vinnik and Vladimir Dunaev, who were rumored to be part of the negotiations; both remain in U.S. custody

- Dunaev was sentenced to over five years for developing the Trickbot malware used against American hospitals, while Vinnik, linked to laundering billions through the BTC-e bitcoin exchange, pleaded guilty and awaits sentencing

-

UK

- Thousands of anti-racism protesters gathered in multiple UK cities, including London, Belfast, and Birmingham, in response to recent violence and riots linked to false rumors about a murder suspect

- The National Police Chiefs’ Council (NPCC) reported 779 arrests related to the riots, with 349 individuals charged; police are investigating online influencers for allegedly inciting violence

- The unrest was sparked by a violent incident in Southport, where three young girls were killed, leading to widespread protests and condemnation of racism, with additional measures like dispersal orders and Section 60 orders being enforced to maintain public safety

-

China

- China’s consumer-price index increased by 0.5% in July 2024, marking the sixth consecutive month of rising consumer inflation, driven mainly by supply-side factors such as weather disruptions affecting food prices

- Despite the rise in consumer inflation, factory-gate prices in China continued to decline, with the producer-price index falling 0.8% in July 2024, marking the 22nd consecutive month of contraction, indicating ongoing concerns about weak domestic demand and economic challenges

- Starting September 1, 2024, China will impose stricter regulations on chemicals used in fentanyl production, requiring exporters to obtain licenses, in response to U.S. pressure and as part of efforts to improve diplomatic relations

-

Germany

- Germany’s trade surplus narrowed to €20.4 billion in June as exports fell by 3.4%, a greater decline than expected, largely due to weak demand from the Chinese market and increased trade tensions between Europe and China

-

Canada

- Canada’s rail operations face potential shutdowns as the labor-relations board ruled that a work stoppage at Canadian Pacific Kansas City and Canadian National Railway wouldn’t pose a serious safety risk, allowing unionized workers to strike or the companies to initiate a lockout starting August 22 if no agreements are reached

-

Brazil

- A Voepass twin-engine passenger plane crashed in Vinhedo, Brazil, killing all 62 people on board. Investigators are examining the possibility of ice buildup on the wings, which could have reduced the aircraft’s lift and contributed to the crash.

-

Uganda

- A landslide at the Kiteezi landfill in Kampala, Uganda, has killed at least 12 people, with rescuers continuing to search for survivors following weeks of heavy rain. The incident has displaced approximately 1,000 people as the city seeks a new landfill site

-

Mali

- Dozens of Russian / Wagner Group mercenaries, hired by the Malian government to fight insurgents, were killed in an attack conducted by Tuareg rebels on Sunday. The attack dealt a blow to the image of Wagner Group and the Russian presence in the region

-

New Zealand

- The ANZ-Roy Morgan consumer confidence index for New Zealand rose 5 points to 87.9 in July 2024, amid rising expectations of significant interest-rate cuts and a notable fall in inflation expectations to 3.7%

-

Singapore

- The Monetary Authority of Singapore maintained its monetary policy settings and expects GDP growth to approach its potential rate of 2%-3% for the full year, supported by improved economic momentum and easing inflation

-

EU

- The EU proposed duties between 12.8% and 36.4% on Chinese biofuels, claiming that it found Chinese companies dumping biofuels into European markets at unfair prices

Commodities

-

Oil Prices

- WTI: $76.96 per barrel

- +4.68% WoW; +7.41% YTD; (7.08%) YoY

- Brent: $79.68 per barrel

- +3.74% WoW; +3.43% YTD; (7.78%) YoY

-

US Production

- U.S. oil production amounted to 13.4 million bpd for the week ended August 2, up 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 588, up 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 429.3 million barrels, down (3.7%) YoY

- Refiners operated at a capacity utilization rate of 90.5% for the week, up from 90.1% in the prior week

- U.S. crude oil imports now amount to 6.953 million barrels per day, down (6.9%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.45 per gallon in the week of August 9,

down (10.1%) YoY

- Gasoline prices on the East Coast amounted to $3.48, down (9.2%) YoY

- Gasoline prices in the Midwest amounted to $3.51, down (6.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.11, down (12.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.55, down (12.5%) YoY

- Gasoline prices on the West Coast amounted to $4.21, down (12.4%) YoY

- Motor gasoline inventories were up by 1.3 million barrels from the prior week

- Motor gasoline inventories amounted to 225.1 million barrels, up 4.0% YoY

- Production of motor gasoline averaged 10.04 million bpd, up 1.2% YoY

- Demand for motor gasoline amounted to 8.967 million bpd, down (3.6%) YoY

-

Distillates

- Distillate inventories decreased by 0.9 million in the week of August 9

- Total distillate inventories amounted to 127.8 million barrels, up 10.7% YoY

- Distillate production averaged 5.036 million bpd, up 2.5% YoY

- Demand for distillates averaged 3.469 million bpd in the week, down (7.8%) YoY

-

Natural Gas

- Natural gas inventories increased by 21 billion cubic feet last week

- Total natural gas inventories now amount to 3,270 billion cubic feet, up 7.9% YoY

Credit News

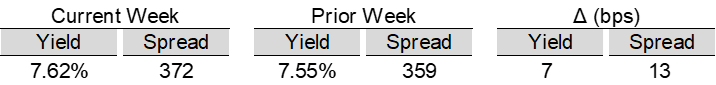

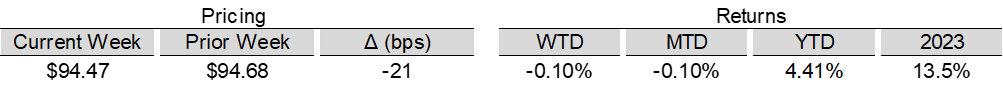

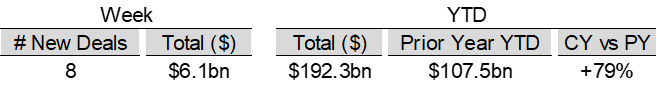

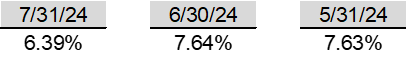

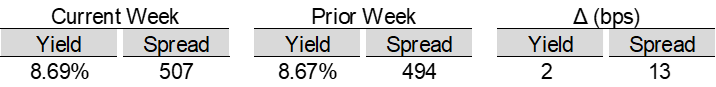

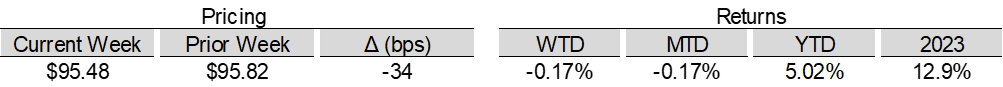

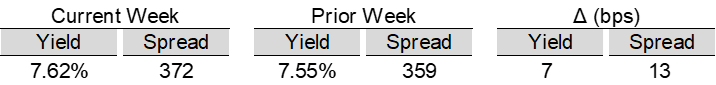

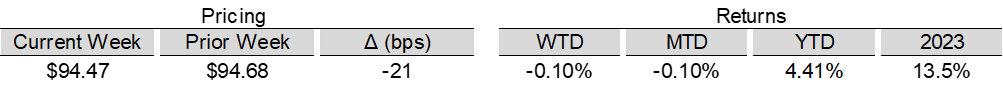

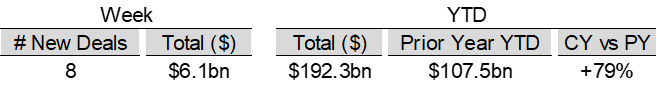

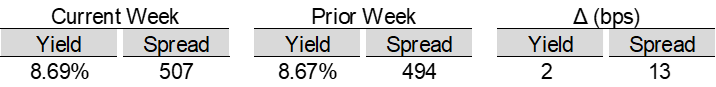

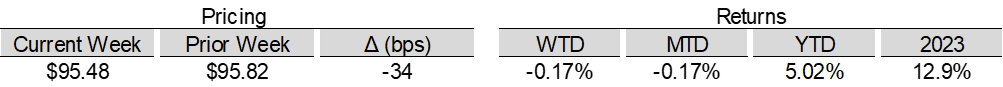

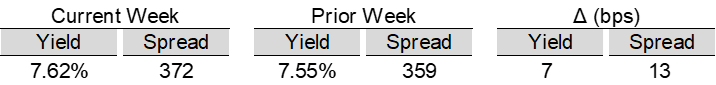

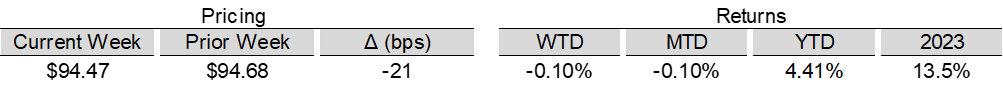

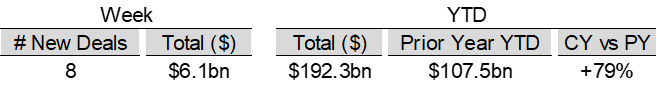

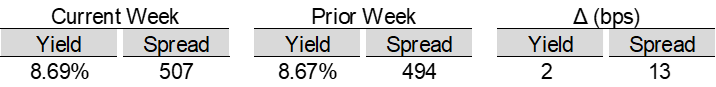

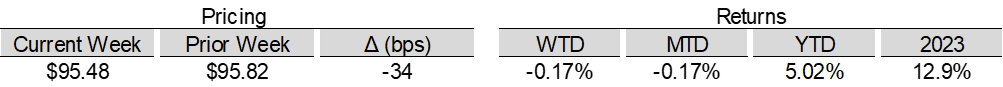

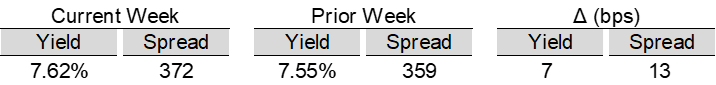

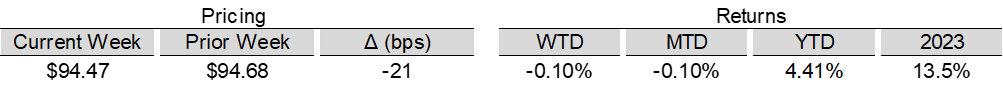

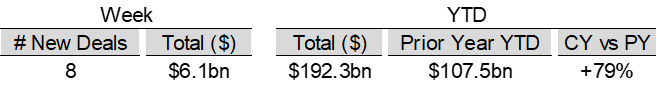

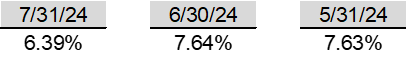

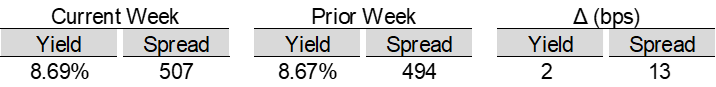

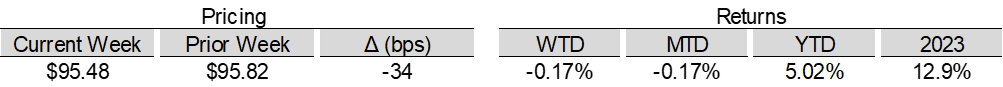

High yield bond yields increased 7bps to 7.62% and spreads increased 13bps to 372bps. Leveraged loan yields increased 2bps to 8.69% and spreads increased 13bps to 507bps. WTD Leveraged loan returns were negative 17bps. WTD high yield bond returns were negative 10bps. 10yr treasury yields increased 2bps to 4.00%. Yields and spreads recovered as investors evaluated the extent of the easing US labor market and the encouraging 2Q earnings.

High-yield:

Week ended 08/09/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

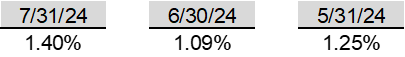

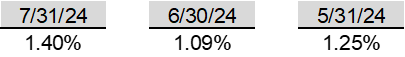

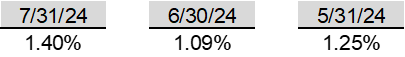

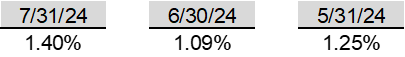

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

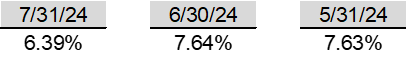

Leveraged loans:

Week ended 08/09/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), Quorum Health Group ($688mn, 7/10/24), Vyaire Medical ($339mn, 6/9/24), 99 Cents Only Stores ($350mn, 4/7/24), and ConvergeOne ($1.3bn, 4/4/24).

CLOs:

Week ended 08/09/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

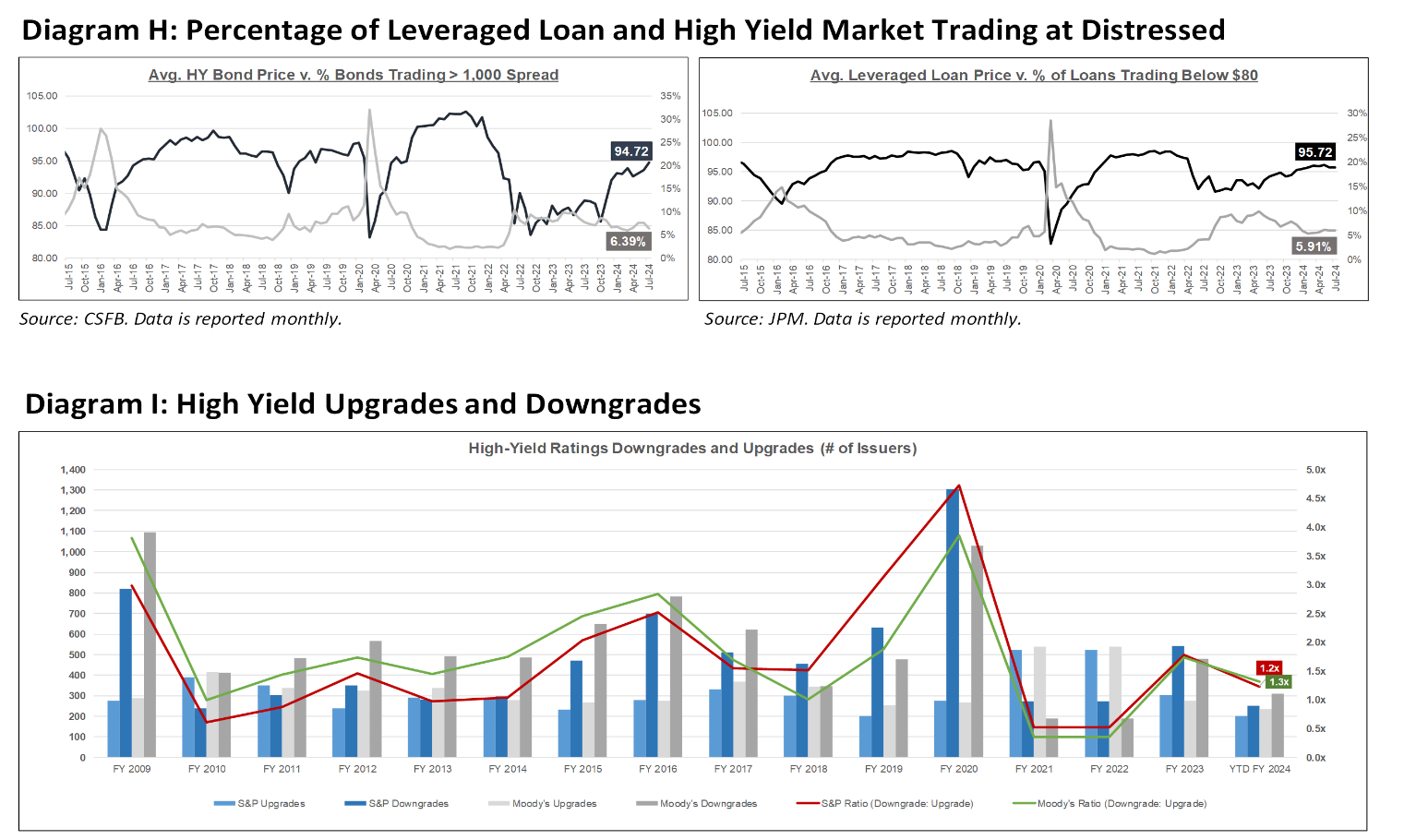

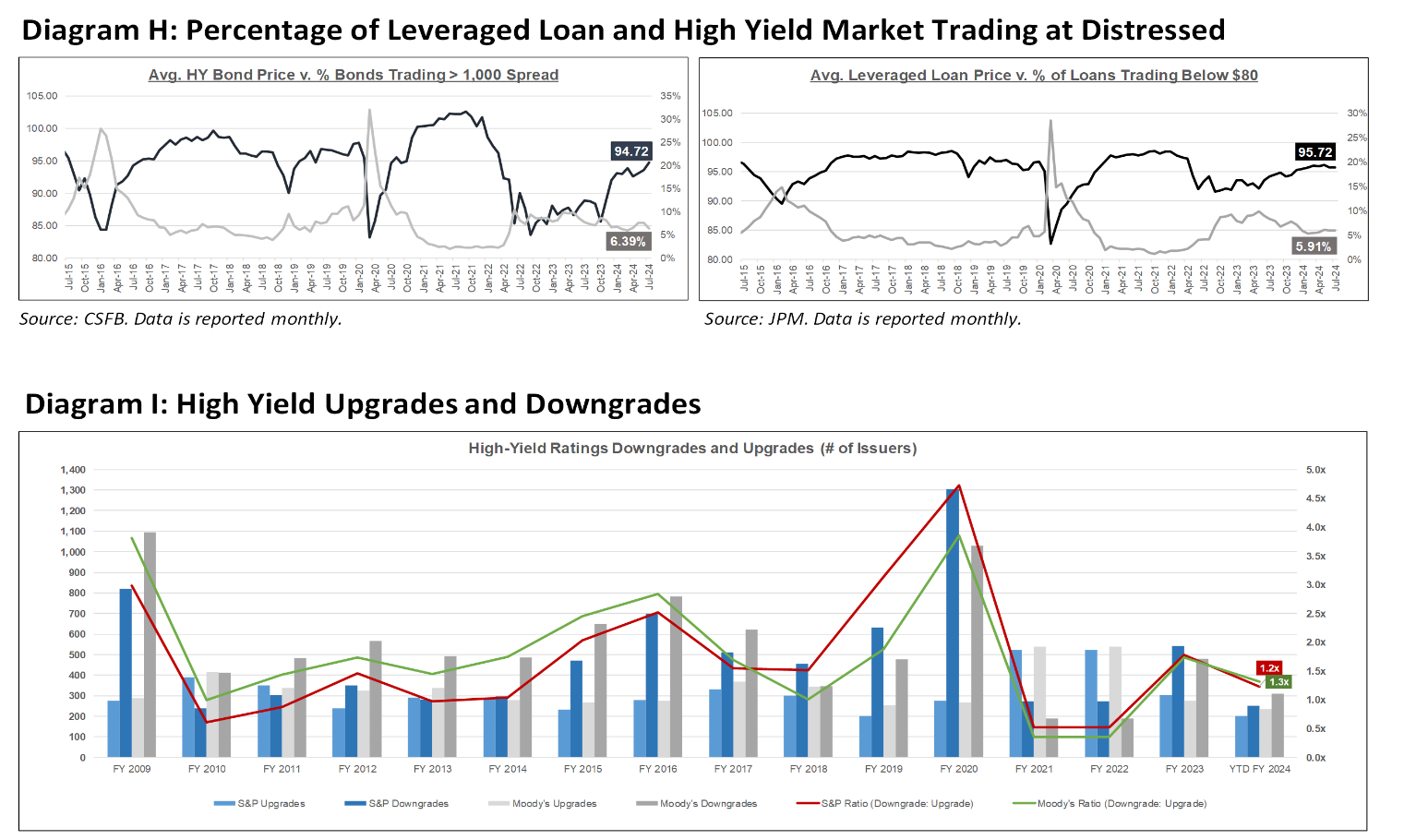

Ratings activity:

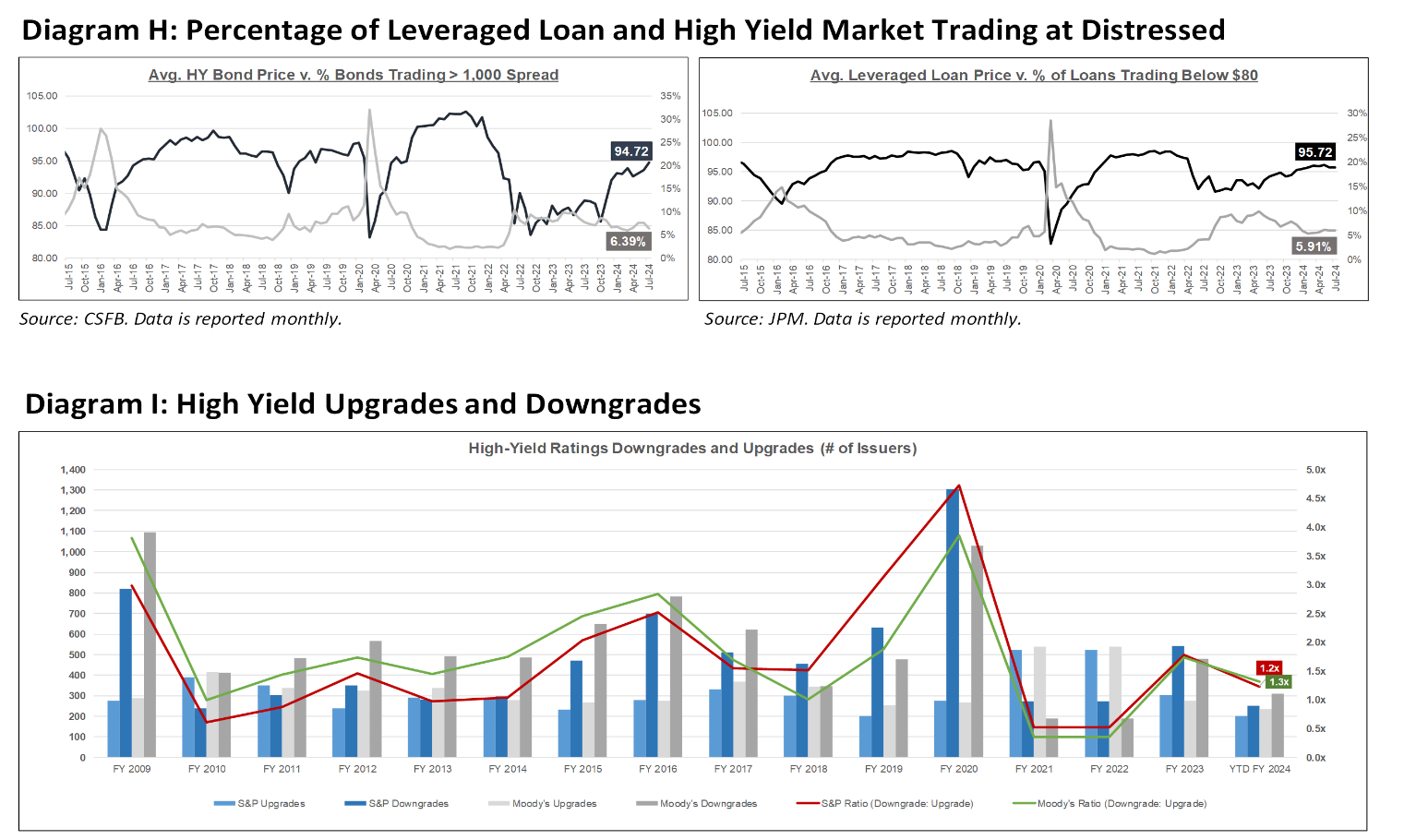

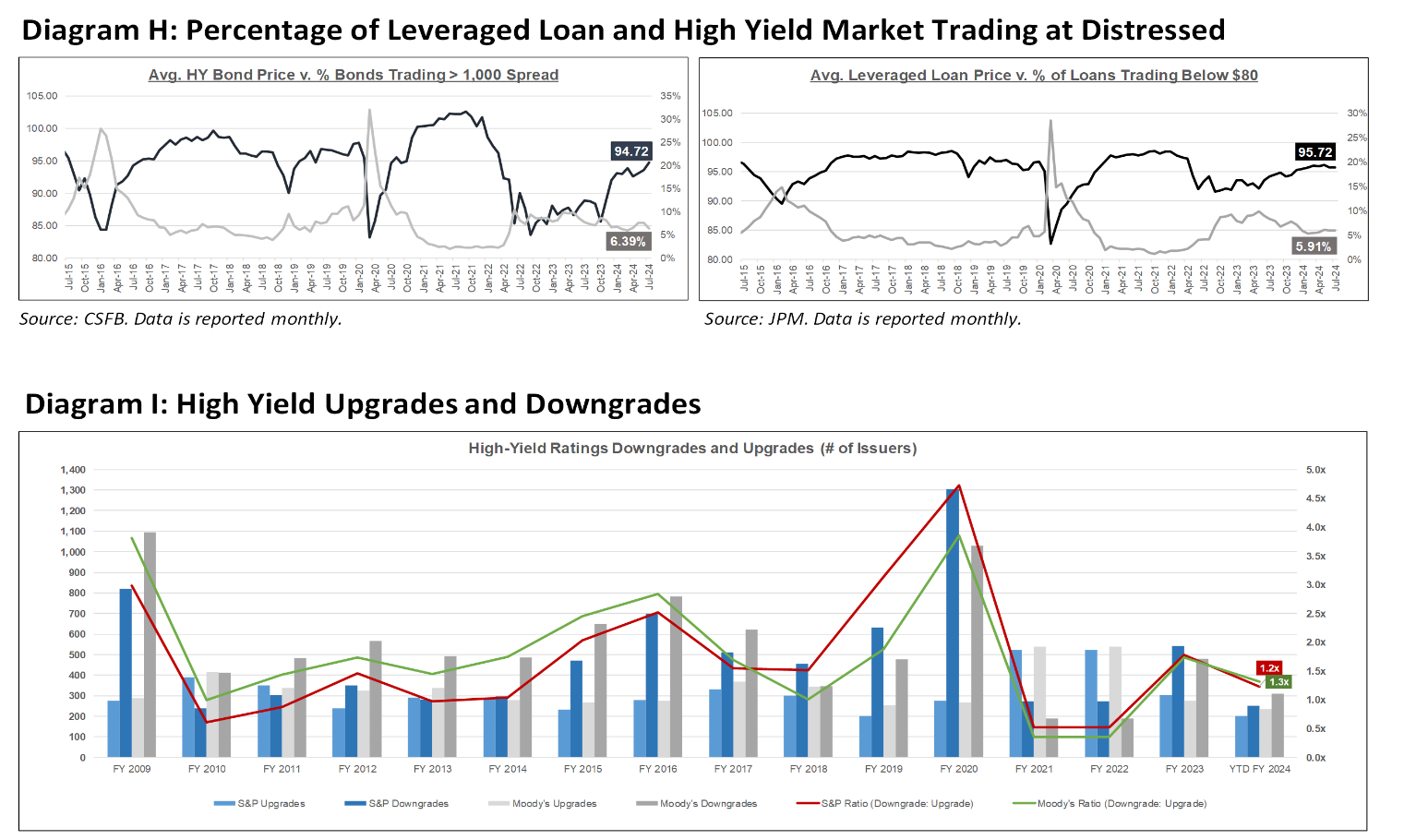

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

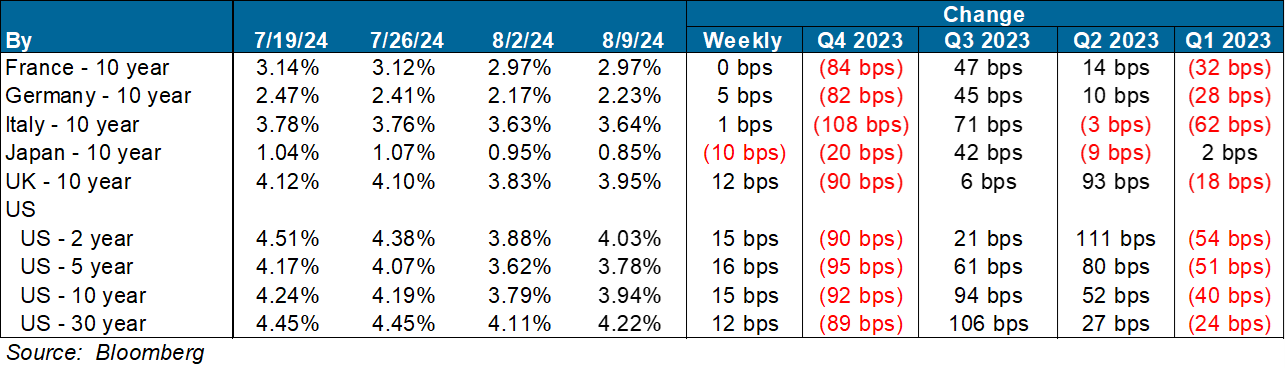

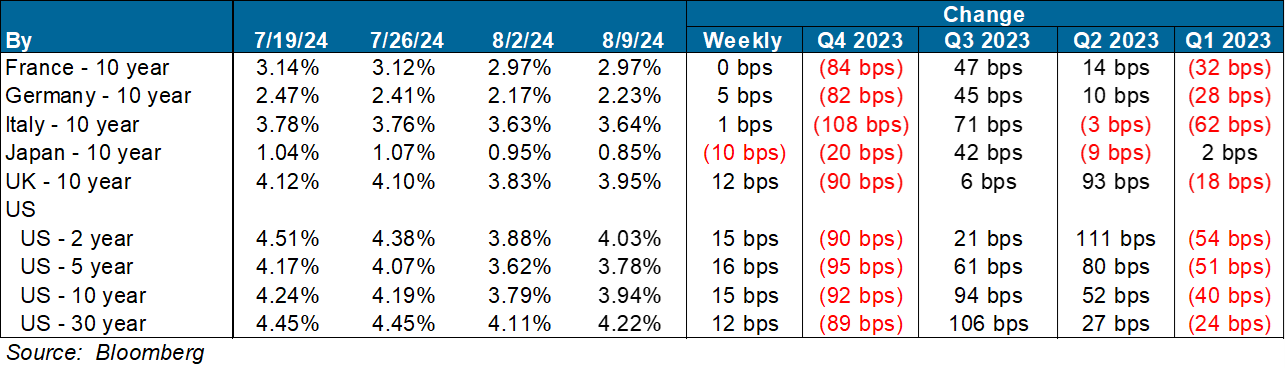

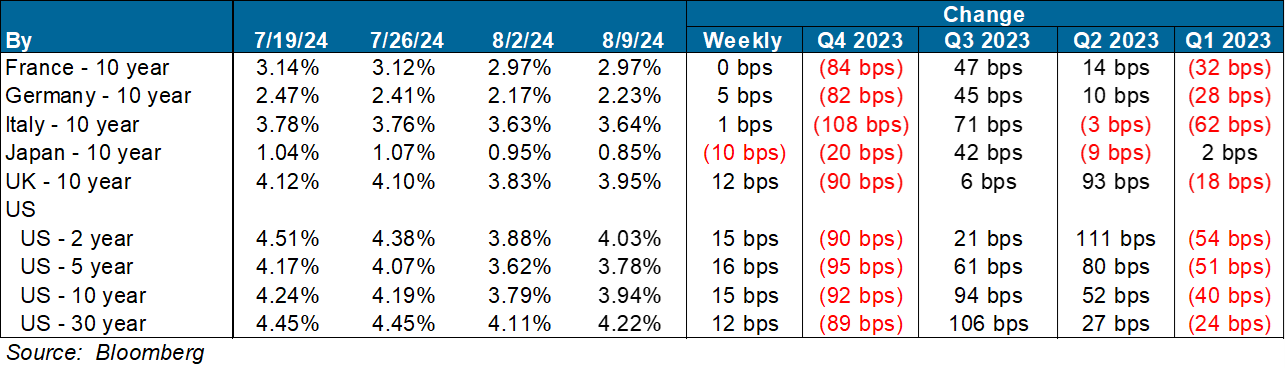

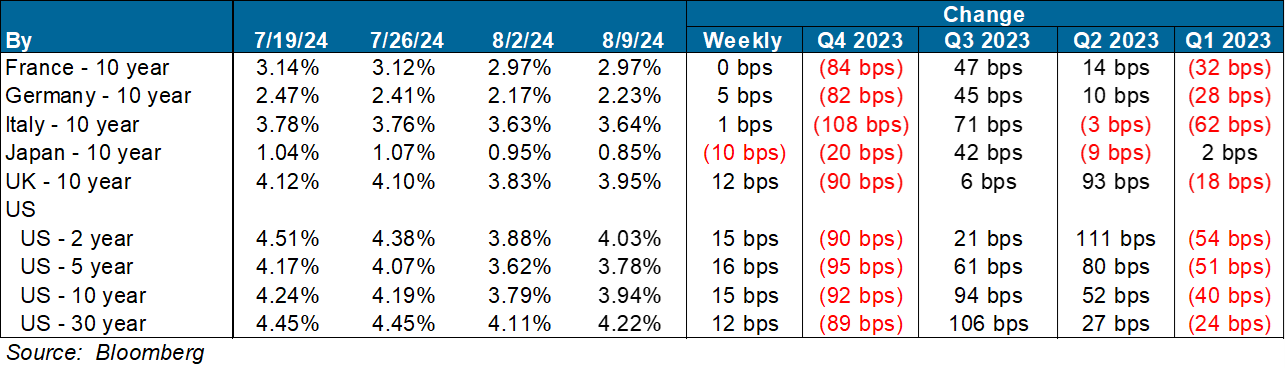

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

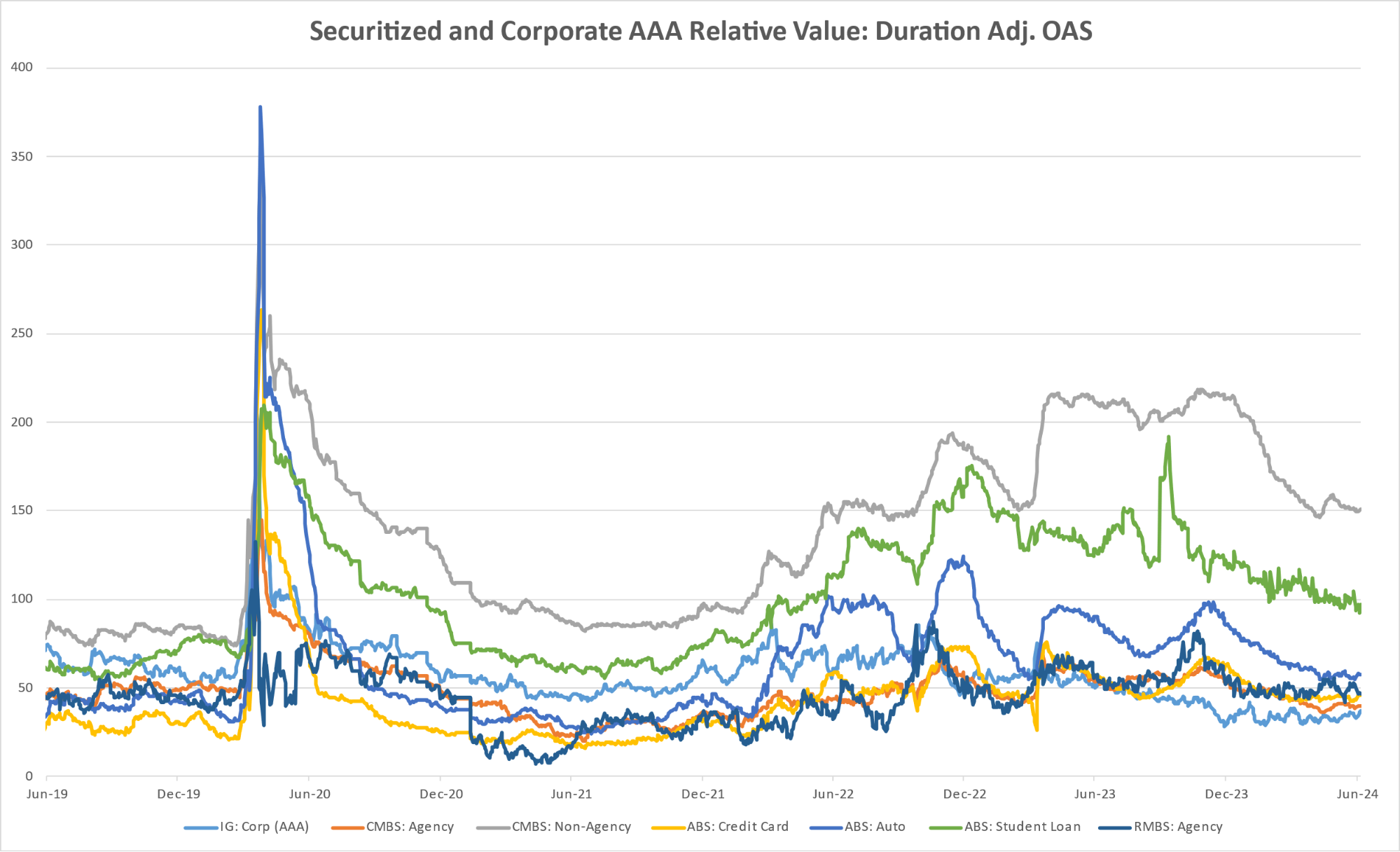

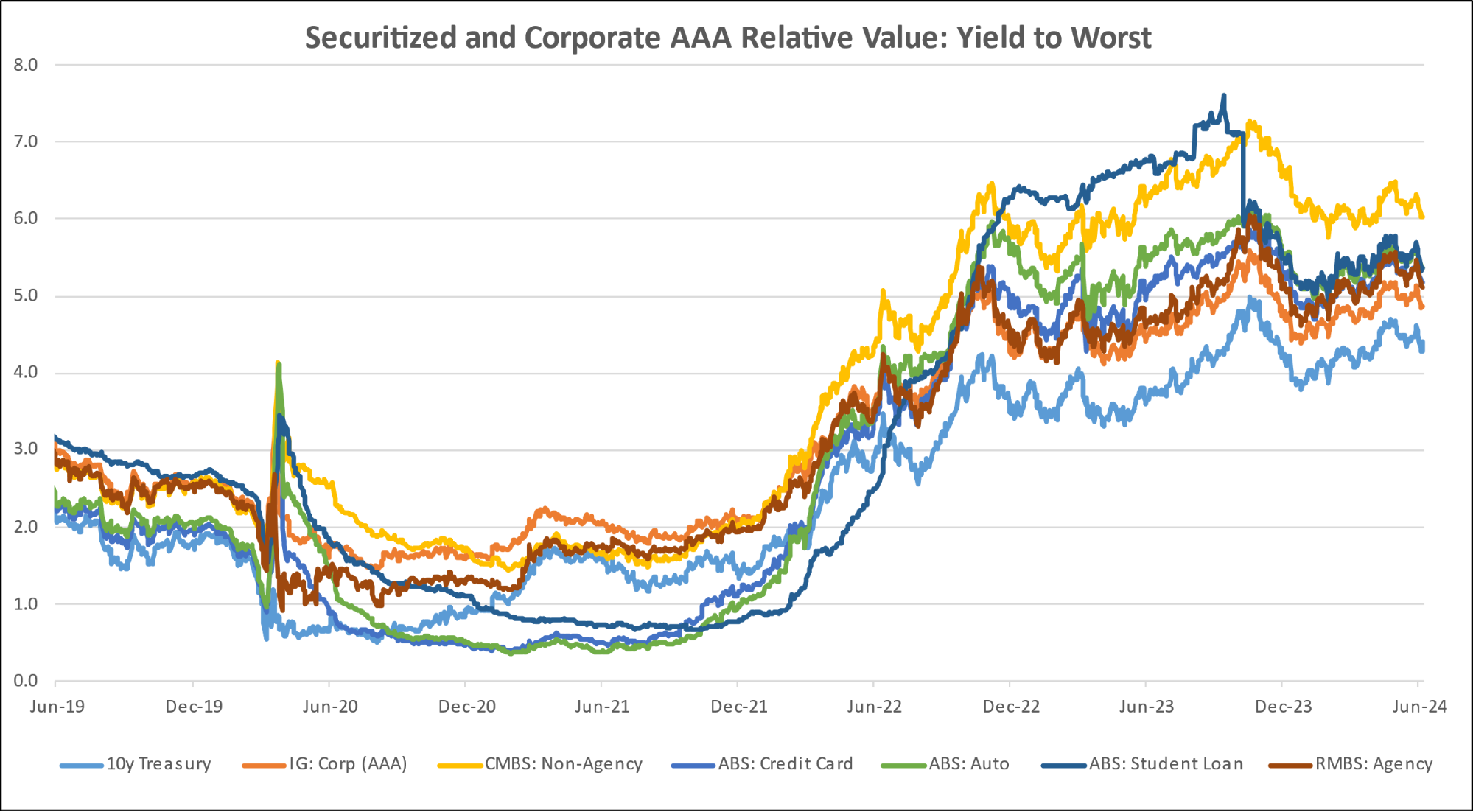

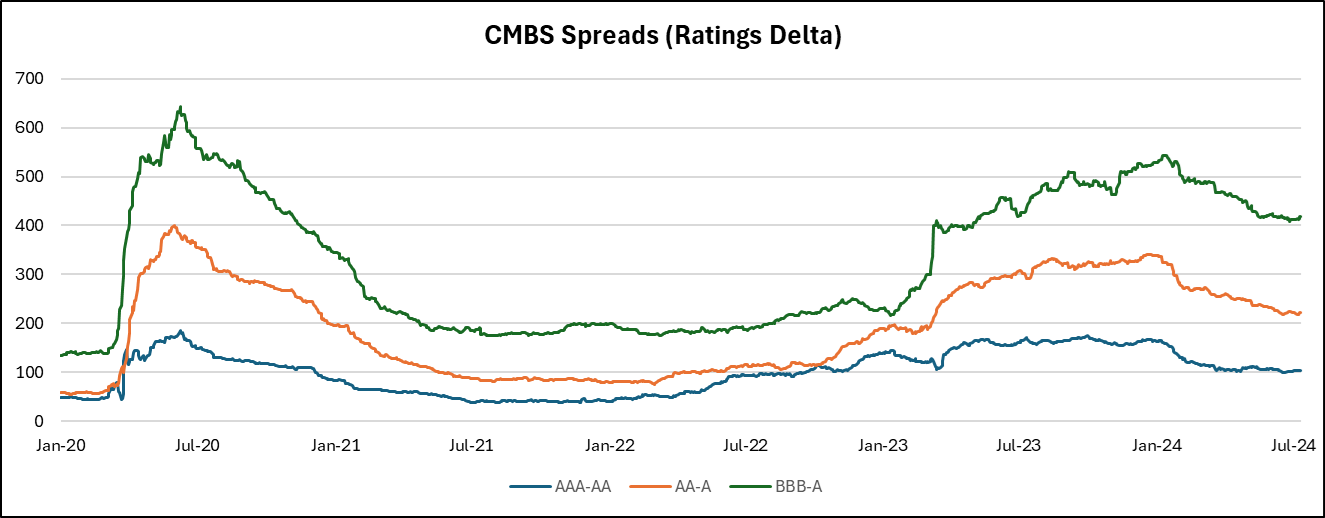

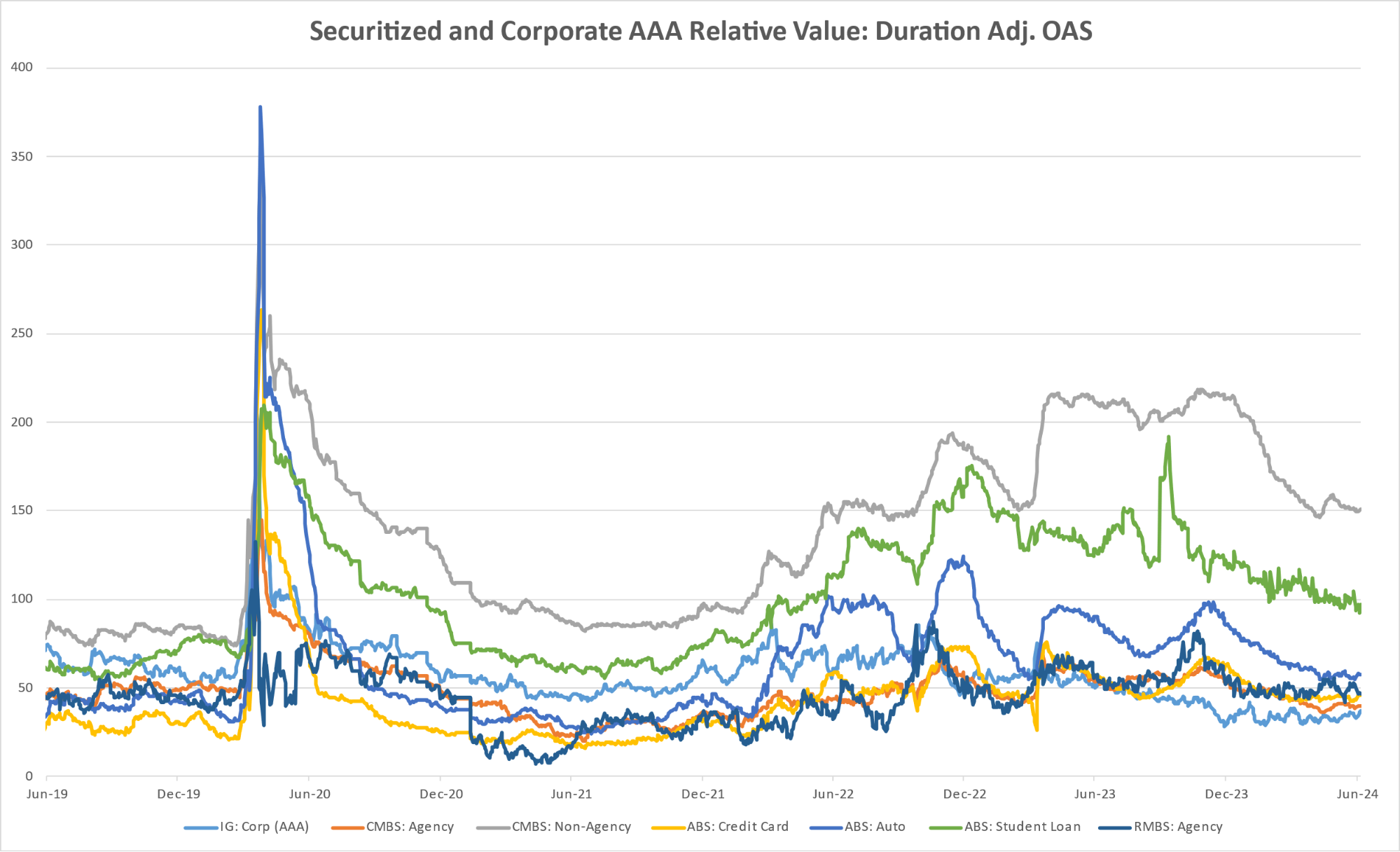

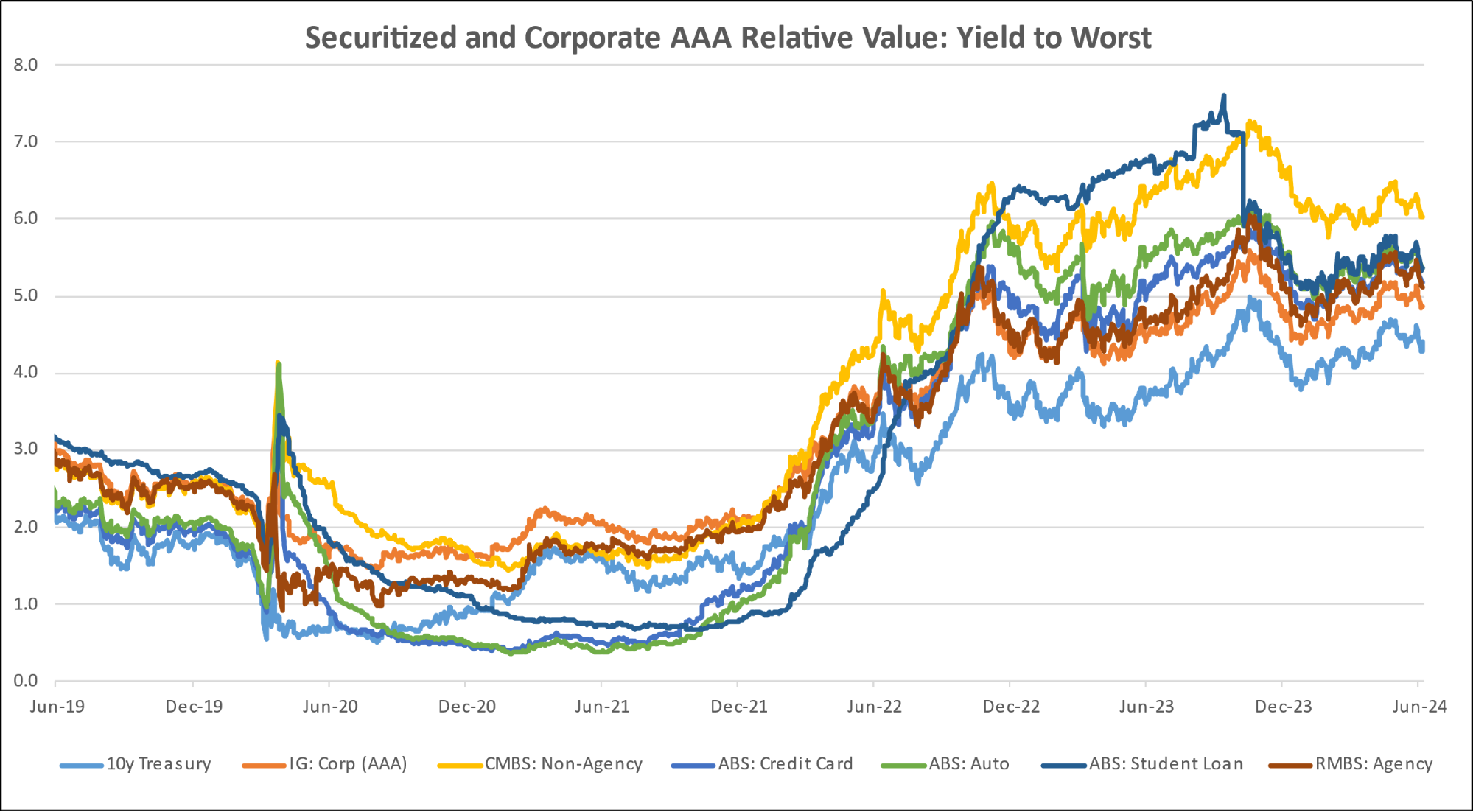

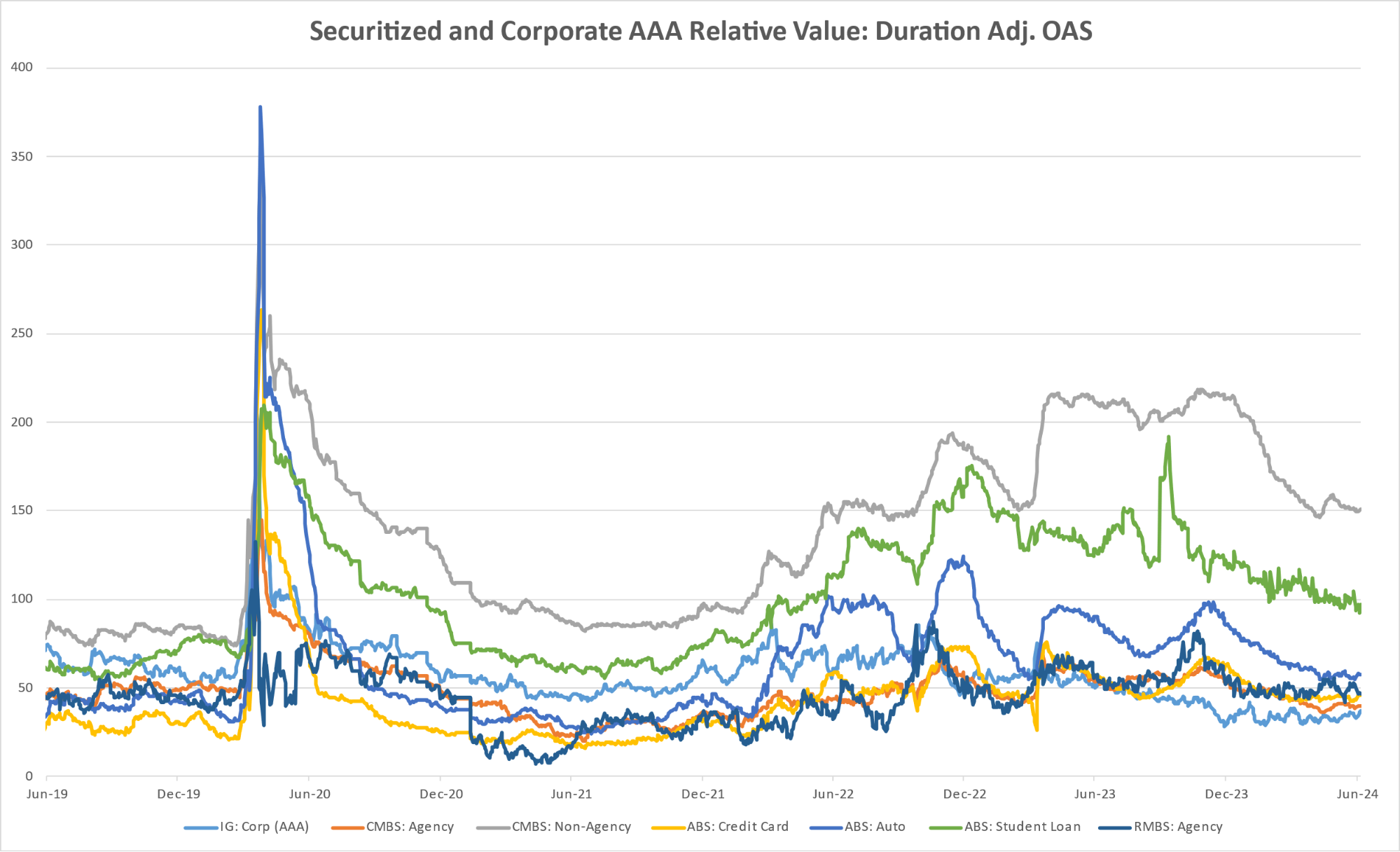

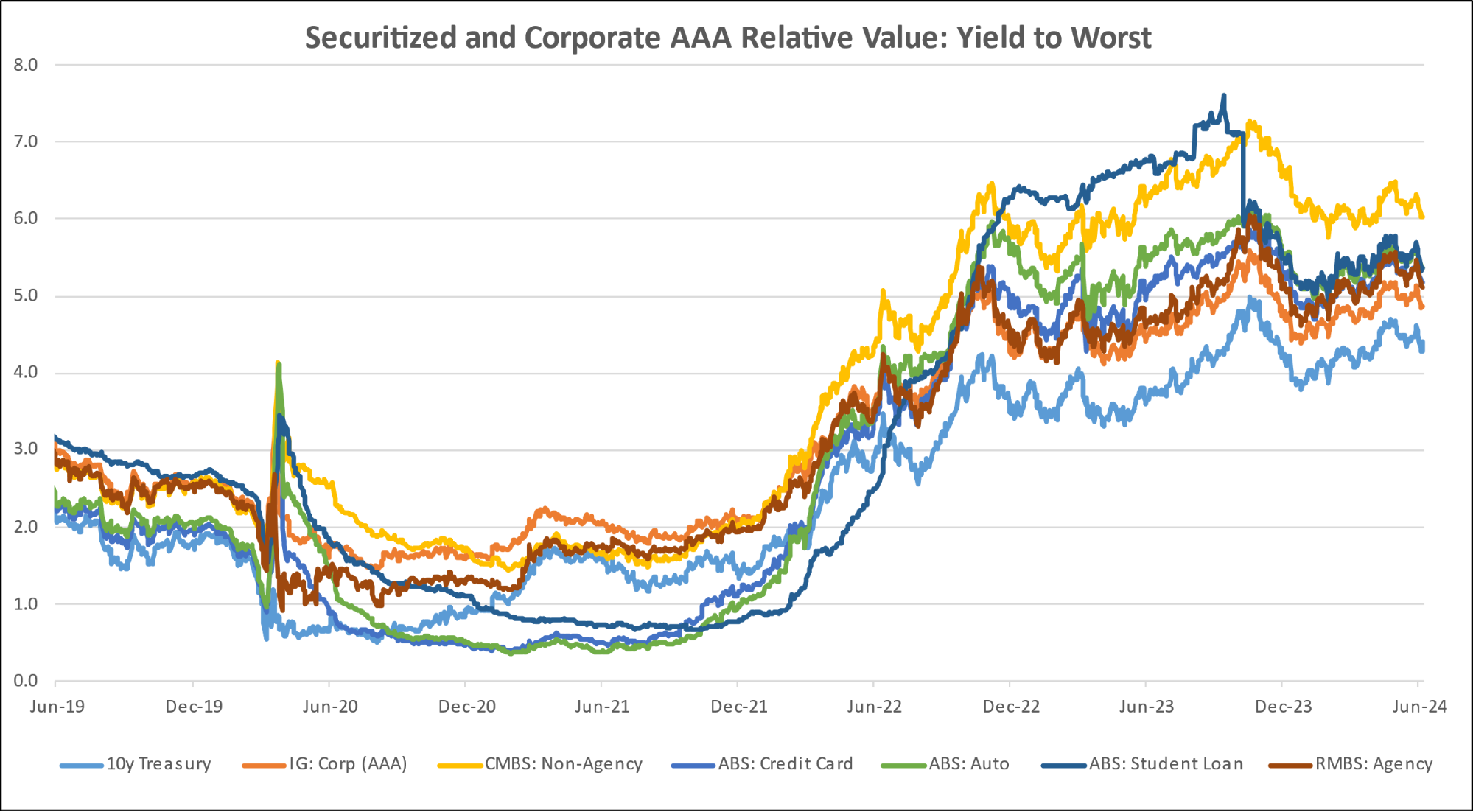

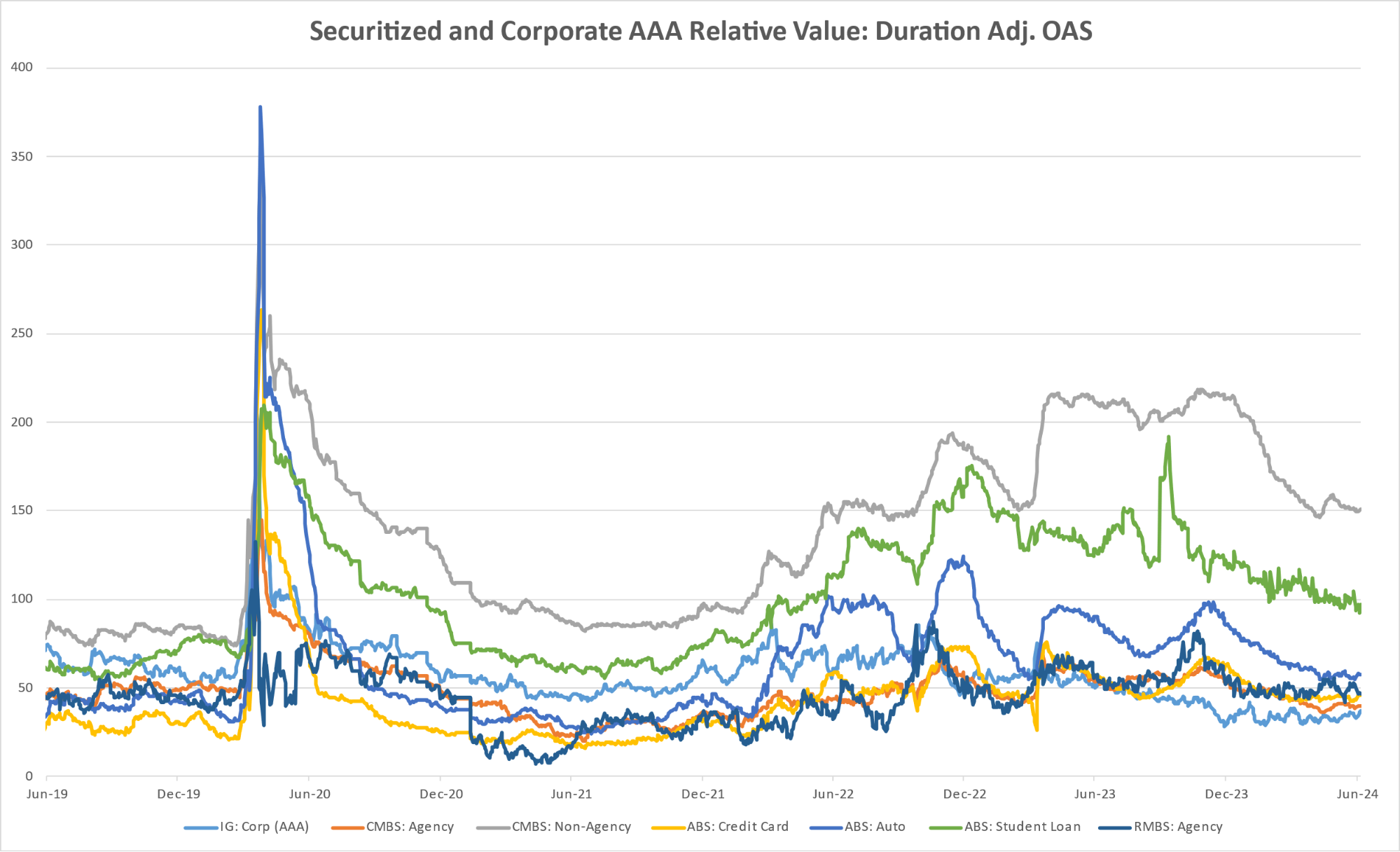

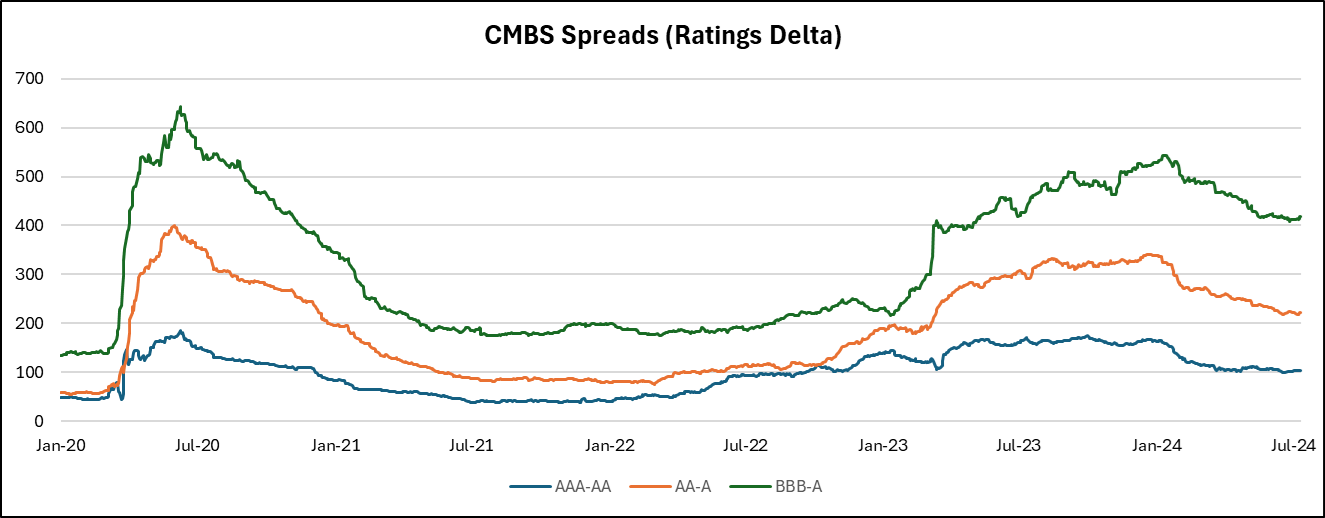

Diagram S: Structured Credit Spreads

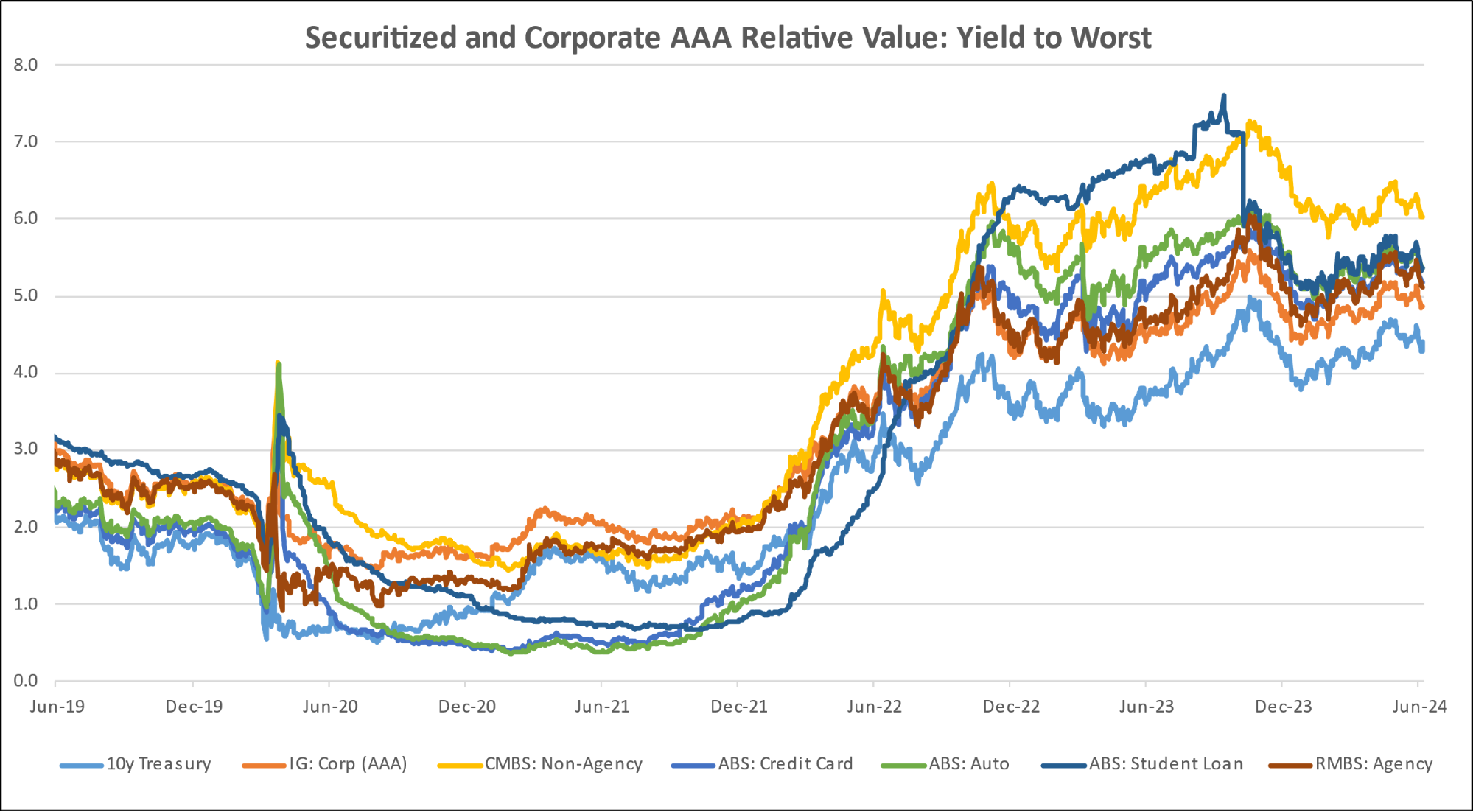

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

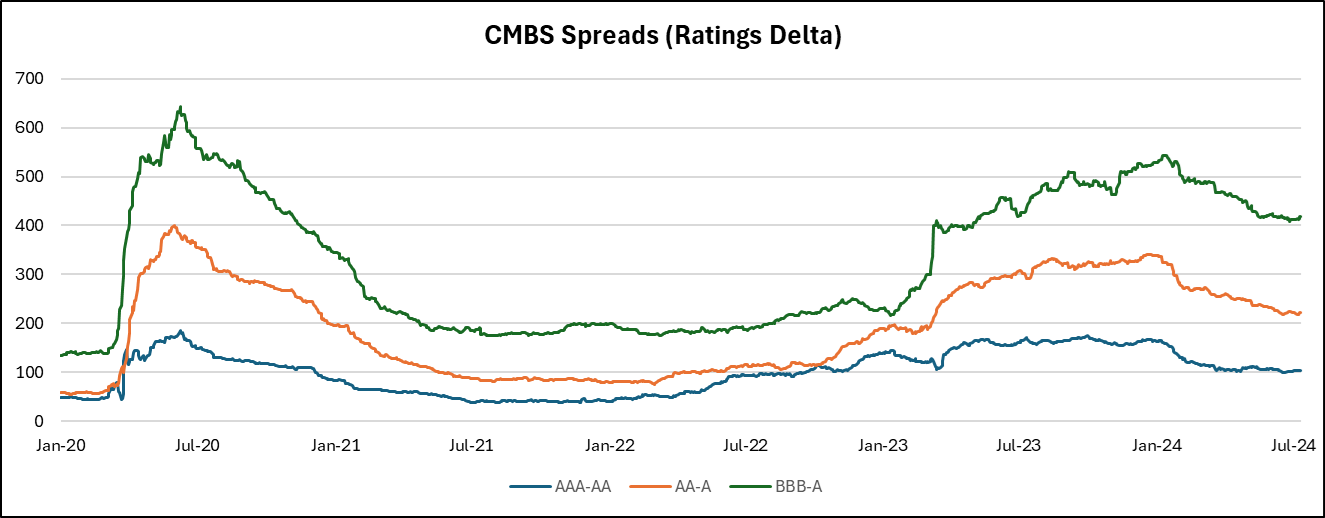

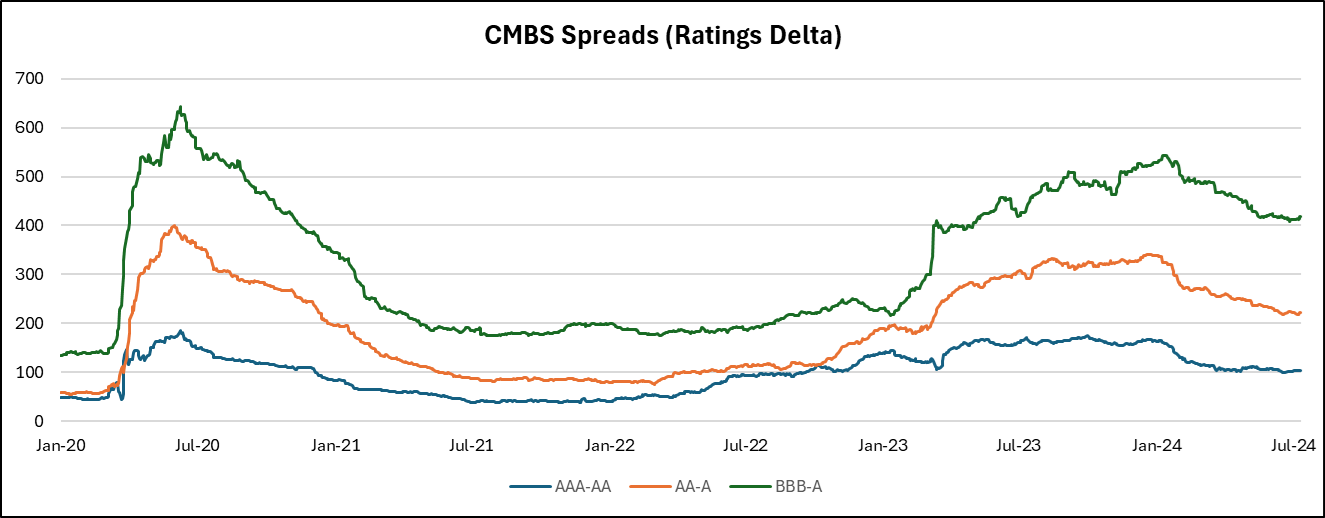

Diagram V: CMBS Spreads

Real Estate

Section 1:

Trends in home financing

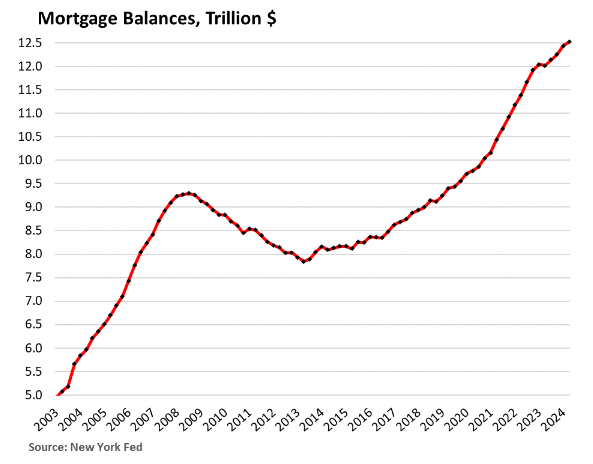

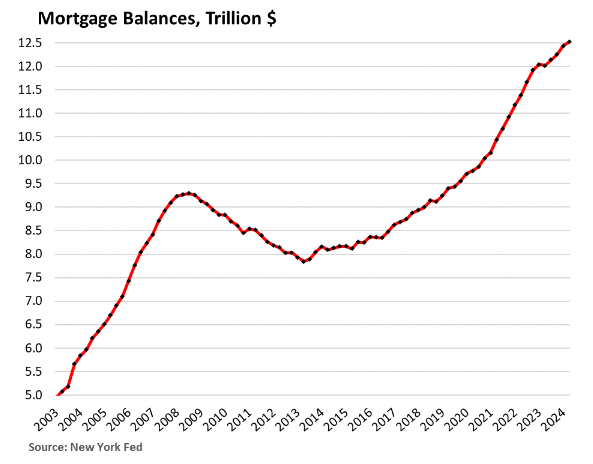

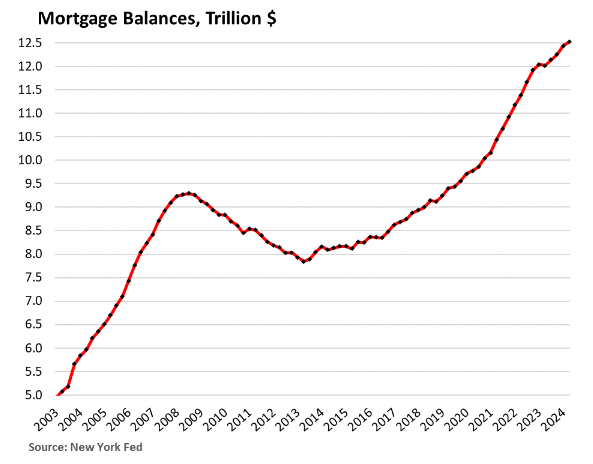

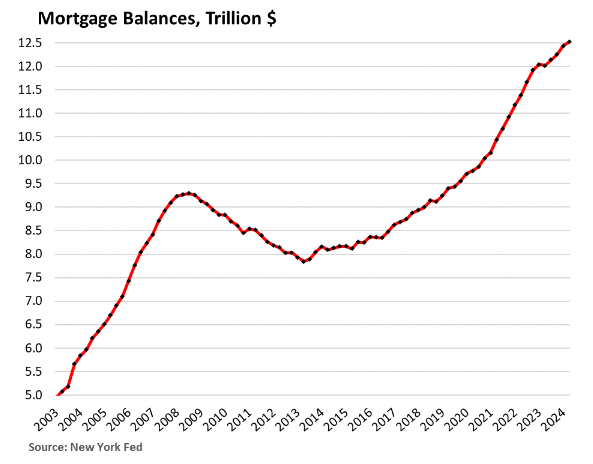

- Mortgage balances increased by $77 billion (0.6%) in Q2 from Q1, the smallest percentage rise since Q2 2023, and the second smallest since 2018, to $12.5 trillion.

- Year-over-year increase of 4.2%.

- Driven by higher home prices and larger amounts financed, particularly in higher-end homes.

- Sales of existing homes and new-home sales are slow, with mortgage applications to purchase homes down by nearly half since 2019.

- Some buyers are bypassing mortgages altogether.

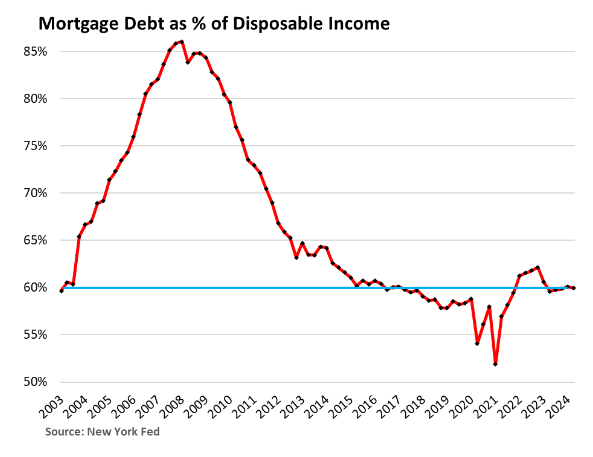

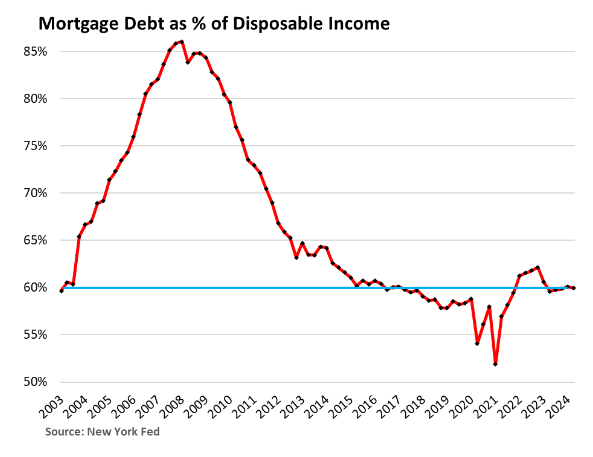

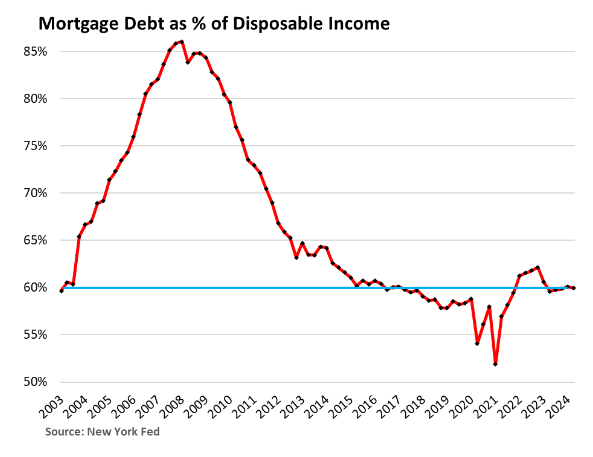

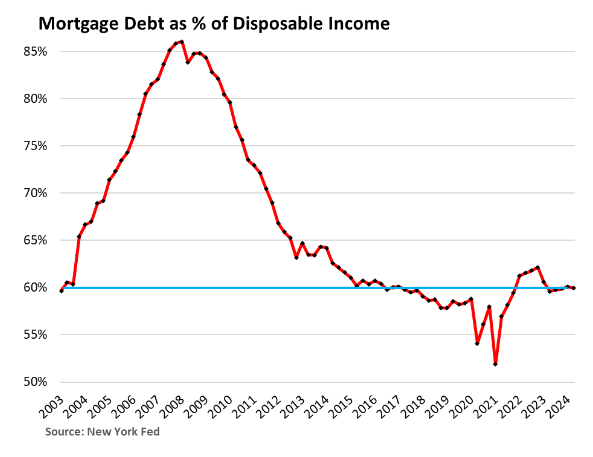

- Mortgage Debt vs. Disposable Income:

- Disposable income rose faster (+0.9%) than mortgage balances (+0.6%) in the latest quarter.

- The mortgage debt to disposable income ratio has remained roughly flat around 60% for the past five quarters, a historically low level.

- Before the 2008 housing crisis, this ratio surged from 60% in 2003 to over 80% in 2006, peaking at 86% in 2008 during the housing market collapse.

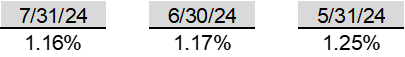

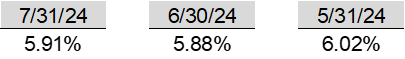

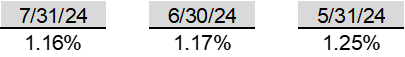

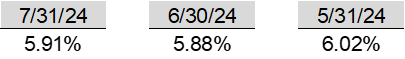

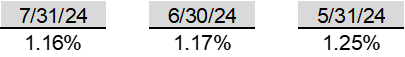

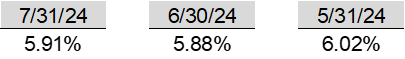

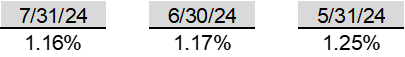

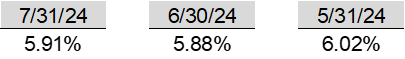

- Serious mortgage delinquencies (90+ days) decreased to 0.57%, down from over 1.0% pre-pandemic.

- Serious delinquencies for HELOCs (90+ days) dropped to 0.36%, the lowest level since 2006.

- Indicates that more borrowers who were behind on payments are catching up on their debts.

- Mortgage forbearance programs and foreclosure bans during the pandemic drastically reduced foreclosures to near zero.

- Foreclosures have increased since the pandemic but remain well below pre-pandemic levels.

- 47,180 consumers had foreclosures in Q2, compared to 65,000 to 90,000 per quarter in 2017-2019.

- The “frying-pan pattern” describes the gradual rise in foreclosures post-pandemic, still not reaching pre-pandemic “Good Times” levels.

Source: Wolfstreet

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- Consumer Credit

- Consumer credit rose by $8.9 billion in June, below the expected $9.7 billion, with a growth rate of 1.9%, down from 5.3% last year

- Revolving credit, such as credit card debt, decreased for the second time in three months, a trend last seen in 2021. Credit card interest rates remain high, at 20% or more

- Non-revolving credit, including auto and student loans, grew at a 3.4% annual rate in June, showing less volatility compared to revolving credit

- US Trade Deficit

- The U.S. trade deficit decreased by 2.5% in June to $73.1 billion, down from a 19-month high of $75.0 billion in May

- Exports rose by 1.5% in June to $265.9 billion, near a record high, while imports increased by 0.6% to $339.0 billion, about 3% below the 2022 record

- The larger trade deficit in Q2 lowered GDP growth by 0.7 percentage points from 2.8%

- S&P Final US Services PMI

- The S&P Global US Services PMI Business Activity Index for July was 55.0, indicating a marked expansion in services activity, with new business rising for the third consecutive month

- Input costs rose, driven by wages and transportation, but selling price inflation slowed due to competition.

- The service sector’s growth contributes to an estimated 2.2% annualized GDP growth rate, contrasting with the nearly stalled manufacturing sector

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 233,000 in the week ended August 2, down 17,000 from the prior week

- The four-week moving average was 240,750, up 2500 from the prior week

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 6,000 to 1.877 million in the week ended July 26. This figure is reported with a one-week lag

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $7.175 trillion in the week ended August 9, down $3.1 billion from the prior week

- Treasury holdings totaled $4.414 trillion, down $8.7 billion from the prior week

- Holdings of mortgage-backed securities (MBS) were $2.32 trillion in the week, down $16.2 billion from the prior week

- Total Public Debt

- Total public debt outstanding was $35.12 trillion as of August 9, an increase of 7.5% from the previous year

- Debt held by the public was $25.81 trillion, and intragovernmental holdings were $7.17 trillion

- Inflation Factors

- CPI:

- The consumer-price index rose 3.0% in June year over year

- On a monthly basis, the CPI decreased -0.1% in June on a seasonally adjusted basis, after increasing 0.0% in May

- The index for all items less food and energy (core CPI) rose 0.1% in June, after rising 0.2% in May

- Core CPI increased 3.3% for the 12 months ending June

- Food and Beverages:

- The food at home index increased 1.1% in June from the same month a year earlier, and increased 0.1% in June month over month

- The food away from home index increased 4.1% in June from the same month a year earlier, and increased 0.4% in June month over month

- Commodities:

- The energy commodities index decreased (3.7%) in May after decreasing (3.5%) in

- The energy commodities index fell (2.3%) over the last 12 months

- The energy services index 2.1% in May after increasing 0.3% in May

- The energy services index rose 4.3% over the last 12 months

- The gasoline index rose (2.5%) over the last 12 months

- The fuel oil index fell 0.8% over the last 12 months

- The index for electricity rose 4.4% over the last 12 months

- The index for natural gas fell 3.7% over the last 12 months

- Supply Chain:

- Drewry’s composite World Container Index decreased to $5,550.76 per 40ft container for

- Drewry’s composite World Container Index has increased by 210.0% over the last 12 months

- Housing Market:

- The shelter index increased 0.2% in June after increasing 0.4% in May

- The rent index increased 0.2% in May after increasing 0.4% in May

- The index for lodging away from home decreased (0.6%) in June after increasing 1.4% in May

- Federal Funds Rate

- The effective Federal Funds Rate is at 5.33%, flat 0.00% year to date

World News

-

Israel/Gaza

- An Israeli airstrike on a Gaza City school complex, used as both a shelter and a militant command post, killed dozens of civilians and 19 members of Hamas and Islamic Jihad

- The strike drew criticism from Arab governments and complicated U.S.-led efforts to restart cease-fire talks between Israel and Hamas

- Israel’s military claimed measures were taken to minimize civilian harm, while Palestinian authorities reported significant casualties, including women and children

- Forty-four Palestinian detainees have died in Israeli military custody from October 7 through July 2, raising allegations of abuse and mistreatment by Israeli authorities

-

Russia

- Ukrainian forces have advanced at least 20 miles into Russia’s Kursk region, marking the first major foreign military invasion of Russian territory since World War II, causing over 76,000 Russian civilians to flee the area

- Despite the Ukrainian incursion, Russian authorities and state media have downplayed the events, referring to the situation as a “counterterrorist operation” and describing Ukrainian forces as “saboteurs.”

- The recent U.S.-Russia prisoner swap did not include Russian cybercriminals Alexander Vinnik and Vladimir Dunaev, who were rumored to be part of the negotiations; both remain in U.S. custody

- Dunaev was sentenced to over five years for developing the Trickbot malware used against American hospitals, while Vinnik, linked to laundering billions through the BTC-e bitcoin exchange, pleaded guilty and awaits sentencing

-

UK

- Thousands of anti-racism protesters gathered in multiple UK cities, including London, Belfast, and Birmingham, in response to recent violence and riots linked to false rumors about a murder suspect

- The National Police Chiefs’ Council (NPCC) reported 779 arrests related to the riots, with 349 individuals charged; police are investigating online influencers for allegedly inciting violence

- The unrest was sparked by a violent incident in Southport, where three young girls were killed, leading to widespread protests and condemnation of racism, with additional measures like dispersal orders and Section 60 orders being enforced to maintain public safety

-

China

- China’s consumer-price index increased by 0.5% in July 2024, marking the sixth consecutive month of rising consumer inflation, driven mainly by supply-side factors such as weather disruptions affecting food prices

- Despite the rise in consumer inflation, factory-gate prices in China continued to decline, with the producer-price index falling 0.8% in July 2024, marking the 22nd consecutive month of contraction, indicating ongoing concerns about weak domestic demand and economic challenges

- Starting September 1, 2024, China will impose stricter regulations on chemicals used in fentanyl production, requiring exporters to obtain licenses, in response to U.S. pressure and as part of efforts to improve diplomatic relations

-

Germany

- Germany’s trade surplus narrowed to €20.4 billion in June as exports fell by 3.4%, a greater decline than expected, largely due to weak demand from the Chinese market and increased trade tensions between Europe and China

-

Canada

- Canada’s rail operations face potential shutdowns as the labor-relations board ruled that a work stoppage at Canadian Pacific Kansas City and Canadian National Railway wouldn’t pose a serious safety risk, allowing unionized workers to strike or the companies to initiate a lockout starting August 22 if no agreements are reached

-

Brazil

- A Voepass twin-engine passenger plane crashed in Vinhedo, Brazil, killing all 62 people on board. Investigators are examining the possibility of ice buildup on the wings, which could have reduced the aircraft’s lift and contributed to the crash.

-

Uganda

- A landslide at the Kiteezi landfill in Kampala, Uganda, has killed at least 12 people, with rescuers continuing to search for survivors following weeks of heavy rain. The incident has displaced approximately 1,000 people as the city seeks a new landfill site

-

Mali

- Dozens of Russian / Wagner Group mercenaries, hired by the Malian government to fight insurgents, were killed in an attack conducted by Tuareg rebels on Sunday. The attack dealt a blow to the image of Wagner Group and the Russian presence in the region

-

New Zealand

- The ANZ-Roy Morgan consumer confidence index for New Zealand rose 5 points to 87.9 in July 2024, amid rising expectations of significant interest-rate cuts and a notable fall in inflation expectations to 3.7%

-

Singapore

- The Monetary Authority of Singapore maintained its monetary policy settings and expects GDP growth to approach its potential rate of 2%-3% for the full year, supported by improved economic momentum and easing inflation

-

EU

- The EU proposed duties between 12.8% and 36.4% on Chinese biofuels, claiming that it found Chinese companies dumping biofuels into European markets at unfair prices

Commodities

-

Oil Prices

- WTI: $76.96 per barrel

- +4.68% WoW; +7.41% YTD; (7.08%) YoY

- Brent: $79.68 per barrel

- +3.74% WoW; +3.43% YTD; (7.78%) YoY

-

US Production

- U.S. oil production amounted to 13.4 million bpd for the week ended August 2, up 0.1 million bpd

from the prior week

-

Rig Count

- The total number of oil rigs amounted to 588, up 2 from last week

-

Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 429.3 million barrels, down (3.7%) YoY

- Refiners operated at a capacity utilization rate of 90.5% for the week, up from 90.1% in the prior week

- U.S. crude oil imports now amount to 6.953 million barrels per day, down (6.9%) YoY

-

Gasoline

- Retail average regular gasoline prices amounted to $3.45 per gallon in the week of August 9,

down (10.1%) YoY

- Gasoline prices on the East Coast amounted to $3.48, down (9.2%) YoY

- Gasoline prices in the Midwest amounted to $3.51, down (6.4%) YoY

- Gasoline prices on the Gulf Coast amounted to $3.11, down (12.2%) YoY

- Gasoline prices in the Rocky Mountain region amounted to $3.55, down (12.5%) YoY

- Gasoline prices on the West Coast amounted to $4.21, down (12.4%) YoY

- Motor gasoline inventories were up by 1.3 million barrels from the prior week

- Motor gasoline inventories amounted to 225.1 million barrels, up 4.0% YoY

- Production of motor gasoline averaged 10.04 million bpd, up 1.2% YoY

- Demand for motor gasoline amounted to 8.967 million bpd, down (3.6%) YoY

-

Distillates

- Distillate inventories decreased by 0.9 million in the week of August 9

- Total distillate inventories amounted to 127.8 million barrels, up 10.7% YoY

- Distillate production averaged 5.036 million bpd, up 2.5% YoY

- Demand for distillates averaged 3.469 million bpd in the week, down (7.8%) YoY

-

Natural Gas

- Natural gas inventories increased by 21 billion cubic feet last week

- Total natural gas inventories now amount to 3,270 billion cubic feet, up 7.9% YoY

Credit News

High yield bond yields increased 7bps to 7.62% and spreads increased 13bps to 372bps. Leveraged loan yields increased 2bps to 8.69% and spreads increased 13bps to 507bps. WTD Leveraged loan returns were negative 17bps. WTD high yield bond returns were negative 10bps. 10yr treasury yields increased 2bps to 4.00%. Yields and spreads recovered as investors evaluated the extent of the easing US labor market and the encouraging 2Q earnings.

High-yield:

Week ended 08/09/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 08/09/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros ($2.8bn, 7/11/24), Quorum Health Group ($688mn, 7/10/24), Vyaire Medical ($339mn, 6/9/24), 99 Cents Only Stores ($350mn, 4/7/24), and ConvergeOne ($1.3bn, 4/4/24).

CLOs:

Week ended 08/09/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Diagram V: CMBS Spreads

Real Estate

Section 1:

Trends in home financing

- Mortgage balances increased by $77 billion (0.6%) in Q2 from Q1, the smallest percentage rise since Q2 2023, and the second smallest since 2018, to $12.5 trillion.

- Year-over-year increase of 4.2%.

- Driven by higher home prices and larger amounts financed, particularly in higher-end homes.

- Sales of existing homes and new-home sales are slow, with mortgage applications to purchase homes down by nearly half since 2019.

- Some buyers are bypassing mortgages altogether.

- Mortgage Debt vs. Disposable Income:

- Disposable income rose faster (+0.9%) than mortgage balances (+0.6%) in the latest quarter.

- The mortgage debt to disposable income ratio has remained roughly flat around 60% for the past five quarters, a historically low level.

- Before the 2008 housing crisis, this ratio surged from 60% in 2003 to over 80% in 2006, peaking at 86% in 2008 during the housing market collapse.

- Serious mortgage delinquencies (90+ days) decreased to 0.57%, down from over 1.0% pre-pandemic.

- Serious delinquencies for HELOCs (90+ days) dropped to 0.36%, the lowest level since 2006.

- Indicates that more borrowers who were behind on payments are catching up on their debts.

- Mortgage forbearance programs and foreclosure bans during the pandemic drastically reduced foreclosures to near zero.

- Foreclosures have increased since the pandemic but remain well below pre-pandemic levels.

- 47,180 consumers had foreclosures in Q2, compared to 65,000 to 90,000 per quarter in 2017-2019.

- The “frying-pan pattern” describes the gradual rise in foreclosures post-pandemic, still not reaching pre-pandemic “Good Times” levels.

Source: Wolfstreet

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index