U.S. News

- New Home Sales

- U.S. new-home sales fell sharply by 17.3% in October, reaching a seasonally adjusted annual rate of 610,000 – the lowest level since November 2022, primarily due to hurricanes in the South.

- The South saw a 27.7% drop in new-home sales, significantly affecting the national total, while sales in the Northeast surged by 53.3%.

- The median price of new homes rose to $437,300, while supply increased 23.4% month over month.

- Consumer Confidence

- Consumer confidence increased to 111.7 in November, a 16-month high, fueled by easing inflation, strong job growth, and rising stock prices.

- The expectations index, which measures six-month outlooks, climbed to 92.3, marking its highest point since December 2021, signaling growing optimism about 2025.

- PCE Index

- The PCE index increased by 0.2% in October, bringing the annual inflation rate to 2.3%, up from 2.1%, signaling a continued upward trend in prices through year-end.

- The core PCE index, which excludes food and energy prices, rose by 0.3% in October, with the 12-month core rate climbing to 2.8%, the first increase since June.

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 213,000 in the week ended November 22, down 2,000 from the prior week.

- The four-week moving average was 217,000, down 1,250 from the prior week.

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 9,000 to 1.907 million in the week ended November 15. This figure is reported with a one-week lag.

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $6.905 trillion in the week ended November 29, down $18.6 billion from the prior week.

- Treasury holdings totaled $4.323 trillion, down $2.3 billion from the prior week.

- Holdings of mortgage-backed securities (MBS) were $2.26 trillion in the week, down $9.4 billion from the prior week.

- Total Public Debt

- Total public debt outstanding was $36.09 trillion as of November 29, an increase of 6.5% from the previous year.

- Debt held by the public was $28.74 trillion, and intragovernmental holdings were $7.38 trillion.

- Inflation Factors

- CPI:

- The consumer-price index rose 2.6% in October year over year.

- On a monthly basis, the CPI increased 0.2% in October on a seasonally adjusted basis, after increasing 0.2% in September.

- The index for all items less food and energy (core CPI) rose 0.3% in October, after rising 0.3% in September.

- Core CPI increased 3.3% for the 12 months ending October.

- Food & Beverages:

- The food at home index increased 1.1% in October from the same month a year earlier, and increased 0.1% in October month over month.

- The food away from home index increased 3.8% in October from the same month a year earlier, and increased 0.2% in October month over month.

- Commodities:

- The energy commodities index decreased (1.0%) in October after decreasing (4.0%) in September.

- The energy commodities index fell (12.4%) over the last 12 months.

- The energy services index rose (0.4%) in October after increasing 0.4% in September.

- The energy services index rose 4.0% over the last 12 months.

- The gasoline index fell (12.2%) over the last 12 months.

- The fuel oil index fell (20.8%) over the last 12 months.

- The index for electricity rose 4.5% over the last 12 months.

- The index for natural gas rose 2.0% over the last 12 months.

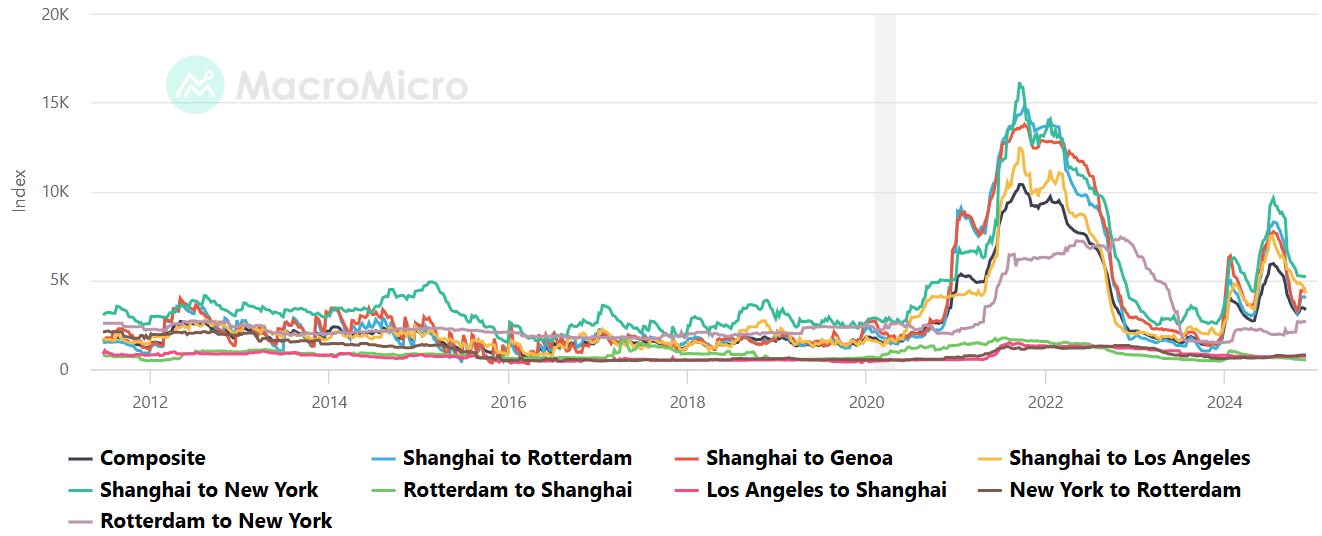

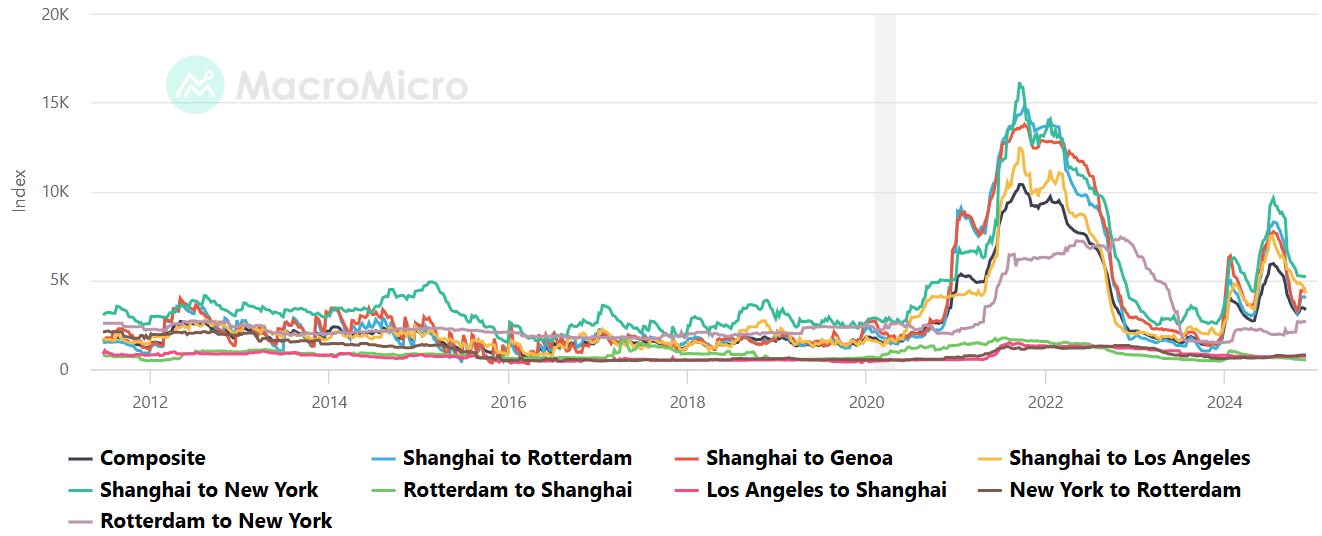

- Supply Chain:

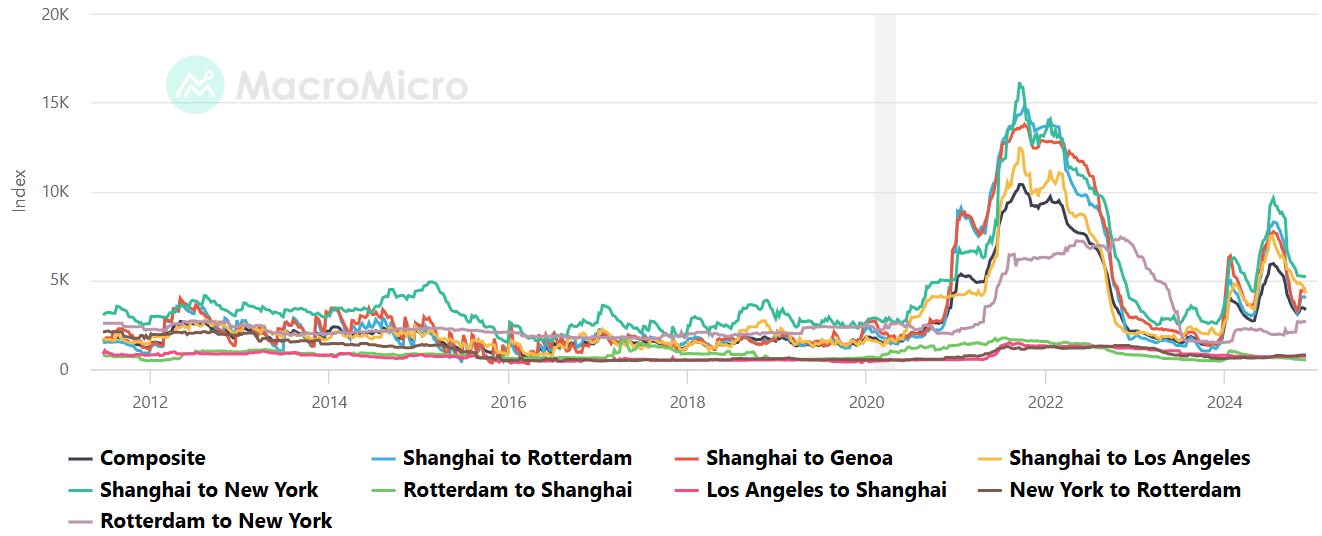

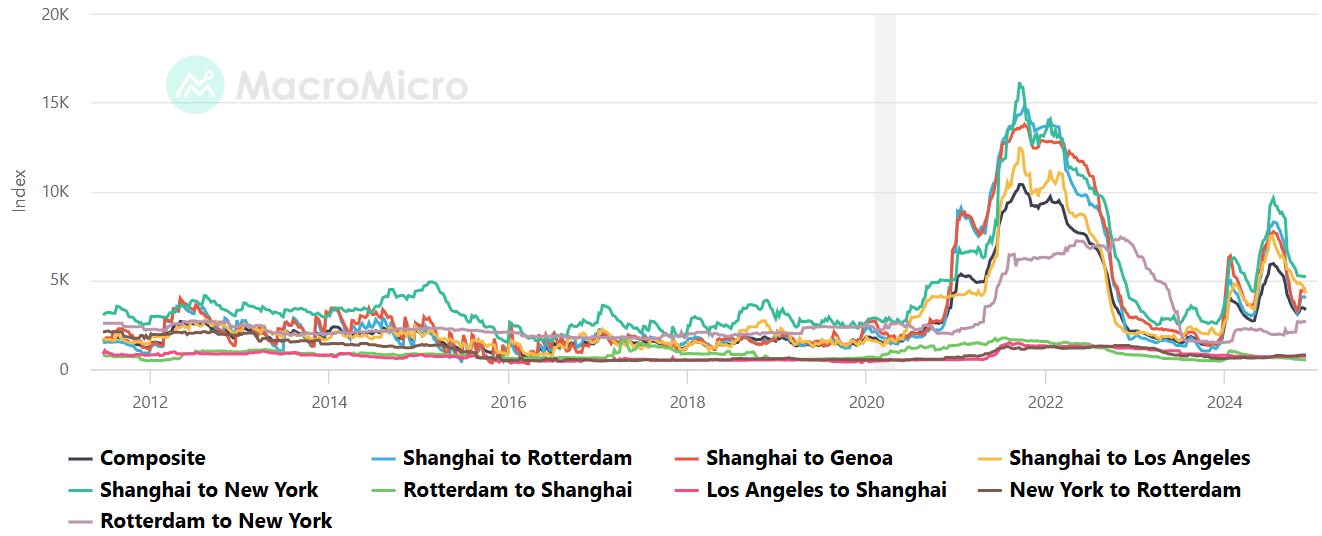

- Drewry’s composite World Container Index decreased to $3,330.61 per 40ft container.

- Drewry’s composite World Container Index has increased by 141.0% over the last 12 months.

- Housing Market:

- The shelter index increased 0.4% in October after increasing 0.2% in September.

- The rent index increased 0.4% in October after increasing 0.2% in September.

- The index for lodging away from home decreased (3.4%) in October after decreasing (3.8%) in September.

- Federal Funds Rate

- The effective Federal Funds Rate is at 4.58%, down (0.75%) year to date.

World News

- Middle East

- A U.S. brokered ceasefire halted over a year of conflict between Hezbollah and Israel. Hezbollah began withdrawing fighters and heavy weapons from southern Lebanon, while Israeli forces also pulled back.

- Airstrikes and mutual accusations of ceasefire violations remain a concern going forward for both parties.

- Syrian rebels, including the Islamist group Hayat Tahrir al-Sham, launched their largest attack since 2020, seizing territory and military assets in northwest Syria near Aleppo.

- The surprise offensive highlights ongoing instability in a fragmented country, despite Assad’s control over much of Syria. Analysts expect Assad’s forces, backed by Russian air power, to launch a counteroffensive to regain lost ground.

- Russia

- Russia’s economy, resilient through early sanctions, is now under severe strain due to new U.S. sanctions targeting Gazprombank, a critical financial conduit for trade and military payments.

- The ruble fell to a 32-month-low this week, causing Russia’s central bank to intervene in currency markets last Wednesday.

- Thousands of Ukrainian and Russian POWs remain in captivity with both sides struggling to conduct meaningful exchanges. Ukraine is resorting to unconventional means such as offering Soviet-era spies’ remains to facilitate swaps.

- Russia appears to use POWs as leverage to pressure Kyiv politically after stating Ukraine’s conditions for swaps are unrealistic.

- China

- Labor disputes in China have surged, with over 1,200 protests in 2024 related to unpaid wages and benefits, signaling local governments’ severe financial strain.

- China’s local governments face a debt crisis, with hidden liabilities estimated between $7 trillion and $11 trillion. The Chinese government introduced a $1.4 trillion debt swap program to ease local government burdens, but economists argue it only offers marginal relief and doesn’t address the root causes of fiscal mismanagement and debt accumulation.

- Admiral Miao Hua, a high-ranking officer in China’s military, has been suspended for alleged serious violations, marking another major step in Xi Jinping’s ongoing anticorruption campaign.

- Miao, who oversaw political indoctrination in the PLA, is one of the highest-ranking officers to face removal, further consolidating Xi’s control over the military.

- India

- Under Prime Minister Modi’s economic strategy, conglomerates like the Adani Group have flourished through close governmental ties, leading to concerns about market concentration and its impact on competition. However, the group’s recent scandal involving bribery and securities fraud has sparked global scrutiny.

- France

- French consumer confidence dropped sharply in November, hitting its lowest point since June, due to a combination of political instability, rising unemployment fears, and industrial restructuring. Major employers like Michelin and Airbus are cutting jobs, while ongoing government struggles have contributed to growing uncertainty.

- Argentina

- Argentine President Javier Milei seeks U.S. support under President-elect Trump to secure new IMF loans for his aggressive capitalist reforms, including austerity measures to combat inflation and stabilize the economy, while aligning with Trump’s political ideology despite diverging on trade and global economic policies.

- Canada

- Canada’s Liberal government, supported by the New Democratic Party, plans to temporarily remove the 5% goods-and-services tax on select items like home heating and diapers to ease affordability challenges amid public dissatisfaction with rising costs and slow economic growth.

- North Korea

- North Korean leader Kim Jong Un dismissed the idea of resuming nuclear talks with President-elect Donald Trump, citing the U.S.’s “unchanging hostile policy” and emphasizing strengthened ties with Russia and expanded nuclear capabilities.

- UK

- U.K. inflation rose to 2.3% in October 2024, exceeding the Bank of England’s 2% target, driven by energy price increases, with core inflation at 3.3%; policymakers plan gradual rate cuts despite lingering inflationary pressures and economic growth concerns.

- Japan

- Japan’s government approved a $141 billion stimulus package to address rising living costs, promote innovation in AI and chip supply chains, and provide inflation relief through cash handouts and energy subsidies, though concerns over public debt and fiscal sustainability remain.

- Brazil

- Brazilian police have accused former President Jair Bolsonaro and 36 allies of plotting a coup to prevent President Luiz Inácio Lula da Silva from taking office in 2023, including plans to assassinate Lula and his vice president, revealing a highly organized operation involving military and political figures.

Commodities

- Oil Prices

- WTI: $68.00 per barrel

- (4.55%) WoW; (5.09%) YTD; (12.66%) YoY

- Brent: $72.94 per barrel

- (2.97%) WoW; (5.32%) YTD; (12.23%) YoY

- Crude Oil Prices per Barrel: West Texas Intermediate (WTI) – Cushing, Oklahoma

- US Production

- U.S. oil production amounted to 13.5 million bpd for the week ended November 22, up 0.1 million bpd from the prior week.

- Rig Count

- The total number of oil rigs amounted to 582, down 1 from last week.

- Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 428.4 million barrels, down (4.7%) YoY.

- Refiners operated at a capacity utilization rate of 90.5% for the week, up from 90.2% in the prior week.

- U.S. crude oil imports now amount to 7.684 million barrels per day, down 4.3% YoY.

-

Gasoline

- Retail average regular gasoline prices amounted to $3.06 per gallon in the week of November 29, down (5.7%) YoY.

- Gasoline prices on the East Coast amounted to $3.12, down (4.4%) YoY.

- Gasoline prices in the Midwest amounted to $2.95, down (5.2%) YoY.

- Gasoline prices on the Gulf Coast amounted to $2.73, down (2.5%) YoY.

- Gasoline prices in the Rocky Mountain region amounted to $2.95, down (8.4%) YoY.

- Gasoline prices on the West Coast amounted to $4.02, down (10.5%) YoY.

- Motor gasoline inventories were up by 3.3 million barrels from the prior week.

- Motor gasoline inventories amounted to 212.2 million barrels, down (2.7%) YoY.

- Production of motor gasoline averaged 9.74 million bpd, up 4.4% YoY.

- Demand for motor gasoline amounted to 8.506 million bpd, up 3.7% YoY.

-

Distillates

- Distillate inventories decreased by 0.4 million in the week of November 29.

- Total distillate inventories amounted to 114.7 million barrels, up 3.6% YoY.

- Distillate production averaged 5.096 million bpd, up 2.0% YoY.

- Demand for distillates averaged 3.718 million bpd in the week, up 23.4% YoY.

- Natural Gas

- Natural gas inventories decreased by 2 billion cubic feet last week.

- Total natural gas inventories now amount to 3,967 billion cubic feet, up 3.4% YoY.

Credit News

High yield bond yields decreased 7bps to 7.14% and spreads increased 6bps to 299bps. Leveraged loan yields decreased 10bps to 8.54% and spreads decreased 2bps to 462bps. WTD Leveraged loan returns were positive 23bps. WTD high yield bond returns were positive 41bps. 10yr treasury yields decreased 20bps to 4.20%. Yields decreased amid limited macro developments and a mild uptick in issuance. The US election outcome produced upside risks to growth from deregulation and tax cutting and downside risks from tariffs and general policy uncertainty.

High-yield:

Week ended 11/29/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 11/29/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Spirit Airlines ($1.6bn, 11/18/24), Franchise Group Inc ($1.1bn,

11/3/24), Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24),

Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions

($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros

($2.8bn, 7/11/24), and Quorum Health Group ($688mn, 7/10/24).

CLOs:

Week ended 11/29/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

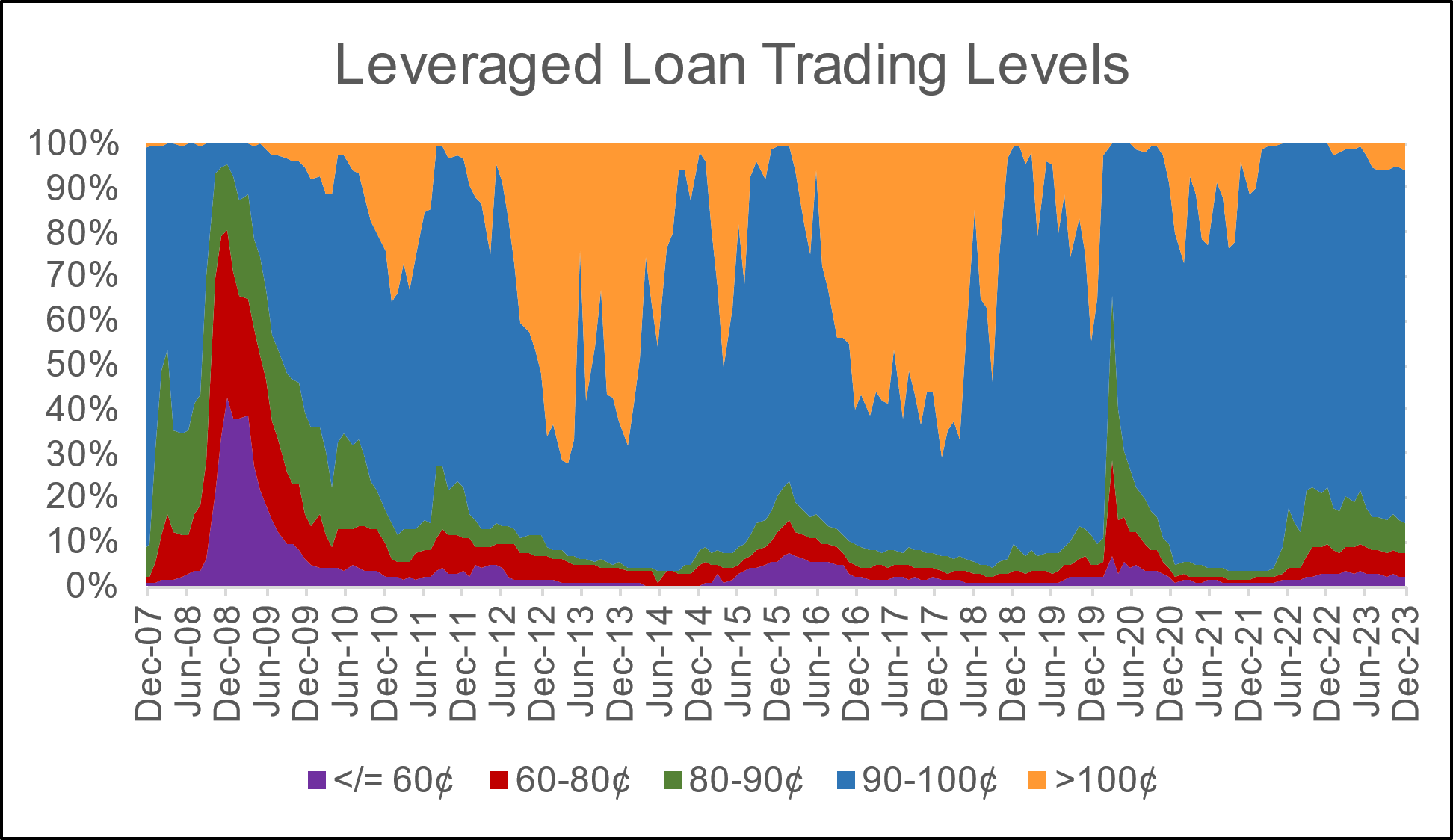

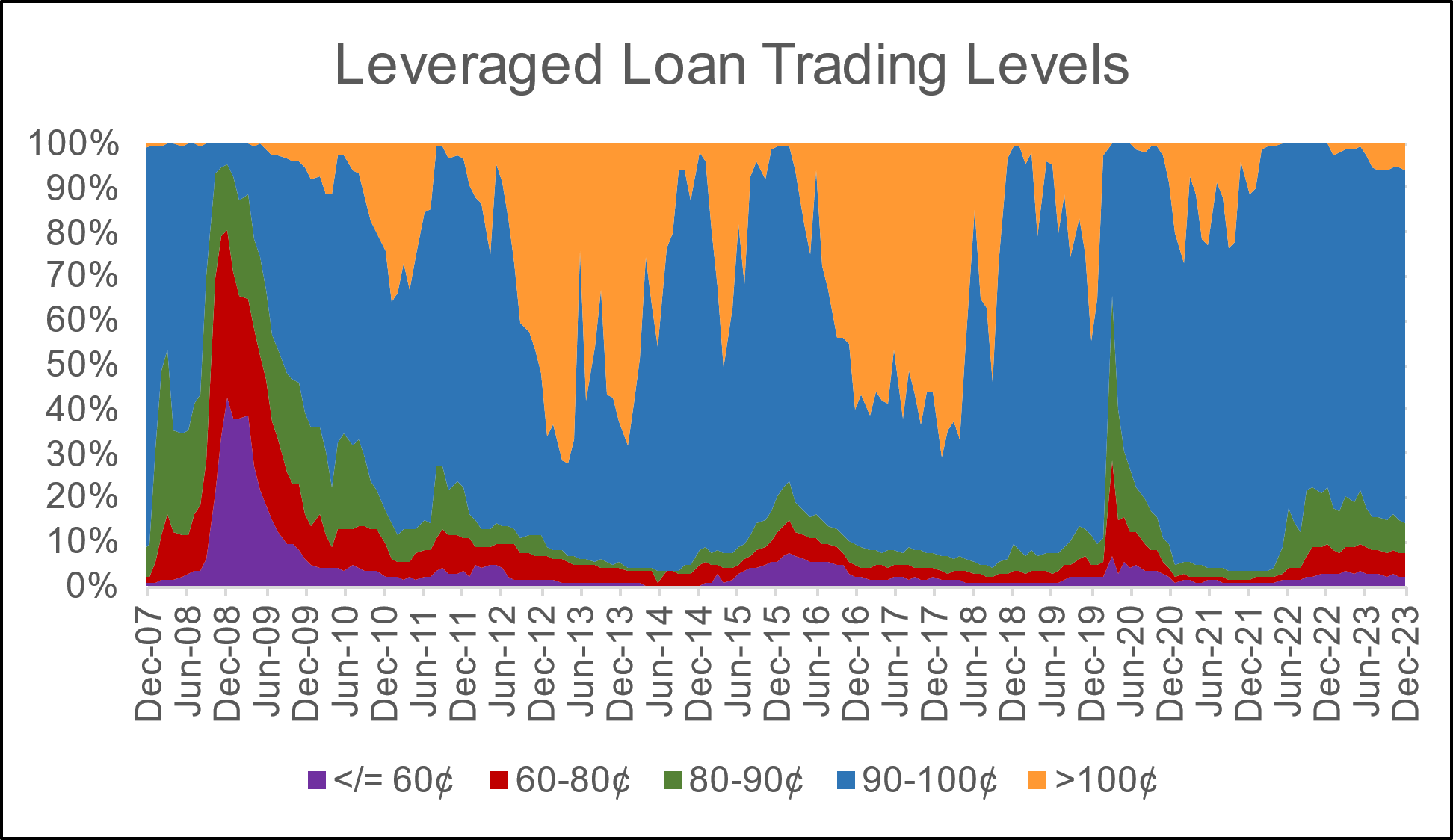

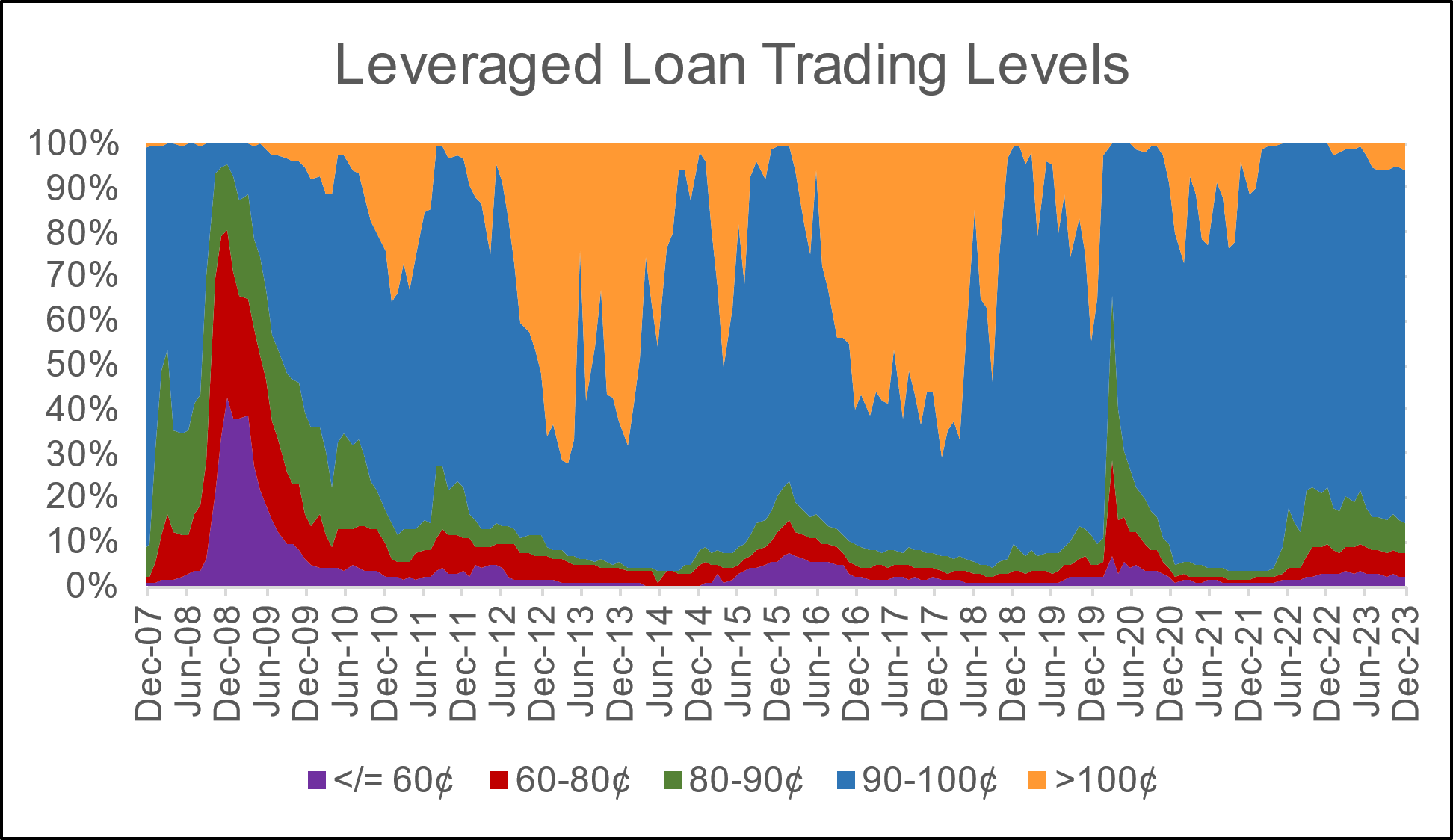

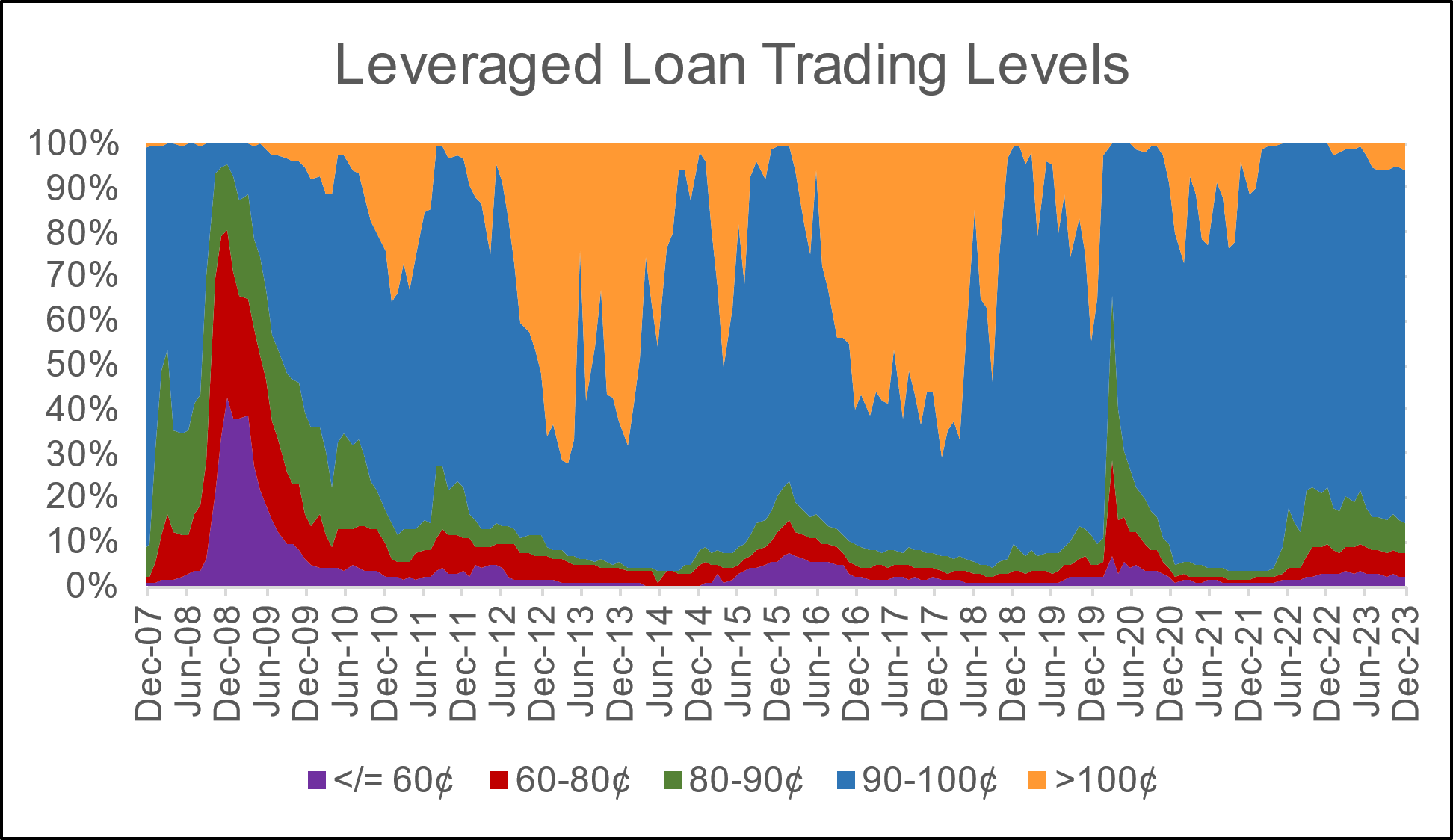

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

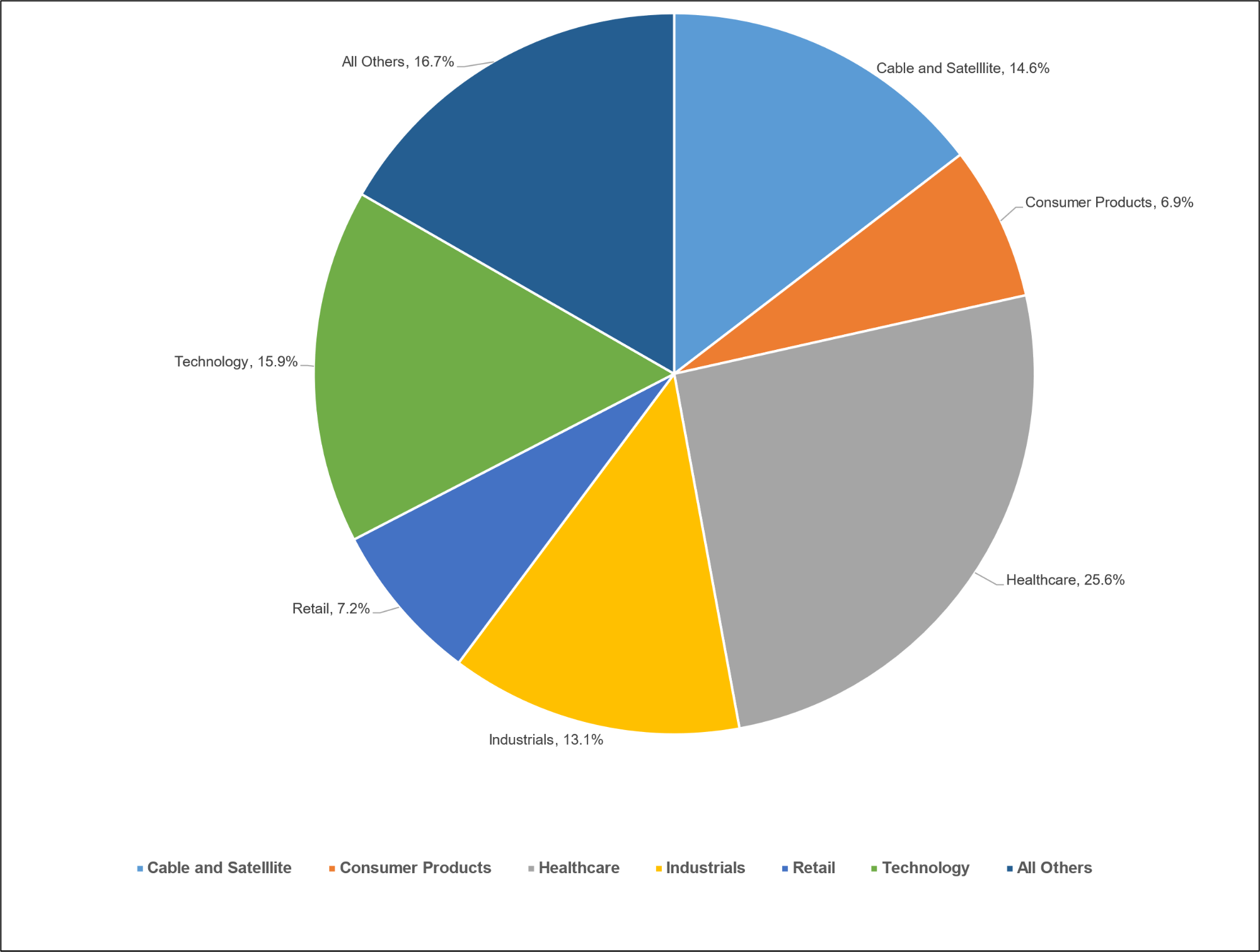

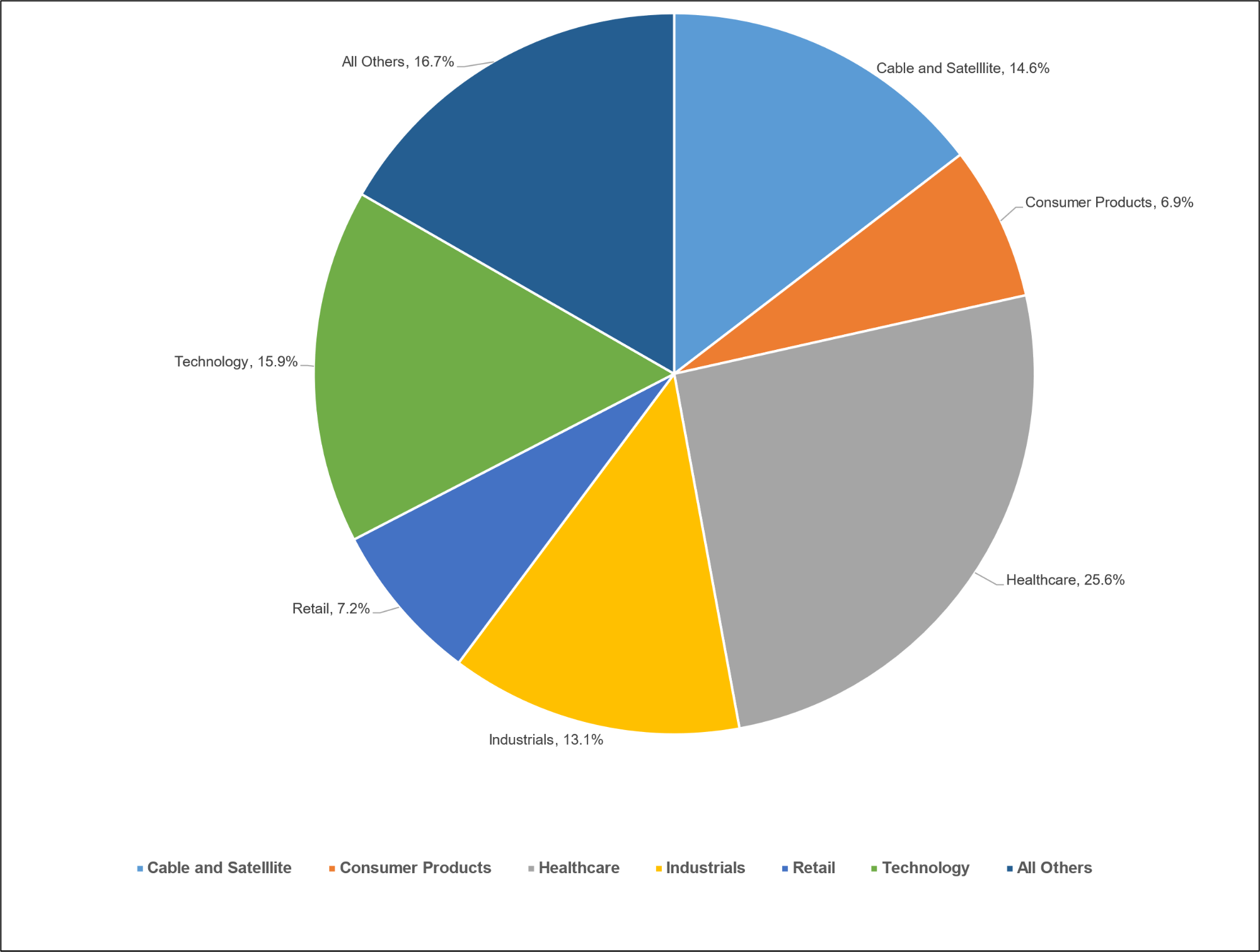

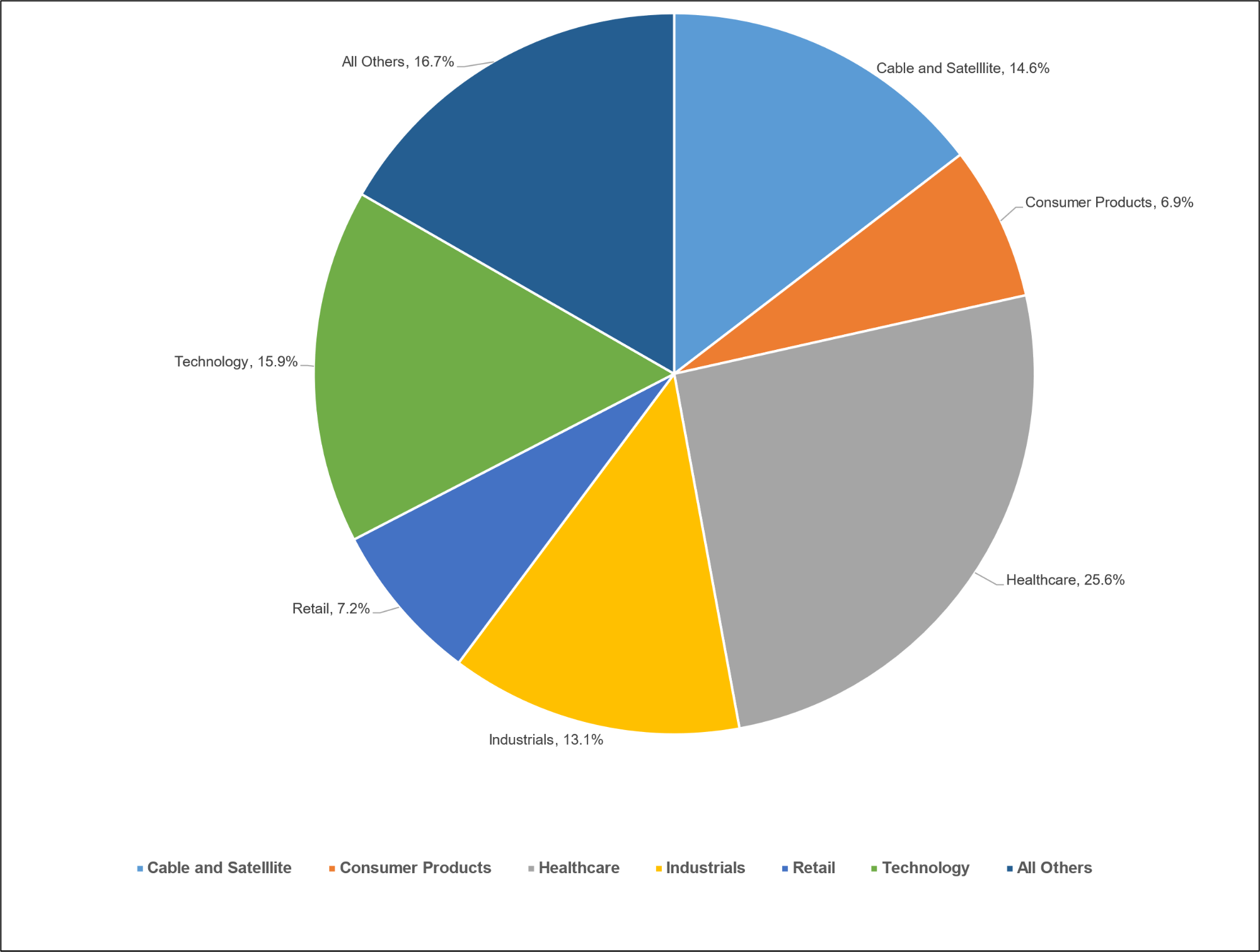

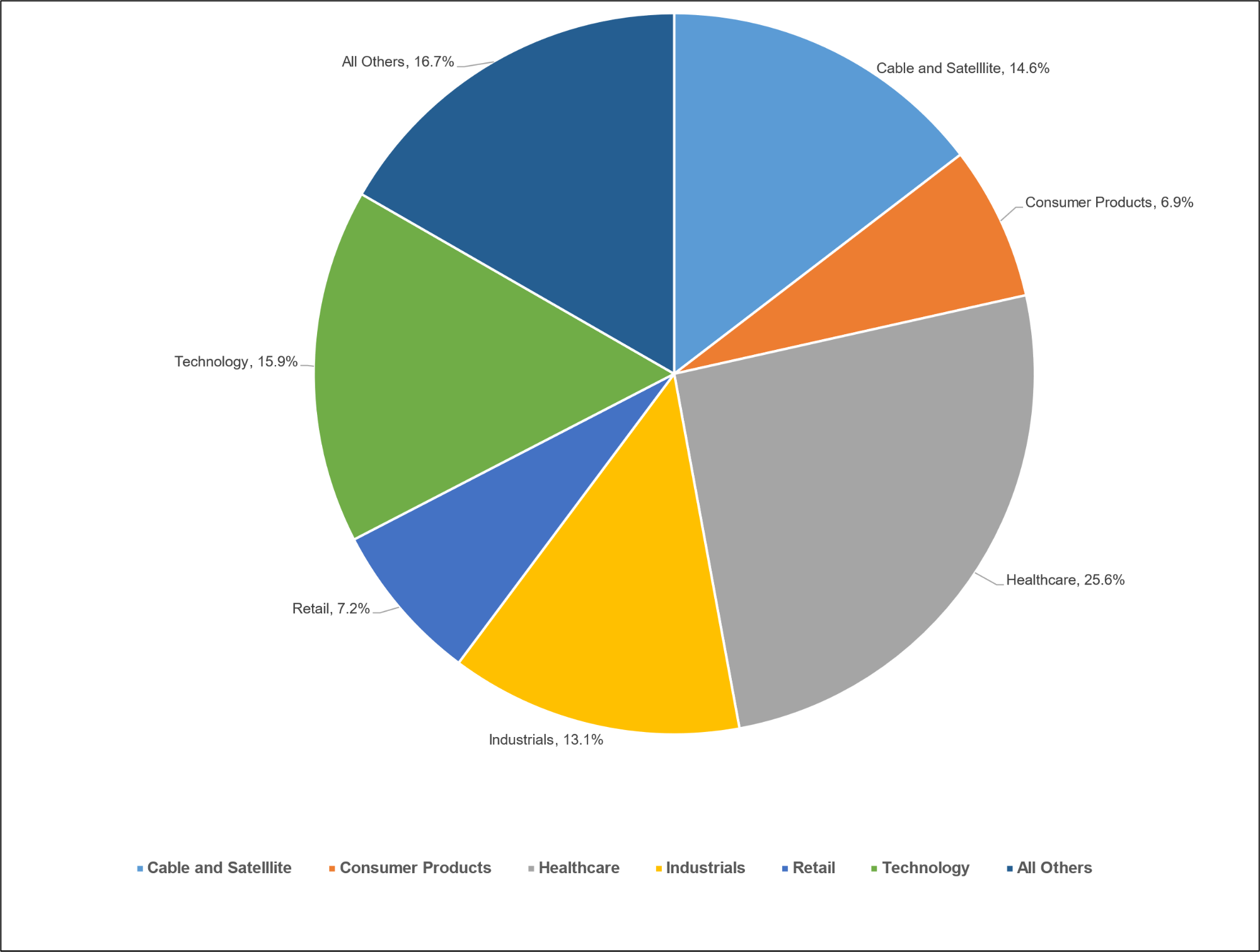

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

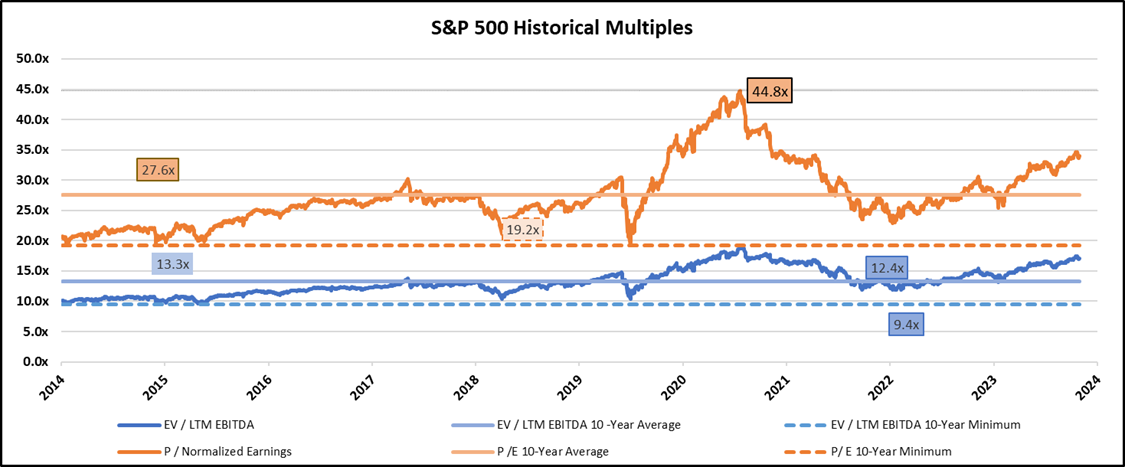

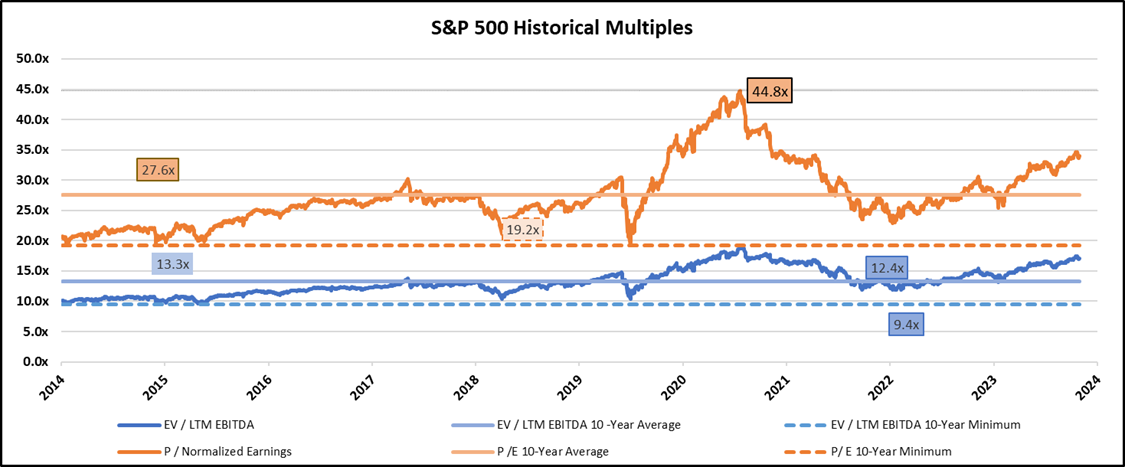

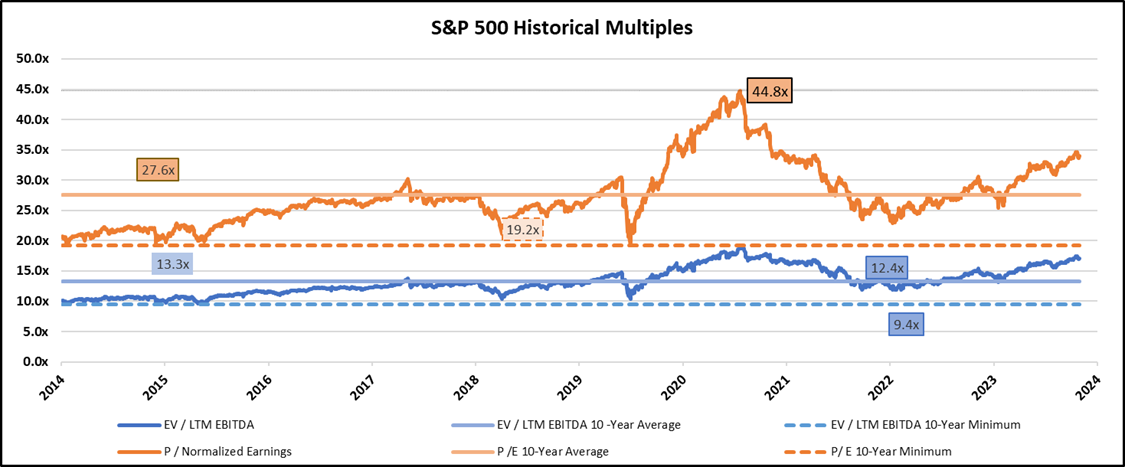

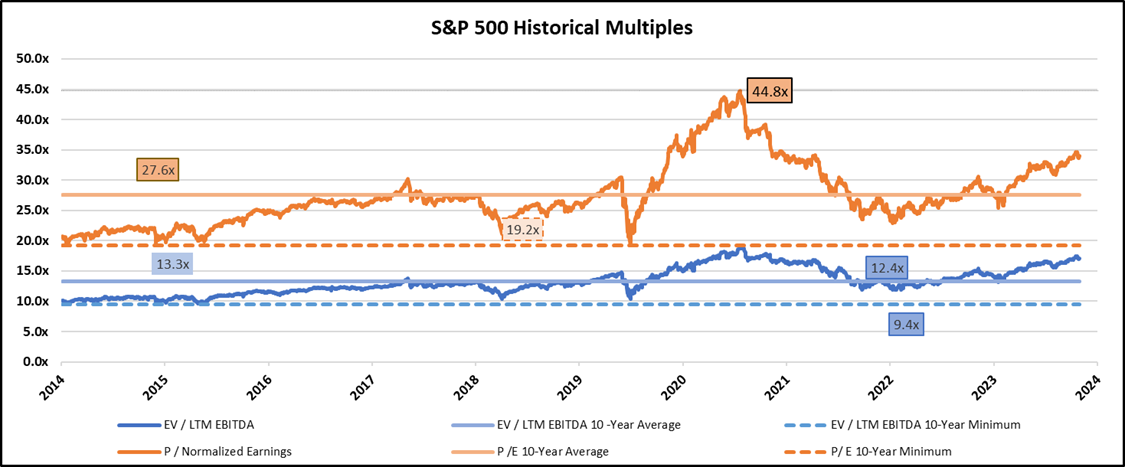

Diagram O: S&P 500 Historical Multiples

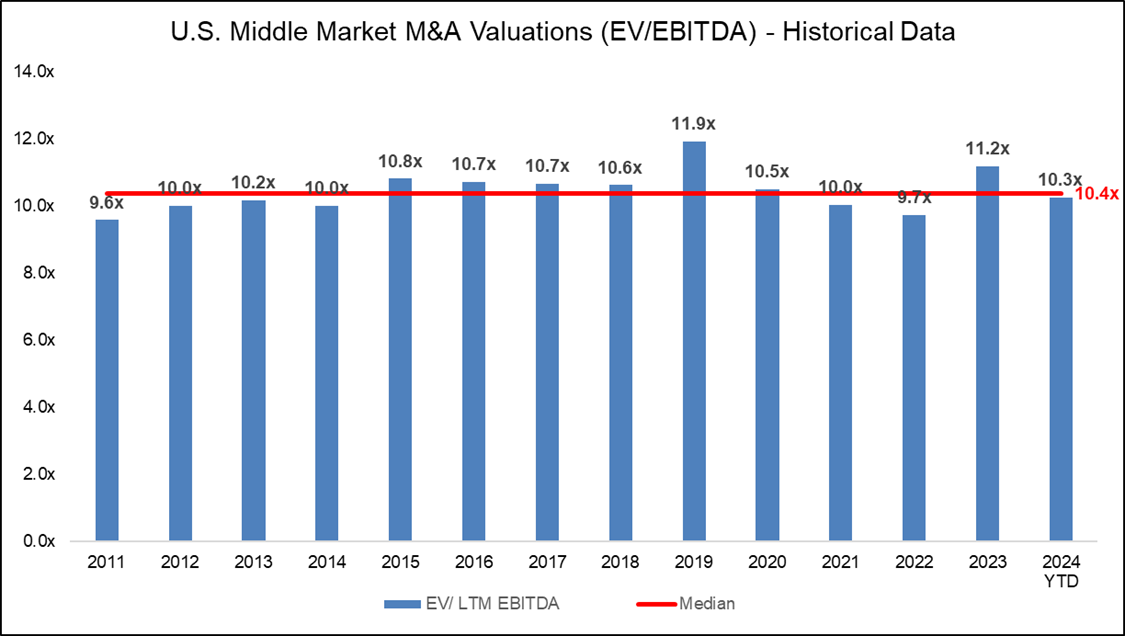

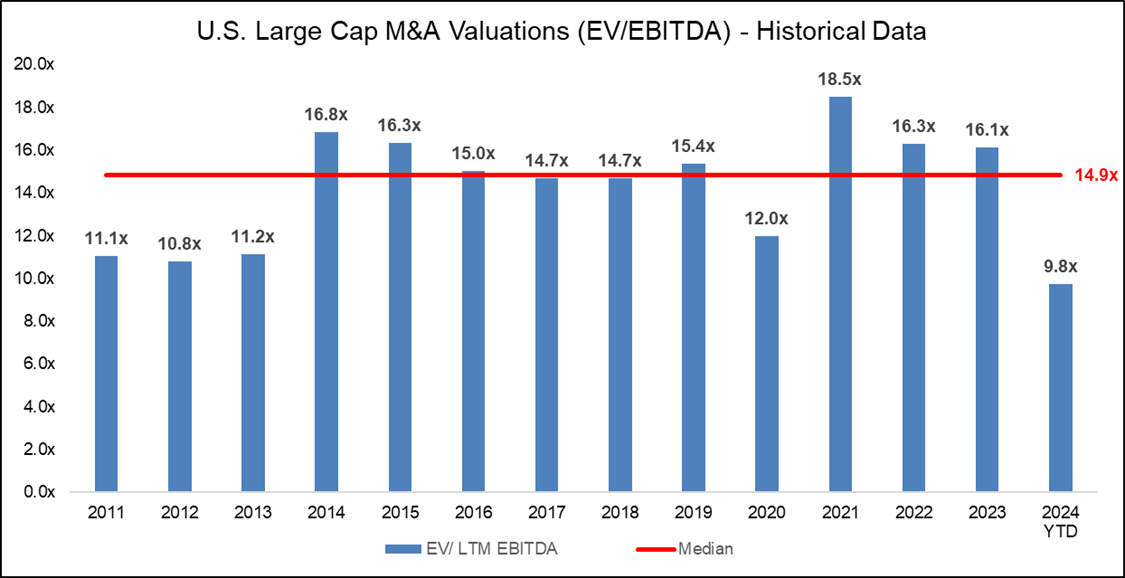

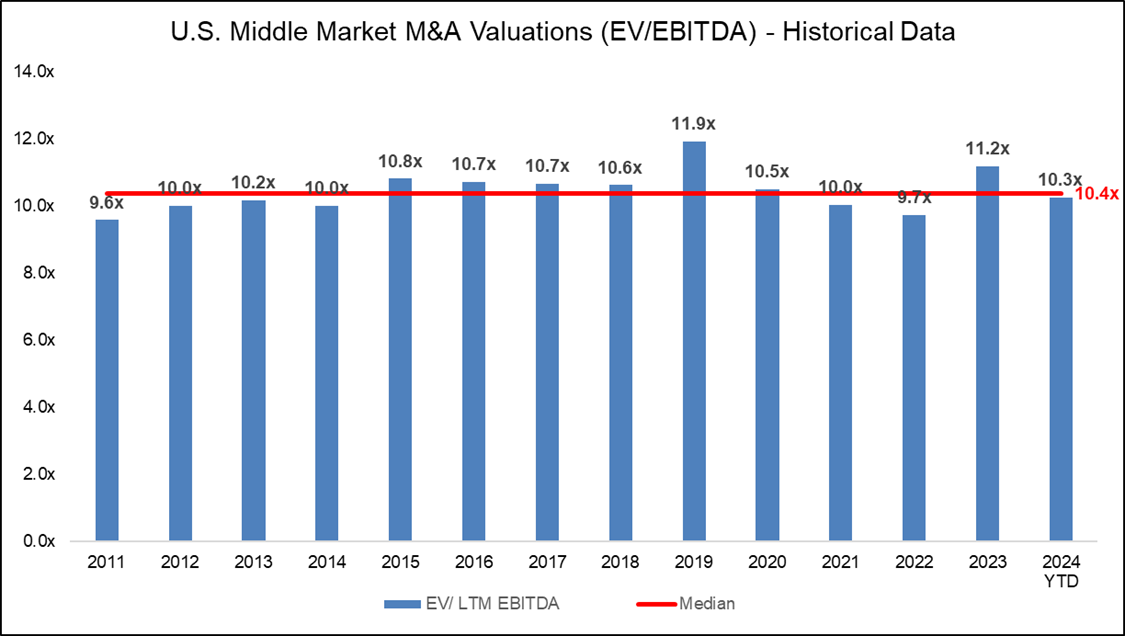

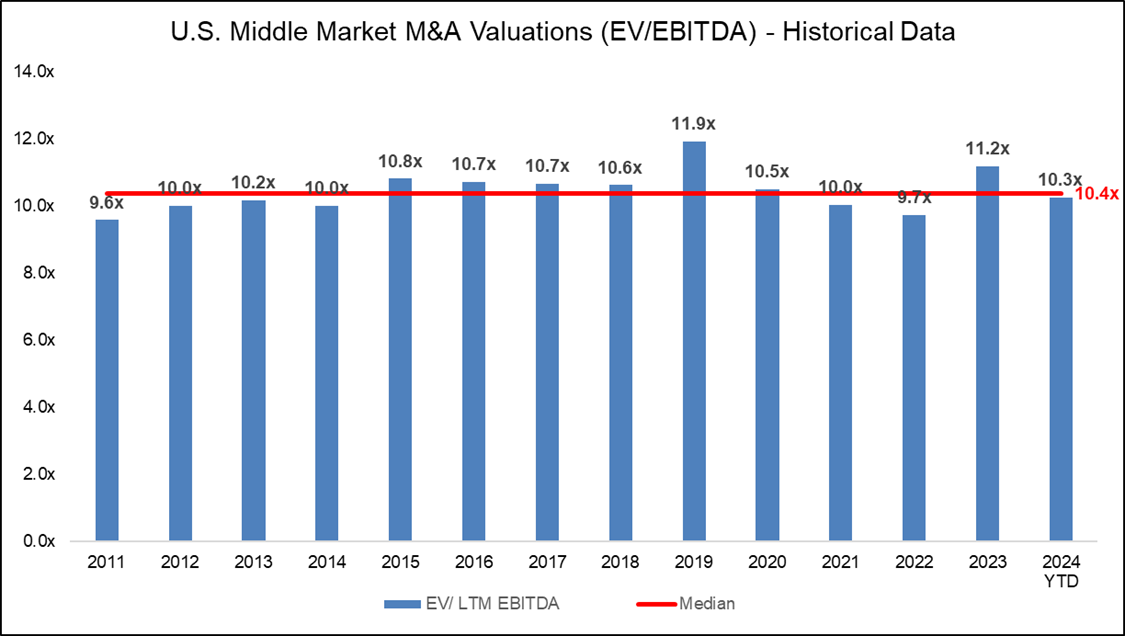

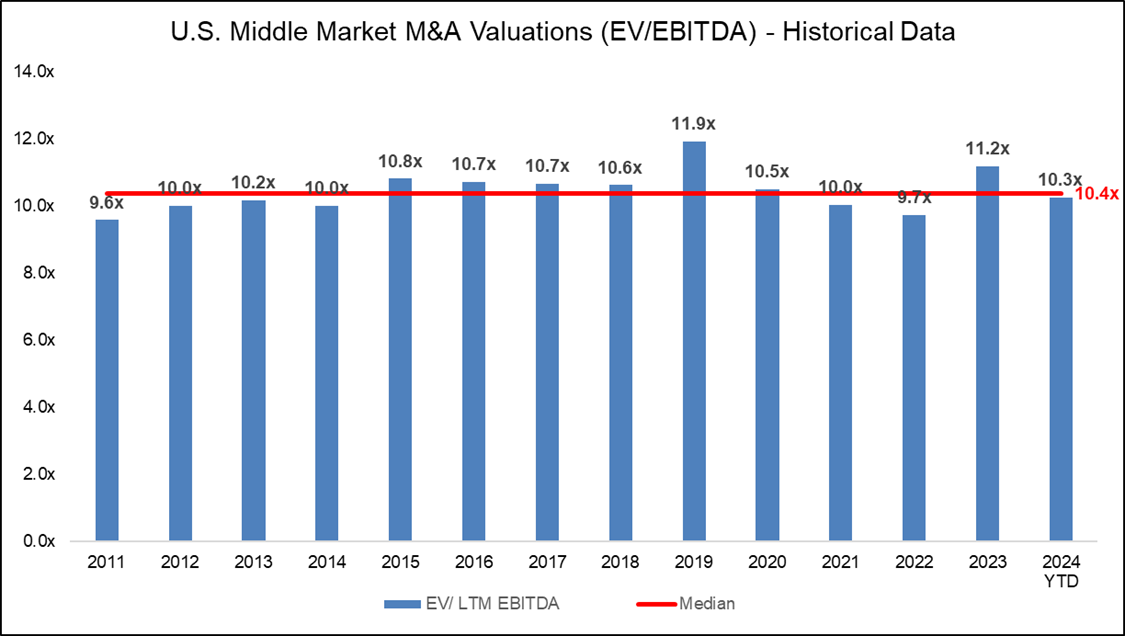

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

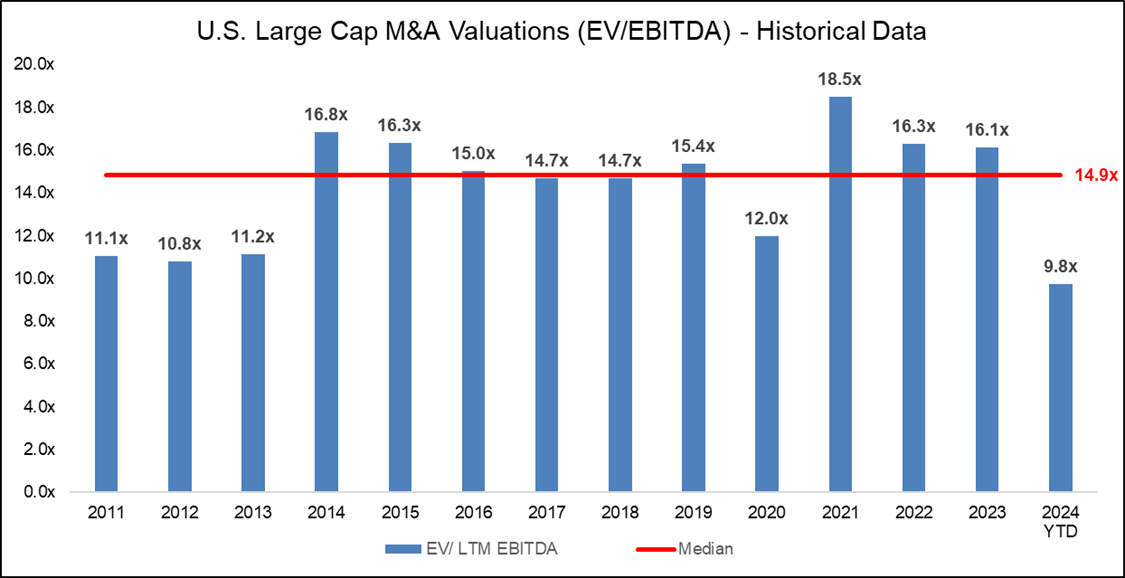

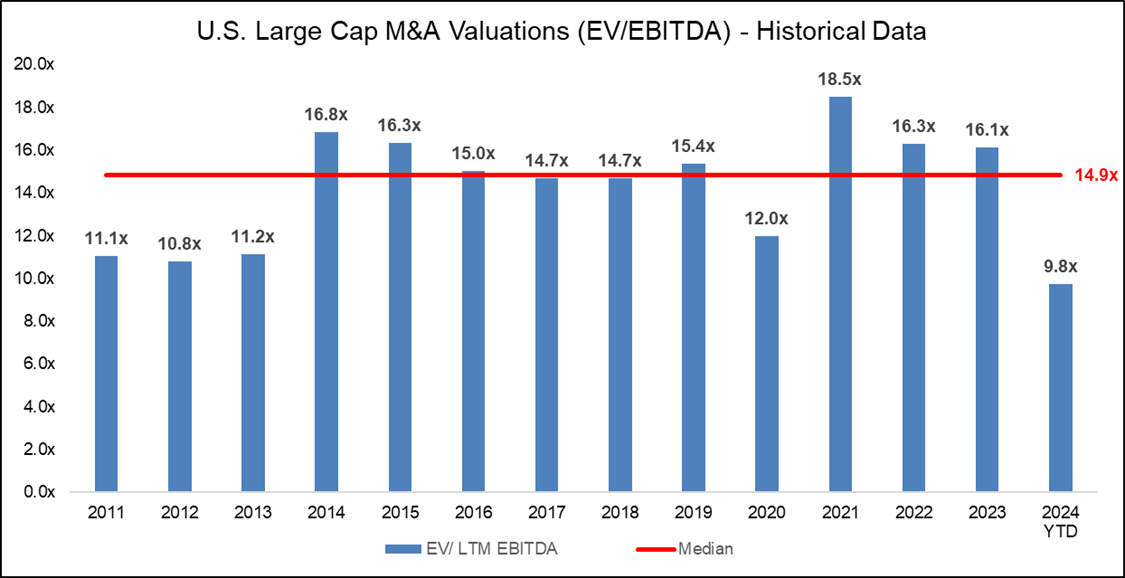

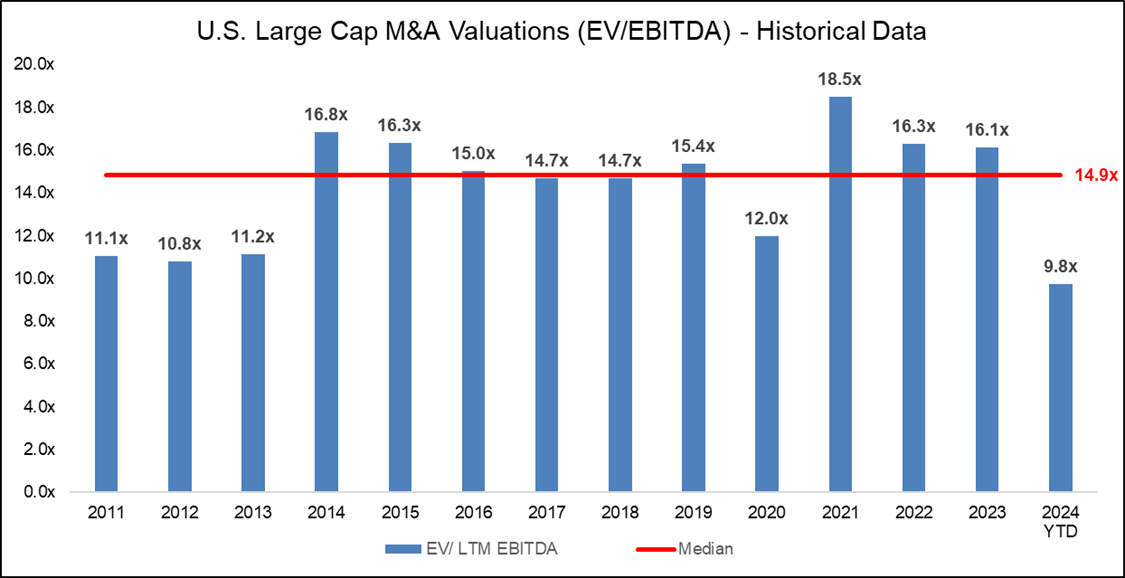

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

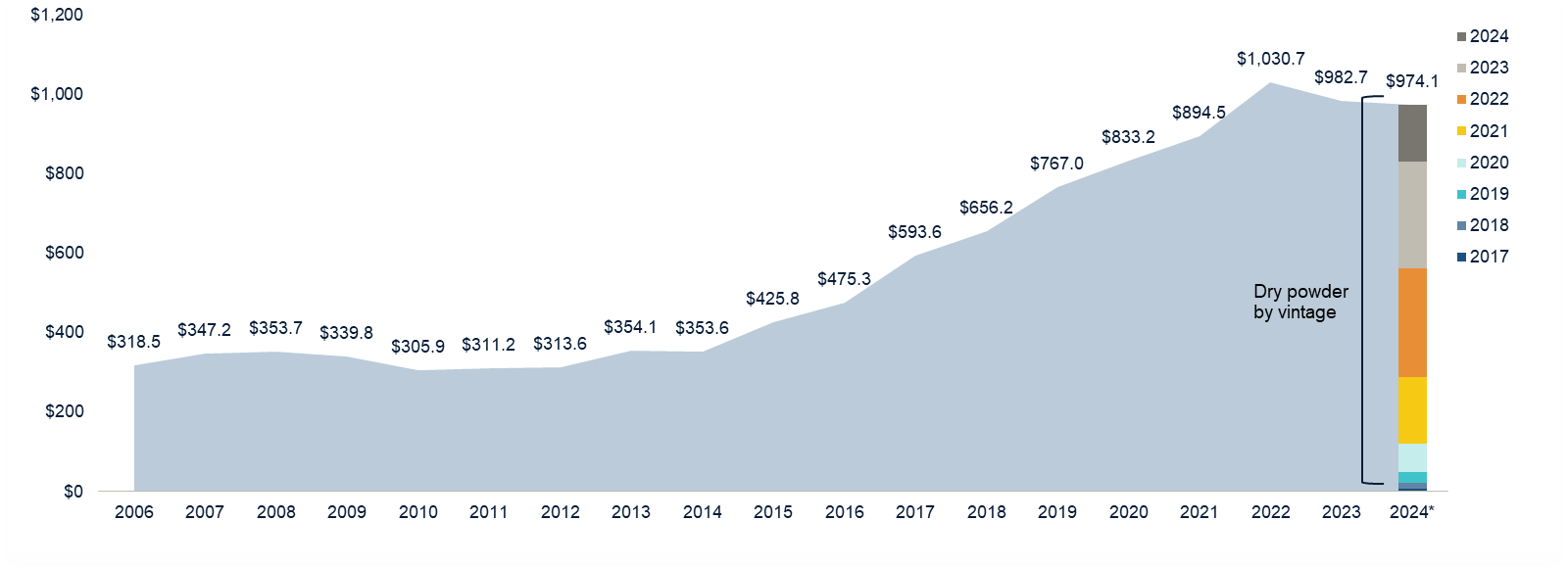

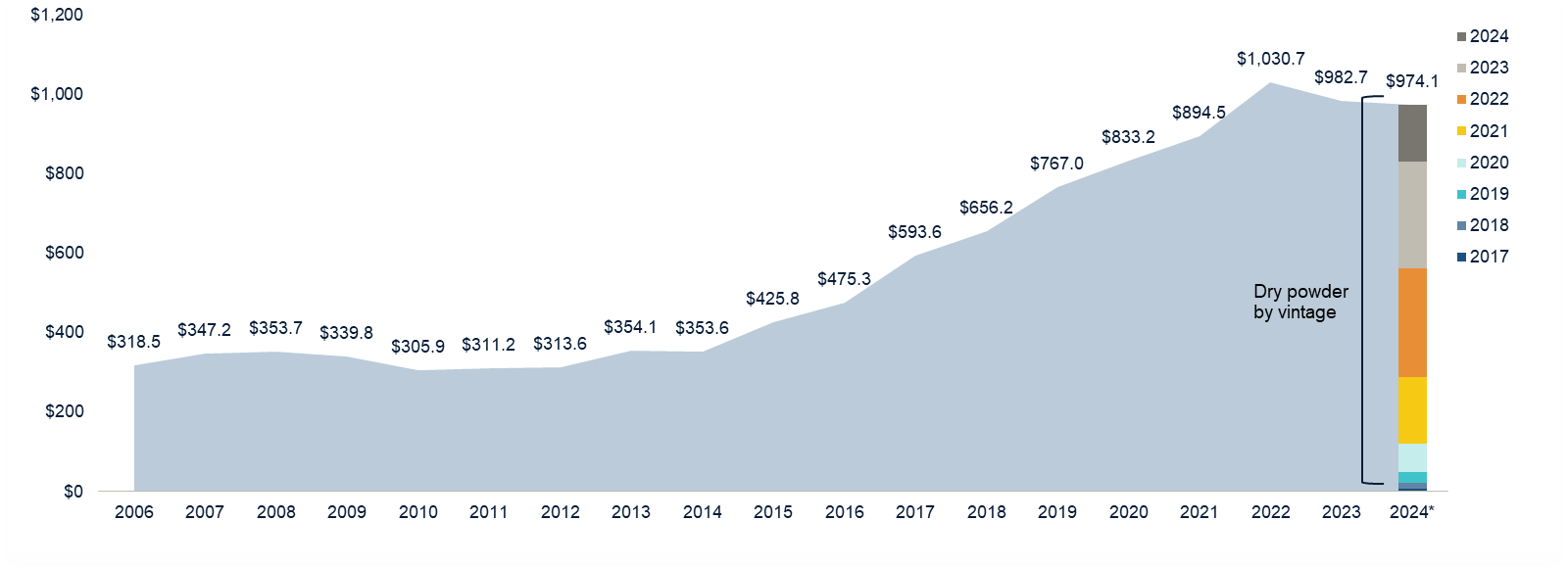

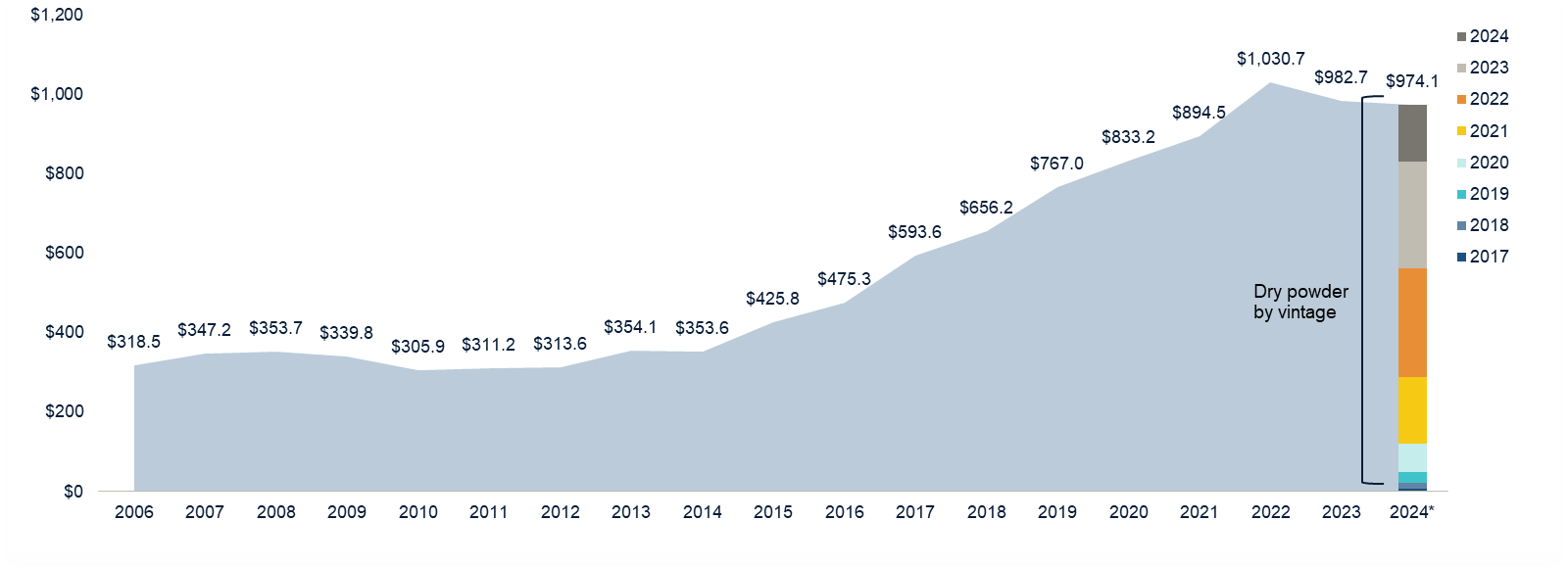

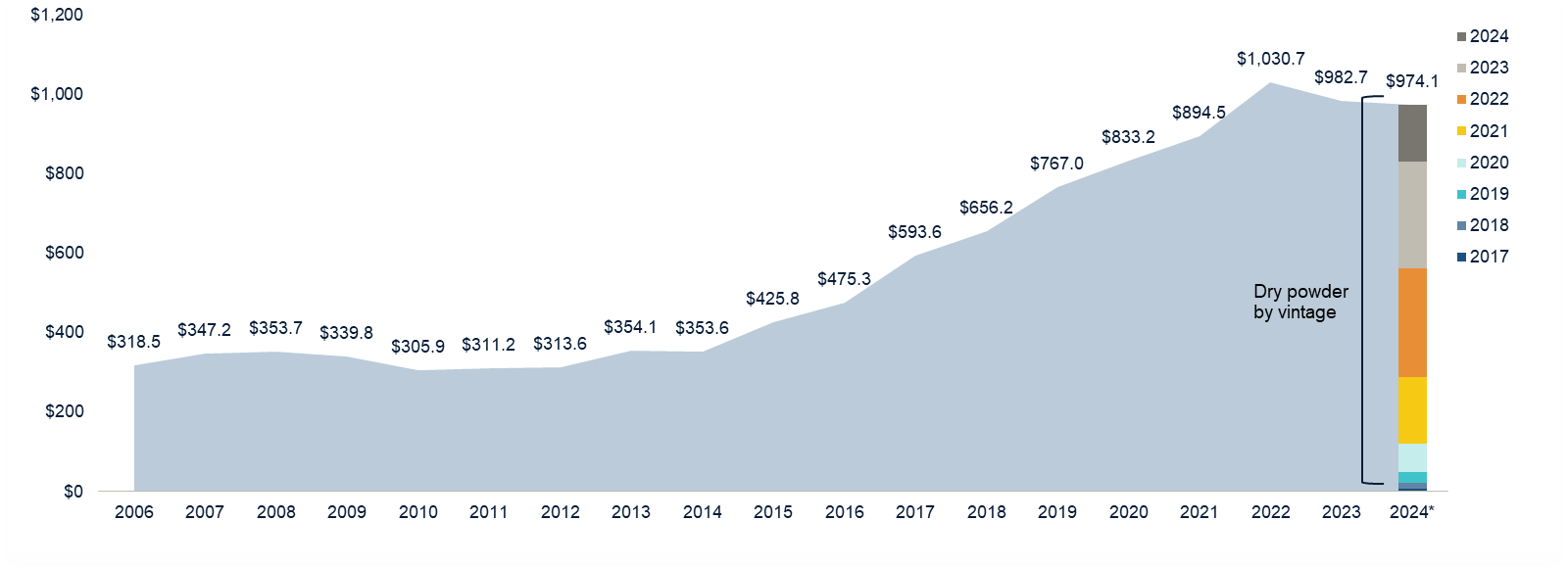

Diagram R: Dry Powder for All Private Equity Buyouts

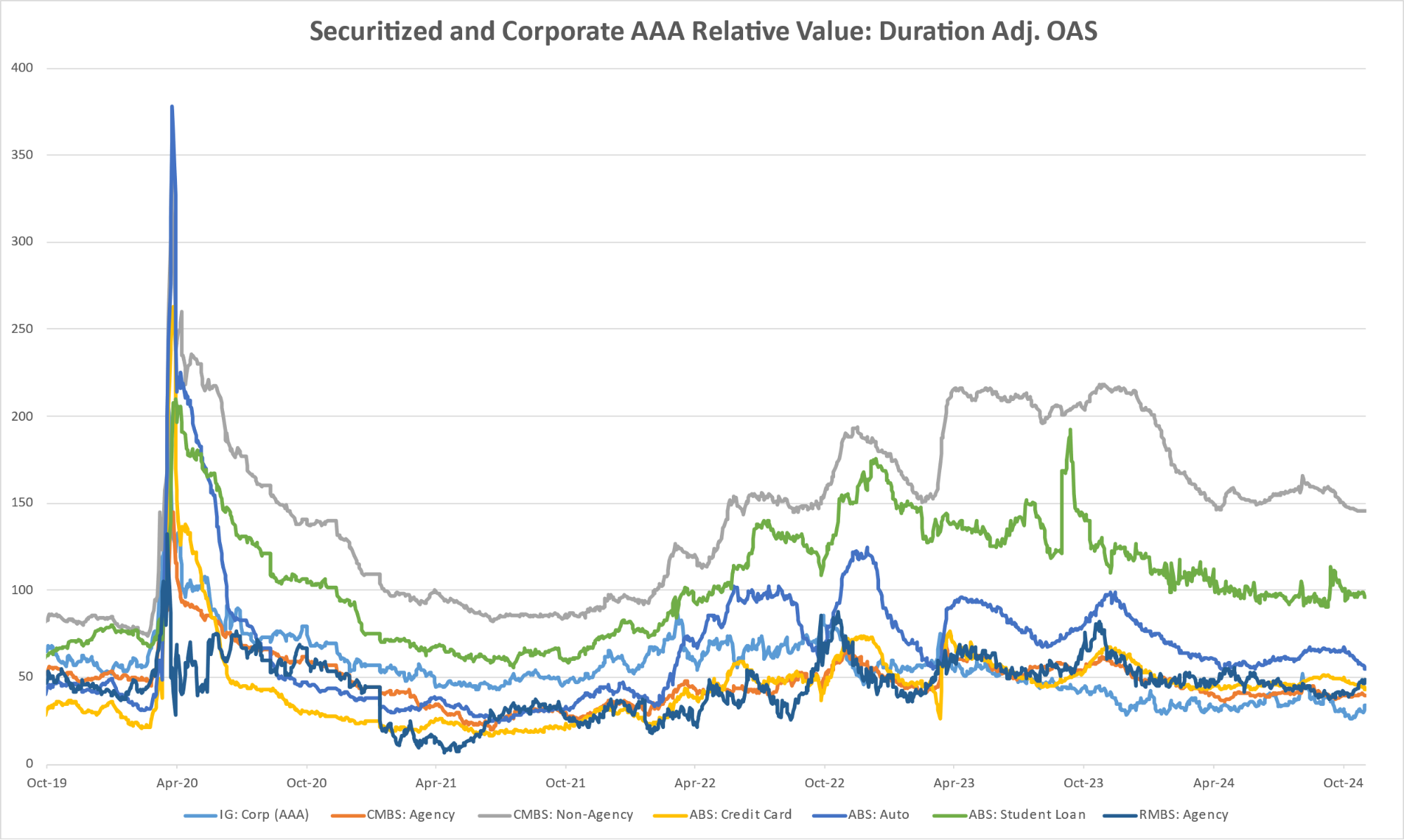

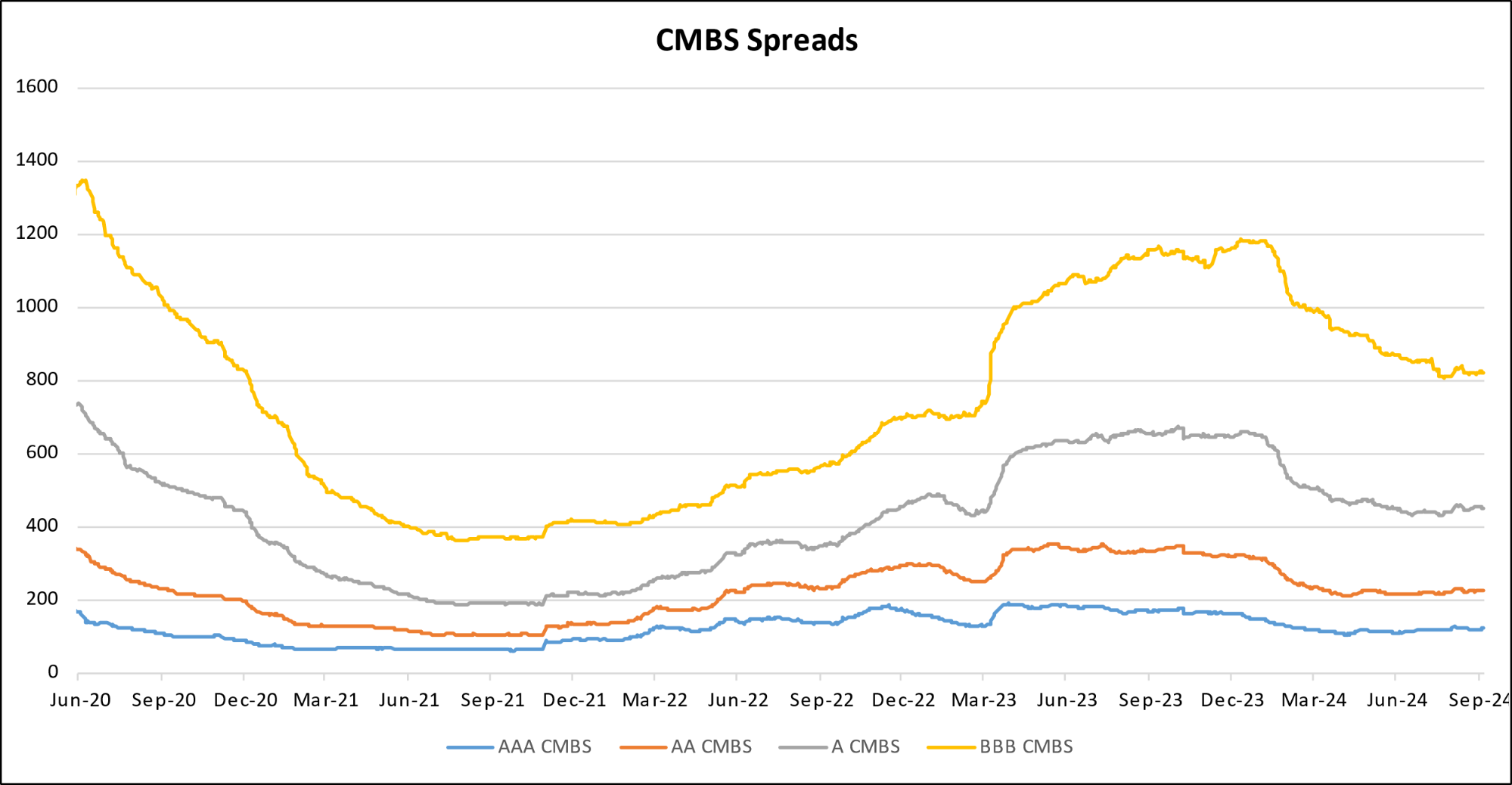

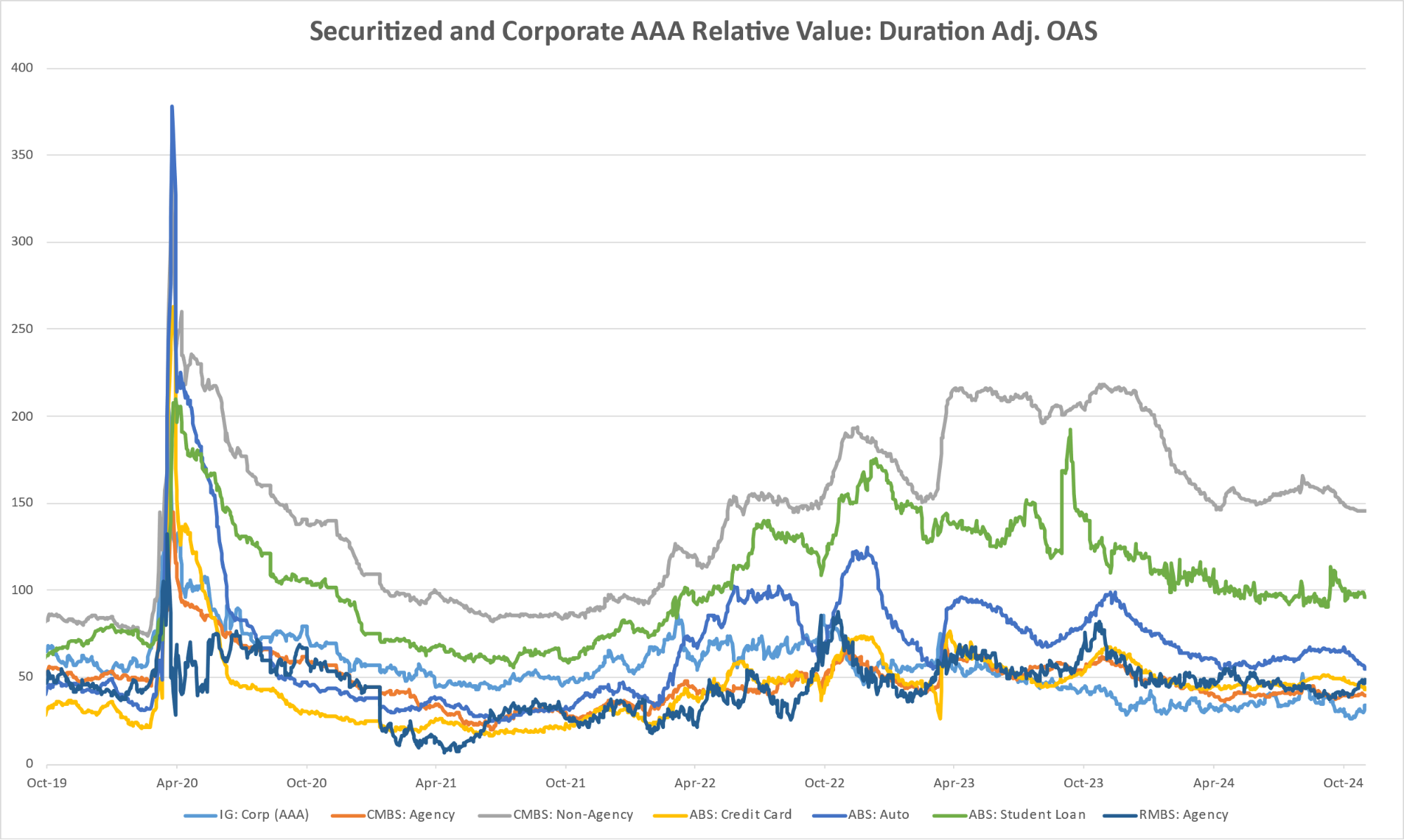

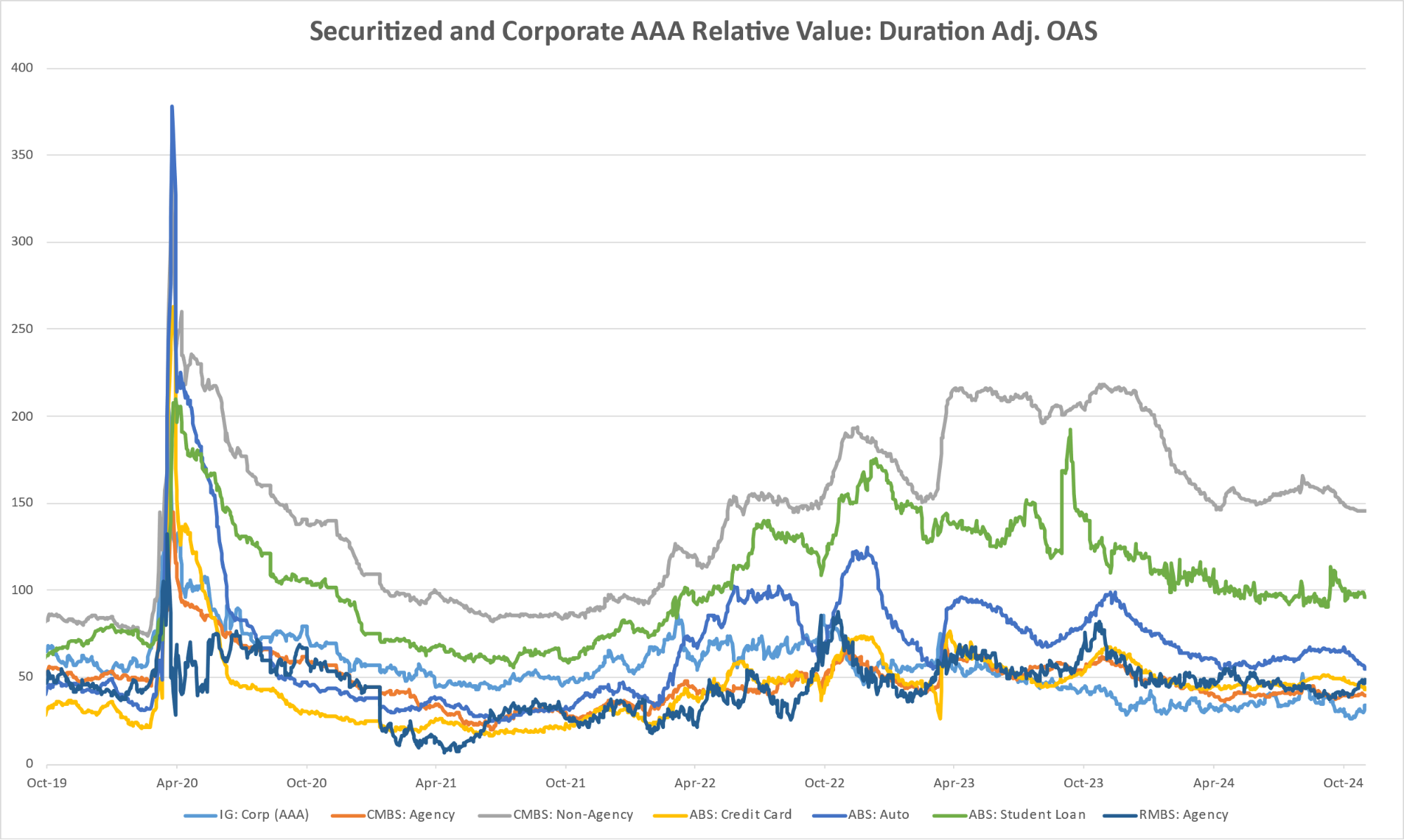

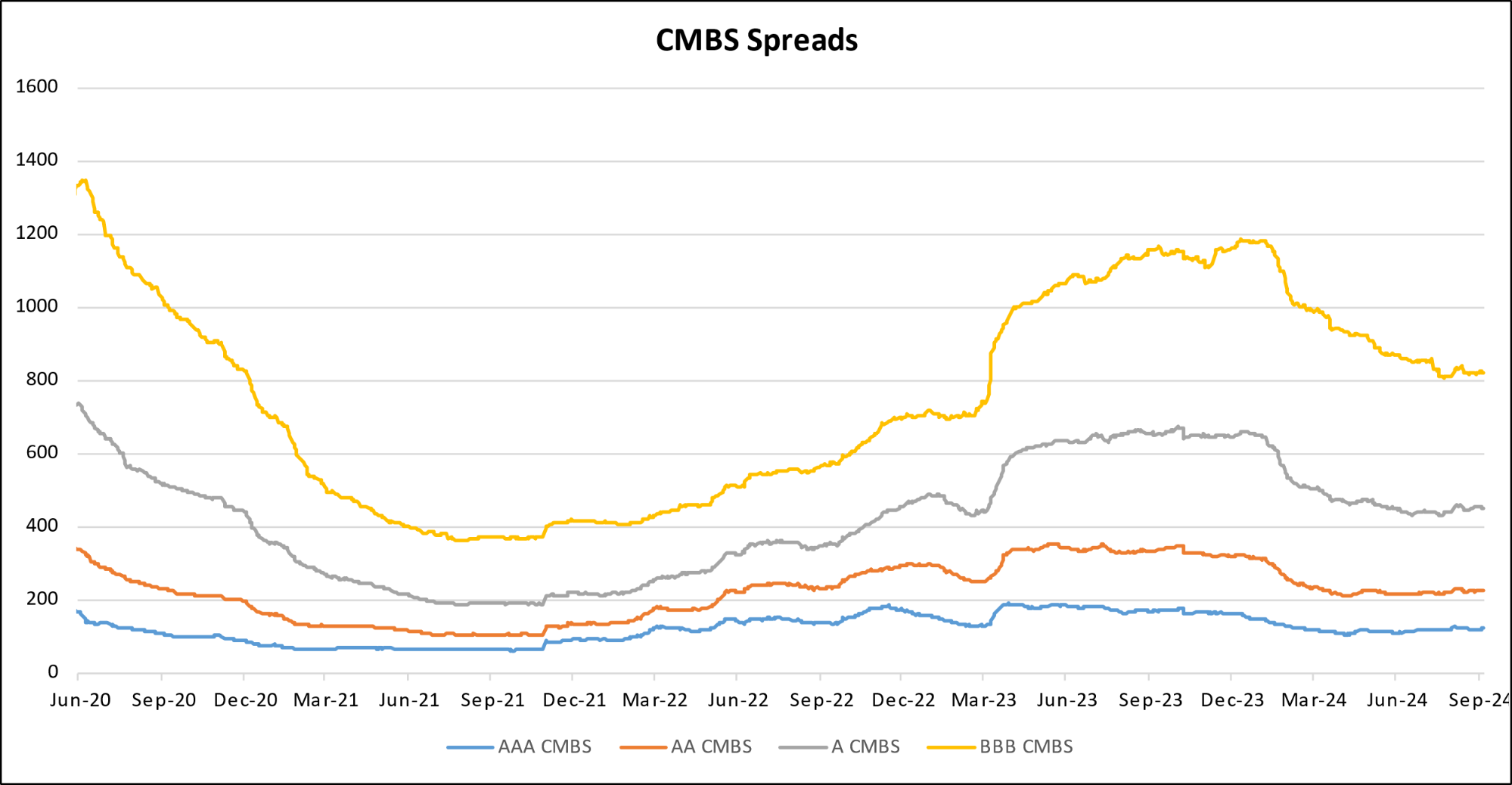

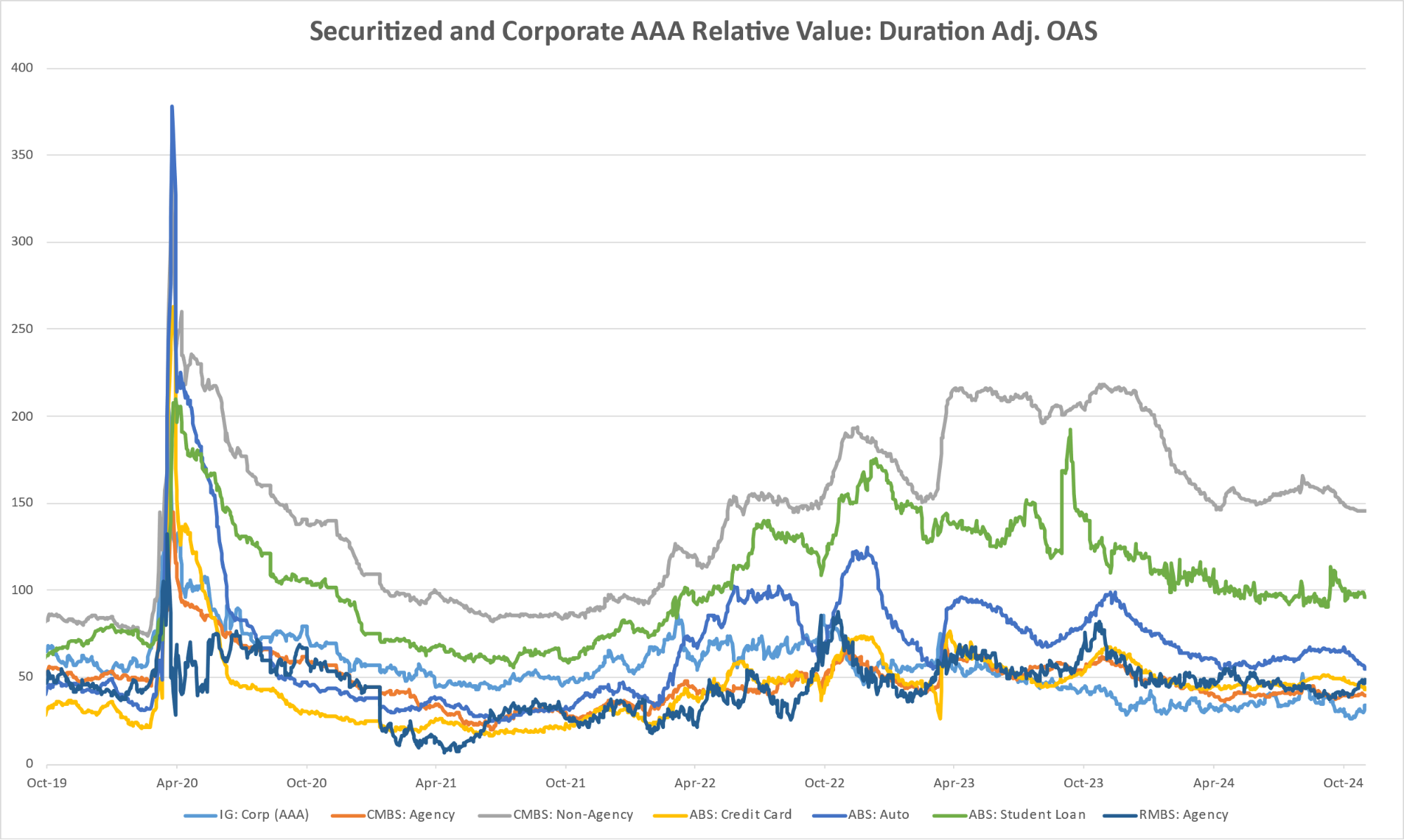

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

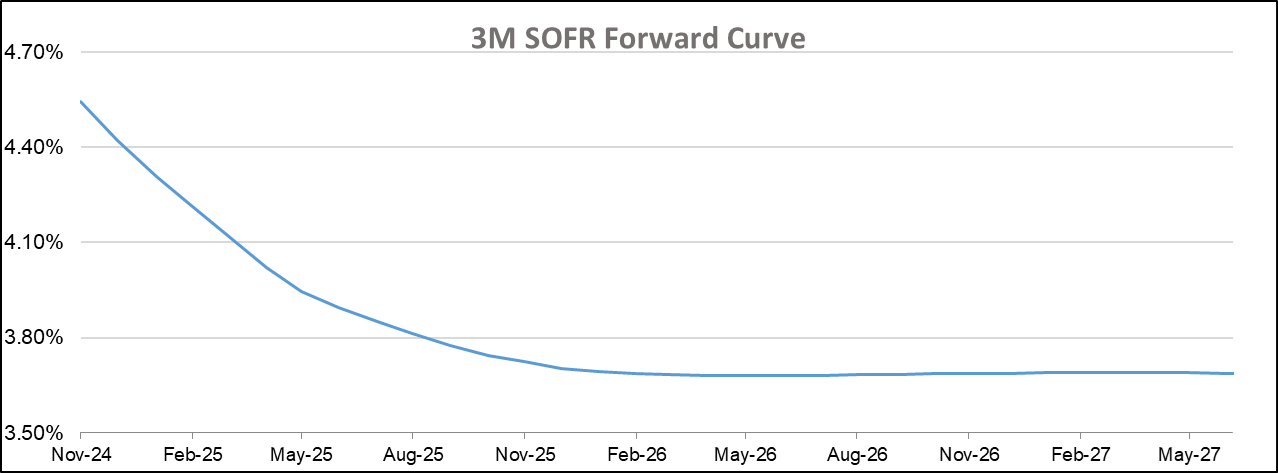

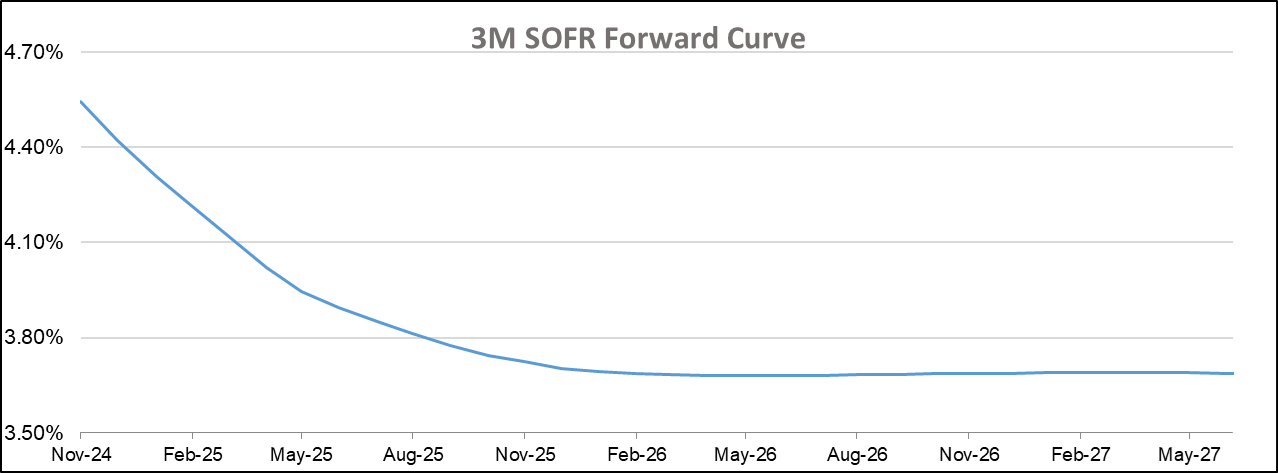

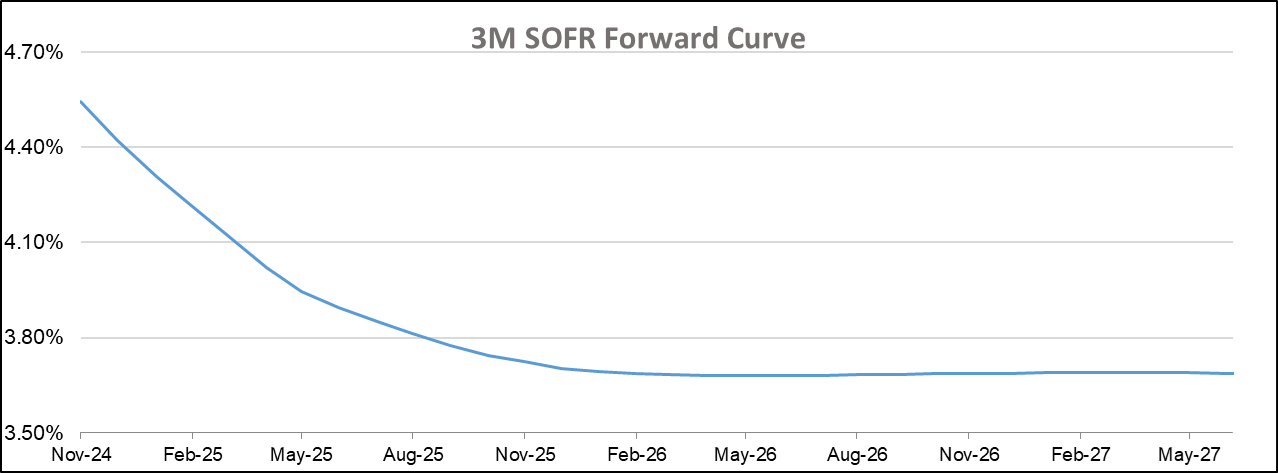

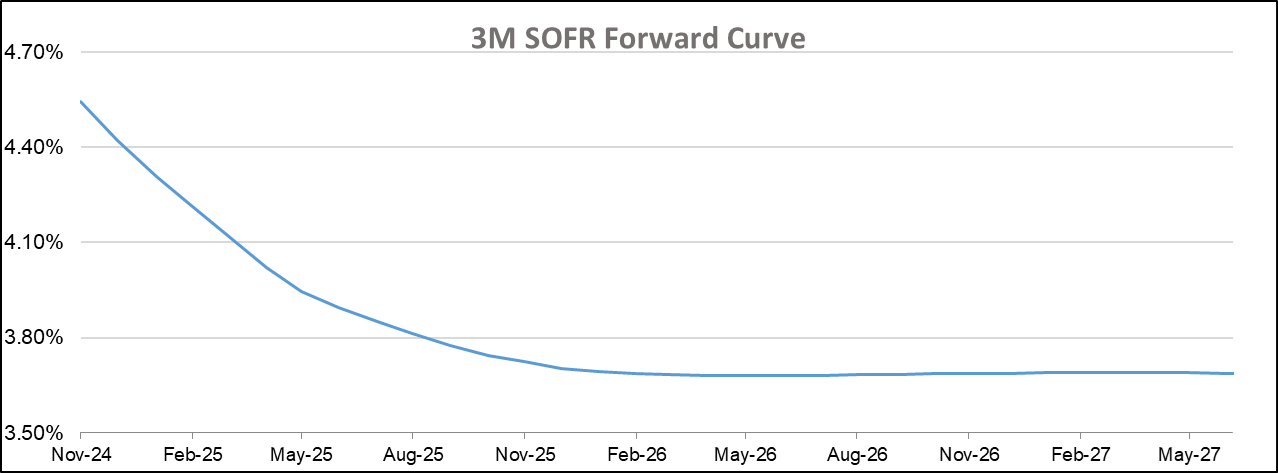

Diagram U: SOFR CURVE

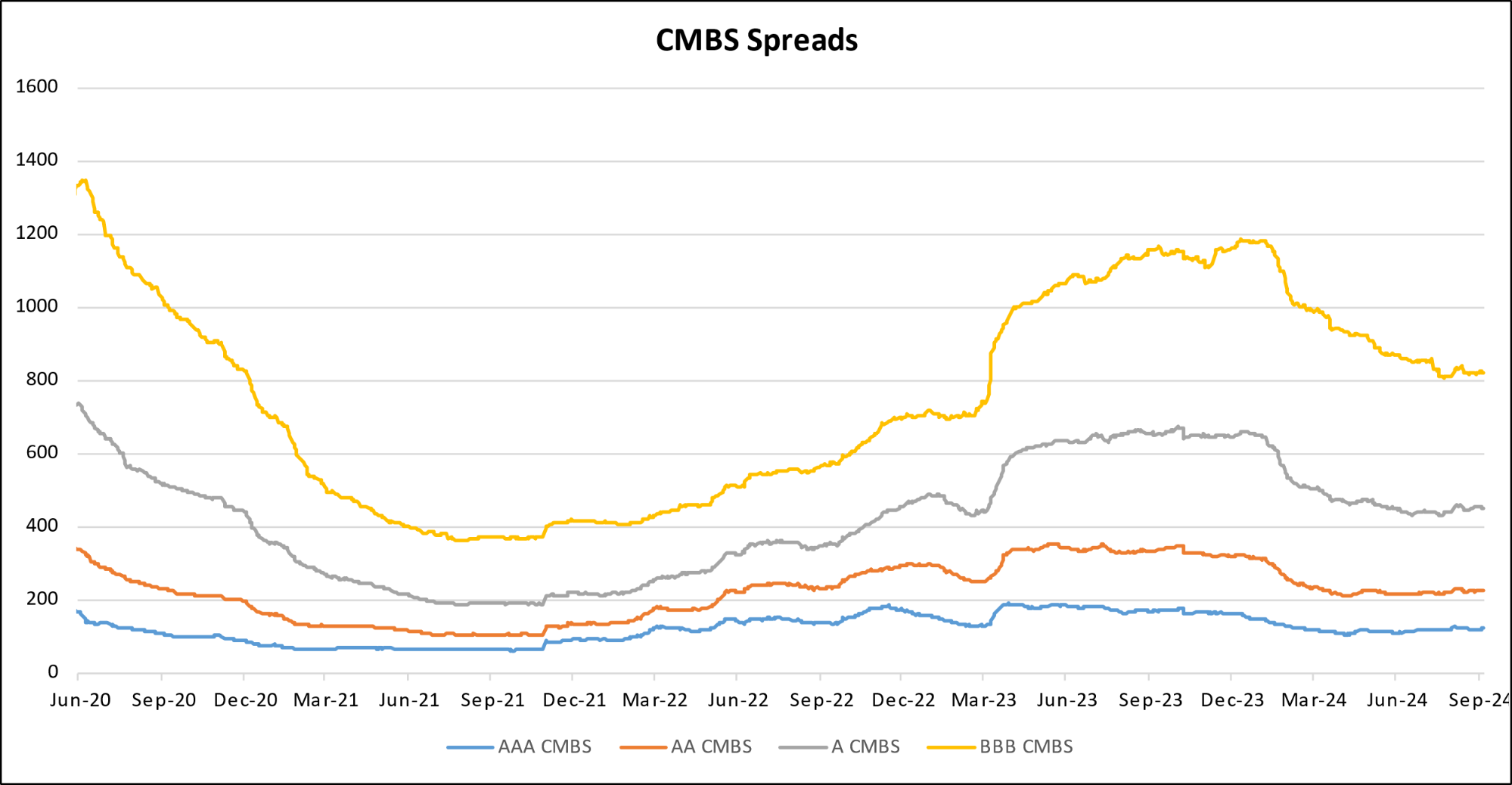

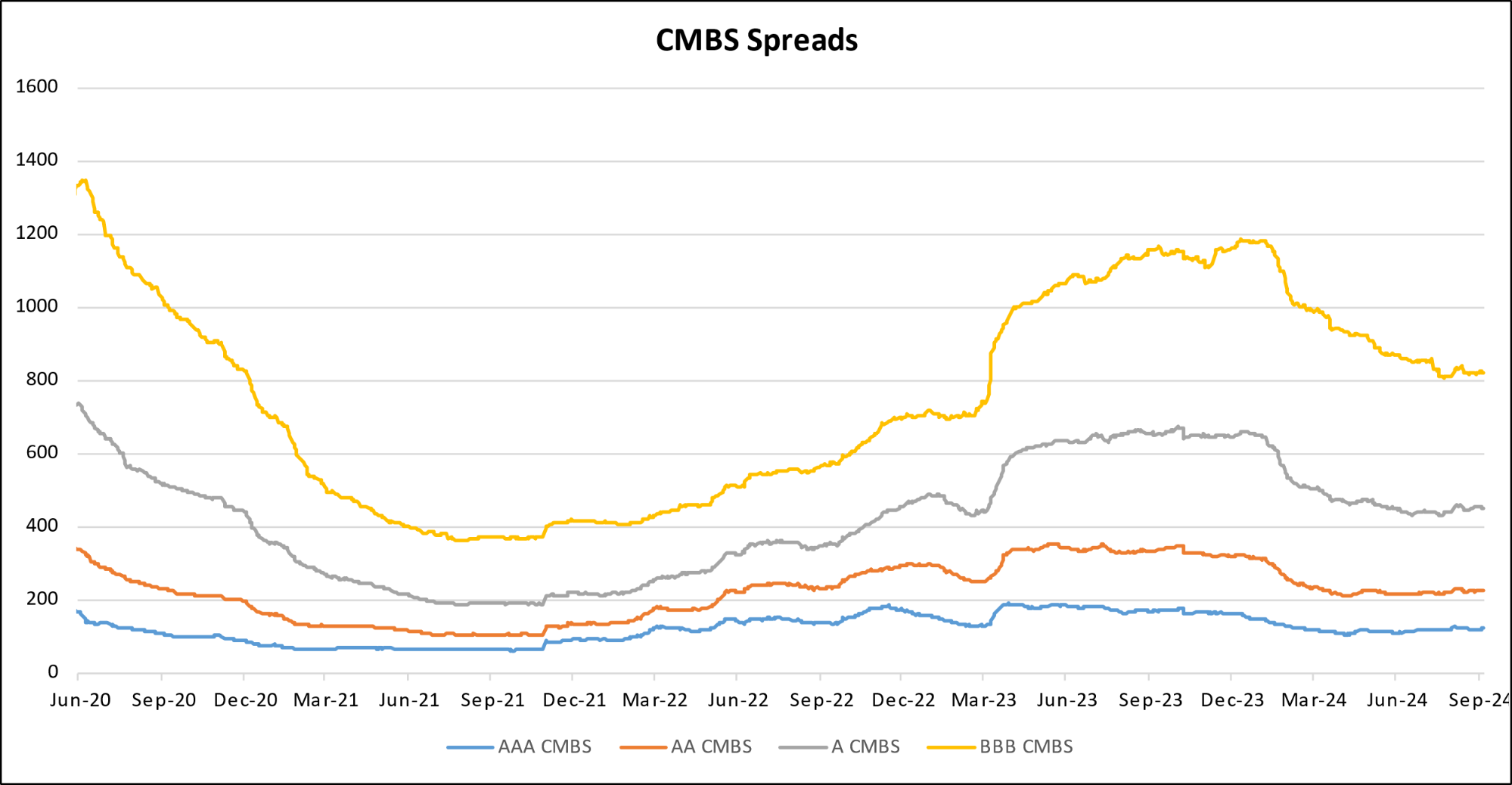

Diagram V: CMBS Spreads

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- New Home Sales

- U.S. new-home sales fell sharply by 17.3% in October, reaching a seasonally adjusted annual rate of 610,000 – the lowest level since November 2022, primarily due to hurricanes in the South.

- The South saw a 27.7% drop in new-home sales, significantly affecting the national total, while sales in the Northeast surged by 53.3%.

- The median price of new homes rose to $437,300, while supply increased 23.4% month over month.

- Consumer Confidence

- Consumer confidence increased to 111.7 in November, a 16-month high, fueled by easing inflation, strong job growth, and rising stock prices.

- The expectations index, which measures six-month outlooks, climbed to 92.3, marking its highest point since December 2021, signaling growing optimism about 2025.

- PCE Index

- The PCE index increased by 0.2% in October, bringing the annual inflation rate to 2.3%, up from 2.1%, signaling a continued upward trend in prices through year-end.

- The core PCE index, which excludes food and energy prices, rose by 0.3% in October, with the 12-month core rate climbing to 2.8%, the first increase since June.

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., decreased to 213,000 in the week ended November 22, down 2,000 from the prior week.

- The four-week moving average was 217,000, down 1,250 from the prior week.

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 9,000 to 1.907 million in the week ended November 15. This figure is reported with a one-week lag.

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $6.905 trillion in the week ended November 29, down $18.6 billion from the prior week.

- Treasury holdings totaled $4.323 trillion, down $2.3 billion from the prior week.

- Holdings of mortgage-backed securities (MBS) were $2.26 trillion in the week, down $9.4 billion from the prior week.

- Total Public Debt

- Total public debt outstanding was $36.09 trillion as of November 29, an increase of 6.5% from the previous year.

- Debt held by the public was $28.74 trillion, and intragovernmental holdings were $7.38 trillion.

- Inflation Factors

- CPI:

- The consumer-price index rose 2.6% in October year over year.

- On a monthly basis, the CPI increased 0.2% in October on a seasonally adjusted basis, after increasing 0.2% in September.

- The index for all items less food and energy (core CPI) rose 0.3% in October, after rising 0.3% in September.

- Core CPI increased 3.3% for the 12 months ending October.

- Food & Beverages:

- The food at home index increased 1.1% in October from the same month a year earlier, and increased 0.1% in October month over month.

- The food away from home index increased 3.8% in October from the same month a year earlier, and increased 0.2% in October month over month.

- Commodities:

- The energy commodities index decreased (1.0%) in October after decreasing (4.0%) in September.

- The energy commodities index fell (12.4%) over the last 12 months.

- The energy services index rose (0.4%) in October after increasing 0.4% in September.

- The energy services index rose 4.0% over the last 12 months.

- The gasoline index fell (12.2%) over the last 12 months.

- The fuel oil index fell (20.8%) over the last 12 months.

- The index for electricity rose 4.5% over the last 12 months.

- The index for natural gas rose 2.0% over the last 12 months.

- Supply Chain:

- Drewry’s composite World Container Index decreased to $3,330.61 per 40ft container.

- Drewry’s composite World Container Index has increased by 141.0% over the last 12 months.

- Housing Market:

- The shelter index increased 0.4% in October after increasing 0.2% in September.

- The rent index increased 0.4% in October after increasing 0.2% in September.

- The index for lodging away from home decreased (3.4%) in October after decreasing (3.8%) in September.

- Federal Funds Rate

- The effective Federal Funds Rate is at 4.58%, down (0.75%) year to date.

World News

- Middle East

- A U.S. brokered ceasefire halted over a year of conflict between Hezbollah and Israel. Hezbollah began withdrawing fighters and heavy weapons from southern Lebanon, while Israeli forces also pulled back.

- Airstrikes and mutual accusations of ceasefire violations remain a concern going forward for both parties.

- Syrian rebels, including the Islamist group Hayat Tahrir al-Sham, launched their largest attack since 2020, seizing territory and military assets in northwest Syria near Aleppo.

- The surprise offensive highlights ongoing instability in a fragmented country, despite Assad’s control over much of Syria. Analysts expect Assad’s forces, backed by Russian air power, to launch a counteroffensive to regain lost ground.

- Russia

- Russia’s economy, resilient through early sanctions, is now under severe strain due to new U.S. sanctions targeting Gazprombank, a critical financial conduit for trade and military payments.

- The ruble fell to a 32-month-low this week, causing Russia’s central bank to intervene in currency markets last Wednesday.

- Thousands of Ukrainian and Russian POWs remain in captivity with both sides struggling to conduct meaningful exchanges. Ukraine is resorting to unconventional means such as offering Soviet-era spies’ remains to facilitate swaps.

- Russia appears to use POWs as leverage to pressure Kyiv politically after stating Ukraine’s conditions for swaps are unrealistic.

- China

- Labor disputes in China have surged, with over 1,200 protests in 2024 related to unpaid wages and benefits, signaling local governments’ severe financial strain.

- China’s local governments face a debt crisis, with hidden liabilities estimated between $7 trillion and $11 trillion. The Chinese government introduced a $1.4 trillion debt swap program to ease local government burdens, but economists argue it only offers marginal relief and doesn’t address the root causes of fiscal mismanagement and debt accumulation.

- Admiral Miao Hua, a high-ranking officer in China’s military, has been suspended for alleged serious violations, marking another major step in Xi Jinping’s ongoing anticorruption campaign.

- Miao, who oversaw political indoctrination in the PLA, is one of the highest-ranking officers to face removal, further consolidating Xi’s control over the military.

- India

- Under Prime Minister Modi’s economic strategy, conglomerates like the Adani Group have flourished through close governmental ties, leading to concerns about market concentration and its impact on competition. However, the group’s recent scandal involving bribery and securities fraud has sparked global scrutiny.

- France

- French consumer confidence dropped sharply in November, hitting its lowest point since June, due to a combination of political instability, rising unemployment fears, and industrial restructuring. Major employers like Michelin and Airbus are cutting jobs, while ongoing government struggles have contributed to growing uncertainty.

- Argentina

- Argentine President Javier Milei seeks U.S. support under President-elect Trump to secure new IMF loans for his aggressive capitalist reforms, including austerity measures to combat inflation and stabilize the economy, while aligning with Trump’s political ideology despite diverging on trade and global economic policies.

- Canada

- Canada’s Liberal government, supported by the New Democratic Party, plans to temporarily remove the 5% goods-and-services tax on select items like home heating and diapers to ease affordability challenges amid public dissatisfaction with rising costs and slow economic growth.

- North Korea

- North Korean leader Kim Jong Un dismissed the idea of resuming nuclear talks with President-elect Donald Trump, citing the U.S.’s “unchanging hostile policy” and emphasizing strengthened ties with Russia and expanded nuclear capabilities.

- UK

- U.K. inflation rose to 2.3% in October 2024, exceeding the Bank of England’s 2% target, driven by energy price increases, with core inflation at 3.3%; policymakers plan gradual rate cuts despite lingering inflationary pressures and economic growth concerns.

- Japan

- Japan’s government approved a $141 billion stimulus package to address rising living costs, promote innovation in AI and chip supply chains, and provide inflation relief through cash handouts and energy subsidies, though concerns over public debt and fiscal sustainability remain.

- Brazil

- Brazilian police have accused former President Jair Bolsonaro and 36 allies of plotting a coup to prevent President Luiz Inácio Lula da Silva from taking office in 2023, including plans to assassinate Lula and his vice president, revealing a highly organized operation involving military and political figures.

Commodities

- Oil Prices

- WTI: $68.00 per barrel

- (4.55%) WoW; (5.09%) YTD; (12.66%) YoY

- Brent: $72.94 per barrel

- (2.97%) WoW; (5.32%) YTD; (12.23%) YoY

- Crude Oil Prices per Barrel: West Texas Intermediate (WTI) – Cushing, Oklahoma

- US Production

- U.S. oil production amounted to 13.5 million bpd for the week ended November 22, up 0.1 million bpd from the prior week.

- Rig Count

- The total number of oil rigs amounted to 582, down 1 from last week.

- Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 428.4 million barrels, down (4.7%) YoY.

- Refiners operated at a capacity utilization rate of 90.5% for the week, up from 90.2% in the prior week.

- U.S. crude oil imports now amount to 7.684 million barrels per day, down 4.3% YoY.

-

Gasoline

- Retail average regular gasoline prices amounted to $3.06 per gallon in the week of November 29, down (5.7%) YoY.

- Gasoline prices on the East Coast amounted to $3.12, down (4.4%) YoY.

- Gasoline prices in the Midwest amounted to $2.95, down (5.2%) YoY.

- Gasoline prices on the Gulf Coast amounted to $2.73, down (2.5%) YoY.

- Gasoline prices in the Rocky Mountain region amounted to $2.95, down (8.4%) YoY.

- Gasoline prices on the West Coast amounted to $4.02, down (10.5%) YoY.

- Motor gasoline inventories were up by 3.3 million barrels from the prior week.

- Motor gasoline inventories amounted to 212.2 million barrels, down (2.7%) YoY.

- Production of motor gasoline averaged 9.74 million bpd, up 4.4% YoY.

- Demand for motor gasoline amounted to 8.506 million bpd, up 3.7% YoY.

-

Distillates

- Distillate inventories decreased by 0.4 million in the week of November 29.

- Total distillate inventories amounted to 114.7 million barrels, up 3.6% YoY.

- Distillate production averaged 5.096 million bpd, up 2.0% YoY.

- Demand for distillates averaged 3.718 million bpd in the week, up 23.4% YoY.

- Natural Gas

- Natural gas inventories decreased by 2 billion cubic feet last week.

- Total natural gas inventories now amount to 3,967 billion cubic feet, up 3.4% YoY.

Credit News

High yield bond yields decreased 7bps to 7.14% and spreads increased 6bps to 299bps. Leveraged loan yields decreased 10bps to 8.54% and spreads decreased 2bps to 462bps. WTD Leveraged loan returns were positive 23bps. WTD high yield bond returns were positive 41bps. 10yr treasury yields decreased 20bps to 4.20%. Yields decreased amid limited macro developments and a mild uptick in issuance. The US election outcome produced upside risks to growth from deregulation and tax cutting and downside risks from tariffs and general policy uncertainty.

High-yield:

Week ended 11/29/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 11/29/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Spirit Airlines ($1.6bn, 11/18/24), Franchise Group Inc ($1.1bn,

11/3/24), Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24),

Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions

($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), Wheel Pros

($2.8bn, 7/11/24), and Quorum Health Group ($688mn, 7/10/24).

CLOs:

Week ended 11/29/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Diagram V: CMBS Spreads

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index