U.S. News

- Wholesale Inventories

- U.S. wholesale inventories increased by 0.2% in October, reversing a 0.2% decline in September

- Inventories could increase in months ahead as businesses fearful of higher tariffs stockpile goods

- Sales at wholesalers fell 0.1% in October after rising 0.5% in September. At October’s sales pace it would take wholesalers 1.34 months to clear shelves, unchanged from September

- Consumer Price Index

- Consumer prices increased by 0.3% in November, the fastest pace in seven months, with the annual inflation rate ticking up to 2.7% from 2.6%

- The core inflation rate, which excludes food and energy, also rose 0.3% for the fourth consecutive month, holding steady at 3.3% annually

- Despite the inflation uptick, markets have largely priced in a quarter-percentage-point cut with economists forecasting fewer rate reductions in 2025

- Producer Price Index

- U.S. producer prices rose 0.4% in November, the largest increase in five months, driven by a 3.1% surge in food prices

- Core inflation remained steady at 0.2% for the fifth consecutive month

- Nonrevolving credit, such as auto and student loans, rose by a modest 1.1% in October, reflecting less volatility compared to revolving credit

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 242,000 in the week ended December 6, up 17,000 from the prior week.

- The four-week moving average was 224,250, up 5,750 from the prior week.

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 15,000 to 1.886 million in the week ended November 29. This figure is reported with a one-week lag.

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $6.897 trillion in the week ended December 13, up $1.7 billion from the prior week.

- Treasury holdings totaled $4.316 trillion, down $4.3 billion from the prior week.

- Holdings of mortgage-backed securities (MBS) were $2.25 trillion in the week, down $7.6 billion from the prior week.

- Total Public Debt

- Total public debt outstanding was $36.13 trillion as of December 13, an increase of 6.8% from the previous year.

- Debt held by the public was $28.85 trillion, and intragovernmental holdings were $7.30 trillion.

- Inflation Factors

- CPI:

- The consumer-price index rose 2.6% in November year over year.

- On a monthly basis, the CPI increased 0.0% in November on a seasonally adjusted basis, after increasing 0.2% in October.

- The index for all items less food and energy (core CPI) remained flat 0.0% in November, after rising 0.3% in October.

- Core CPI increased 3.3% for the 12 months ending November.

- Food & Beverages:

- The food at home index increased 1.1% in November from the same month a year earlier, and staying flat 0.0% in November month over month.

- The food away from home index increased 3.4% in November from the same month a year earlier, and staying flat 0.0% in November month over month.

- Commodities:

- The energy commodities index decreased 0.0% in November after decreasing

- The energy commodities index fell (8.9%) over the last 12 months.

- The energy services index rose 0.0% in November after decreasing (0.4%) in October.

- The energy services index rose 3.3% over the last 12 months.

- The gasoline index fell (5.3%) over the last 12 months.

- The fuel oil index fell (18.7%) over the last 12 months.

- The index for electricity rose 3.5% over the last 12 months.

- The index for natural gas rose (1.9%) over the last 12 months.

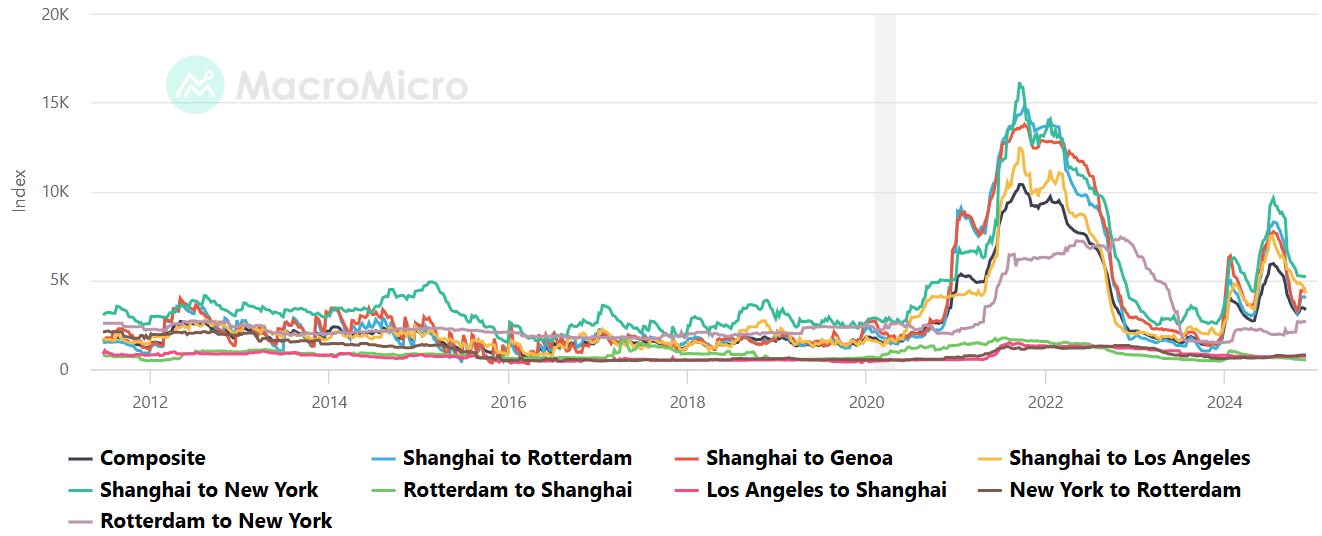

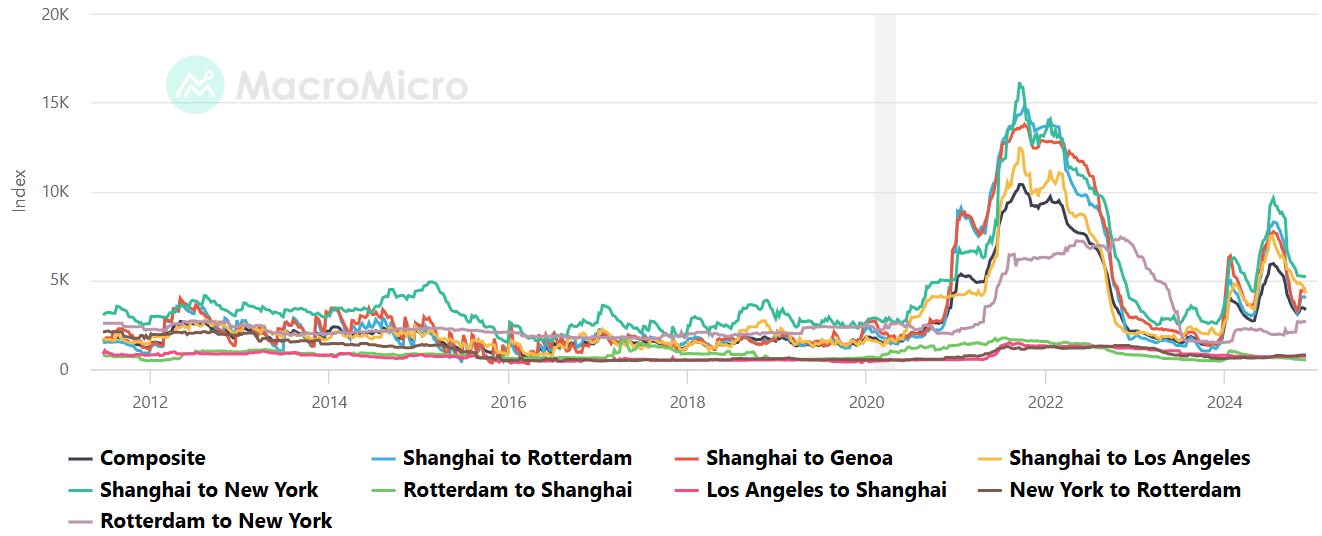

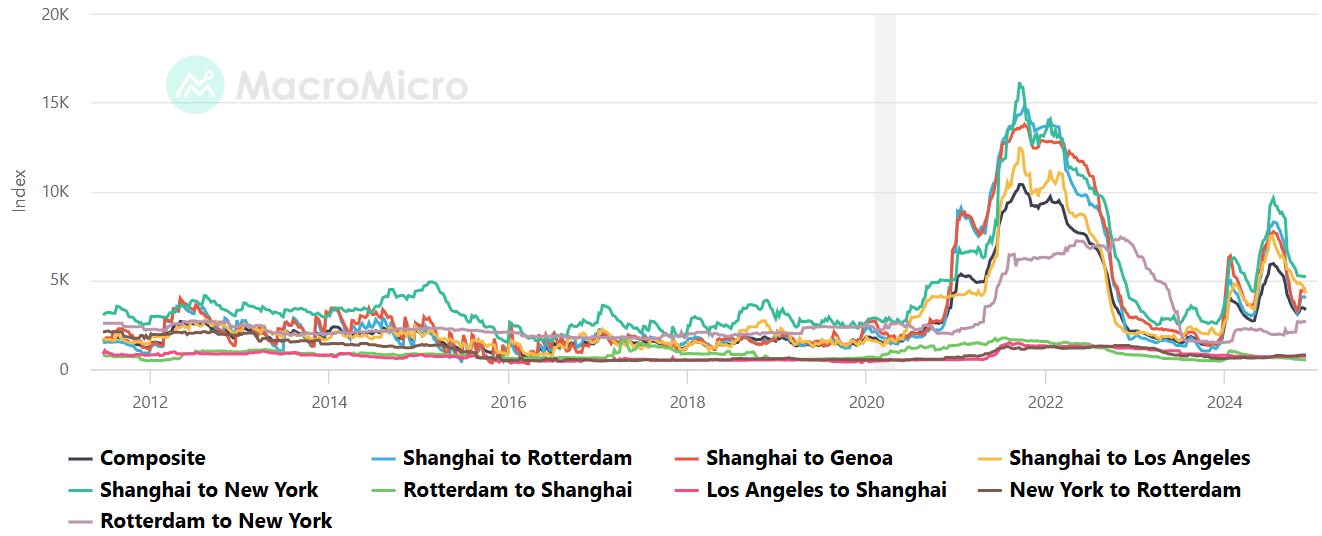

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,528.70 per 40ft container.

- Drewry’s composite World Container Index has increased by 132.0% over the last 12 months.

- Housing Market:

- The shelter index increased 0.0% in November after increasing 0.4% in October.

- The rent index increased 0.4% in October after increasing 0.4% in October.

- The index for lodging away from home decreased 0.0% in November after decreasing (3.4%) in October.

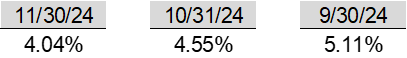

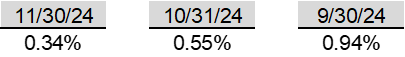

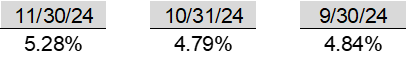

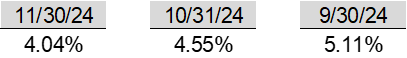

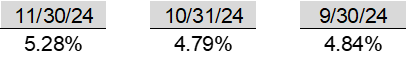

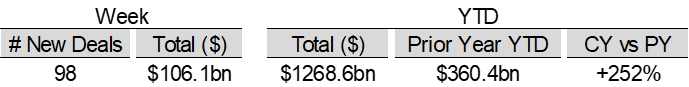

- Federal Funds Rate

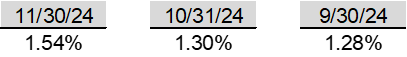

- The effective Federal Funds Rate is at 4.58%, down (0.75%) year to date.

World News

- Middle East

- The Assad regime fell without resistance, leaving Damascus in a temporary power vacuum. Rebel forces, led by Hayat Tahrir al-Sham moved to restore order, curbing looting and forming a transitional government under Mohammed al-Bashir

- Hayat Tahrir al-Sham faces hurdles in uniting Syria’s diverse communities and maintaining state institutions. The group has reassured minorities, preserved some former regime officials and promised personal freedoms, while seeking to balance governance reforms with maintaining public support

- Hamas has yielded to two of Israel’s key demands for a cease-fire deal in Gaza. Hamas told mediators for the first time that it would allow the temporary presence of Israeli forces in Gaza’s when the fighting stops and submitted a list of hostages, including U.S. citizens, for release under a ceasefire deal

- As part of the latest proposal, the 60-day ceasefire plan includes the release of up to 30 hostages in exchange for Palestinian prisoners and increased humanitarian aid

- Europe

- French President Emannuel Macron appointed Francois Bayrou as the new prime minister to address a political deadlock in the National Assembly, following the resignation of Michel Barnier

- Bayrou, a seasoned centrist and ally of Macron, faces resistance from socialist lawmakers and risks further political instability. Bayrou must draft a 2025 budget to address France’s growing public deficit, which has unsettled investors

- Germany’s central bank significantly lowered its 2025 economic growth forecast to just 0.2%, down from a previous estimate of 1.1%. The country is facing a second consecutive year of decline in 2024 (-0.2%), with structural issues impacting its industrial sector, export business and investments

- The central bank highlighted increased global trade protectionism and geopolitical tensions as major sources of uncertainty, particularly for Germany’s export-driven economy

- China

- China pledged to adopt a “moderately loose” monetary policy and a more proactive fiscal approach in 2025, marking a significant shift from its previous “prudent” stance. This includes boosting domestic demand, stabilizing the housing market, and potentially increasing government borrowing to address economic downturns and trade tensions

- Some economists caution that the effectiveness of rate cuts and stimulus measures may be limited in an economy with low borrowing appetite

- Taiwan reported China’s largest maritime military operation in nearly 30 years, with nearly 90 naval and coast guard vessels deployed across a vast region, signaling potential efforts to block Taiwan’s defense and hinder U.S. allies like Japan and the Philippines

- The surge in Chinese ships, including warplanes and naval vessels near Taiwan, follows heightened tensions due to Taiwan President Lai Ching-te’s recent visits to Hawaii and Guam, fueling speculation that China’s military presence is in response to Taiwan’s growing international engagements

- Africa

- The war in Sudan has escalated with foreign mercenaries, including Colombian fighters, being deployed by the UAE to support the rebel Rapid Support Forces against Sudan’s military. The involvement of foreign fighters and weapons has complicated the conflict, with the UAE and Egypt backing opposing sides for strategic control over Sudan’s resources

- U.K.

- A Chinese businessman with ties to Prince Andrew has been banned from entering the U.K. after intelligence services alleged he attempted to influence the British royal on behalf of Beijing, posing a national security risk; the businessman, identified as H6, was found to have cultivated a close relationship with Andrew, including being invited to his 2020 birthday party and acting on his behalf for a financial initiative linked to China

- South Korea

- In a chaotic six-hour period, South Korea’s President Yoon Suk Yeol declared martial law, citing threats to democracy, only to have it overturned by a National Assembly vote, which lawmakers fought to complete as soldiers attempted to storm the legislature

- Romania

- Romania’s Constitutional Court annulled its presidential election following allegations that a Kremlin-backed influence campaign on TikTok elevated pro-Russian candidate Calin Georgescu to a lead position. Using a network of 25,000 TikTok accounts, the campaign amplified Georgescu’s anti-NATO, anti-EU messaging, disrupting the electoral process and leading to the cancellation of the second round of voting

- Spain

- The U.S. Federal Maritime Commission is investigating Spain for blocking American-flagged ships, suspected of carrying military cargo to Israel. If confirmed, Spain could face penalties, including restrictions on its ships docking at U.S. ports

- India

- Under Prime Minister Modi’s economic strategy, conglomerates like the Adani Group have flourished through close governmental ties, leading to concerns about market concentration and its impact on competition. However, the group’s recent scandal involving bribery and securities fraud has sparked global scrutiny

- Argentina

- Argentine President Javier Milei seeks U.S. support under President-elect Trump to secure new IMF loans for his aggressive capitalist reforms, including austerity measures to combat inflation and stabilize the economy, while aligning with Trump’s political ideology despite diverging on trade and global economic policies

- Canada

- Canada’s Liberal government, supported by the New Democratic Party, plans to temporarily remove the 5% goods-and-services tax on select items like home heating and diapers to ease affordability challenges amid public dissatisfaction with rising costs and slow economic growth

Commodities

- Oil Prices

- WTI: $71.21 per barrel

- 5.97% WoW; (0.61%) YTD; 2.50% YoY

- Brent: $74.45 per barrel

- 4.68% WoW; (3.36%) YTD; 0.26% YoY

- US Production

- U.S. oil production amounted to 13.6 million bpd for the week ended December 6, up 0.1 million bpd from the prior week.

- Rig Count

- The total number of oil rigs amounted to 589, down 0 from last week.

- Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 422.0 million barrels, down (4.3%) YoY.

- Refiners operated at a capacity utilization rate of 92.4% for the week, down from 93.3% in the prior week.

- U.S. crude oil imports now amount to 7.290 million barrels per day, down (8.2%) YoY.

-

Gasoline

- Retail average regular gasoline prices amounted to $3.03 per gallon in the week of December 13, down (2.0%) YoY.

- Gasoline prices on the East Coast amounted to $3.11, down (3.8%) YoY.

- Gasoline prices in the Midwest amounted to $2.89, down (2.9%) YoY.

- Gasoline prices on the Gulf Coast amounted to $2.70, down (0.4%) YoY.

- Gasoline prices in the Rocky Mountain region amounted to $2.91, down (3.5%) YoY.

- Gasoline prices on the West Coast amounted to $3.96, down (7.2%) YoY.

- Motor gasoline inventories were up by 5.1 million barrels from the prior week.

- Motor gasoline inventories amounted to 219.7 million barrels, down (1.9%) YoY.

- Production of motor gasoline averaged 10.05 million bpd, up 5.3% YoY.

- Demand for motor gasoline amounted to 8.810 million bpd, down (0.6%) YoY.

-

Distillates

- Distillate inventories decreased by 3.2 million in the week of December 13.

- Total distillate inventories amounted to 121.3 million barrels, up 6.9% YoY.

- Distillate production averaged 5.229 million bpd, up 4.9% YoY.

- Demand for distillates averaged 3.450 million bpd in the week, down (8.5%) YoY.

- Natural Gas

- Natural gas inventories decreased by 190 billion cubic feet last week.

- Total natural gas inventories now amount to 3,747 billion cubic feet, up 2.3% YoY.

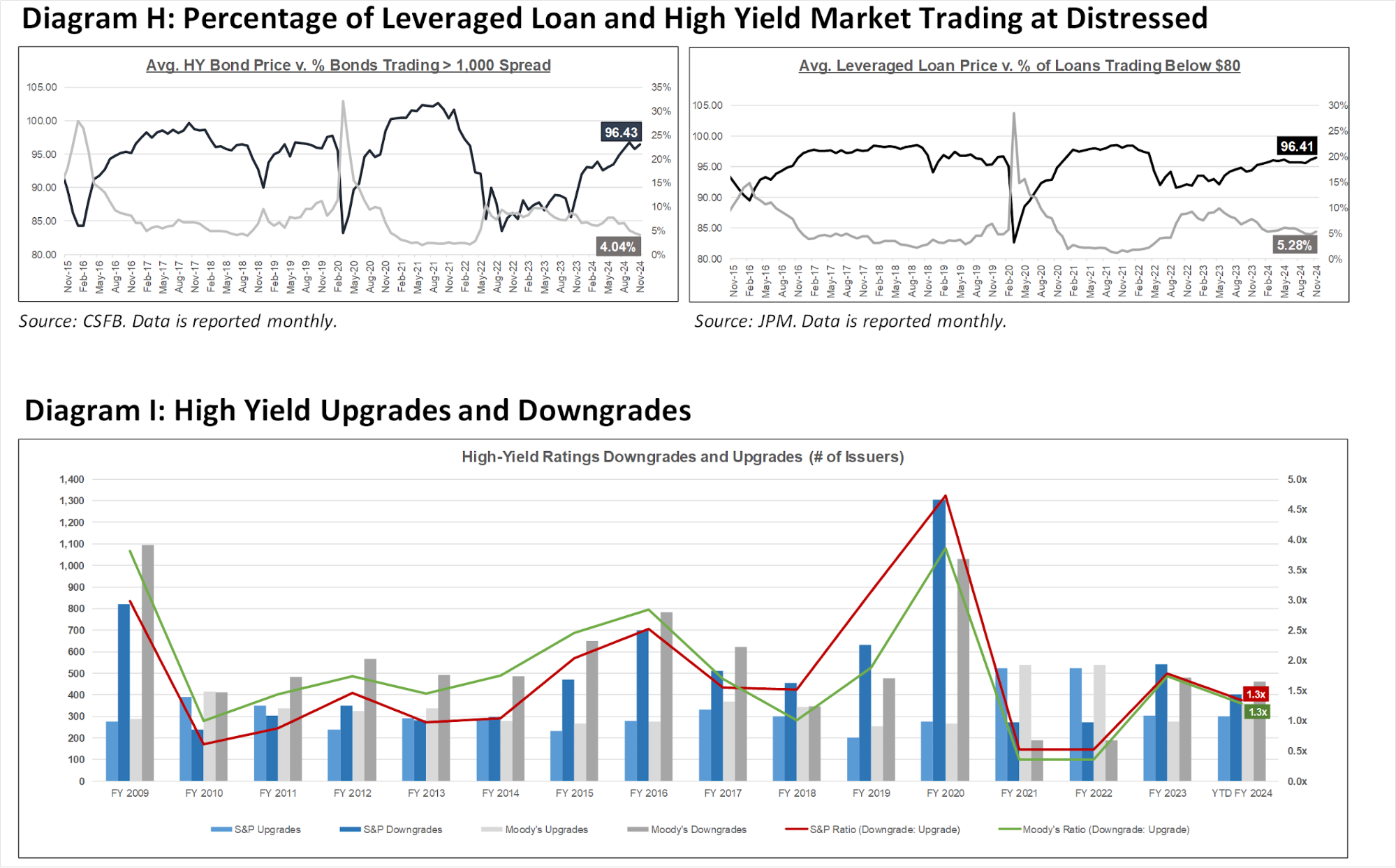

Credit News

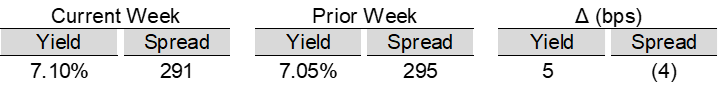

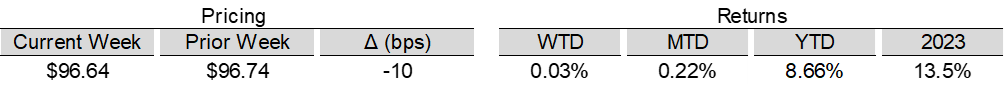

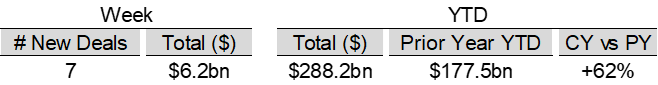

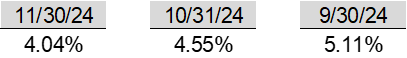

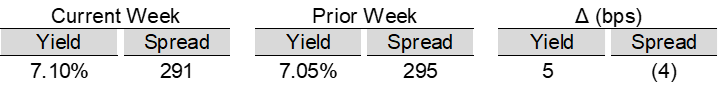

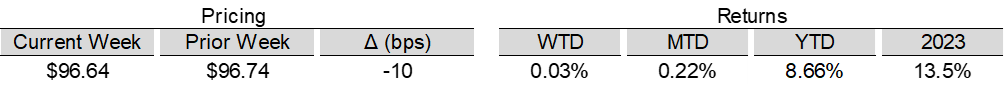

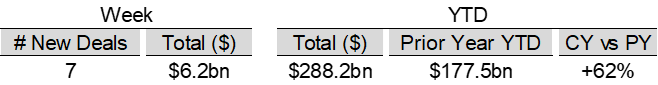

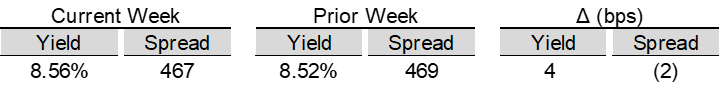

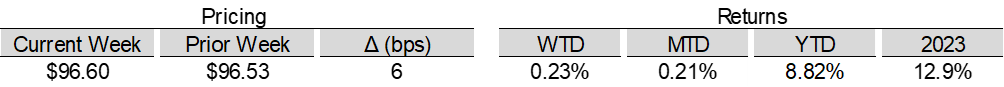

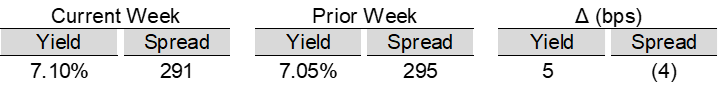

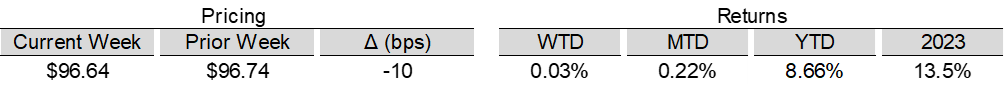

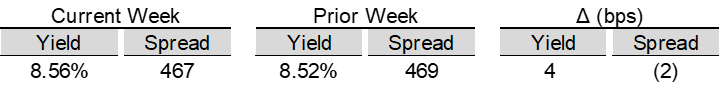

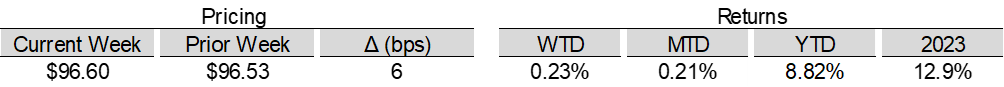

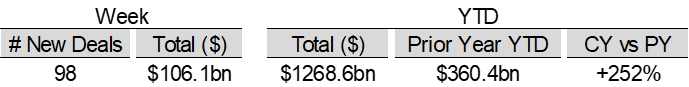

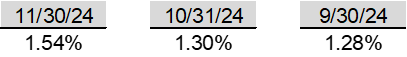

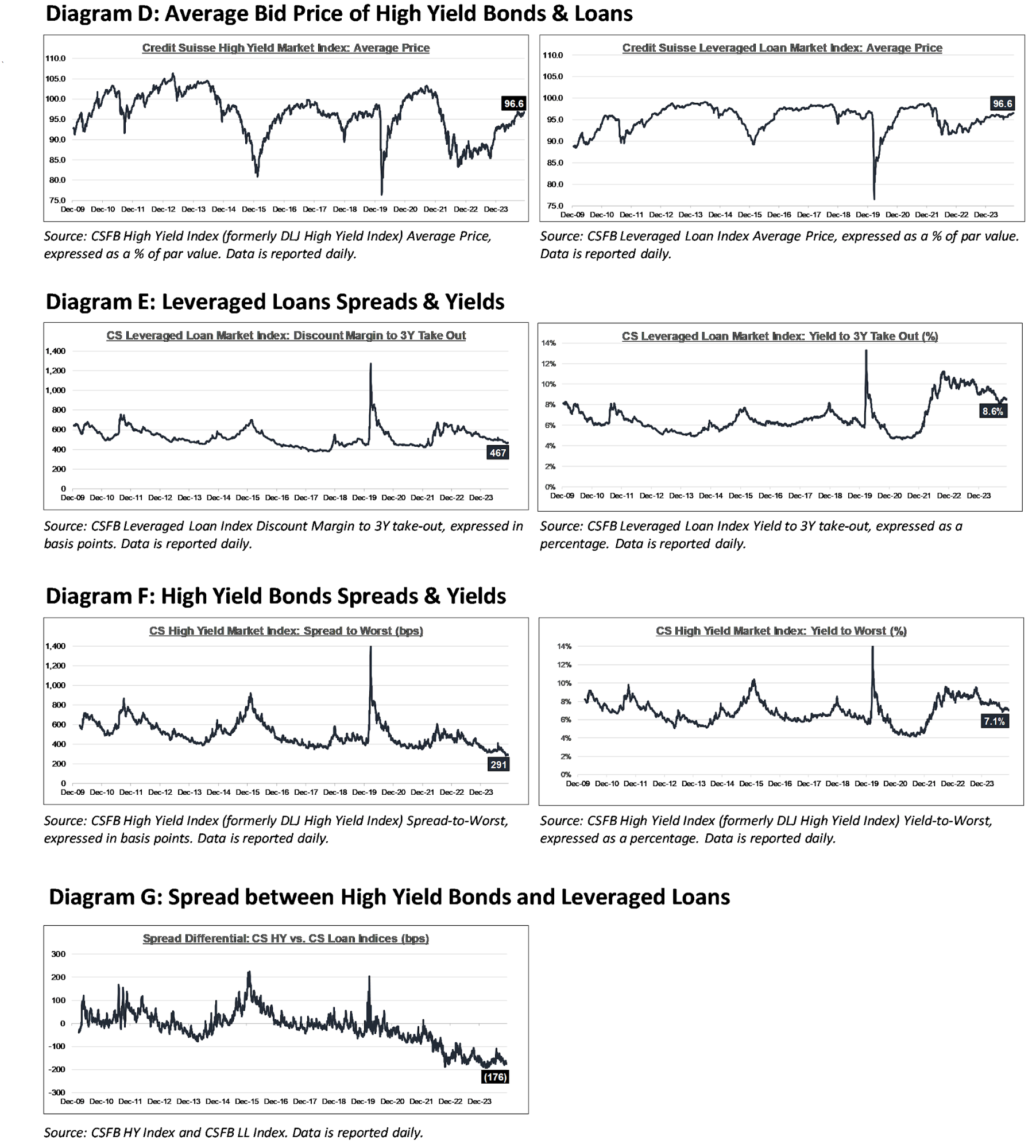

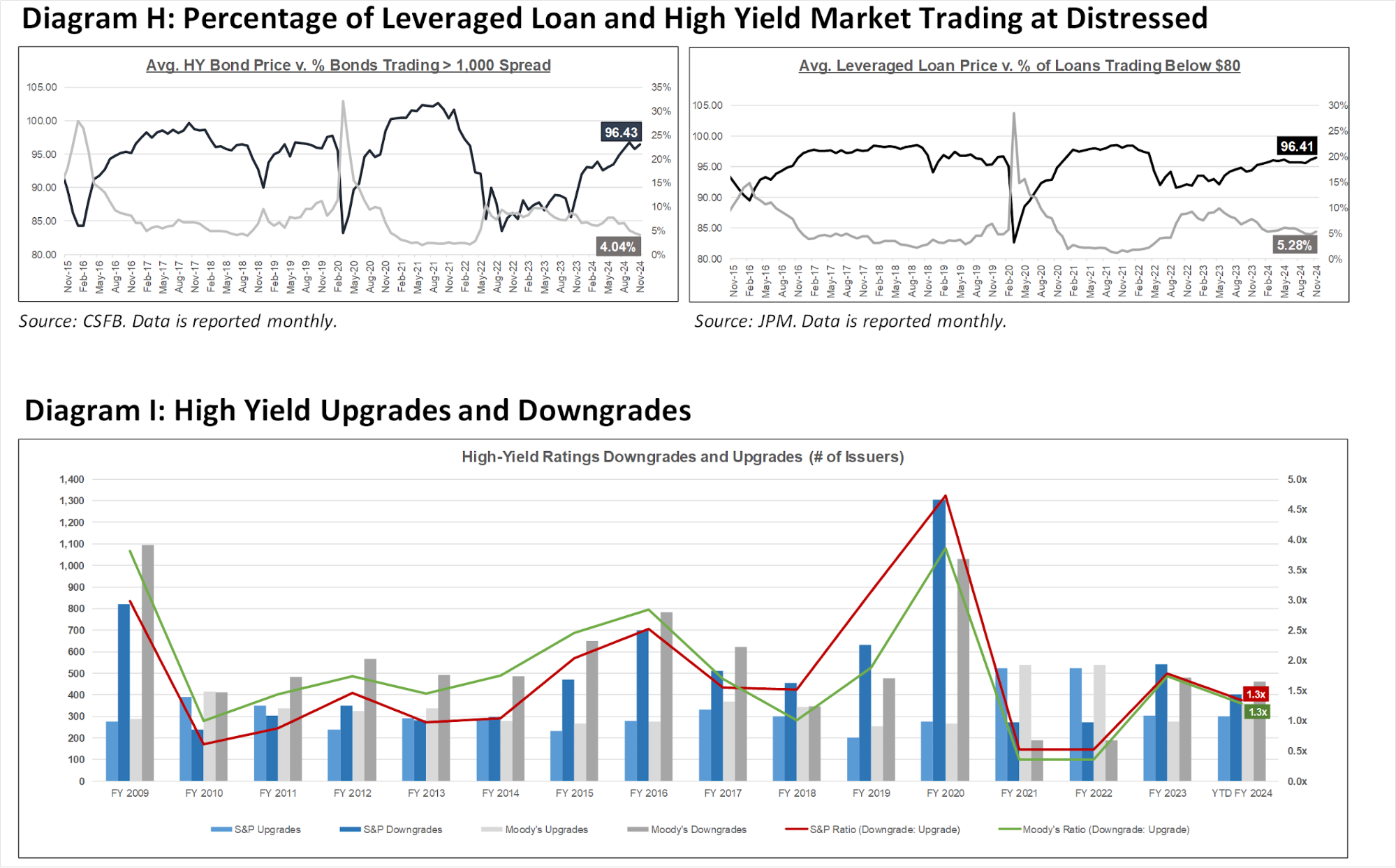

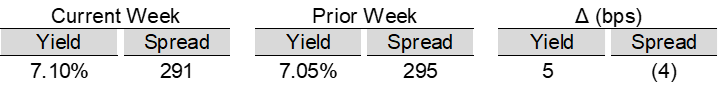

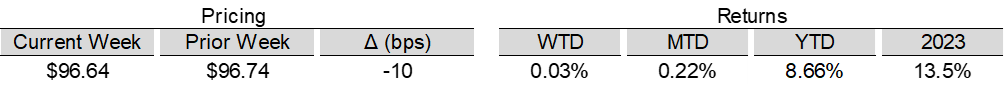

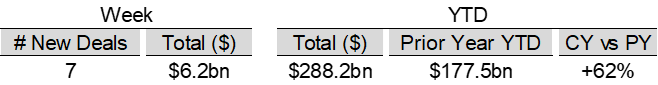

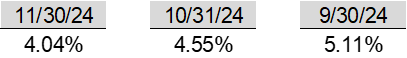

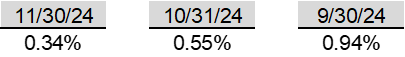

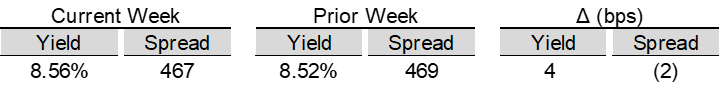

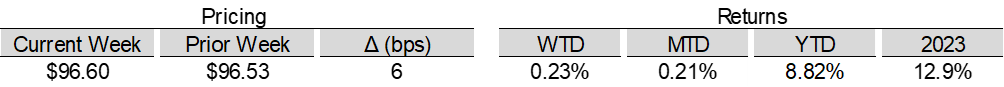

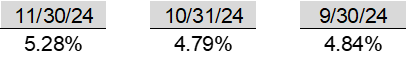

High yield bond yields increased 5bps to 7.10% and spreads decreased 4bps to 291bps. Leveraged loan yields increased 4bps to 8.56% and spreads decreased 2bps to 467bps. WTD Leveraged loan returns were positive 23bps. WTD high yield bond returns were positive 3bps. 10yr treasury yields increased 14bps to 4.32%. Leveraged Loan posted positive returns for a nineteenth consecutive week amid the largest stretch of inflows since early 2022 and a record December for capital markets. This week’s CPI met expectations but still didn’t align with the 2% target. While markets are expecting a rate cut next week, the recent rise in prices and economic activity suggests a more cautious approach to easing going forward.

High-yield:

Week ended 12/13/2024

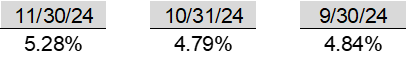

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

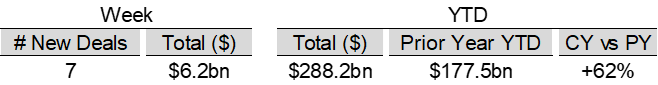

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/13/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Hearthside Food Solutions ($2.6bn, 11/22/24), Spirit Airlines ($1.1bn, 11/18/24), Franchise Group Inc ($1.1bn, 11/3/24), Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24), Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions ($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), and Wheel Pros ($2.8bn, 7/11/24).

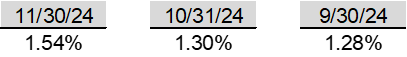

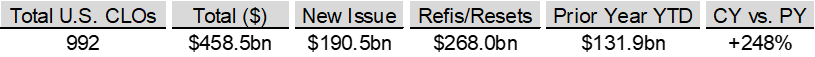

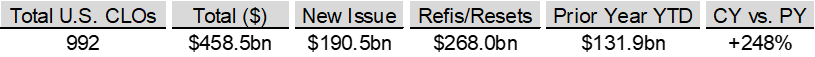

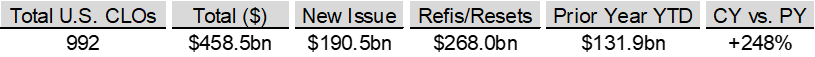

CLOs:

Week ended 12/13/2024

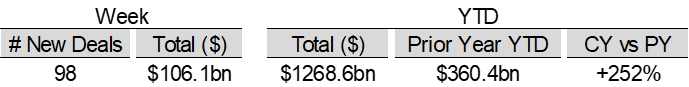

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

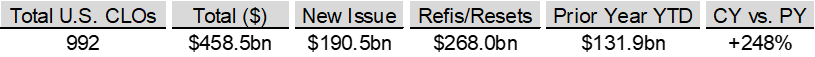

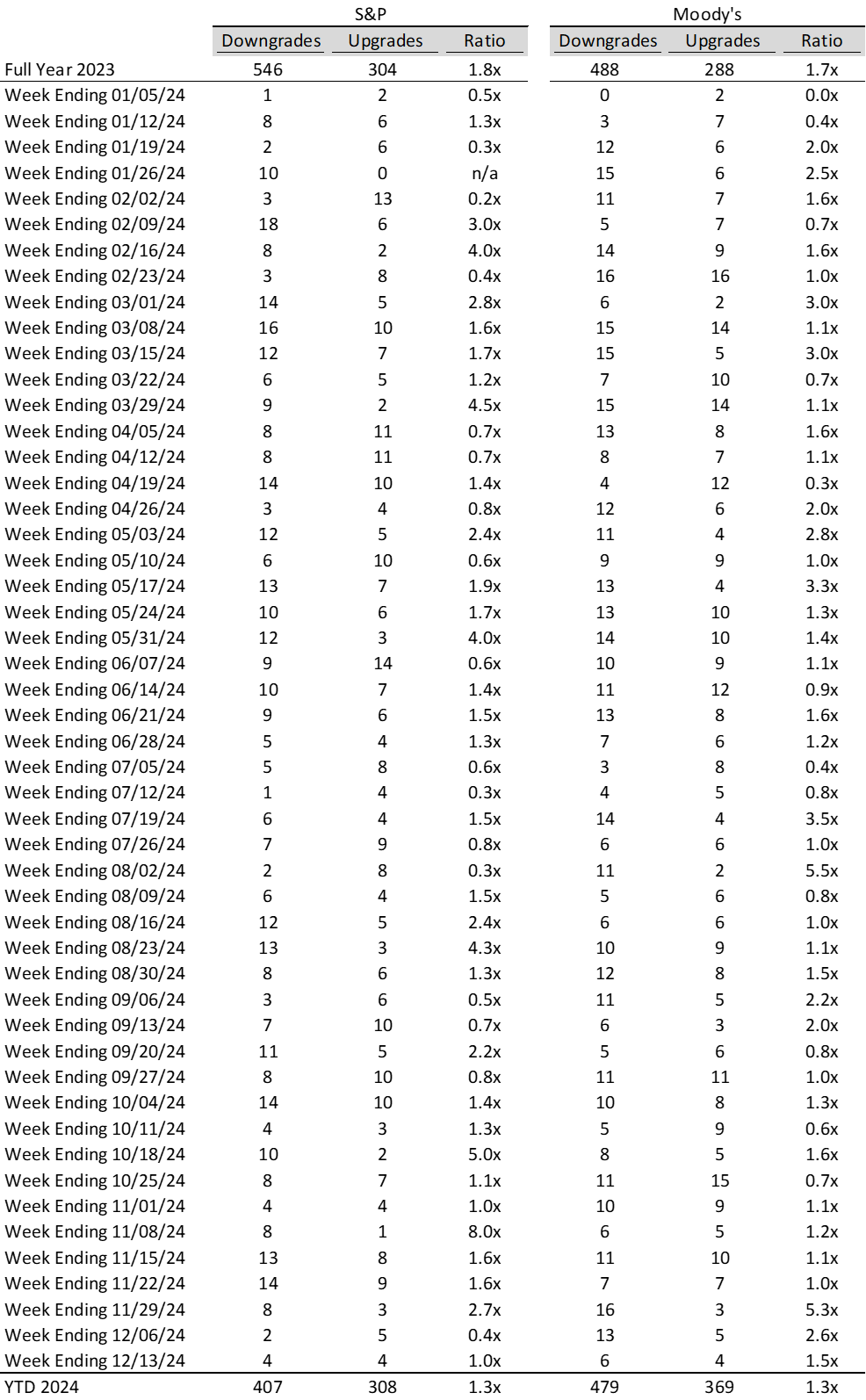

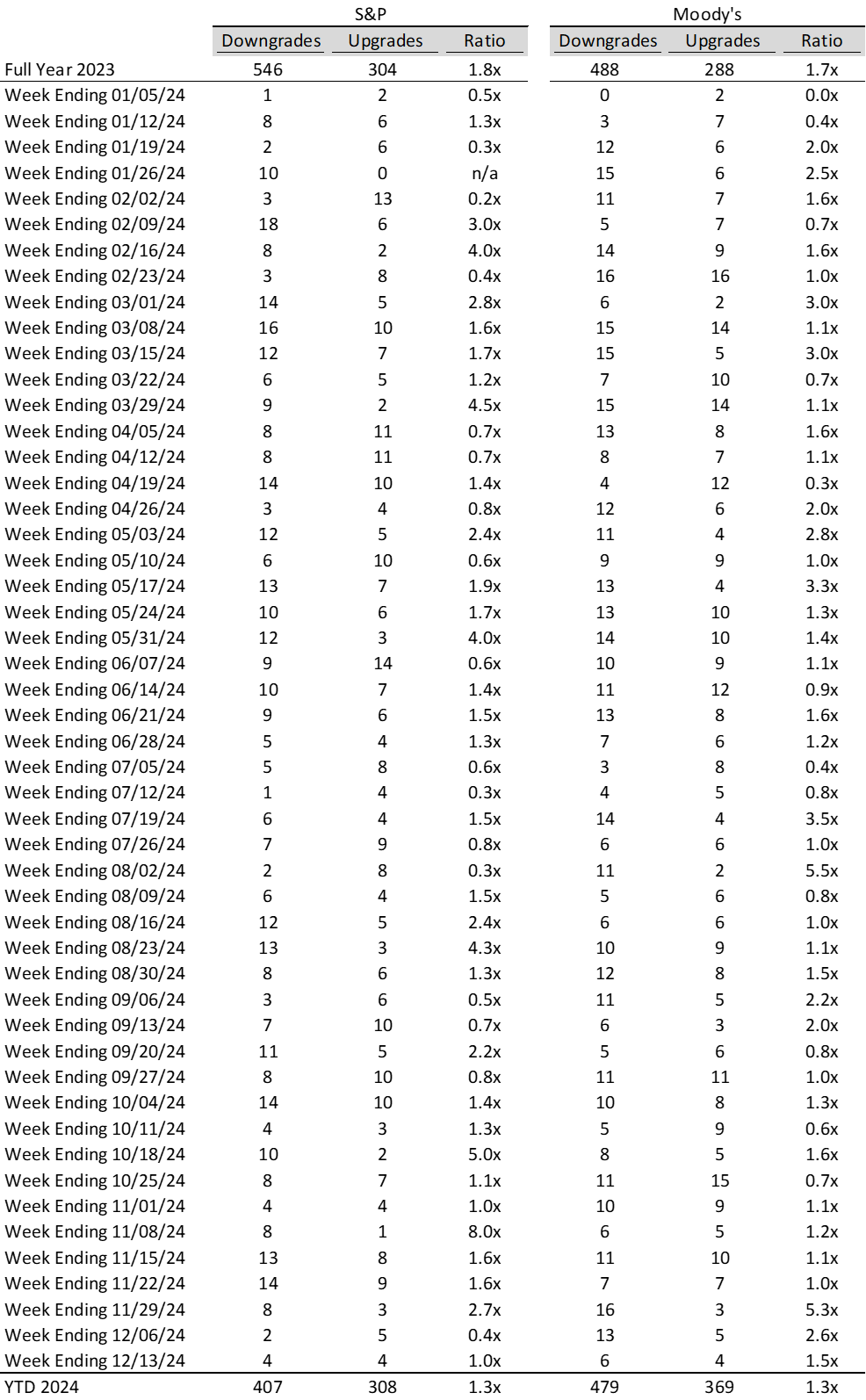

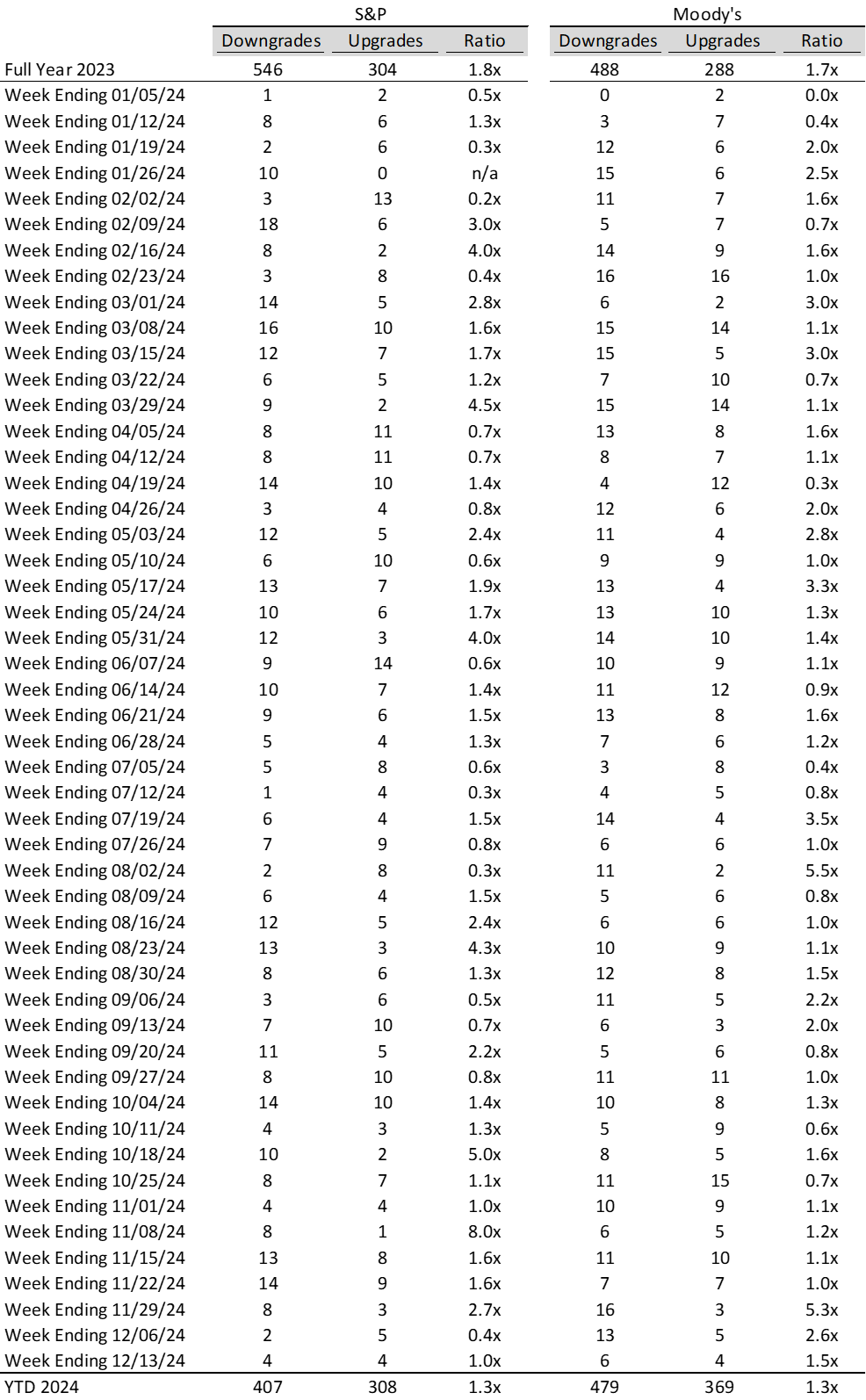

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

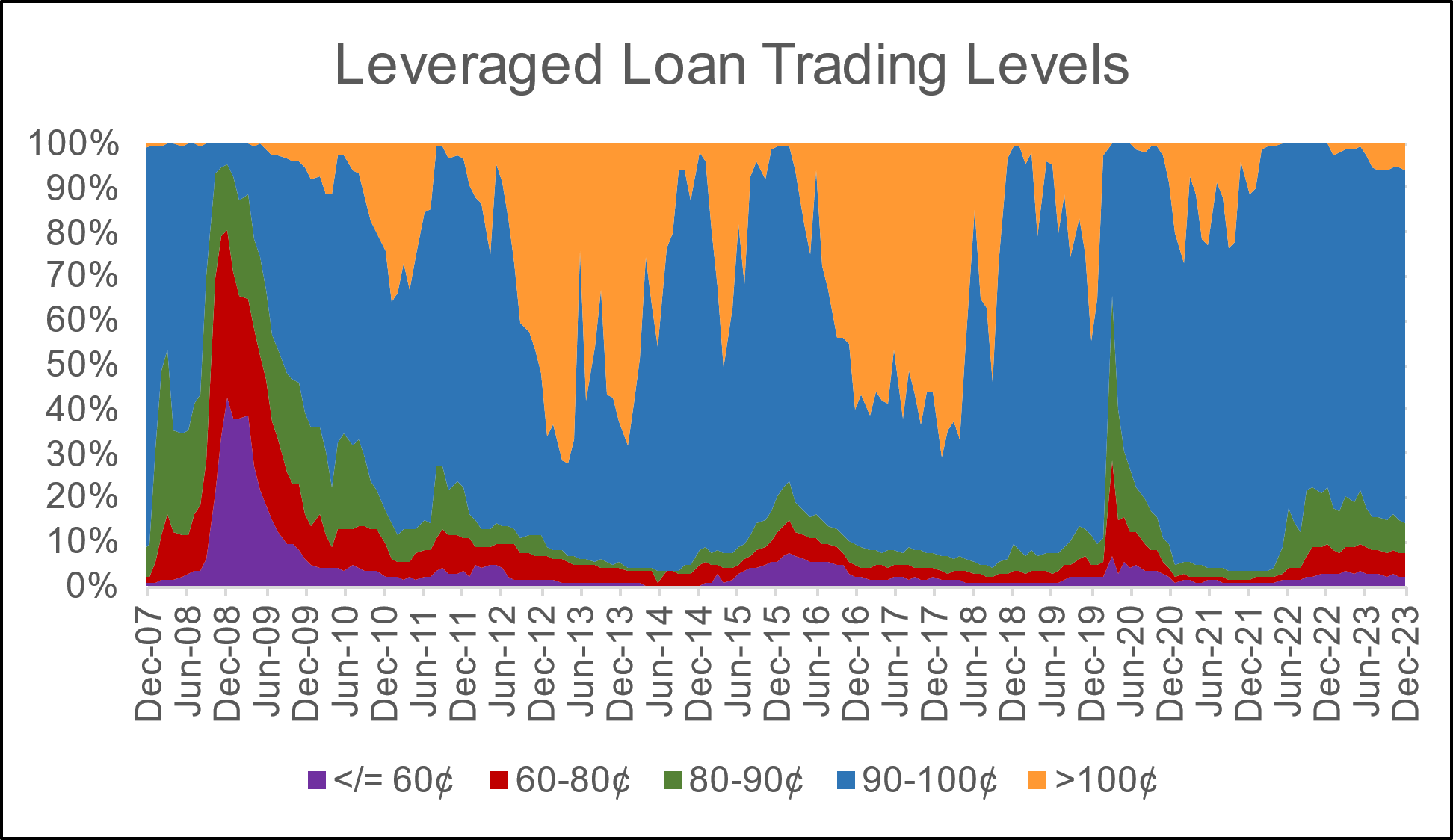

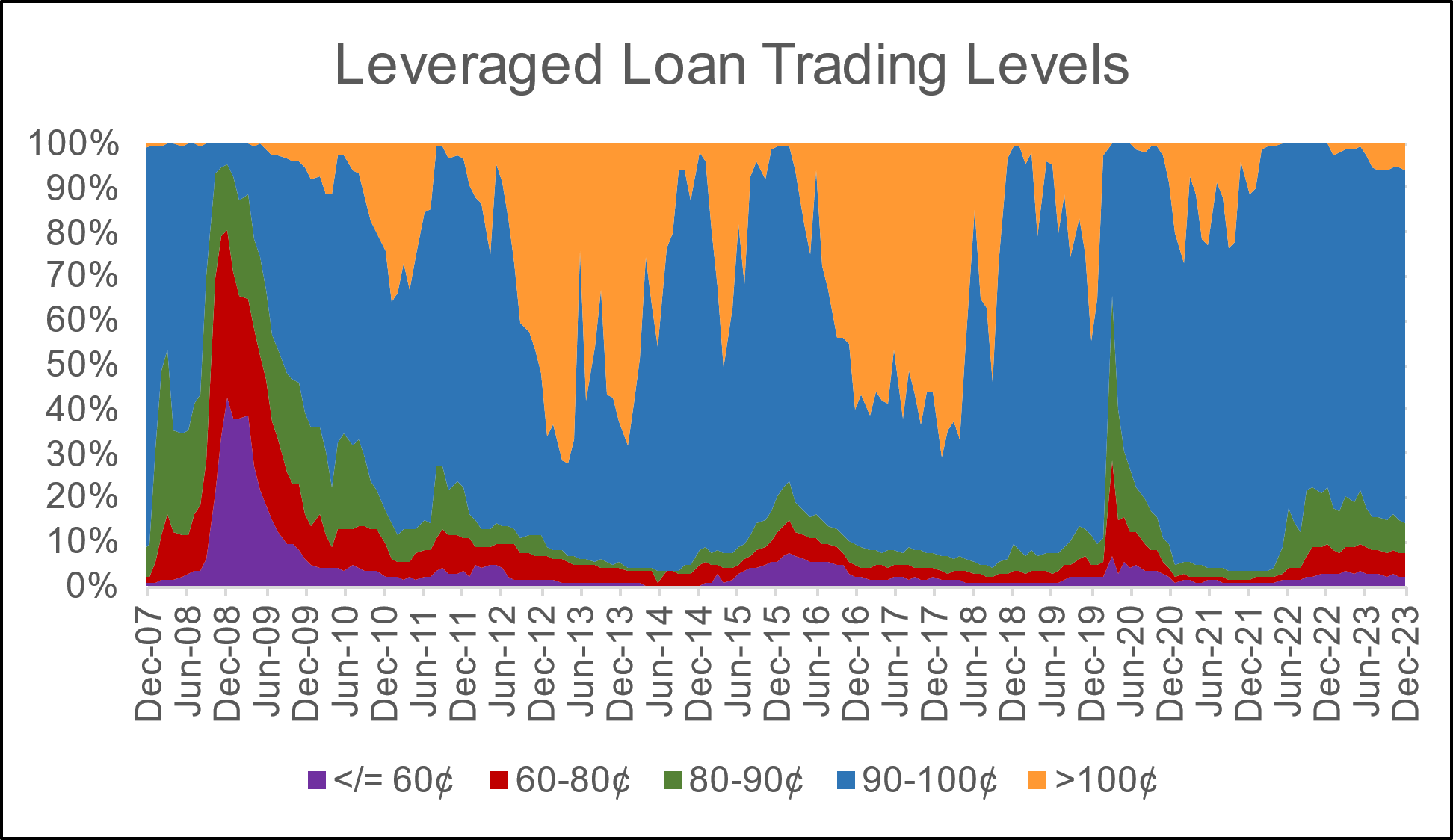

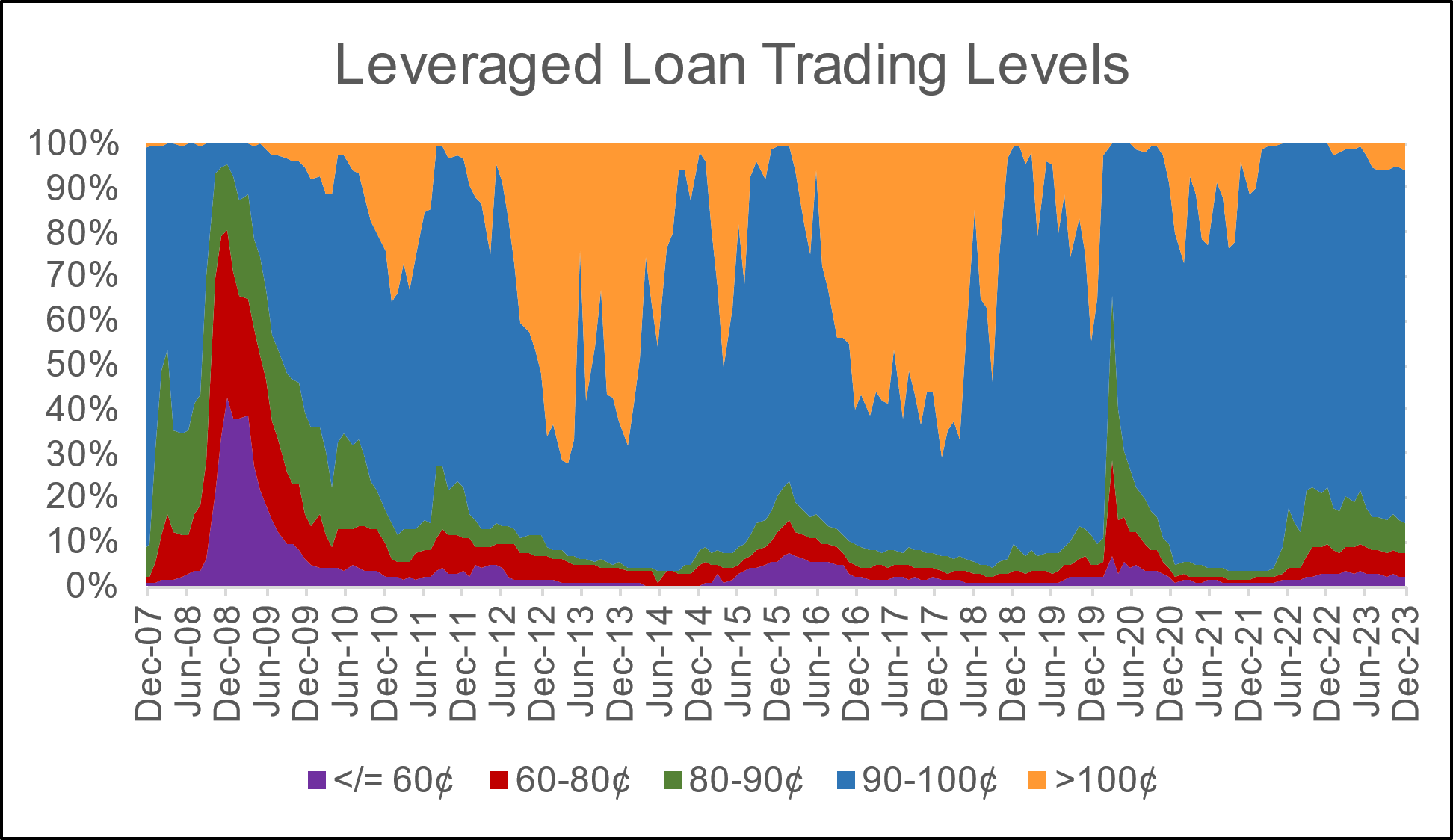

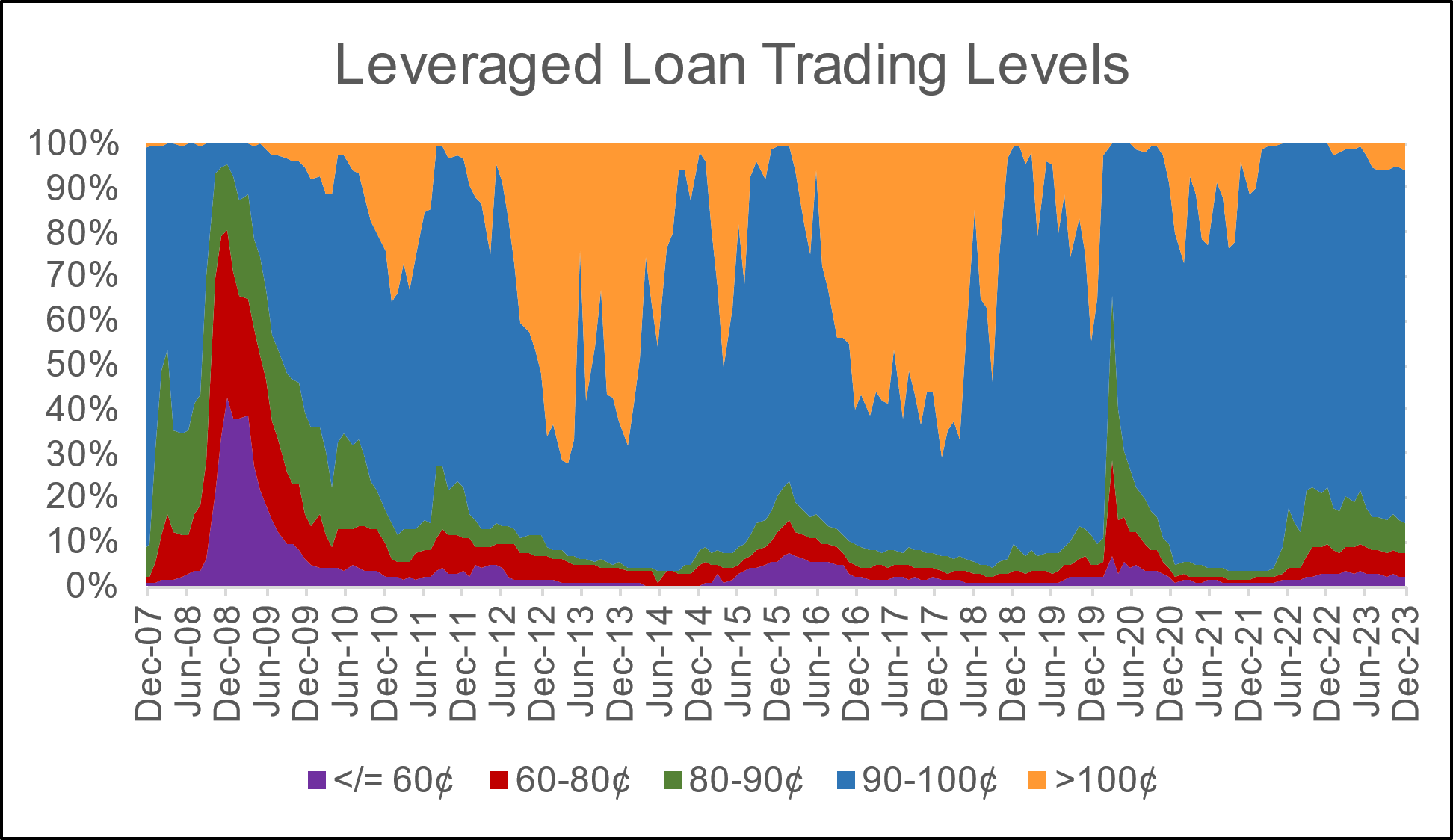

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

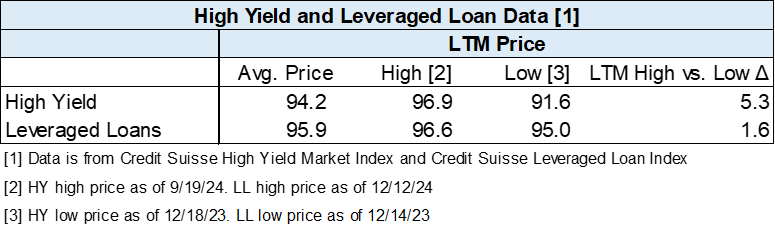

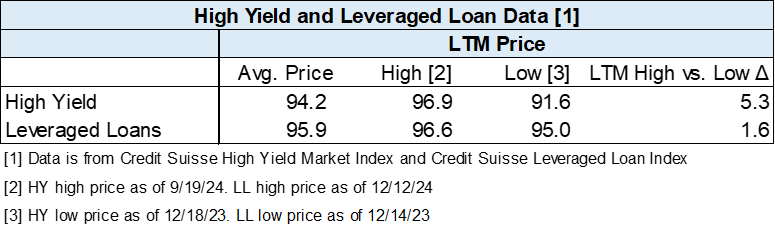

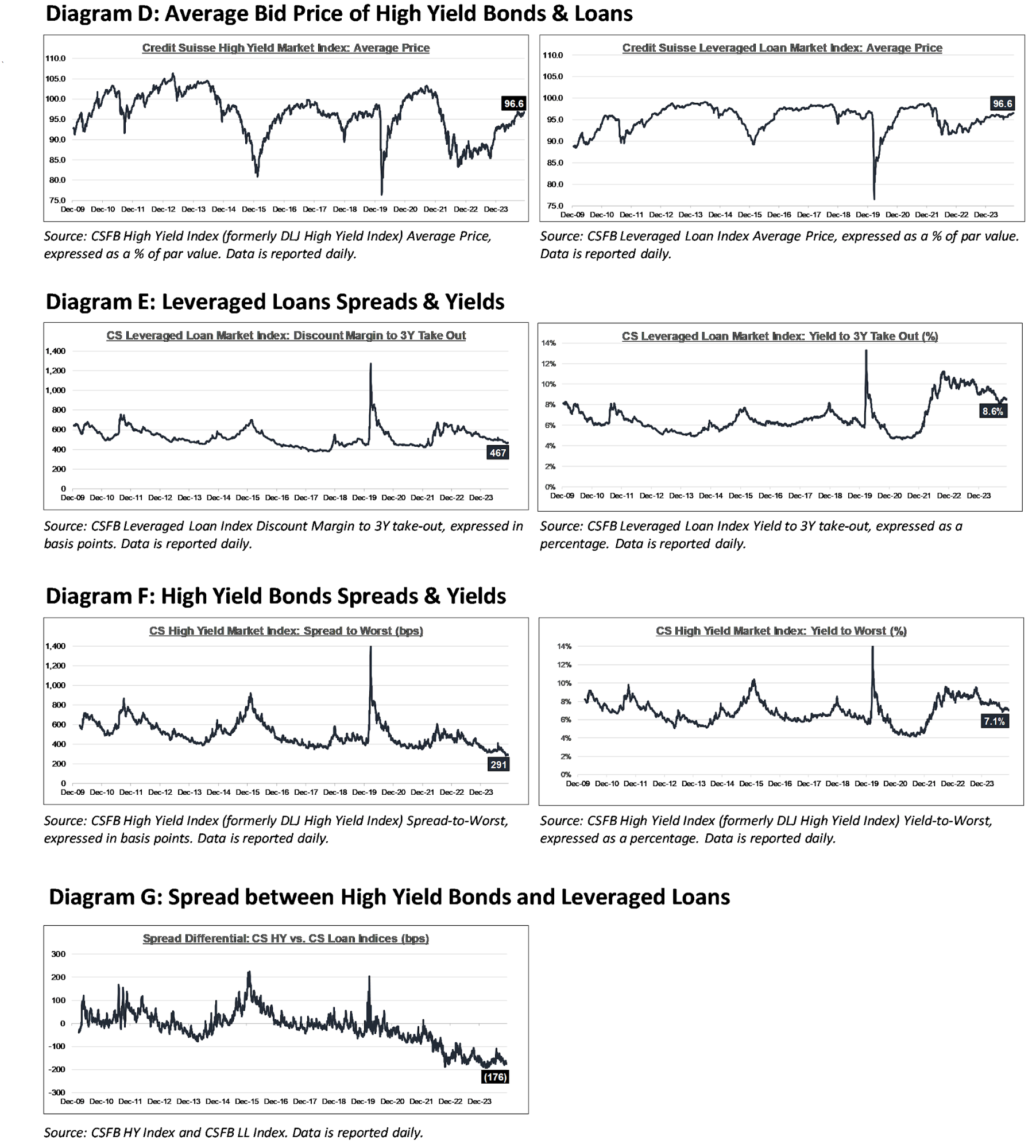

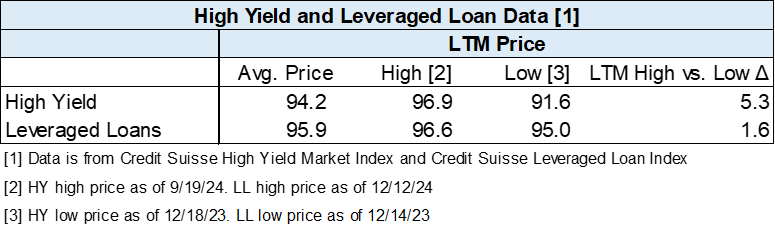

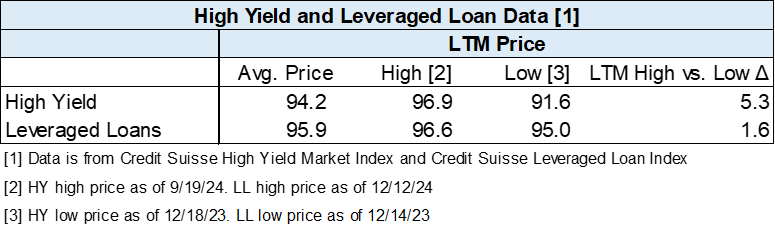

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

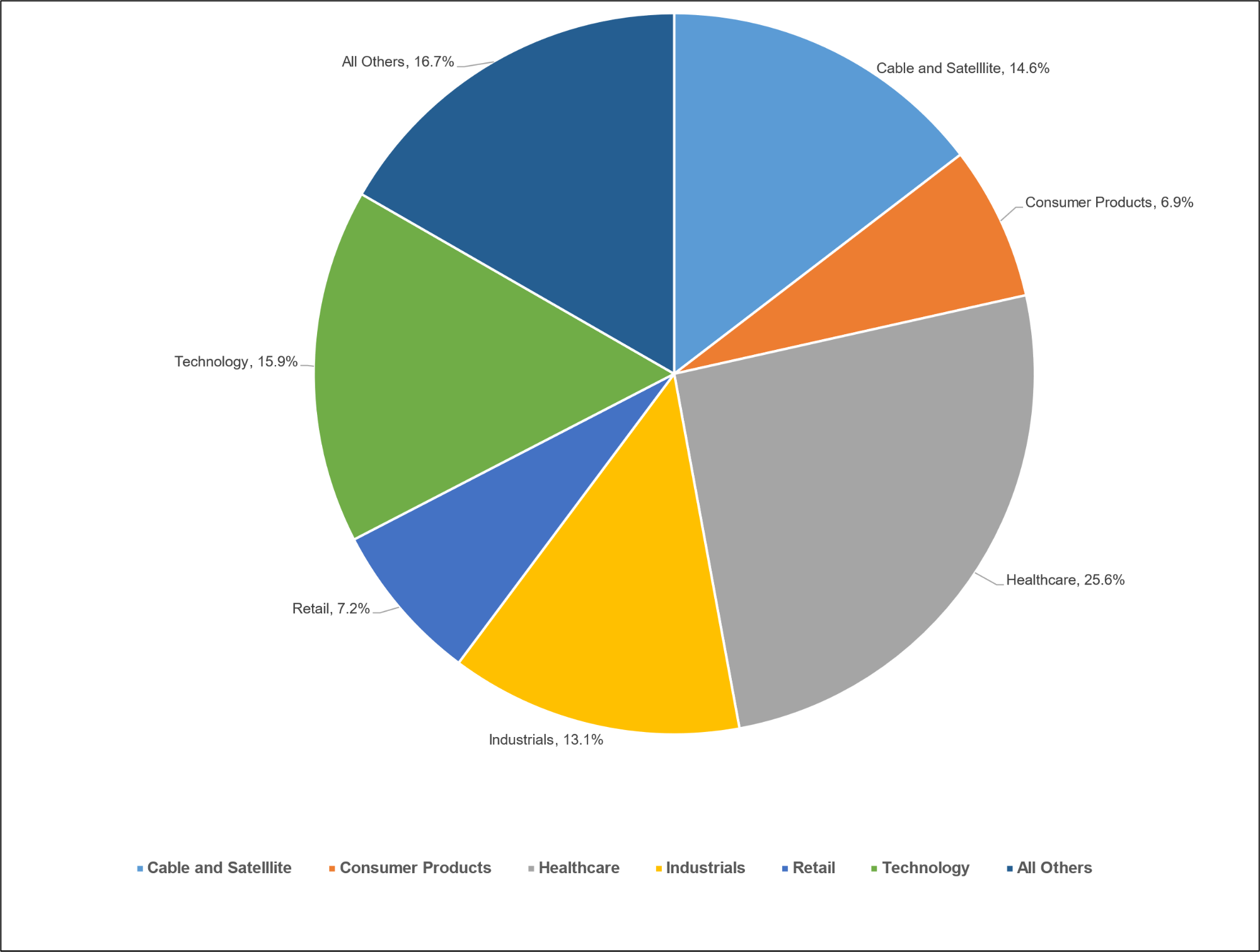

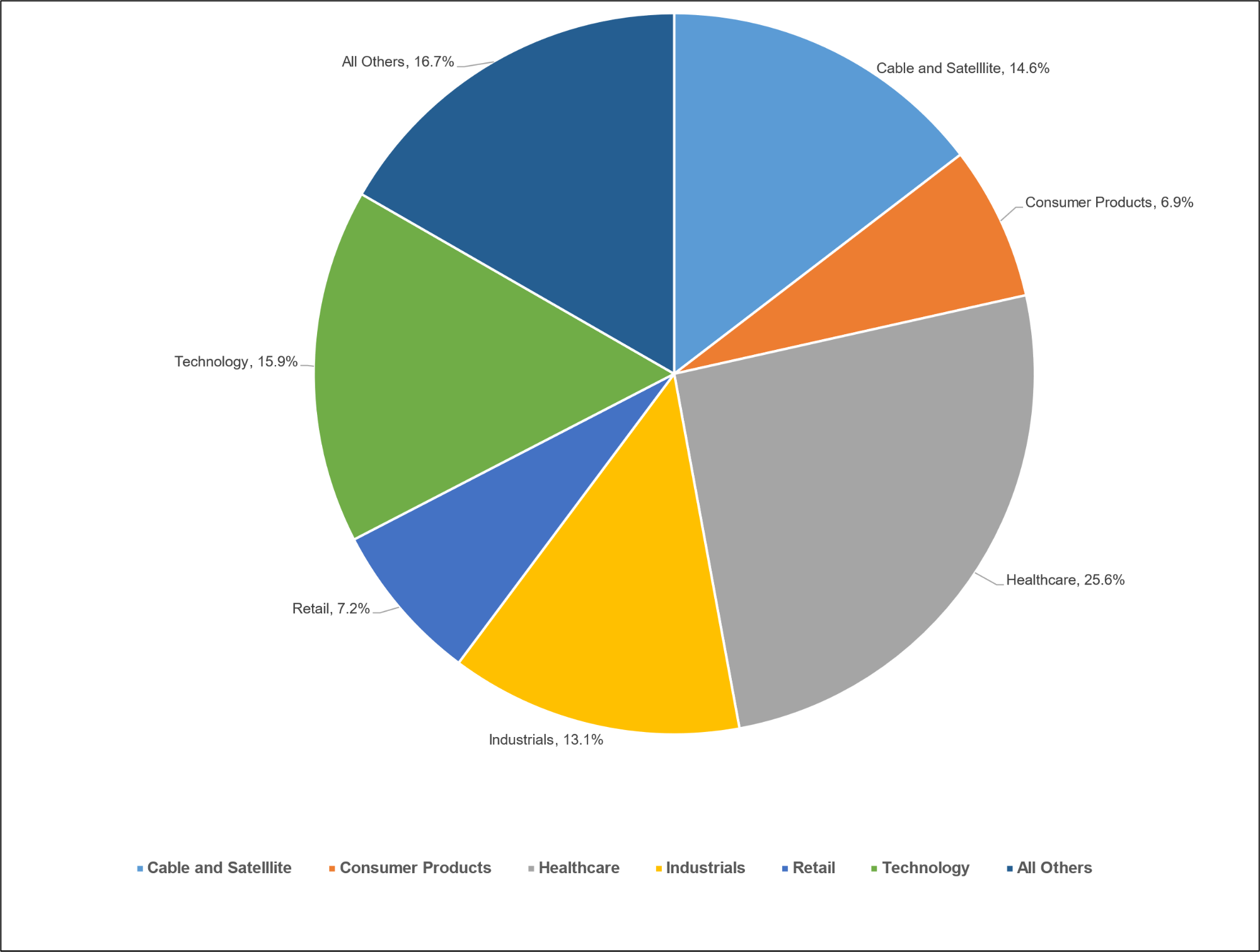

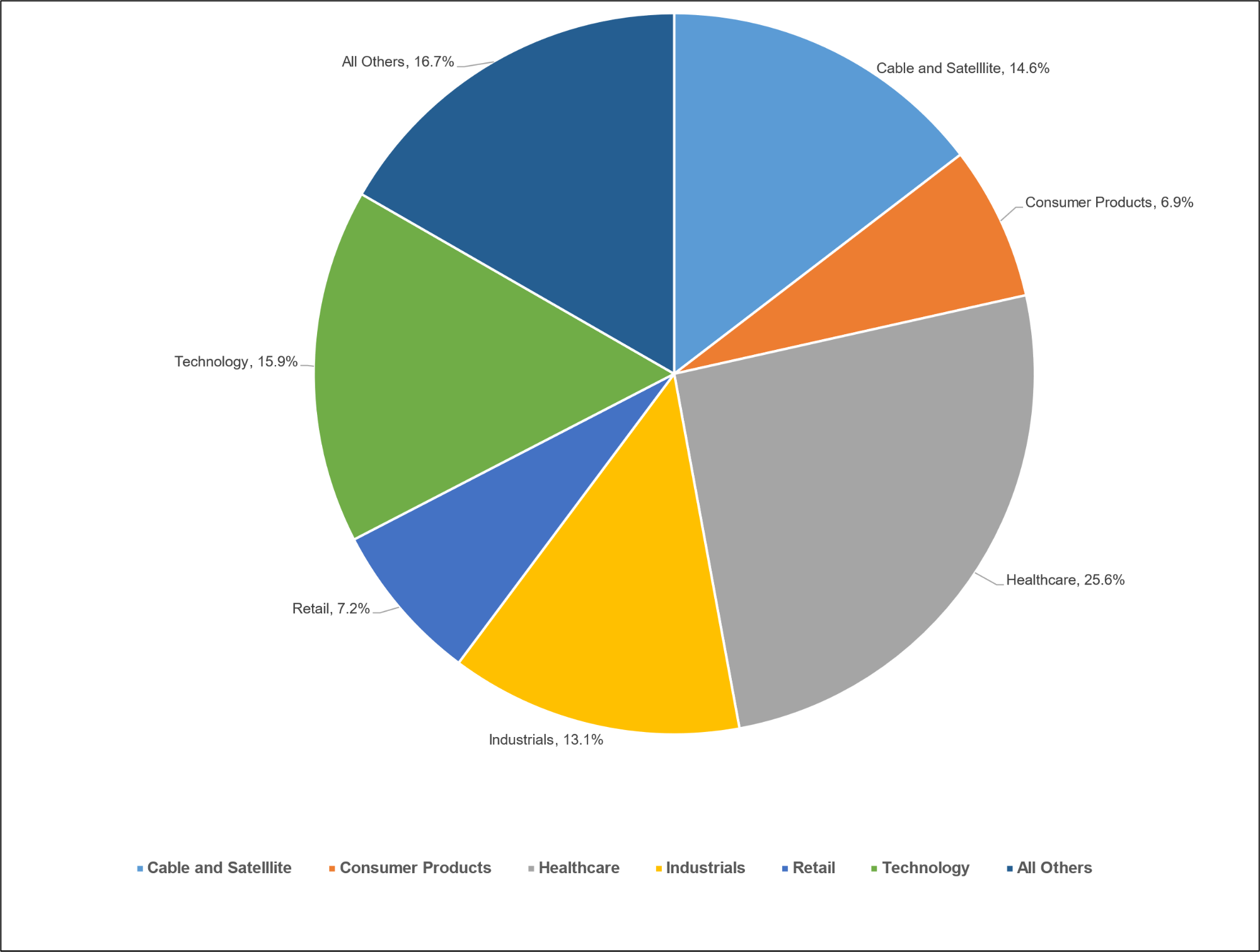

Diagram J: Leveraged Loan Defaults by Sector – Full Year

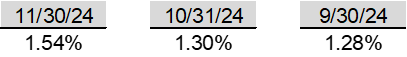

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

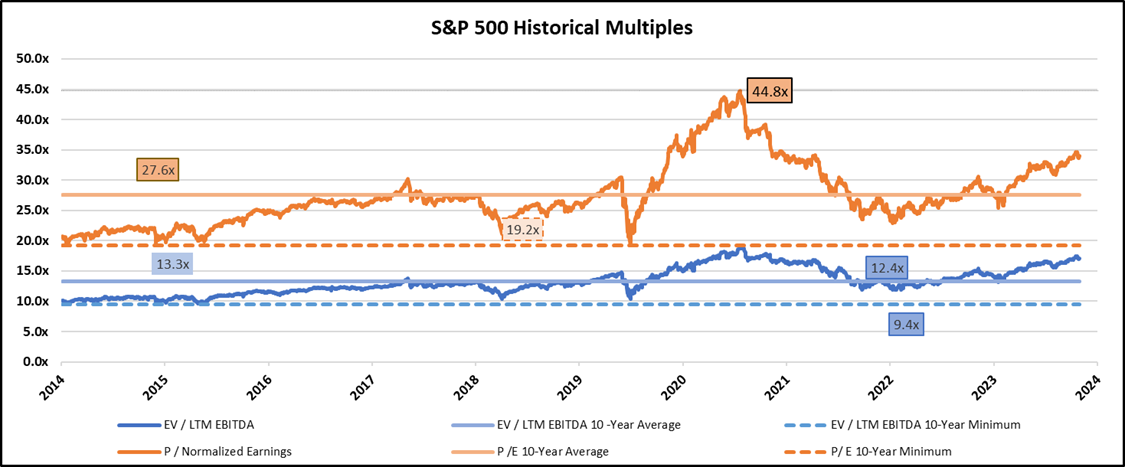

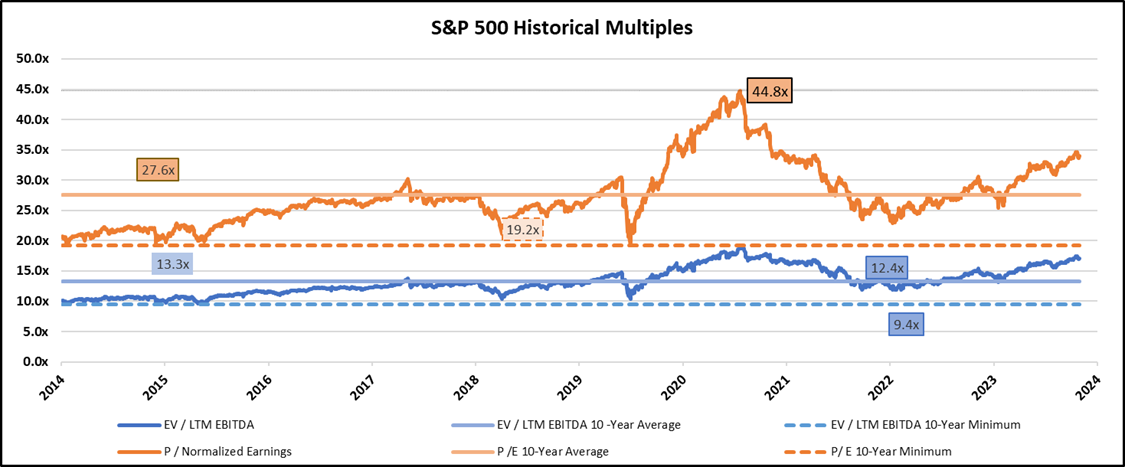

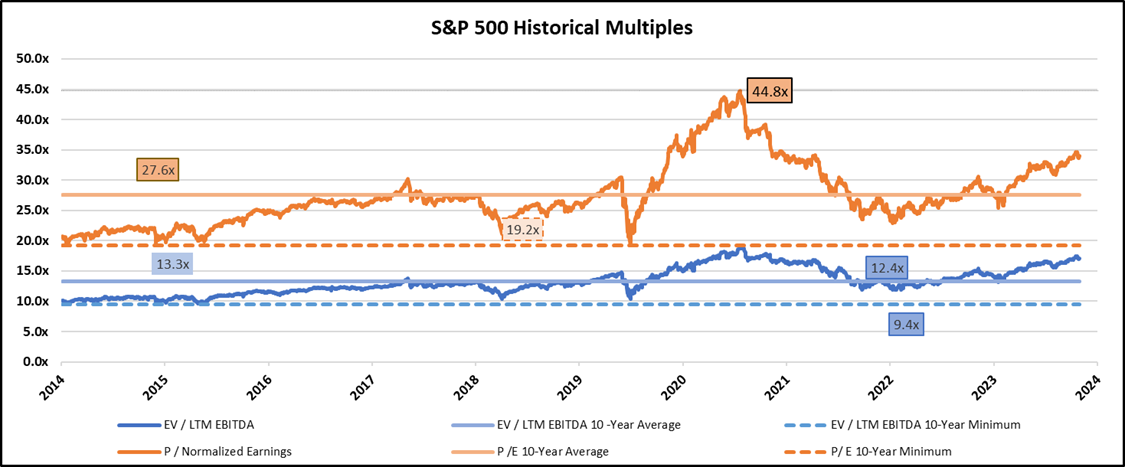

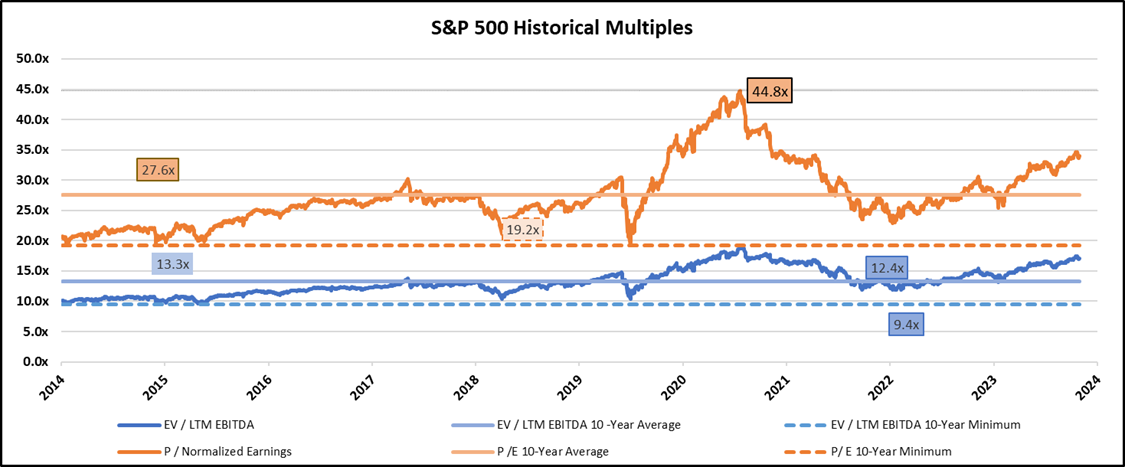

Diagram O: S&P 500 Historical Multiples

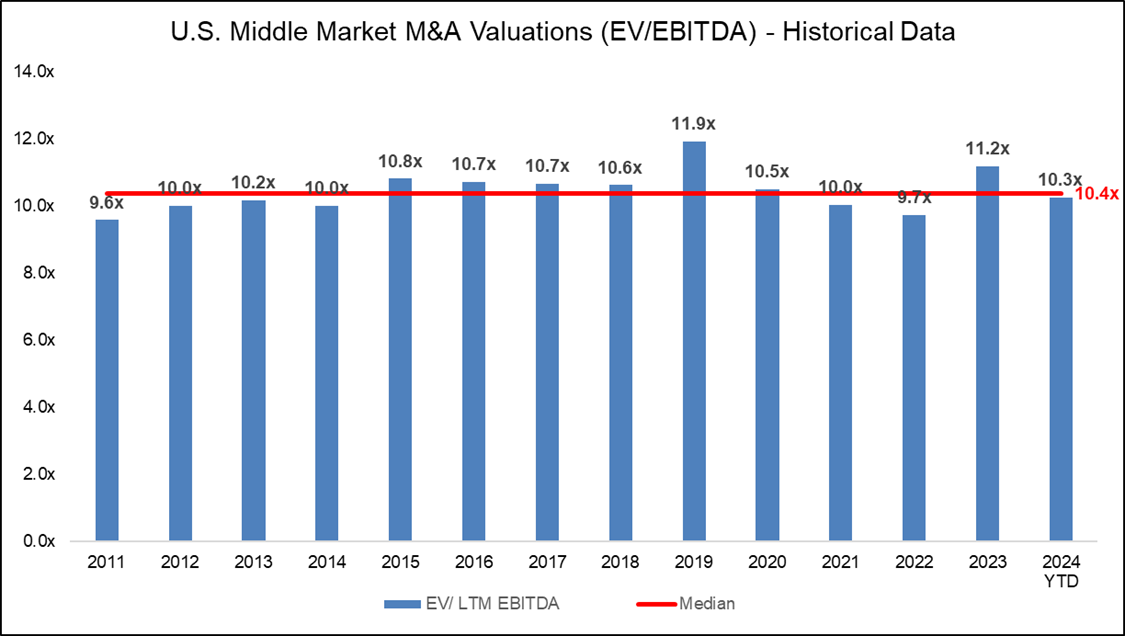

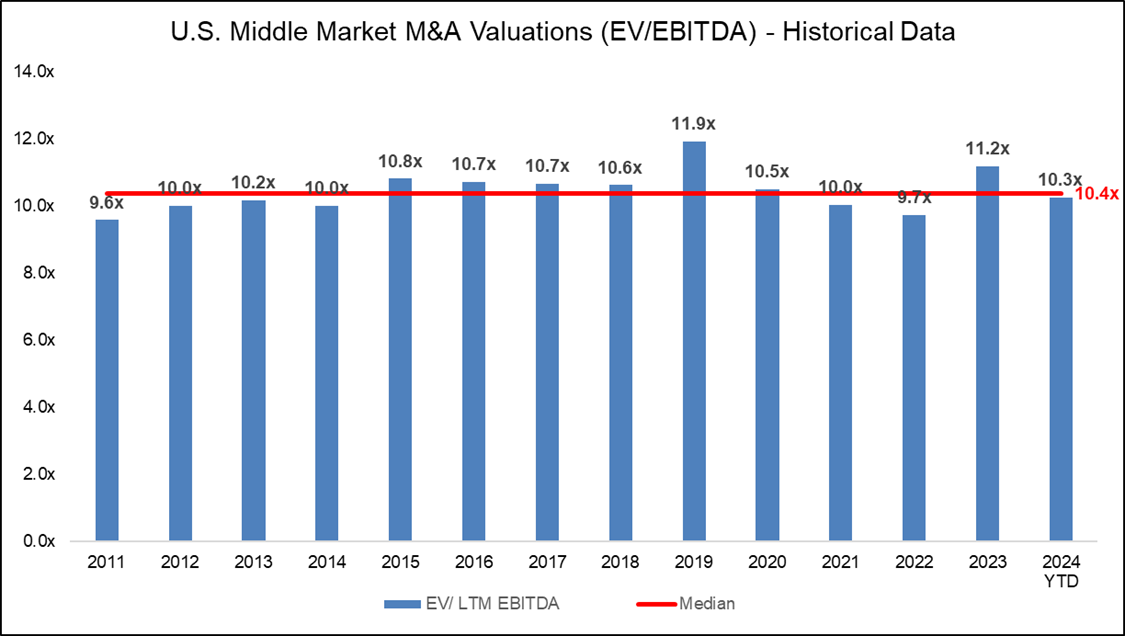

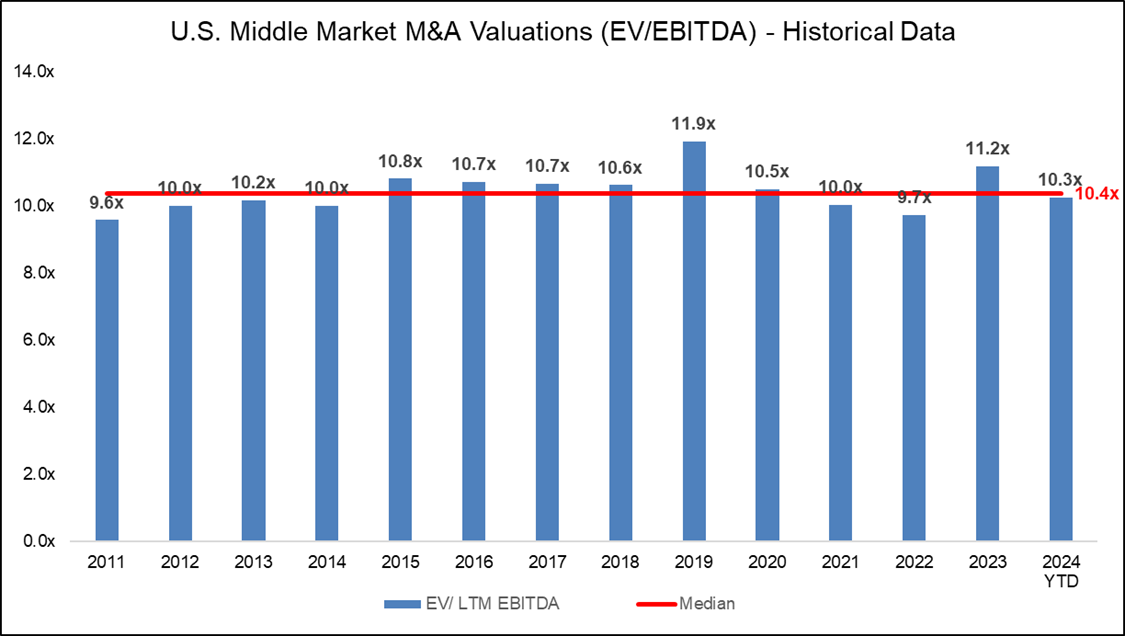

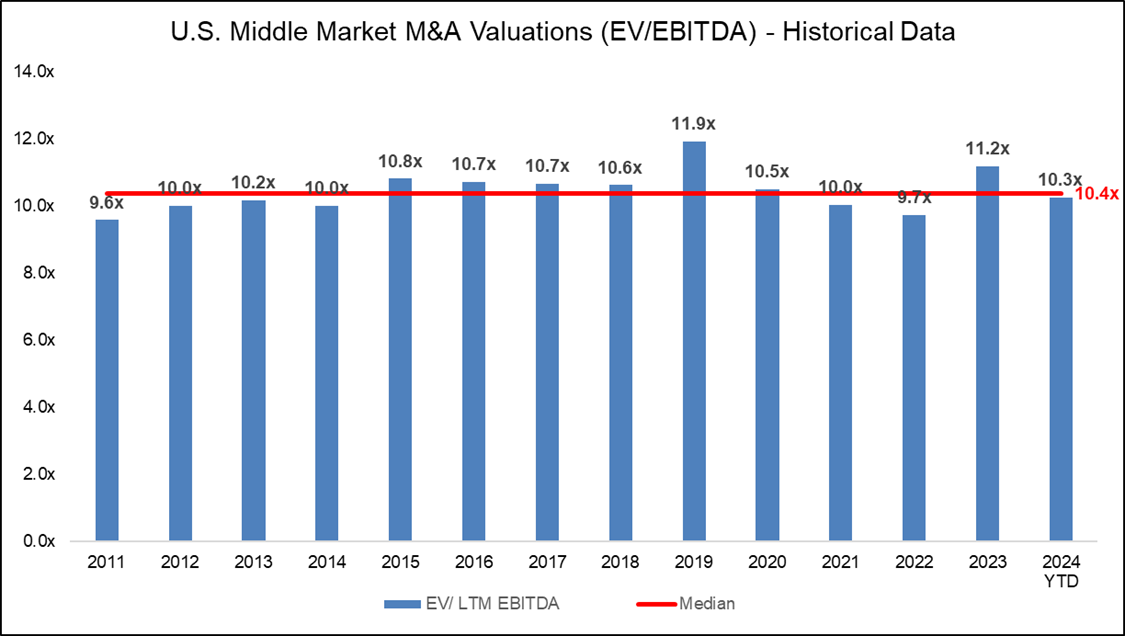

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

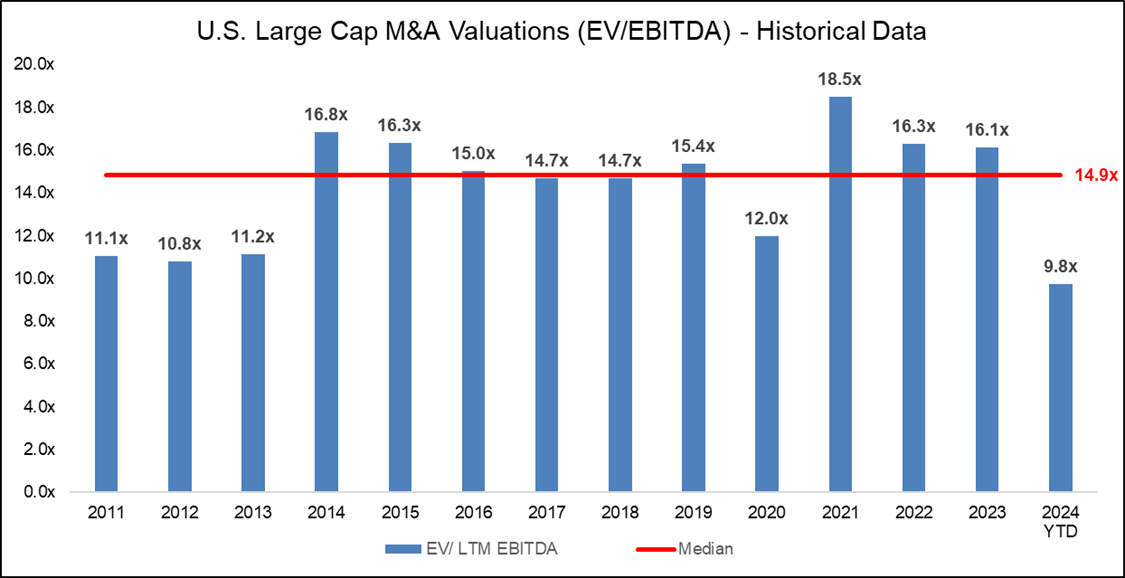

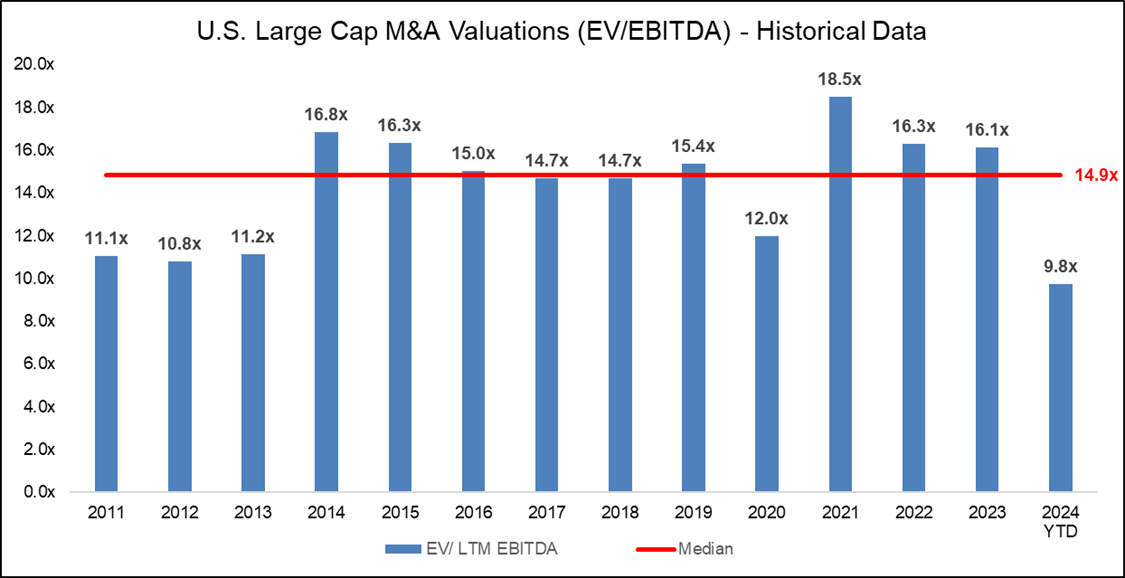

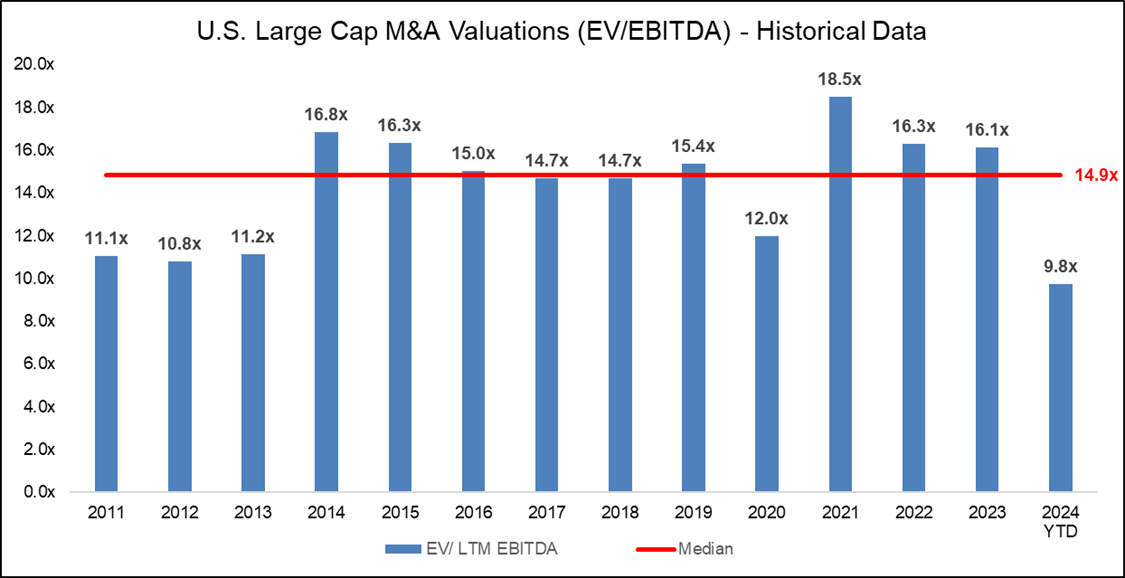

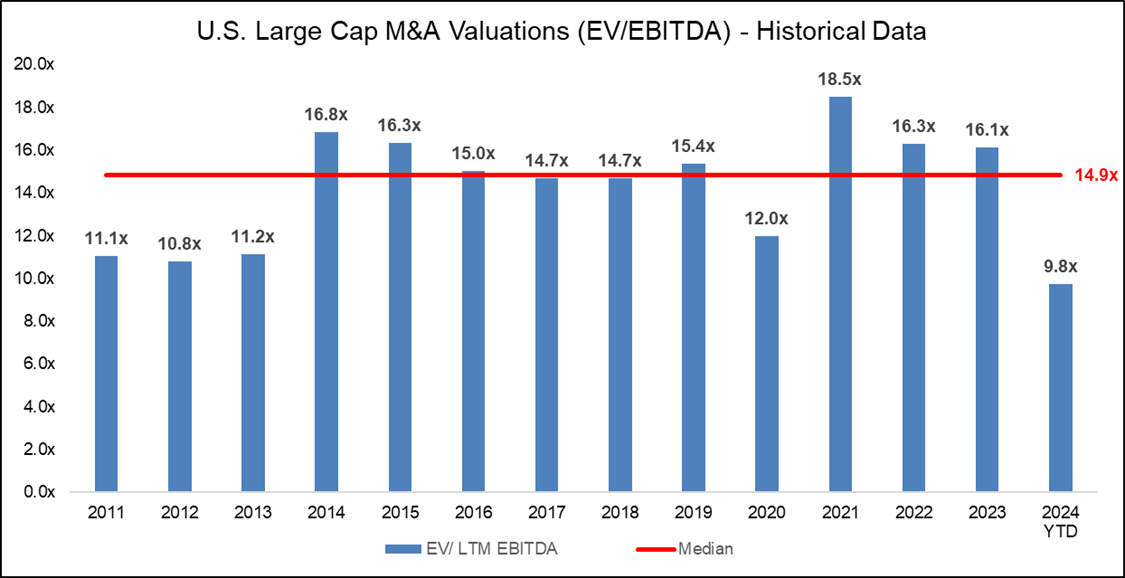

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

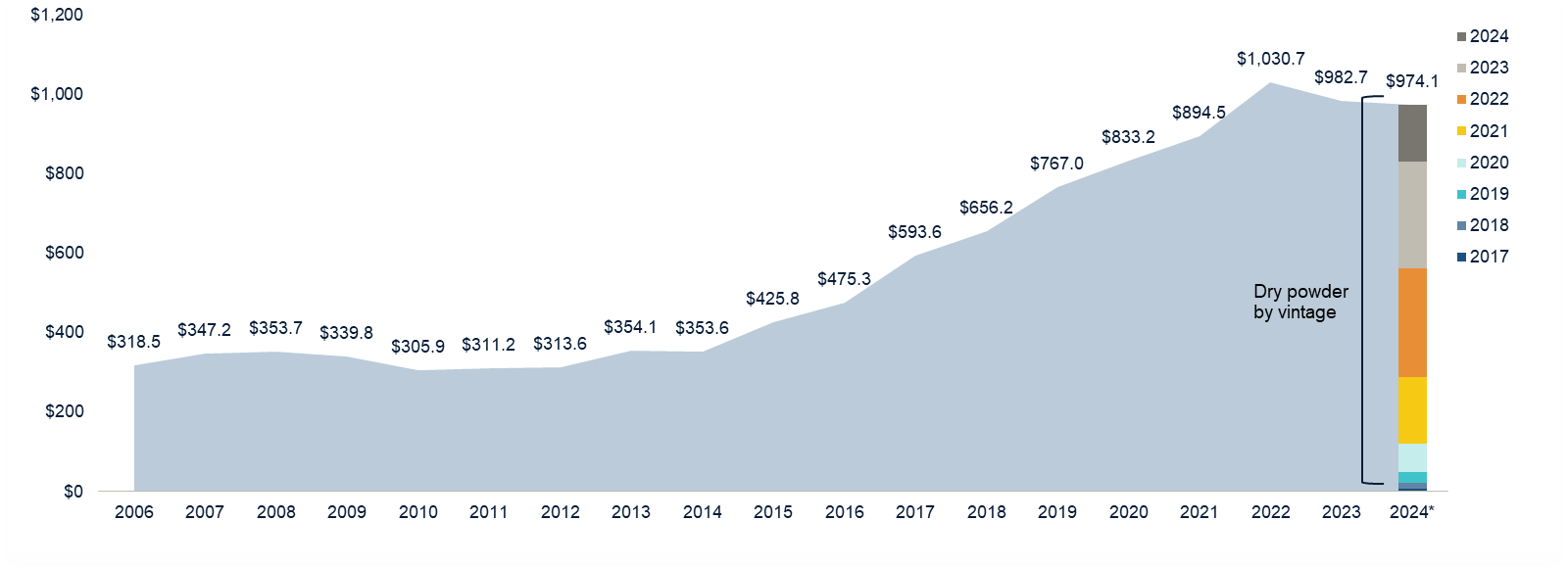

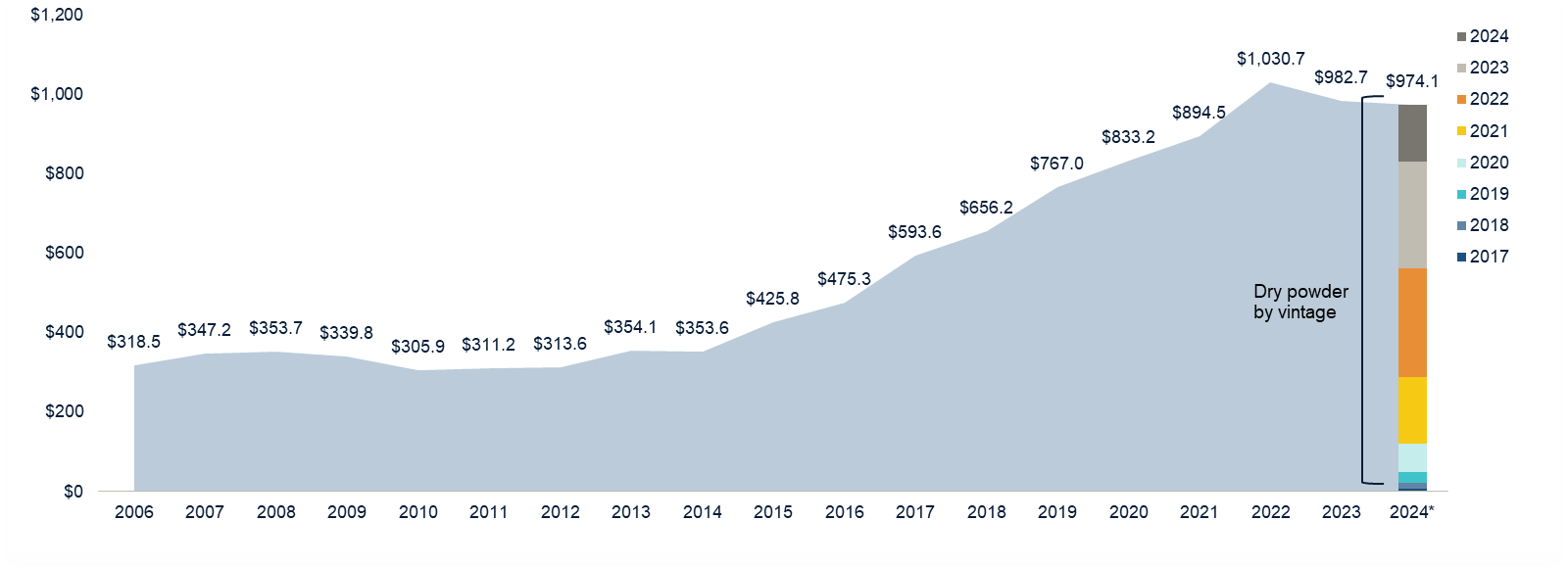

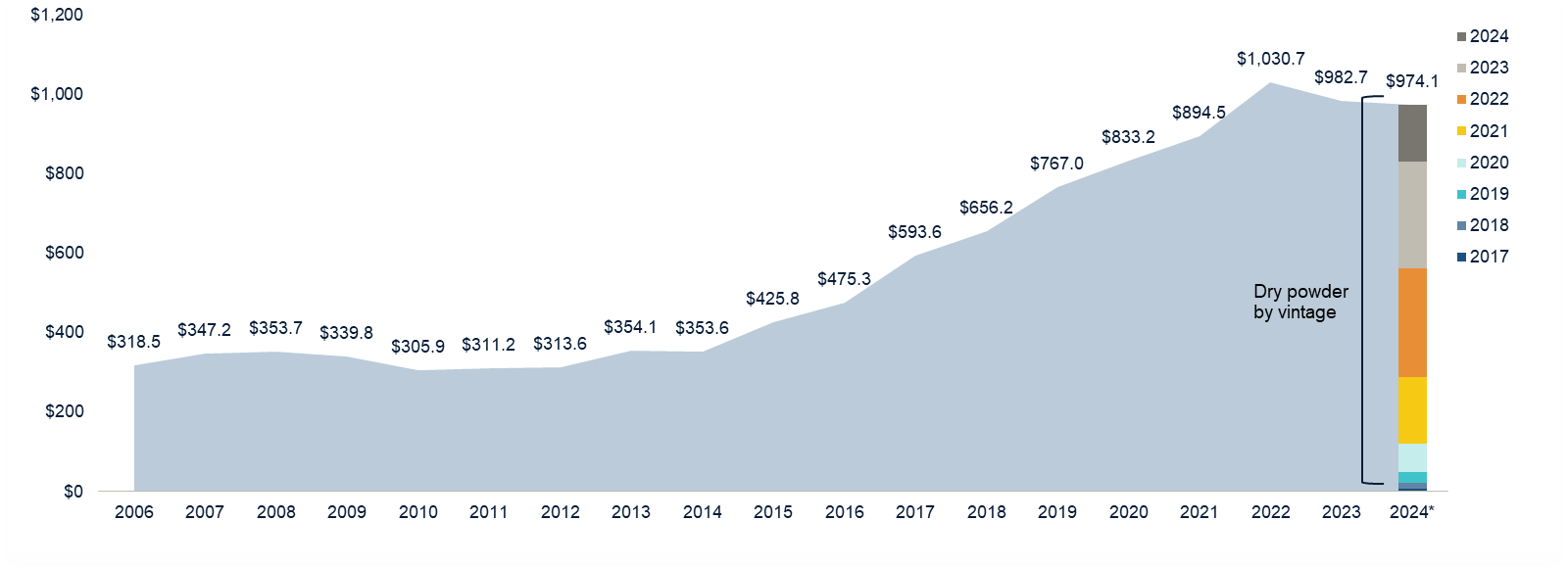

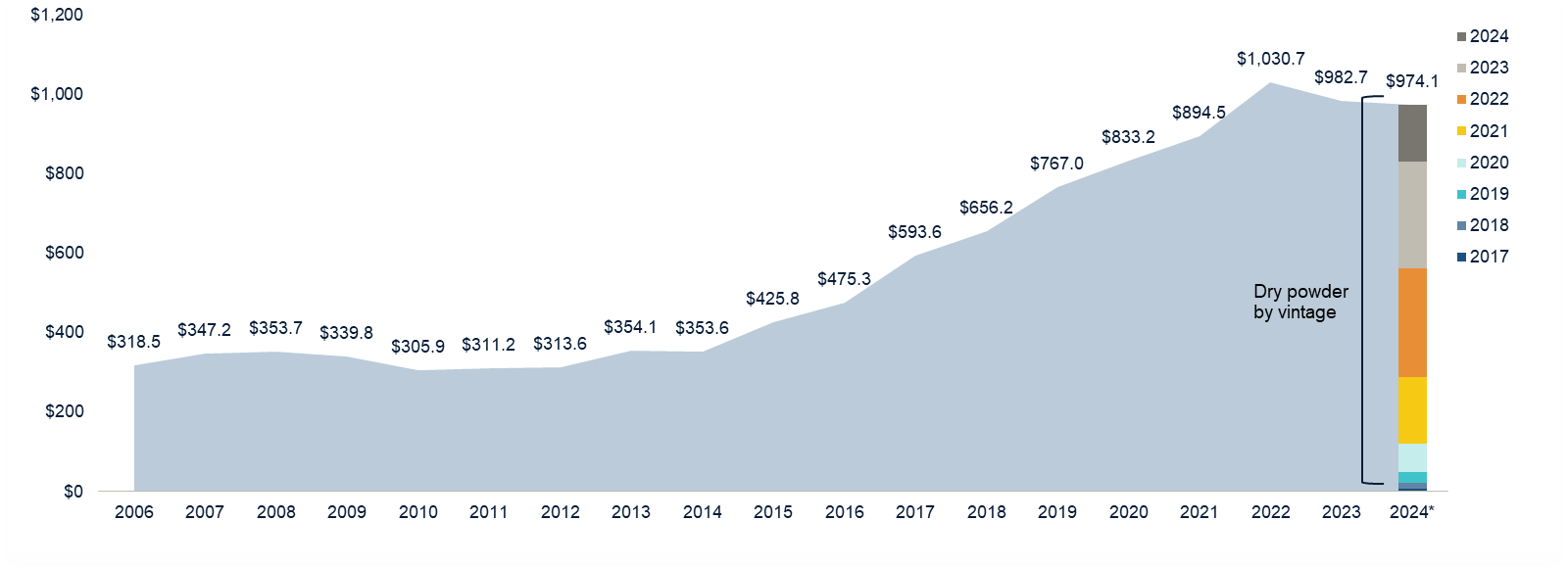

Diagram R: Dry Powder for All Private Equity Buyouts

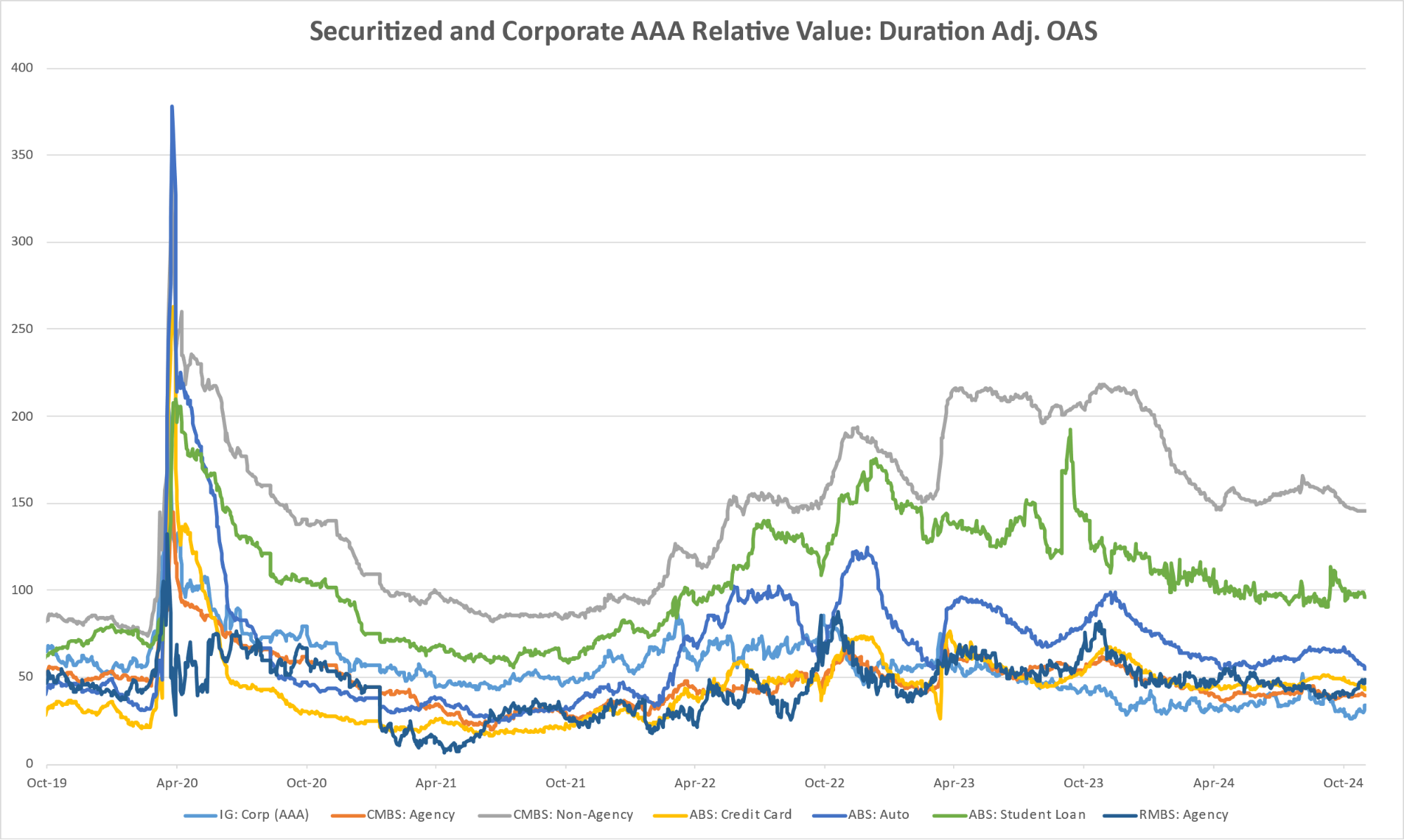

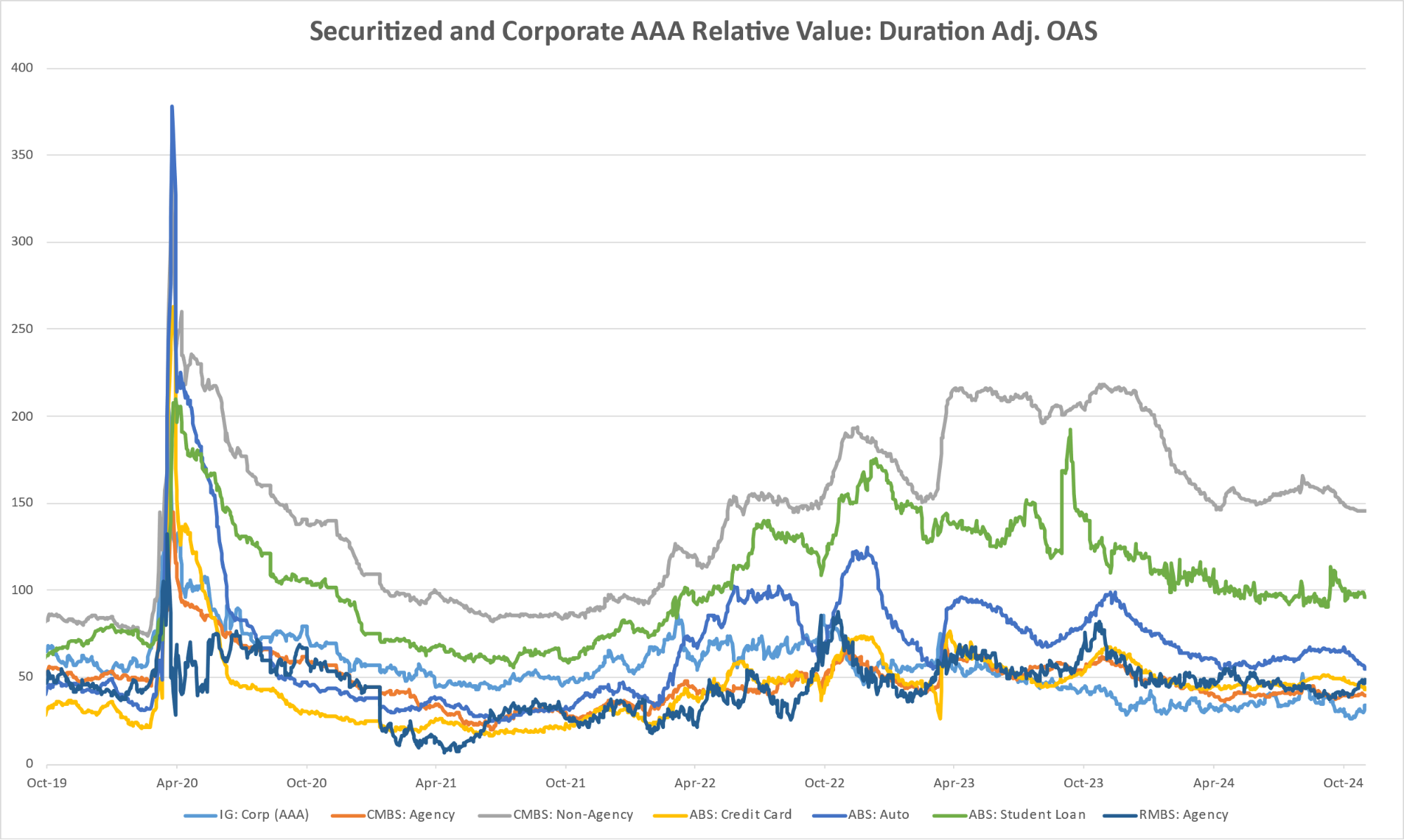

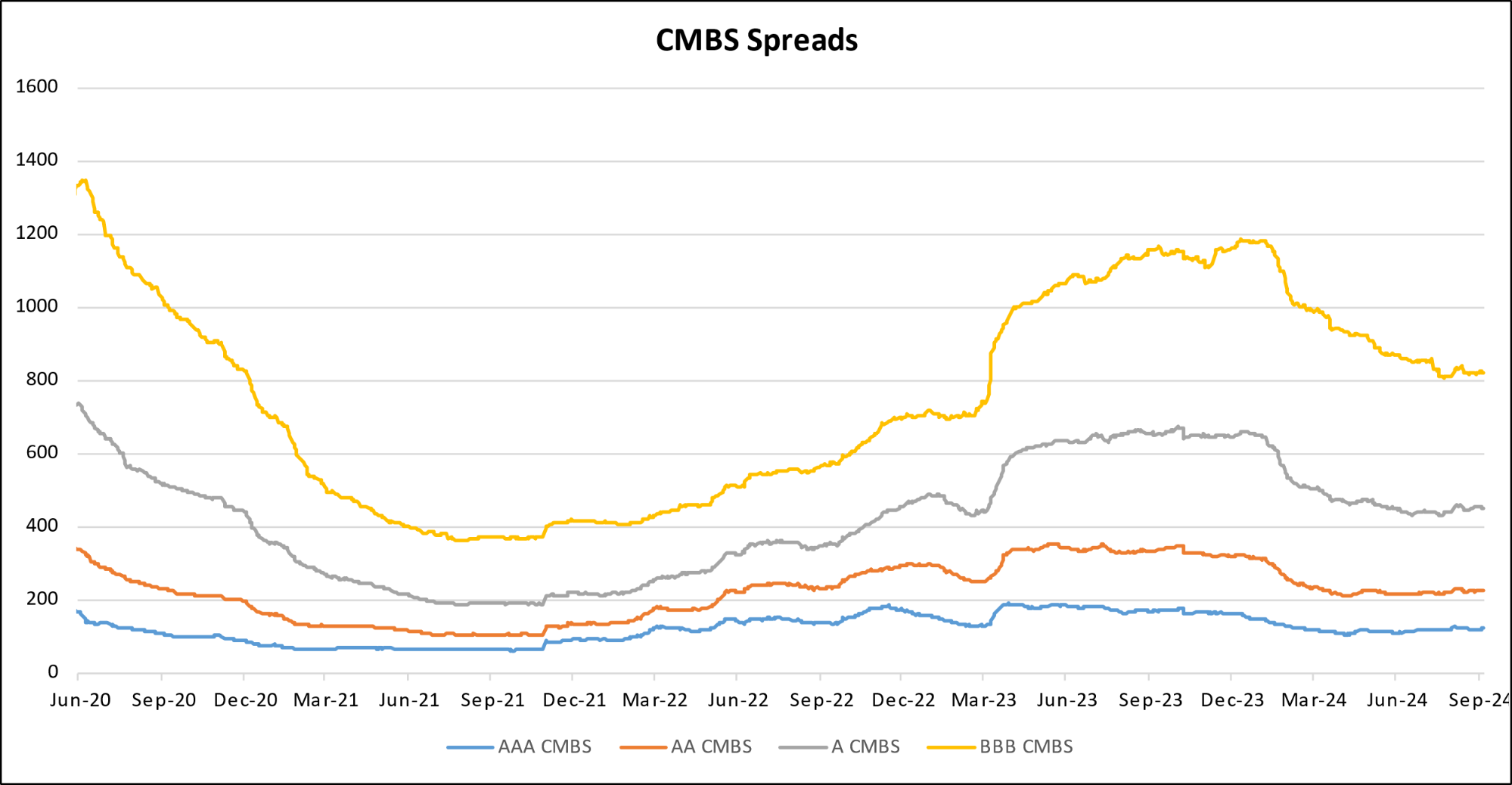

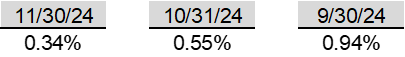

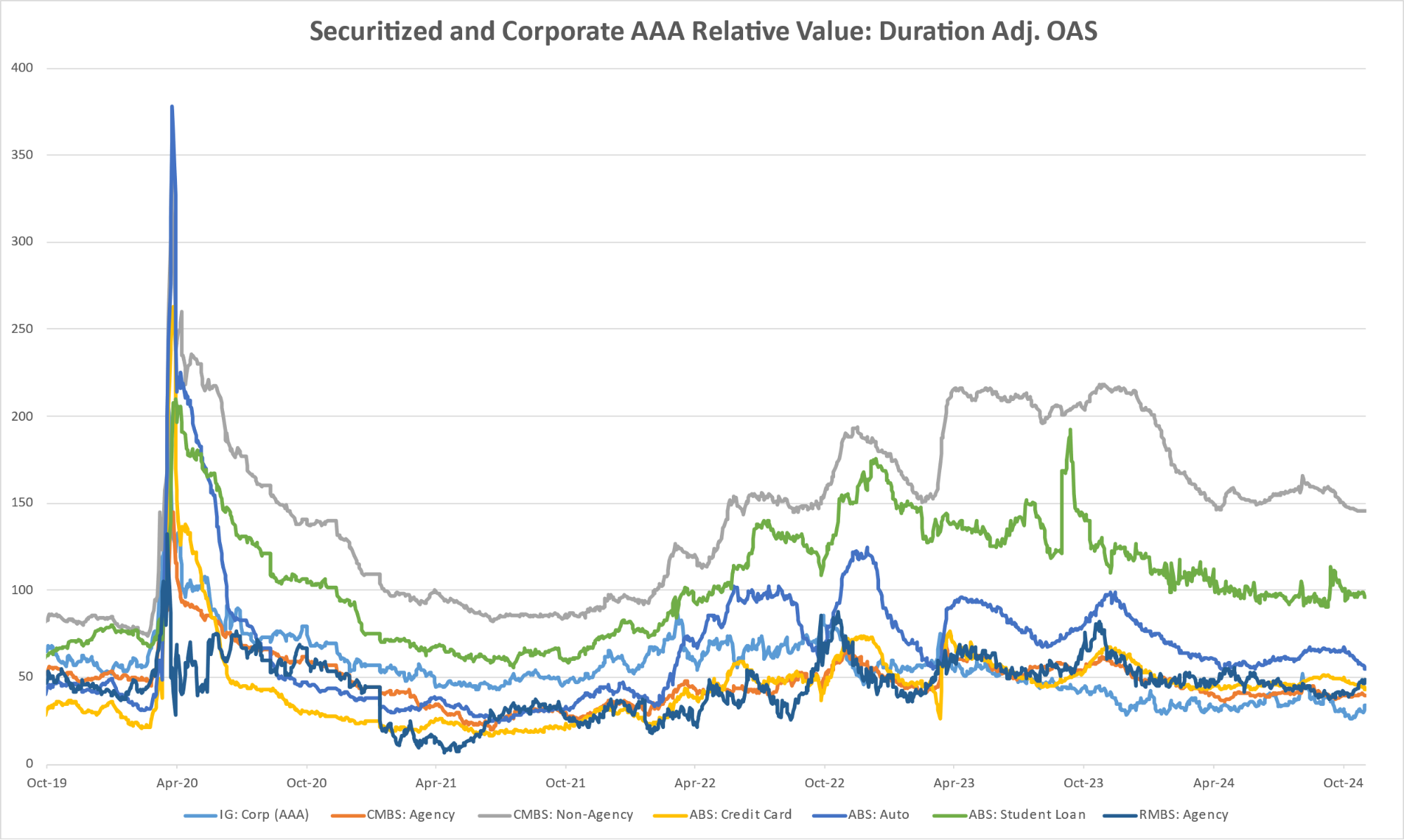

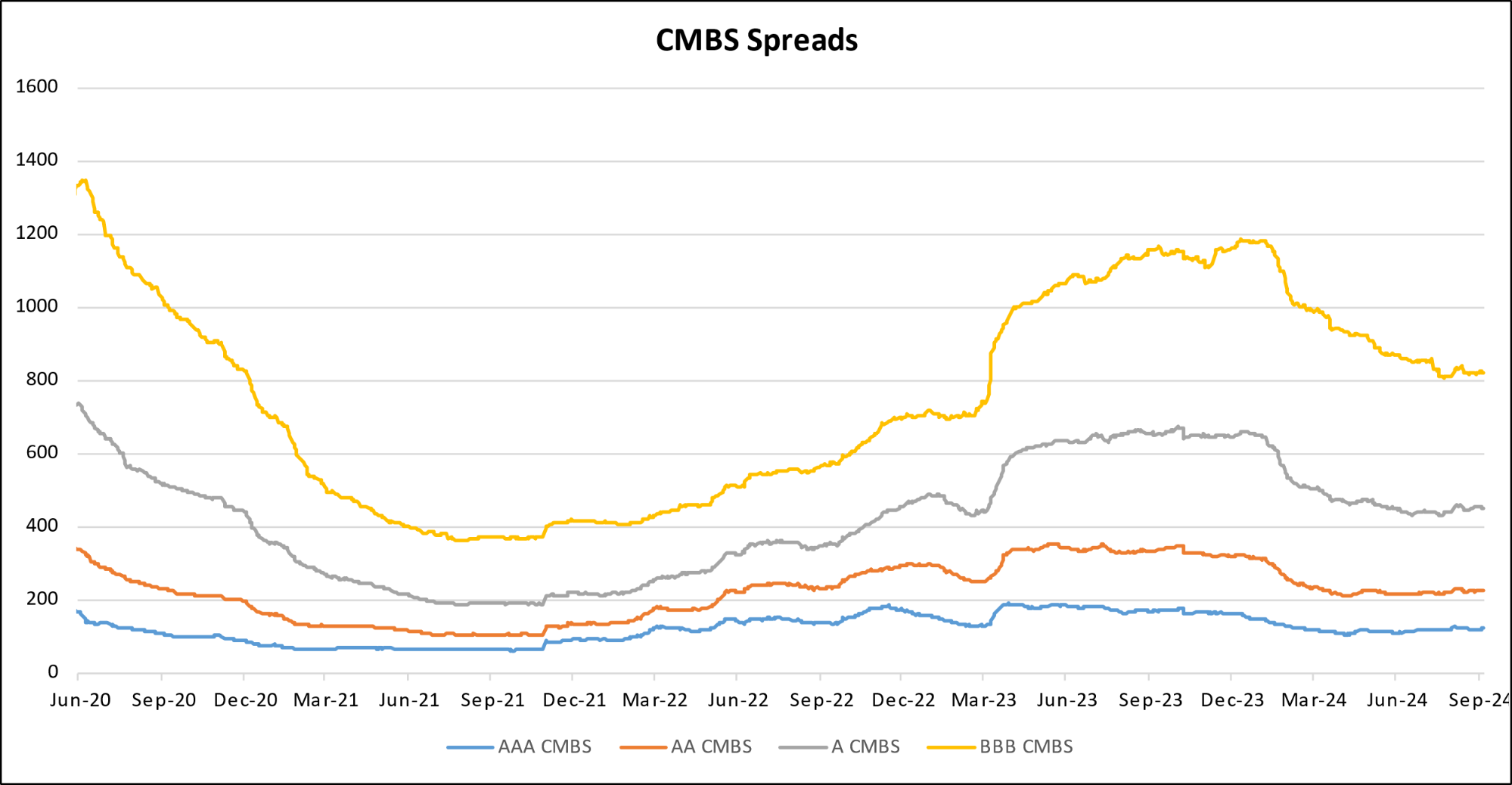

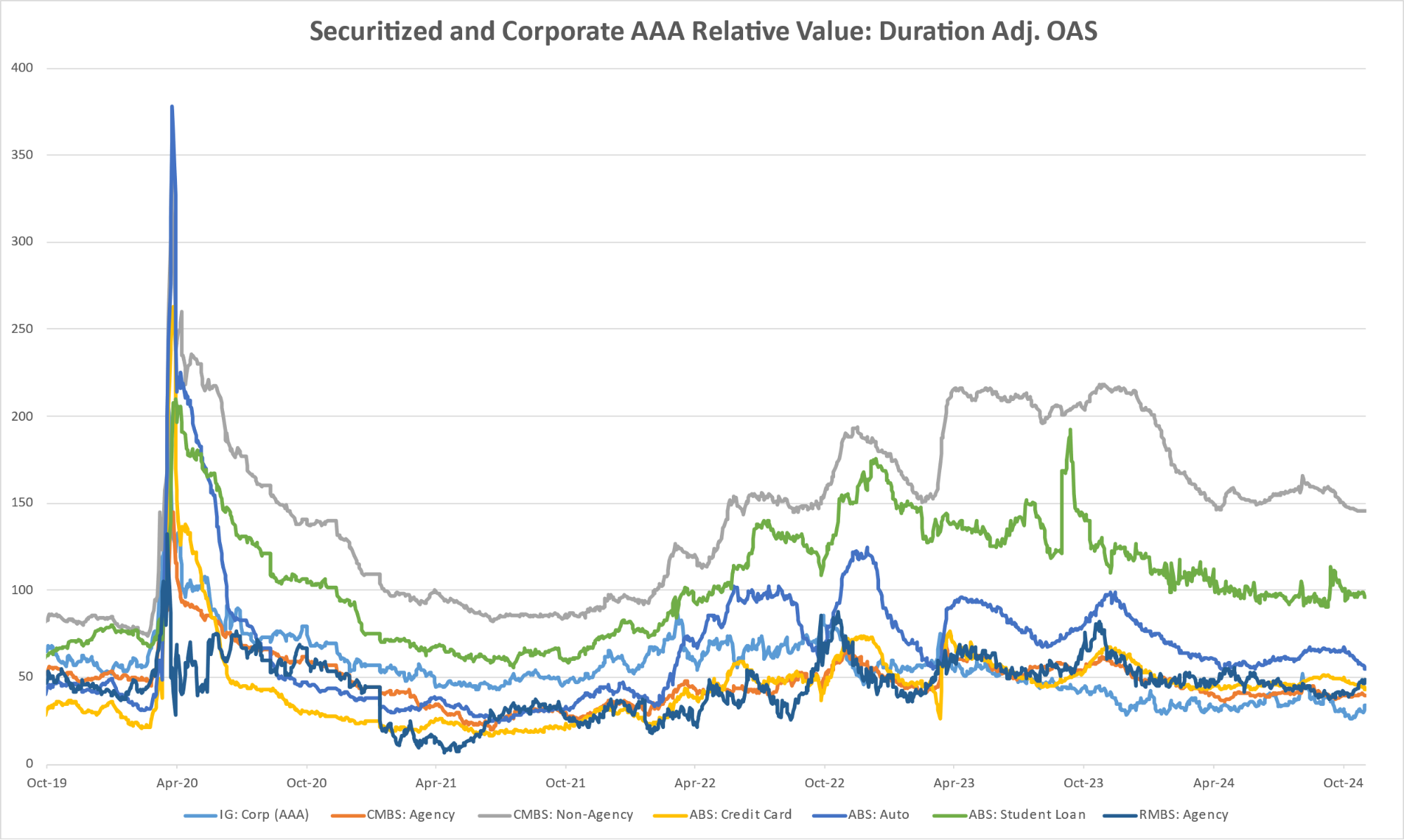

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

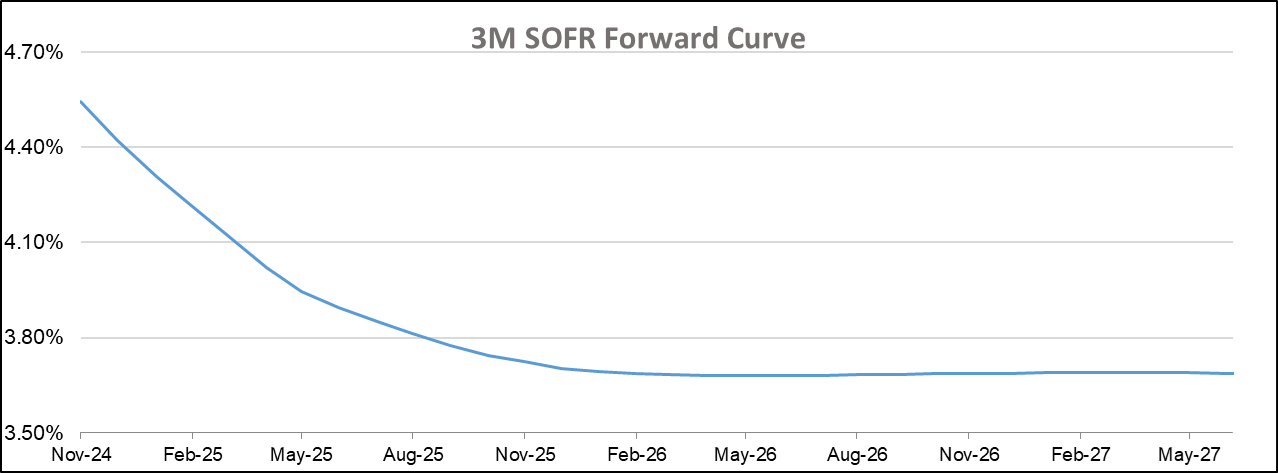

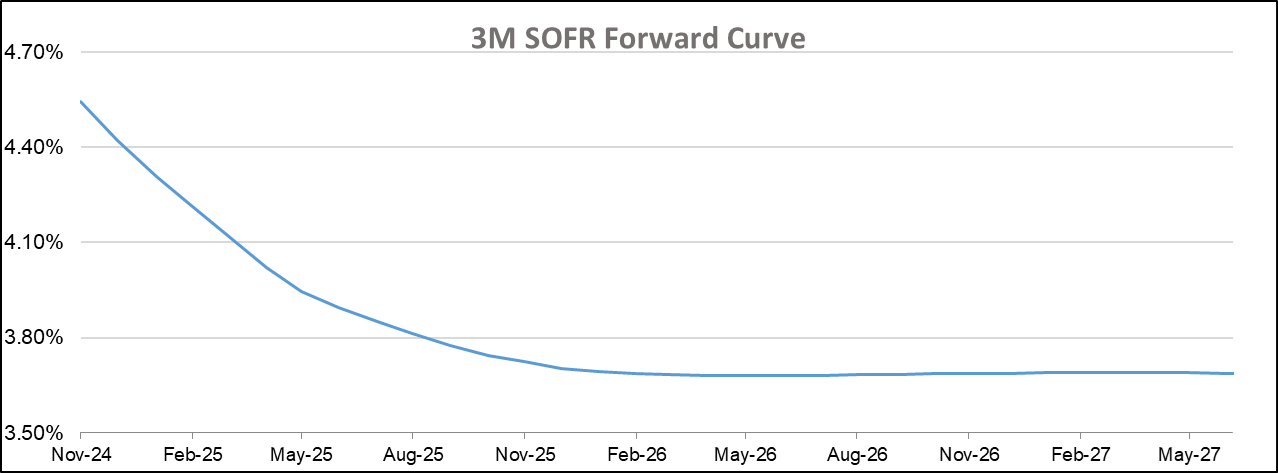

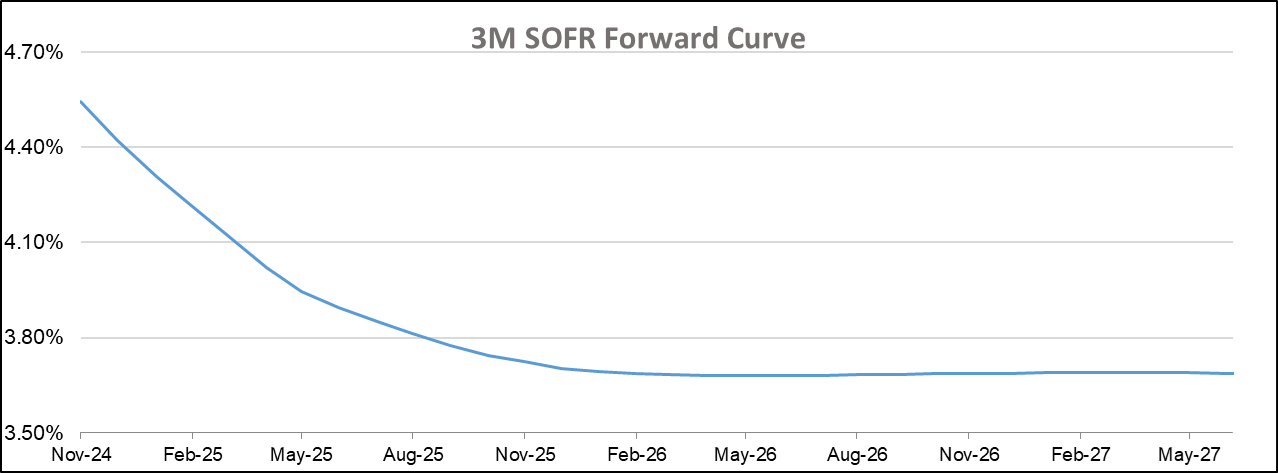

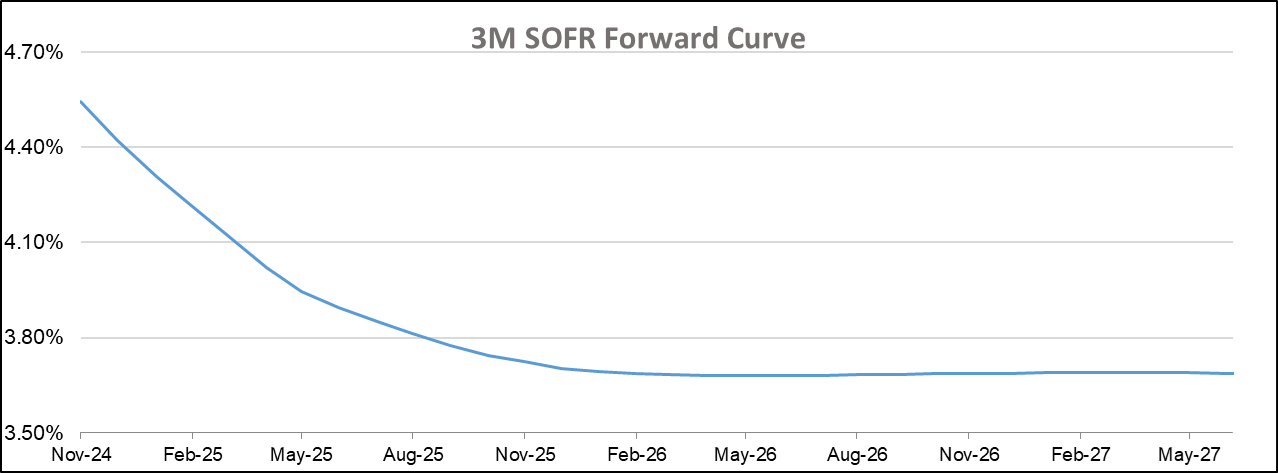

Diagram U: SOFR CURVE

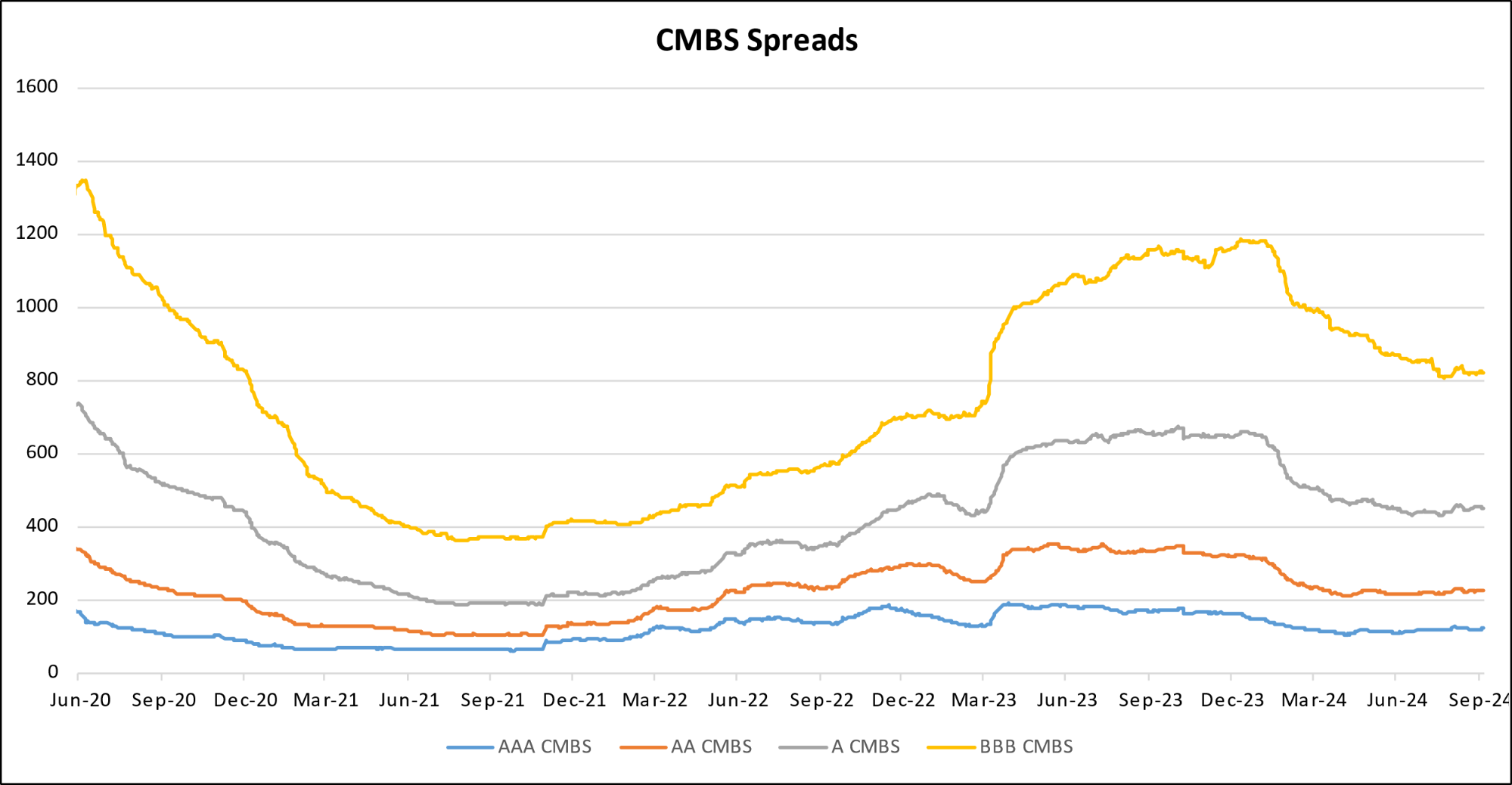

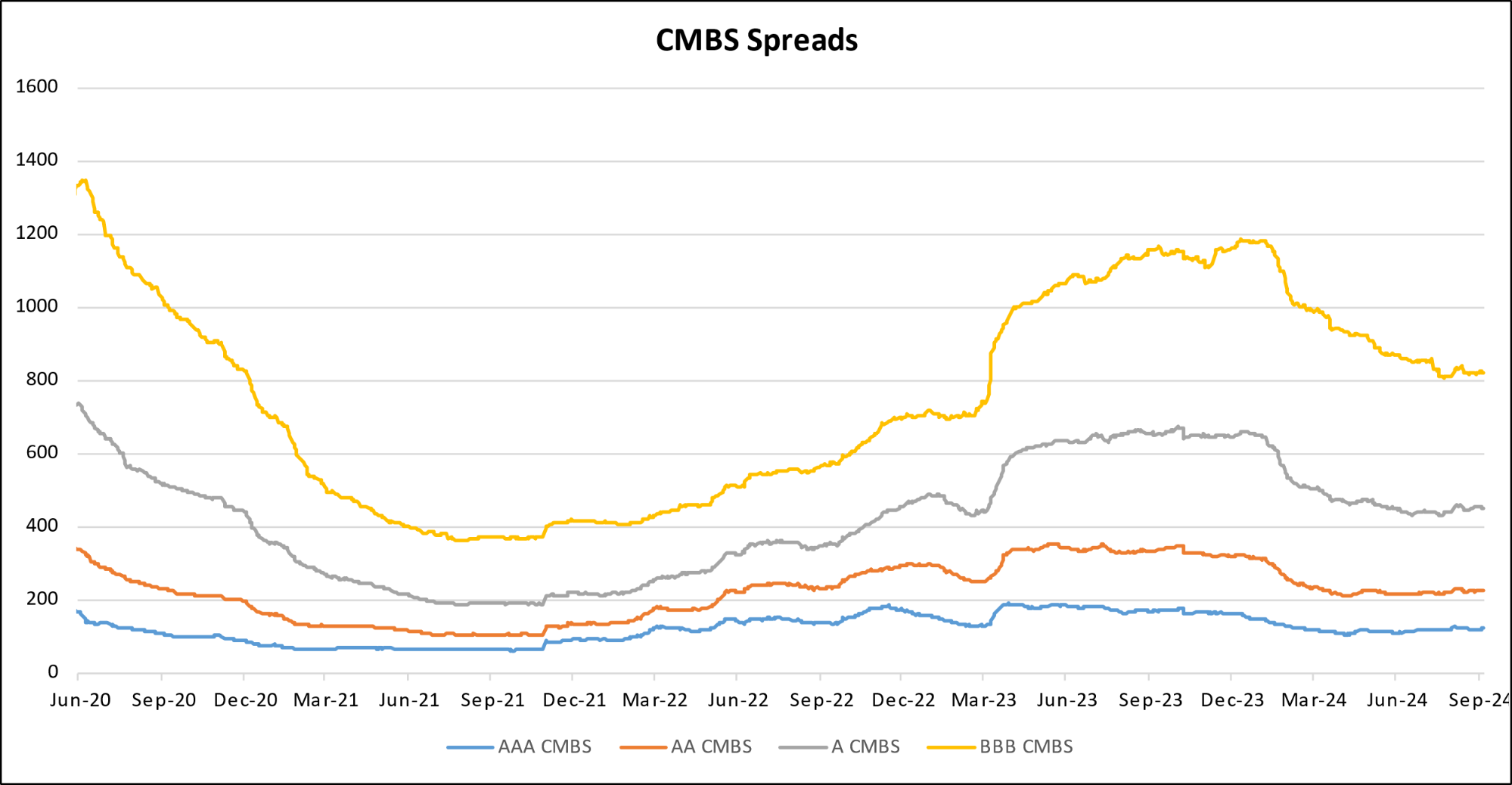

Diagram V: CMBS Spreads

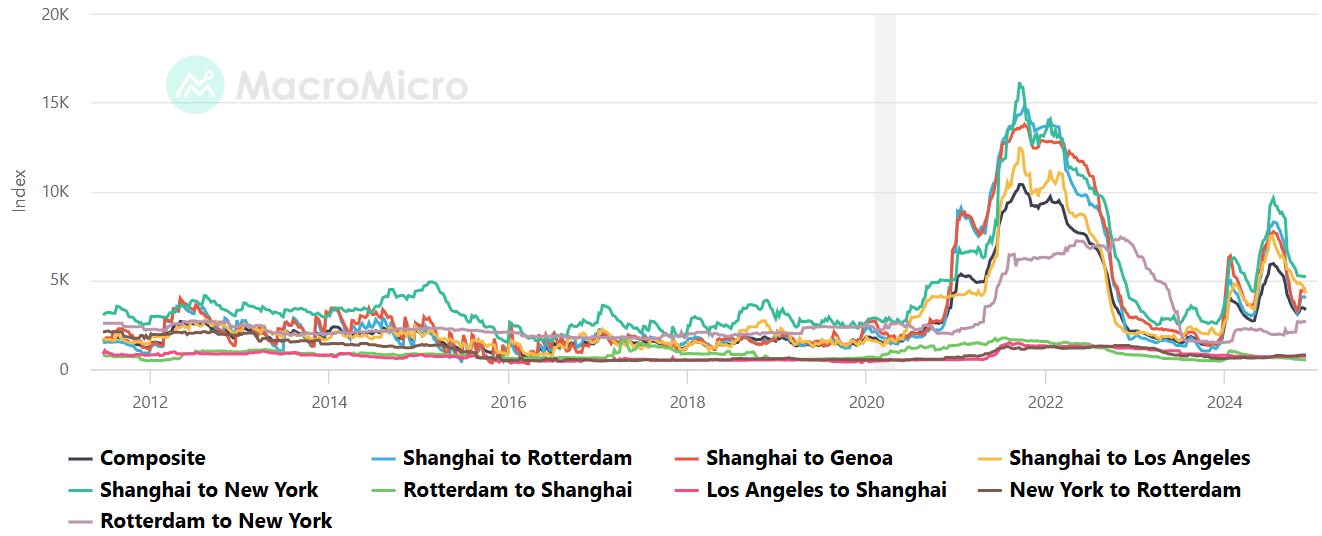

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index

U.S. News

- Wholesale Inventories

- U.S. wholesale inventories increased by 0.2% in October, reversing a 0.2% decline in September

- Inventories could increase in months ahead as businesses fearful of higher tariffs stockpile goods

- Sales at wholesalers fell 0.1% in October after rising 0.5% in September. At October’s sales pace it would take wholesalers 1.34 months to clear shelves, unchanged from September

- Consumer Price Index

- Consumer prices increased by 0.3% in November, the fastest pace in seven months, with the annual inflation rate ticking up to 2.7% from 2.6%

- The core inflation rate, which excludes food and energy, also rose 0.3% for the fourth consecutive month, holding steady at 3.3% annually

- Despite the inflation uptick, markets have largely priced in a quarter-percentage-point cut with economists forecasting fewer rate reductions in 2025

- Producer Price Index

- U.S. producer prices rose 0.4% in November, the largest increase in five months, driven by a 3.1% surge in food prices

- Core inflation remained steady at 0.2% for the fifth consecutive month

- Nonrevolving credit, such as auto and student loans, rose by a modest 1.1% in October, reflecting less volatility compared to revolving credit

- Jobless Claims

- Initial jobless claims, a measure of how many workers were laid off across the U.S., increased to 242,000 in the week ended December 6, up 17,000 from the prior week.

- The four-week moving average was 224,250, up 5,750 from the prior week.

- Continuing claims – those filed by workers unemployed for longer than a week – increased by 15,000 to 1.886 million in the week ended November 29. This figure is reported with a one-week lag.

- Fed’s Balance Sheet

- The Federal Reserve’s assets totaled $6.897 trillion in the week ended December 13, up $1.7 billion from the prior week.

- Treasury holdings totaled $4.316 trillion, down $4.3 billion from the prior week.

- Holdings of mortgage-backed securities (MBS) were $2.25 trillion in the week, down $7.6 billion from the prior week.

- Total Public Debt

- Total public debt outstanding was $36.13 trillion as of December 13, an increase of 6.8% from the previous year.

- Debt held by the public was $28.85 trillion, and intragovernmental holdings were $7.30 trillion.

- Inflation Factors

- CPI:

- The consumer-price index rose 2.6% in November year over year.

- On a monthly basis, the CPI increased 0.0% in November on a seasonally adjusted basis, after increasing 0.2% in October.

- The index for all items less food and energy (core CPI) remained flat 0.0% in November, after rising 0.3% in October.

- Core CPI increased 3.3% for the 12 months ending November.

- Food & Beverages:

- The food at home index increased 1.1% in November from the same month a year earlier, and staying flat 0.0% in November month over month.

- The food away from home index increased 3.4% in November from the same month a year earlier, and staying flat 0.0% in November month over month.

- Commodities:

- The energy commodities index decreased 0.0% in November after decreasing

- The energy commodities index fell (8.9%) over the last 12 months.

- The energy services index rose 0.0% in November after decreasing (0.4%) in October.

- The energy services index rose 3.3% over the last 12 months.

- The gasoline index fell (5.3%) over the last 12 months.

- The fuel oil index fell (18.7%) over the last 12 months.

- The index for electricity rose 3.5% over the last 12 months.

- The index for natural gas rose (1.9%) over the last 12 months.

- Supply Chain:

- Drewry’s composite World Container Index increased to $3,528.70 per 40ft container.

- Drewry’s composite World Container Index has increased by 132.0% over the last 12 months.

- Housing Market:

- The shelter index increased 0.0% in November after increasing 0.4% in October.

- The rent index increased 0.4% in October after increasing 0.4% in October.

- The index for lodging away from home decreased 0.0% in November after decreasing (3.4%) in October.

- Federal Funds Rate

- The effective Federal Funds Rate is at 4.58%, down (0.75%) year to date.

World News

- Middle East

- The Assad regime fell without resistance, leaving Damascus in a temporary power vacuum. Rebel forces, led by Hayat Tahrir al-Sham moved to restore order, curbing looting and forming a transitional government under Mohammed al-Bashir

- Hayat Tahrir al-Sham faces hurdles in uniting Syria’s diverse communities and maintaining state institutions. The group has reassured minorities, preserved some former regime officials and promised personal freedoms, while seeking to balance governance reforms with maintaining public support

- Hamas has yielded to two of Israel’s key demands for a cease-fire deal in Gaza. Hamas told mediators for the first time that it would allow the temporary presence of Israeli forces in Gaza’s when the fighting stops and submitted a list of hostages, including U.S. citizens, for release under a ceasefire deal

- As part of the latest proposal, the 60-day ceasefire plan includes the release of up to 30 hostages in exchange for Palestinian prisoners and increased humanitarian aid

- Europe

- French President Emannuel Macron appointed Francois Bayrou as the new prime minister to address a political deadlock in the National Assembly, following the resignation of Michel Barnier

- Bayrou, a seasoned centrist and ally of Macron, faces resistance from socialist lawmakers and risks further political instability. Bayrou must draft a 2025 budget to address France’s growing public deficit, which has unsettled investors

- Germany’s central bank significantly lowered its 2025 economic growth forecast to just 0.2%, down from a previous estimate of 1.1%. The country is facing a second consecutive year of decline in 2024 (-0.2%), with structural issues impacting its industrial sector, export business and investments

- The central bank highlighted increased global trade protectionism and geopolitical tensions as major sources of uncertainty, particularly for Germany’s export-driven economy

- China

- China pledged to adopt a “moderately loose” monetary policy and a more proactive fiscal approach in 2025, marking a significant shift from its previous “prudent” stance. This includes boosting domestic demand, stabilizing the housing market, and potentially increasing government borrowing to address economic downturns and trade tensions

- Some economists caution that the effectiveness of rate cuts and stimulus measures may be limited in an economy with low borrowing appetite

- Taiwan reported China’s largest maritime military operation in nearly 30 years, with nearly 90 naval and coast guard vessels deployed across a vast region, signaling potential efforts to block Taiwan’s defense and hinder U.S. allies like Japan and the Philippines

- The surge in Chinese ships, including warplanes and naval vessels near Taiwan, follows heightened tensions due to Taiwan President Lai Ching-te’s recent visits to Hawaii and Guam, fueling speculation that China’s military presence is in response to Taiwan’s growing international engagements

- Africa

- The war in Sudan has escalated with foreign mercenaries, including Colombian fighters, being deployed by the UAE to support the rebel Rapid Support Forces against Sudan’s military. The involvement of foreign fighters and weapons has complicated the conflict, with the UAE and Egypt backing opposing sides for strategic control over Sudan’s resources

- U.K.

- A Chinese businessman with ties to Prince Andrew has been banned from entering the U.K. after intelligence services alleged he attempted to influence the British royal on behalf of Beijing, posing a national security risk; the businessman, identified as H6, was found to have cultivated a close relationship with Andrew, including being invited to his 2020 birthday party and acting on his behalf for a financial initiative linked to China

- South Korea

- In a chaotic six-hour period, South Korea’s President Yoon Suk Yeol declared martial law, citing threats to democracy, only to have it overturned by a National Assembly vote, which lawmakers fought to complete as soldiers attempted to storm the legislature

- Romania

- Romania’s Constitutional Court annulled its presidential election following allegations that a Kremlin-backed influence campaign on TikTok elevated pro-Russian candidate Calin Georgescu to a lead position. Using a network of 25,000 TikTok accounts, the campaign amplified Georgescu’s anti-NATO, anti-EU messaging, disrupting the electoral process and leading to the cancellation of the second round of voting

- Spain

- The U.S. Federal Maritime Commission is investigating Spain for blocking American-flagged ships, suspected of carrying military cargo to Israel. If confirmed, Spain could face penalties, including restrictions on its ships docking at U.S. ports

- India

- Under Prime Minister Modi’s economic strategy, conglomerates like the Adani Group have flourished through close governmental ties, leading to concerns about market concentration and its impact on competition. However, the group’s recent scandal involving bribery and securities fraud has sparked global scrutiny

- Argentina

- Argentine President Javier Milei seeks U.S. support under President-elect Trump to secure new IMF loans for his aggressive capitalist reforms, including austerity measures to combat inflation and stabilize the economy, while aligning with Trump’s political ideology despite diverging on trade and global economic policies

- Canada

- Canada’s Liberal government, supported by the New Democratic Party, plans to temporarily remove the 5% goods-and-services tax on select items like home heating and diapers to ease affordability challenges amid public dissatisfaction with rising costs and slow economic growth

Commodities

- Oil Prices

- WTI: $71.21 per barrel

- 5.97% WoW; (0.61%) YTD; 2.50% YoY

- Brent: $74.45 per barrel

- 4.68% WoW; (3.36%) YTD; 0.26% YoY

- US Production

- U.S. oil production amounted to 13.6 million bpd for the week ended December 6, up 0.1 million bpd from the prior week.

- Rig Count

- The total number of oil rigs amounted to 589, down 0 from last week.

- Inventories

-

Crude Oil

- Total U.S. crude oil inventories now amount to 422.0 million barrels, down (4.3%) YoY.

- Refiners operated at a capacity utilization rate of 92.4% for the week, down from 93.3% in the prior week.

- U.S. crude oil imports now amount to 7.290 million barrels per day, down (8.2%) YoY.

-

Gasoline

- Retail average regular gasoline prices amounted to $3.03 per gallon in the week of December 13, down (2.0%) YoY.

- Gasoline prices on the East Coast amounted to $3.11, down (3.8%) YoY.

- Gasoline prices in the Midwest amounted to $2.89, down (2.9%) YoY.

- Gasoline prices on the Gulf Coast amounted to $2.70, down (0.4%) YoY.

- Gasoline prices in the Rocky Mountain region amounted to $2.91, down (3.5%) YoY.

- Gasoline prices on the West Coast amounted to $3.96, down (7.2%) YoY.

- Motor gasoline inventories were up by 5.1 million barrels from the prior week.

- Motor gasoline inventories amounted to 219.7 million barrels, down (1.9%) YoY.

- Production of motor gasoline averaged 10.05 million bpd, up 5.3% YoY.

- Demand for motor gasoline amounted to 8.810 million bpd, down (0.6%) YoY.

-

Distillates

- Distillate inventories decreased by 3.2 million in the week of December 13.

- Total distillate inventories amounted to 121.3 million barrels, up 6.9% YoY.

- Distillate production averaged 5.229 million bpd, up 4.9% YoY.

- Demand for distillates averaged 3.450 million bpd in the week, down (8.5%) YoY.

- Natural Gas

- Natural gas inventories decreased by 190 billion cubic feet last week.

- Total natural gas inventories now amount to 3,747 billion cubic feet, up 2.3% YoY.

Credit News

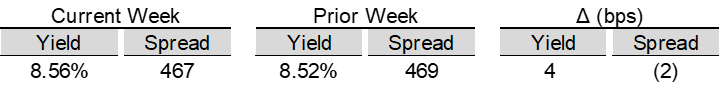

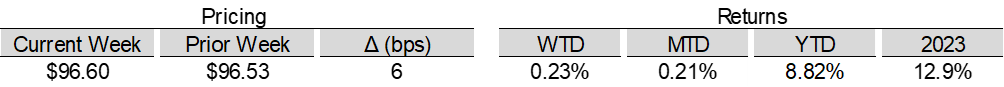

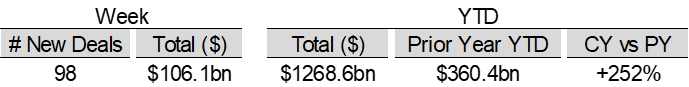

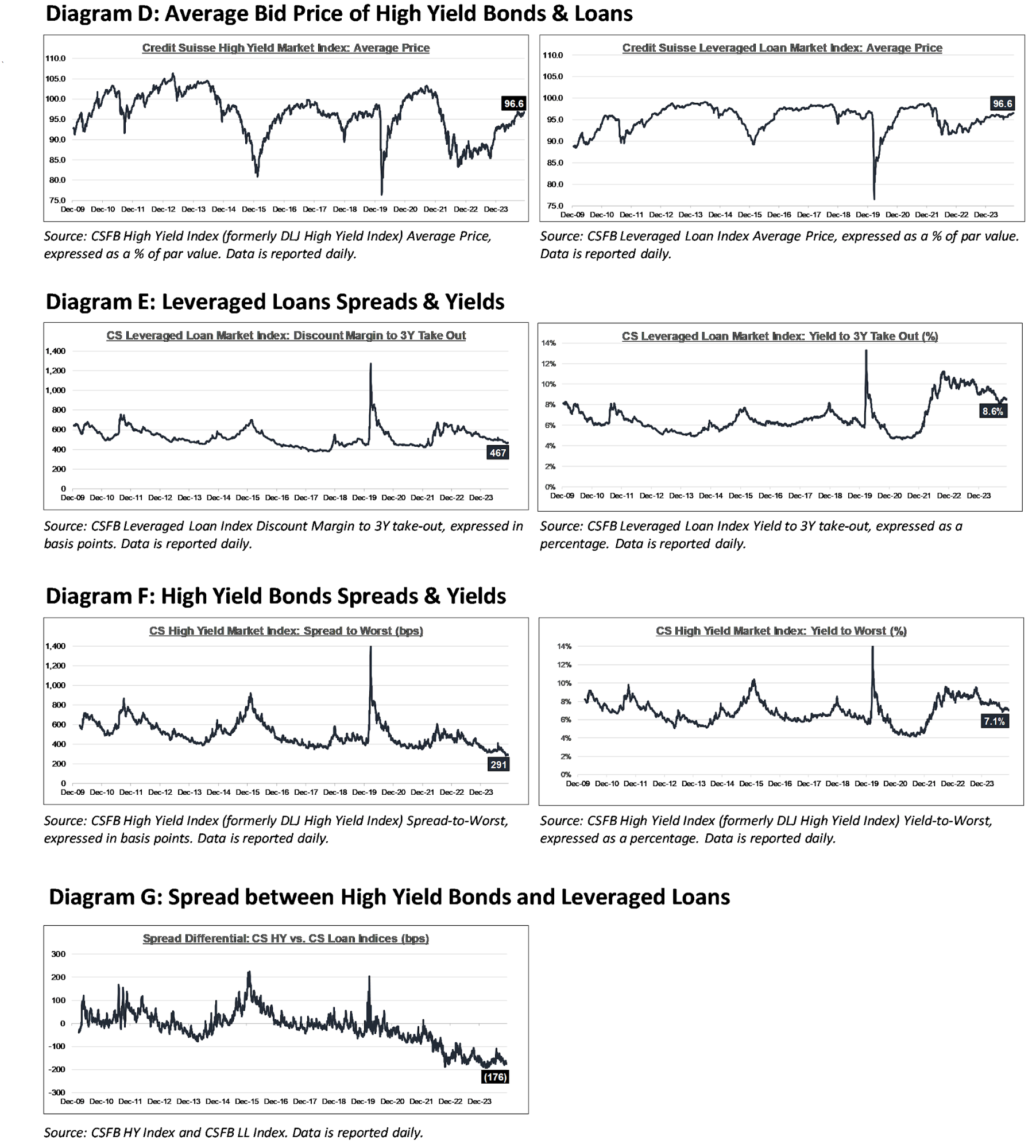

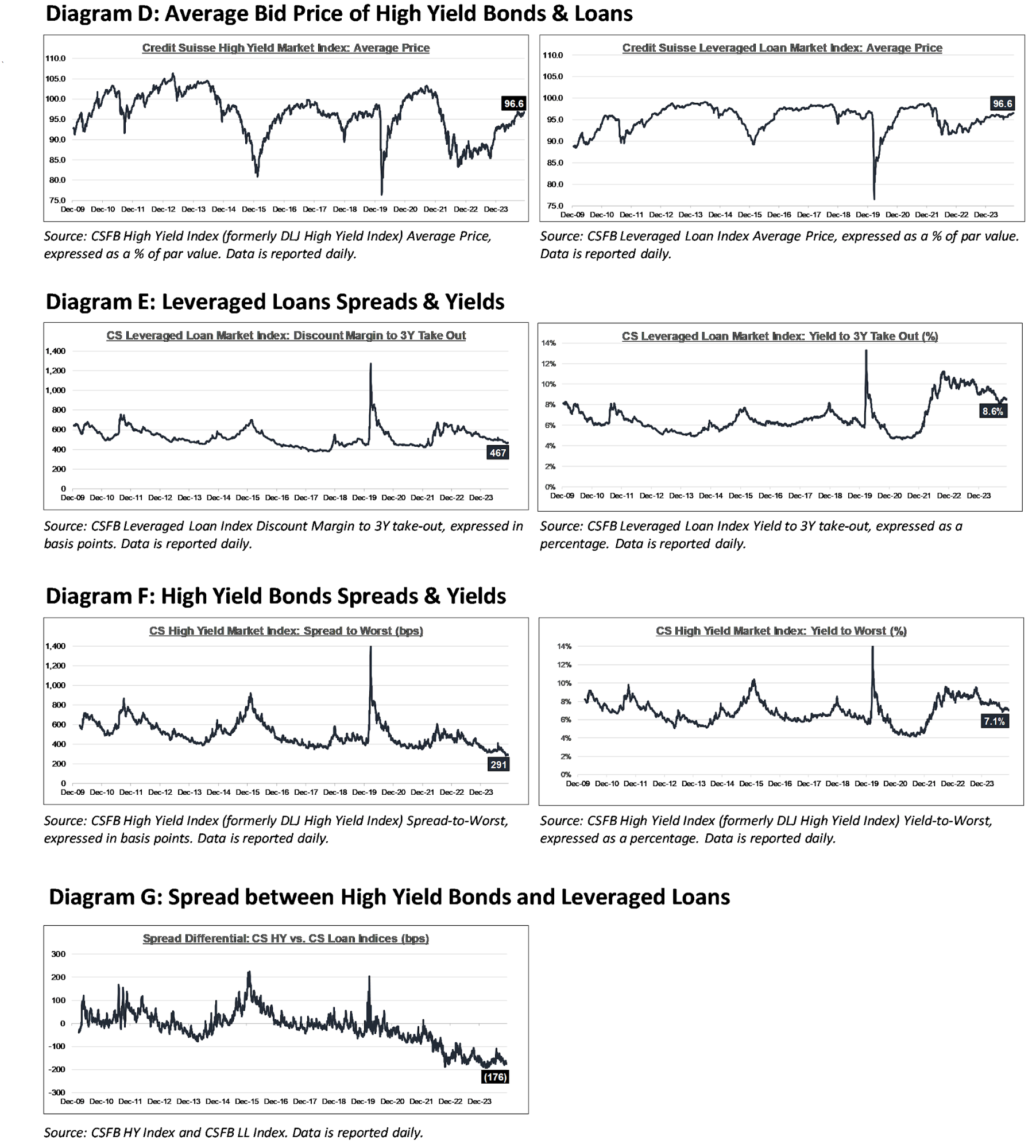

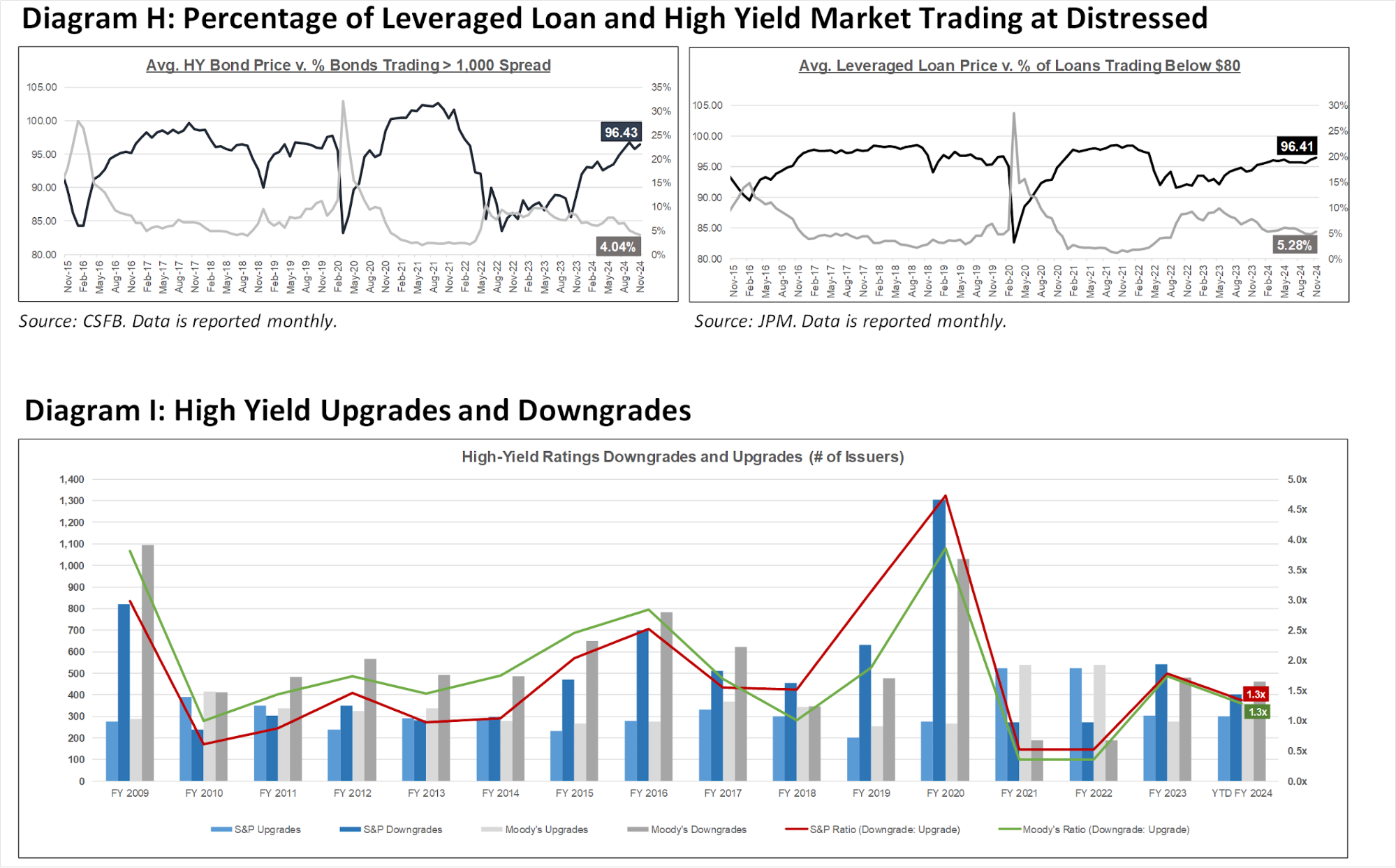

High yield bond yields increased 5bps to 7.10% and spreads decreased 4bps to 291bps. Leveraged loan yields increased 4bps to 8.56% and spreads decreased 2bps to 467bps. WTD Leveraged loan returns were positive 23bps. WTD high yield bond returns were positive 3bps. 10yr treasury yields increased 14bps to 4.32%. Leveraged Loan posted positive returns for a nineteenth consecutive week amid the largest stretch of inflows since early 2022 and a record December for capital markets. This week’s CPI met expectations but still didn’t align with the 2% target. While markets are expecting a rate cut next week, the recent rise in prices and economic activity suggests a more cautious approach to easing going forward.

High-yield:

Week ended 12/13/2024

- Yields & Spreads1

- Pricing & Returns1

- Fund Flows2

- New Issue2

- Distressed Level (trading in excess of 1,000 bps)2

- Total HY Defaults

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Leveraged loans:

Week ended 12/13/2024

- Yields & Spreads1

- Leveraged Loan Index1

- Fund Flows2

- New Issue2

- Distressed Level (loan price below $80)1

- Total Loan Defaults

Default activity:

- Most recent defaults include: Hearthside Food Solutions ($2.6bn, 11/22/24), Spirit Airlines ($1.1bn, 11/18/24), Franchise Group Inc ($1.1bn, 11/3/24), Exactech ($254mn, 10/29/24), American Tire Distributors ($975mn, 10/23/24), Accuride ($291mn, 10/11/2024), Mavenir Systems ($712mn, 9/27/24), Digital Media Solutions ($208mn, 9/12/24), 2U ($374mn, 7/25/24), Rodan & Fields ($763mn, 7/11/24), and Wheel Pros ($2.8bn, 7/11/24).

CLOs:

Week ended 12/13/2024

- New U.S. CLO Issuance2

- New U.S. CLO Issuance2

Note:High-yield and leveraged loan yields and spreads are swap-adjusted

1 Source: Credit Suisse High Yield and Leveraged Loan Index

2 Source: JP Morgan

Ratings activity:

- S&P and Moody’s High Yield Ratings

Appendix:

Diagram A: Leveraged Loan Trading Levels

Source: Credit Suisse Leveraged Loan Index

Diagram B: High Yield and Leveraged Loan LTM Price

Diagram C: Leveraged Loan and High Yield Returns

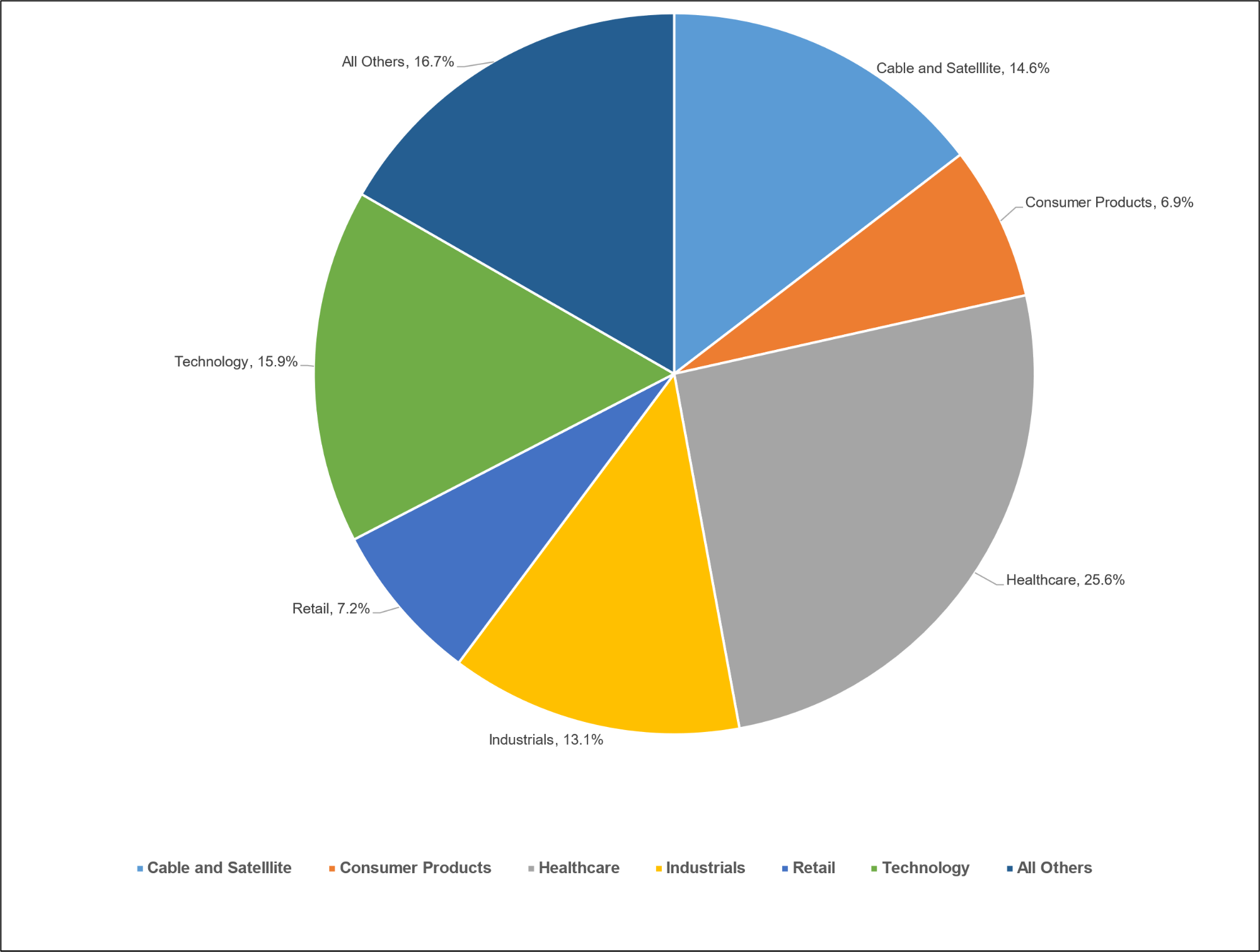

Diagram J: Leveraged Loan Defaults by Sector – Full Year

Diagram L: CLO Economics

Diagram N: Developed Country GovBond Yields (%)

Diagram O: S&P 500 Historical Multiples

Diagram P: U.S. Middle-Market M&A Valuations (EV/EBITDA)

Diagram Q: U.S. Large Cap M&A Valuations (EV/EBITDA

Diagram R: Dry Powder for All Private Equity Buyouts

Diagram S: Structured Credit Spreads

Diagram T: Structured Credit Yield

Diagram U: SOFR CURVE

Diagram V: CMBS Spreads

Freight Rates

Drewry World Container Index

China-Global & Shanghai Export Container Freight Index